Ibrahim Akcengiz

Investment Thesis

The Chefs’ Warehouse, Inc. (NASDAQ:CHEF) is a family-operated specialty food distributor. The company has reported a solid quarterly result, a sign of the financial turnaround. I believe the company might show strong growth in FY2022, which can give strong returns to its investors.

About Chefs’ Warehouse

The company is a specialty food and center-of-the-plate product distributor in the United States and Canada, with its headquarters in Ridgefield, Connecticut. The business is dedicated to meeting the unique demands of the chefs who own and run some of the top independent, menu-driven diners, fine dining facilities, country clubs, hotels, and caterers. The company’s range of specialty foods includes about 50,000 stock-keeping units, including handmade charcuterie, gourmet cheeses, uncommon oils and vinegar, truffles, caviar, chocolate, and pastry goods. Custom-cut beef, shellfish, hormone-free chicken, and food items like cooking oils, butter, eggs, milk, and flour are all included in the center-of-the-plate offerings.

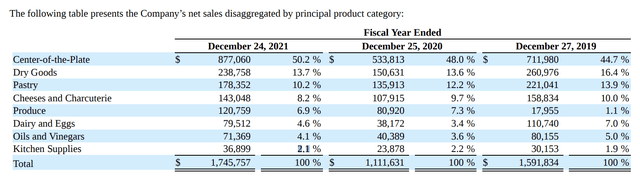

Through a postal and e-commerce infrastructure, it directly markets to consumers its center-of-the-plate products. The company generates 50.2% of its revenue from the center-of-the-plate segment. Dry Goods contribute 13.7%, Pastry contribute 10.2%, Cheeses and Charcuterie contribute 8.2%, Dairy and Eggs contribute 4.6%, Produce contributes 6.9%, Oils and Vinegar contribute 4.1%, and Kitchen Supplies contribute 2.1%.

Revenue Segment (Annual Report)

The company aims to increase its customer base by enhancing its product portfolio, the efficiency of the sales team, and selecting the company for acquisition. The company wants to expand its customers in the existing market by collaborating with the existing restaurants. The company is also exploring opportunities in new markets with acquisitions. It has completed twenty-three acquisitions since the IPO. The company aims to capitalize on the existing infrastructure and expand its footprints into new markets. All these growth strategies are evidence that the company will continue the ongoing growth phase.

Solid Financial Growth

CHEF recently announced financial results for its Q2 2022 ended June 24, 2022. The company reported net sales of $648.1 million in the Q2 2022, an increase of 53.2% from $423.0 million in the Q2 2021. The company’s organic growth increased by $152.3 million, or 36.0%, compared to the previous year’s same quarter. Previous acquisitions contributed 17.2% or $72.9 million in sales growth in the last quarter. In the company’s specialty segment, the organic case count climbed by about 34.8%, driven by unique client and placement growth of 35.9% and 54.6%, respectively, compared to the corresponding quarter of last year. As compared to the previous year’s quarter, organic pounds sales in the company’s center-of-the-plate category climbed by almost 14.2%.

In comparison to the same quarter last year, estimated inflation in the company’s specialized categories was 16.4%, and in its center-of-the-plate categories was 10.9%. The company’s gross profit margin expanded by 140 bps and stood at 24.1% compared to the 22.7% gross margin of Q2 2021. The gross profit margin increase is the weighted average of 70 bps decrease in the specialty category and a 230 bps increase in the center-of-the-plate category compared to the prior-year quarter. Selling, general, and administrative costs rose from $90.4 million in Q2 2021 to $124.5 million in Q2 2022, a rise of around 37.8%. For the last quarter, the surge was principally brought on by cost increases in compensation and benefits. The company has reported an operating profit of $27.6 million, which is a dramatic increase of 487.2% as compared to the $4.7 million in the previous year’s same quarter. The increase was driven by the rise in gross profit, which shows the increased operational efficiency of the company. It has reported a net income of $16.9 million or $0.42 diluted EPS, which is significant growth of 1436.3% compared to the $1.1 million or $0.03 diluted EPS.

After the strong results, the company has raised its full-year outlook. The company estimates the net sales of the full year of FY2022 might be between $2.375 to $2.475 billion. The company estimates the gross profit could reach $553.0 to $576.0 million with a 23.28% gross profit margin, and adjusted EBITDA can range from $135.0 to $145.0 million. I believe the company’s estimates are fair, and it will again become a profitable business after two consecutive weak financial years.

What is the main risk faced by CHEF?

Inflation

CHEF generally operates at a low-profit margin to make the product price attractive to the consumers. The increased inflation has stressed the profit margins due to increased production costs. The supply chain disruption has added to the negative effects of rising inflation. The company faces a risk of a stressed profit margin due to increased product procurement costs. It has managed this risk by maintaining a good product mix and having a higher number of suppliers to limit the supply deficit risk exposure.

Technical Analysis and Fundamental Valuation

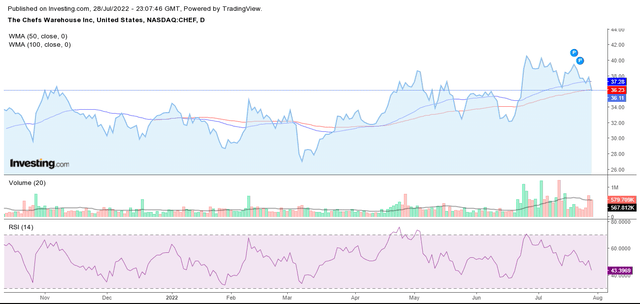

Technical Analysis Chart (Investing.com)

CHEF has positive technical indicators. The stock price has a strong support level at its 100-day weighted moving average (WMA). The stock is testing its 50-day WMA level and is likely to cross it. We will witness a fresh momentum once it crosses its 50-day WMA level. The stock has a strong support zone at $36 levels, and there is a limited downside from current price levels as per WMA analysis. The RSI indicator suggests that the stock price is in the buying territory. The stock is currently consolidating in the 40-60 band zone. There is no significant divergence in the RSI, but the current pattern reflects a buying opportunity in the stock.

CHEF has posted robust quarterly results with tremendous improvement. It has experienced a share price increase of 21% over the past one year. The company has sustained the market volatility and managed to perform exceedingly well when it comes to the share price. CHEF is currently trading at a share price of $36.11. It is trading at a P/E multiple of 28.90x with FY2022 EPS estimates of $1.31. The company has a strong buy rating by Seeking Alpha and is ranked 2 out of 7 companies in the food distributors industry. This reflects the company’s growth potential and strong financial performance. I believe the company has remarkable upside potential in the share price.

Conclusion

CHEF has shown tremendous improvement in quarterly results beating the estimates by significant margins. It has substantial growth prospects in the near future. The company has a strong buy rating by Seeking Alpha on the basis of strong growth and momentum. It faces the risk of inflation, but the growth prospects provide a favorable risk-reward profile. The company is trading at an attractive valuation. I assign a buy recommendation after analyzing all these factors.

Be the first to comment