NiseriN/iStock via Getty Images

We are surprised to continue seeing Brunswick Corporation (NYSE:BC) trading at an extremely low valuation, even after the company delivered the best quarter in its history in Q2 2022. The company is seeing limited signs of fuel prices deterring boating, and record Q2 results were just impressive. Net sales of $1.84B were up 18.1%, adjusted EPS of $2.82 were up 11.9%, and adjusted operating earnings of $300M were up 12.7%. There was broad based top-line growth, with record propulsion performance and market share gains, the boat segment posting robust sales and earnings, and strong parts and accessories (P&A) performance led by benefits from 2021 acquisitions. There are signs that the company will continue to post strong results the next few quarters, such as field inventory still low with elevated backlogs, and P&A backlog higher than normal.

The boat club part of the business has been particularly impressive, posting extremely positive results. We find this business very attractive, and one with a particularly strong competitive moat resulting from network effects and high switching costs. There are signs the business will continue its rapid growth, with web search interest for boats and boat club related purchase and activity trending up coming out of Q2. The Freedom Boat Club now has more than 360 locations, with 50,000 membership agreements covering 80,000 members and a fleet size of nearly 5,000 boats. On a same-store basis, Freedom membership growth in the second quarter was 30% higher than in the same quarter in 2021.

The propulsion business has also been performing really well. Among 75-horsepower and greater outboard engines, Mercury has increased US market share in each of the last five years, gaining almost 600 basis points. The capacity expansion at the Fond du Lac, Wisconsin facility, will add significant capacity for the high horsepower outboard engine lineup, and remains on schedule for completion in the fourth quarter of this year. This expansion, which will add more than 50% capacity to the 175-horsepower and higher categories, will be critical in driving future top line and earnings growth together with market share gains.

The parts and accessories part of the business has also been delivering significant increases in sales due in large part to the 2021 acquisitions of Navico, RELiON and SemahTronix.

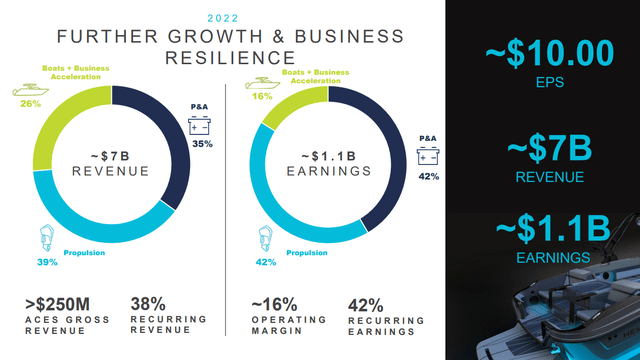

With all business segments firing on all cylinders, the company narrowed the fiscal year 2022 guidance to net sales of $6.9B – $7.1B and Adjusted EPS of $10.00 – $10.30. This means the company is raising the bottom end of its full year EPS guidance, even after absorbing the approximately $0.18 of additional anticipated unfavorable foreign currency exchange rate impact in the second half of the year, primarily related to the strong US dollar. At a recent ~$70 share price, the company is trading at what we consider a bargain valuation of only ~7x earnings.

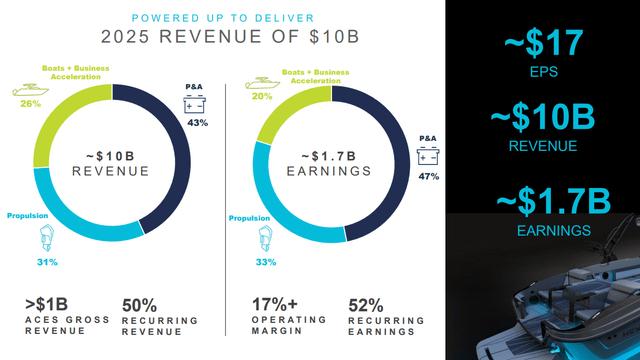

Brunswick Corporation Investor Presentation

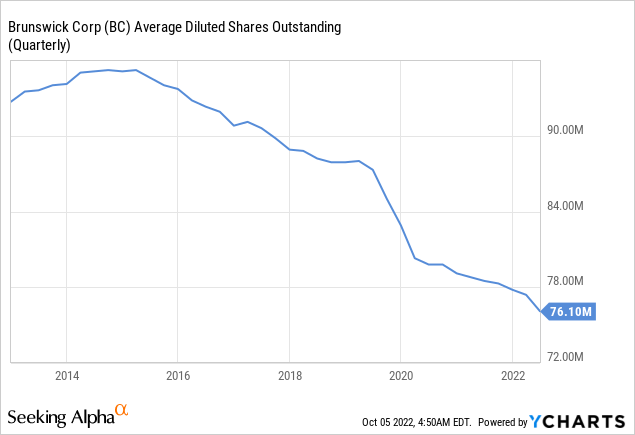

In fact, the company itself considers the valuation very attractive, and that is why it executed $140 million of share repurchases in the second quarter, bringing the year-to-date share repurchases to $220 million. It is planning to continue buying back shares in the back half of the year.

Brunswick Corporation Market Share

One of the reasons we are so surprised at the low valuation of Brunswick Corporation is that this is a business that not only is posting record sales and earnings, but one that is also gaining market share from competitors. CEO David Foulkesmade some really interesting comments during the most recent earnings call regarding market share gains, in particular internationally:

I wouldn’t be surprised we crossed 50% in Canada pretty soon. We’re building in all the European markets Australia, New Zealand we continue to be extremely strong. So that capacity has a lot of clear destinations, not only in the US but internationally, too. And generally, the margins will be strong. We’re not only fulfilling these new OEMs and international OEMs, which tend to have higher margins. But it will also give us the capacity to really get after the repower channel and the commercial channels, which are generally extremely strong margins. So the additional benefit of every unit capacity we get out is not only the value of the unit is the incremental margin associated with marginal units. However, I could not — I cannot wait to get that capacity online. It will be a very exciting time for us.

Balance Sheet

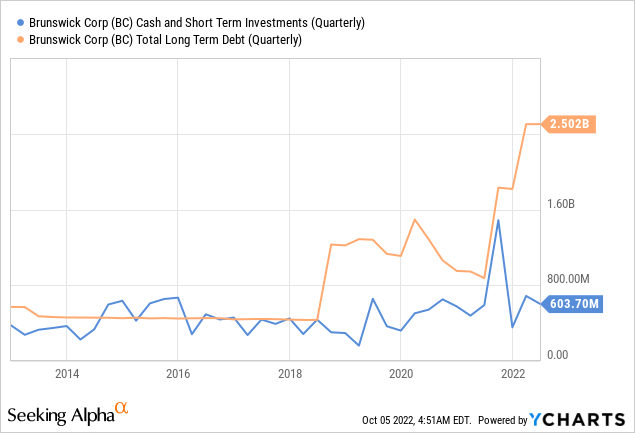

If one want to find a weak spot, it could be the rising debt in the company’s balance sheet. The company has mostly increased debt to finance some very attractive acquisitions, but still debt is now much higher than previously. Still, the company still have a very decent amount of liquidity with ~$603 million in cash and short term investments, and financial debt to EBITDA (TTM) remains reasonable at ~1.8x.

Valuation

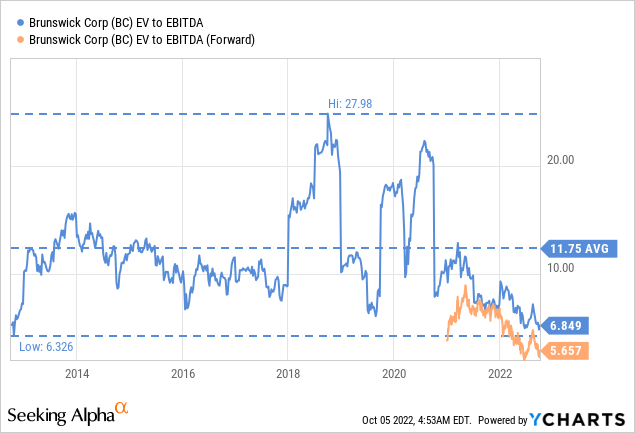

We already talked about how shares are currently trading at a ~7x p/e based on estimated earnings for fiscal year 2022. Based on EV/EBITDA shares are also extremely cheap, with forward EV/EBITDA at almost half the company’s ten year average.

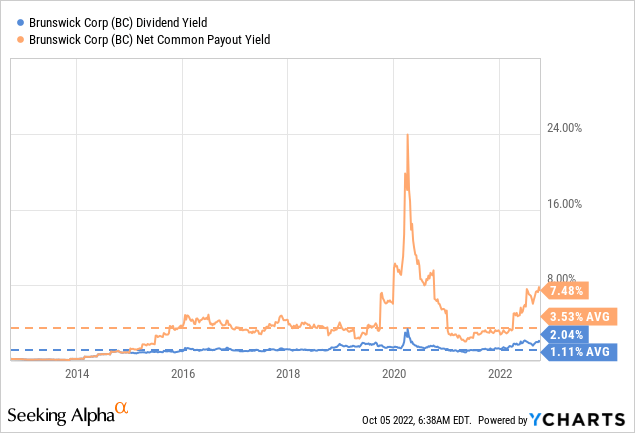

This is why we are not surprised to see the company being so aggressive with its buybacks, sending the net common payout yield that combines net buybacks and the dividend yield, to an extremely attractive ~7.5%.

Looking further into the future, the company is guiding to ~$17 in earnings per share for 2025. That places the forward P/E for 2025 using the current share price at an extremely attractive ~4.1x. Fiscal 2025 is still a few years away, but we don’t know of many industry leading companies with such a low valuation.

Brunswick Corporation Investor Presentation

Conclusion

We are of the opinion that Brunswick Corporation is currently one of the biggest bargains in the market. This is an industry leading company that continues to gain market share, and that is trading at extremely low multiples of earnings. All the business segments are firing on all cylinders, and the boat club business is growing particularly fast. It can be argued that this is a consumer discretionary business, and that we are probably heading into a recession, but we still find the valuation extremely attractive, especially when considering the most recent financial results.

Be the first to comment