Daria Nipot/iStock via Getty Images

Real estate continues to be an area of the markets that interests investors as recession concerns have not abated. With REITs offering the upside of real estate without the administrative downsides of direct real estate ownership and commissions, ETFs like the iShares U.S. Real Estate ETF (NYSEARCA:IYR) come into focus. With their specialty real estate dominating the top of the holdings, we think there’s quite a lot to like about the ETF despite rising real rates. Overall, we think investors might as well go into specific REITs, because ETFs like this eat into yield with management fees, but as far as the exposures go we see nothing wrong with IYR.

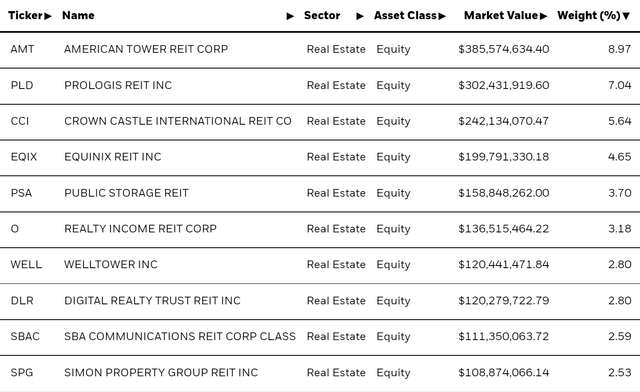

IYR Breakdown

The IYR breakdown shows right away that you’re looking at quite a lot of specialty exposures.

The biggest allocation goes to American Tower (AMT). AMT is not cheap but we like their assets. Firstly, solvency really isn’t an issue for them because they lease to several operators per tower that are all very solvent. AT&T (T), Verizon (VZ) and the rest of them will not have a problem paying up. Moreover, while not indexed to inflation, there is scope for growth on their lease income which does offer some protection. However, long lease lives limit the ability to make quick rollovers for new terms in an inflationary environment.

Below AMT is Prologis (PLD) which is a company whose assets have definitely appreciated in value during the good boom. With logistics assets their portfolio has been very well positioned to establish leases at good prices. Below PLD are more telco assets but also Equinix (EQIX) the internet exchange company which owns real estate in which networks can co-locate and peer to share data and cheapen their IP transit bills with network effect efficiency. Storage REITs and others down the list keep exemplifying a nice specialty streak to IYR, all with recessionary resilience thanks to tenant exposure and their markets.

Parting Considerations

While fundamentally resilient, we should be aware of the economic cost to investors that features of the current macroeconomic environment create for owners of a REIT like this. In particular, exposures like AMT do get outrun by inflation which will persist due to cost-push pressures and continue to propagate into following years following the wage-price mechanism. Average rate increases in AMT’s portfolio are 3% annually, which ordinarily does well but in the face of current rates is somewhat eclipsed. Moreover, long lease terms of over 13 years on average mean that rollovers into a new context don’t happen soon. Similar issues face other telco infrastructure. Prologis is much better off with shorter lease terms and great rollover effects in the current environment, but in general there is an economic loss in relying on the income from these companies. The ETF offers safety, and the resilience is fundamentally there, especially on a credit basis, but we think that investors can do better by playing the active game in the REIT space and thinking more carefully about exactly how to hedge their risks of rising real returns from both rising rates and the persisting component in inflation. In fact, while an alright yield at 2.2%, the IYR yield does get eaten away by a non-negligible 0.4% management fee.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment