Angelika-Angelika/iStock via Getty Images

Introducing Inter Parfums

Inter Parfums (NASDAQ:IPAR) is a company in the prestige fragrance market, selling both in the U.S. as well as many other countries. It has operated for nearly 40 years and has partnerships with many renowned brands, such as Hollister, Abercrombie & Fitch, and Montblanc. It offers its goods through e-commerce to department stores, specialty shops, duty-free shops, beauty merchants, local and foreign wholesalers, and distributors

Industry Outlook

According to a Million Insights report, the market for prestige cosmetics and fragrances took quite a hit during the COVID-pandemic due to disruptions in the supply chain and manufacturing and the closing of retail stores. As this market hasn’t recovered to pre-covid levels yet, the recovery is probably the main driver of future growth.

Furthermore, account manager Emma Fishwick from NPD UK Beauty believes that

people are buying less and upgrading their purchases to those with more innovative formulations (as in make-up and skincare) and in fragrance, they are opting for more expensive bottles and the most potent fragrance formulas. There is also the lure of premium brands, where people can ‘buy into’ designer brands in an affordable way.

Thus, a consumer shift to more expensive and premium fragrances is likely to be another driver for the prestige fragrance market.

The Million Insight’s report expects that, according to estimates, the market for prestige cosmetics and perfumes was worth USD 72.8 billion in 2020 and is projected to grow at a CAGR of 4.3 percent from 2021 to 2028. Given the above factors, I believe that this is a realistic estimate.

Competition

I believe that the market for prestige fragrances is extremely competitive, with some of its competitors being large international companies with much more resources:

|

Company |

Business Description |

Market Cap |

Last Year’s Revenue Growth |

|

Inter Parfums |

Inter Parfums is a company in the prestige fragrance market, selling both in the U.S. as well as many other countries. |

2.64B |

63.17% |

|

The Estée Lauder Companies (EL) |

With well-known brands like Estee Lauder, Clinique, MAC, La Mer, Jo Malone, Aveda, Bobbi Brown, Too Faced, Origins, Dr. Jart+, and The Ordinary, Estee Lauder dominates the worldwide prestige beauty market, contributing to sales in the skincare (59 percent of fiscal 2021 sales), makeup (26 percent), fragrance (12 percent), and haircare (3 percent) categories. |

96.94B |

13.44% |

|

International Flavors & Fragrances (IFF) |

The world’s largest manufacturer of specialty ingredients is International Flavors & Fragrances. The business offers ingredients for the pharmaceutical, food, beverage, health, home, and personal care sectors. |

32.48B |

129.27% |

|

Ulta Beauty (ULTA) |

The largest specialty beauty shop in the United States, Ulta Beauty, has more than 1,300 locations and a partnership with Target. The company sells cosmetics (43 percent of 2021 sales), perfumes, skincare, hair care, and bath and body goods (20 percent of 2021 sales). |

20.77B |

40.29% |

Source: Morningstar and Seeking Alpha

Competitive Position

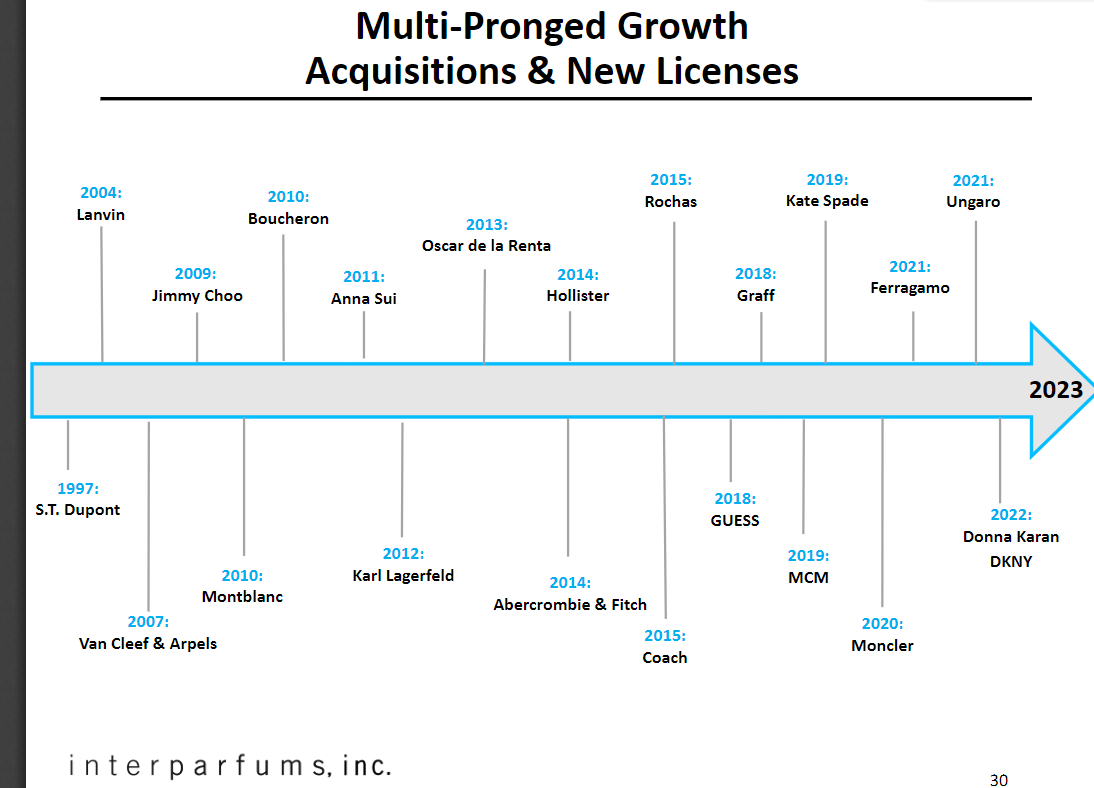

Inter Parfums has been around in the prestige fragrance market for nearly 40 years, building up a significant amount of knowledge, experience, and a trusted reputation. According to their investor presentation, Inter Parfums claims that due to their smaller size compared to some competitors, they are able to work closely with brands in the development process of products. The company further claims that its brand-building expertise combined with successful creative product development and global distribution makes them a wanted partner. I believe that the number of brands that deal with prestigious and well-known brands, historically as well as more recently, is evidence of the fact that they are a wanted partner:

Acquisition and New Licenses (Inter Parfums investor presentation)

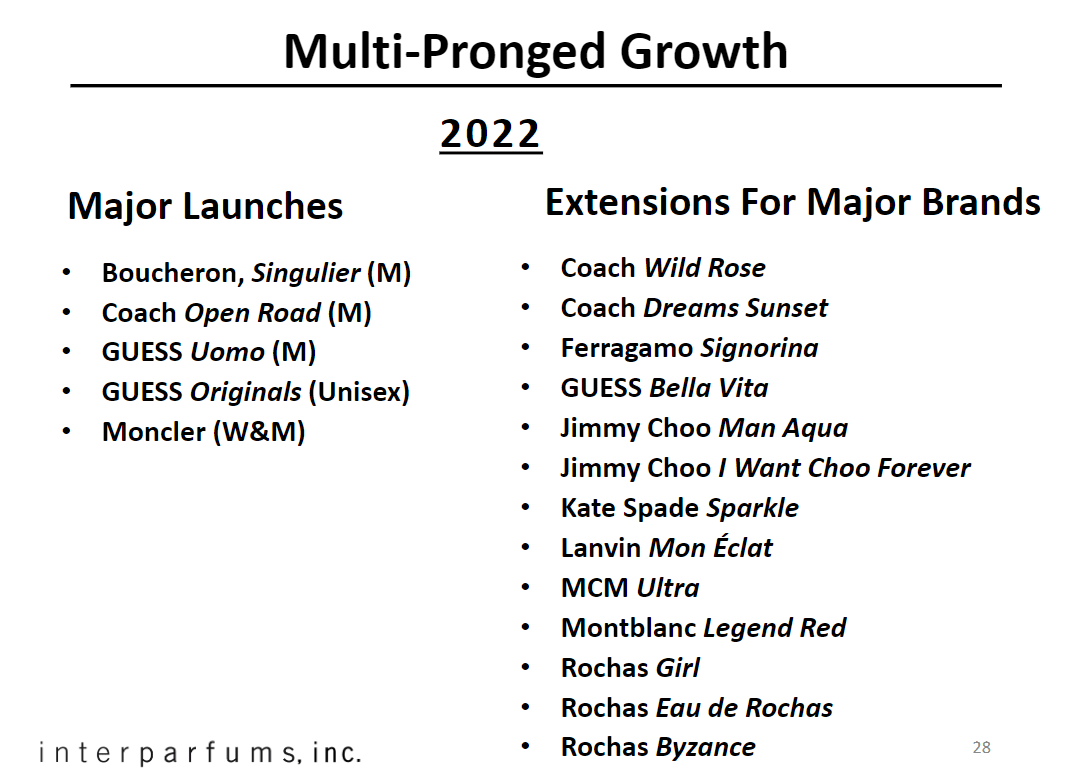

Due to successful product launches, many major partners extend their partnerships, resulting in a positive outlook:

Extensions and launches (Inter Parfums investor presentation)

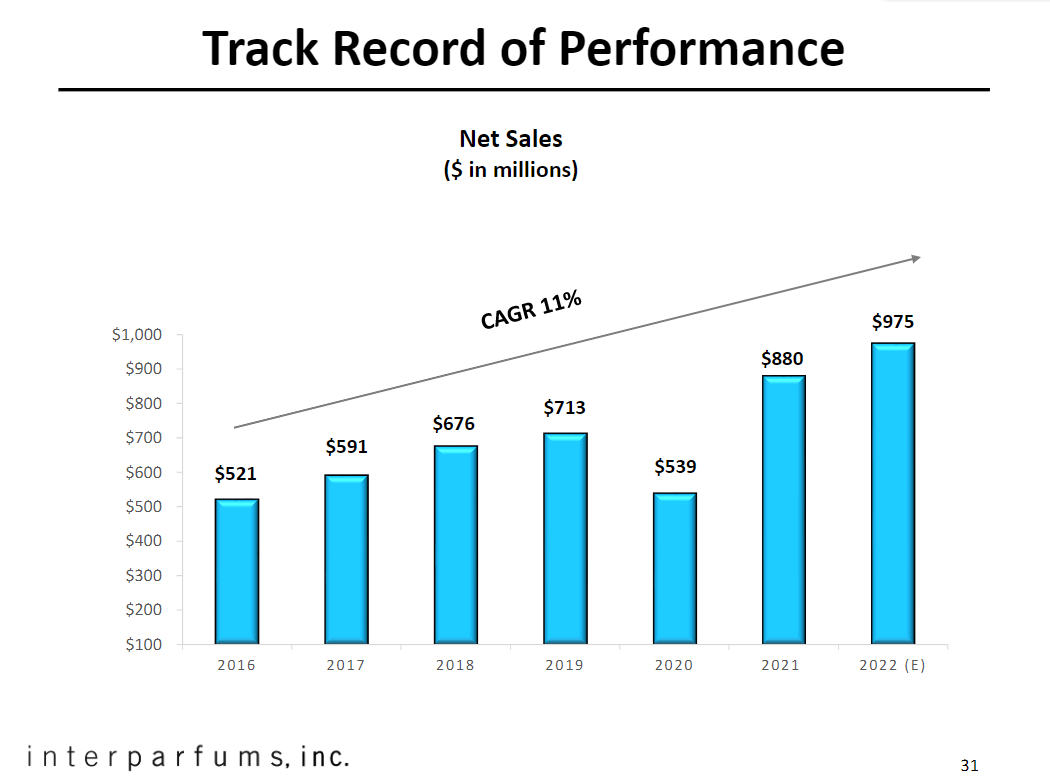

Due to its success, Inter Parfums has seen consistent sales growth over the years:

Sales performance (Investor Presentation)

Furthermore, Inter Parfums is constantly seeking new ways to diversify its revenue streams, as it has completed two acquisitions to get into the travel amenities sector. Furthermore, Inter Parfums signed a strategic agreement and made an equity investment of 25% in origines.parfums.fr, an e-commerce beauty store in France. With this investment, the company hopes to take advantage of the e-commerce fragrance market, which has seen accelerating sales in recent years.

Whilst the competition is intense with huge competitors that have many more resources, Inter Parfums, in my opinion, has a solid competitive position in the premium fragrance market due to its ability to attract respected brands as partners.

Valuation and Financial Performance

Basic statistics comparison:

|

index |

Forward P/E |

Gross Margin |

Free Cash Flow Margin |

3Y sales growth |

3Y EPS growth |

Debt / Equity |

|

Inter Parfums |

28.57 |

63.36% |

-9.85% |

14% |

34% |

0.3 |

|

The Estée Lauder Companies |

31.45 |

76.48% |

10.57% |

6% |

106% |

1.27 |

|

International Flavors & Fragrances |

21.19 |

33.23% |

5.28% |

52% |

-26% |

0.59 |

|

Ulta Beauty |

20.53 |

39.34% |

10.48% |

11% |

138% |

1.06 |

Source: Seeking Alpha

Inter Parfums’ forward P/E ratio lies in the upper range of the competitors. Its earnings-per-share and sales growth are attractive, but nothing out of the ordinary compared to its competitors. According to its latest annual report, the free cash flow margin was negative but mainly influenced by the acquisition of its future headquarters by the property developer. In 2020, the cash flow margin was almost 10%, which is typical compared to the competitors. The advantage of Inter Parfums is its low debt-to-equity ratio.

Inter Parfums’ forward P/E is almost double the current S&P 500 median. While I believe that Inter Parfums is set to grow at a nice rate in the future, double the valuation is quite a premium.

Final Take

I believe that Inter Parfums has a respected reputation in the prestige fragrance market and has many attractive deals with renowned brands. It has had consistent growth in revenues and profits over the years. I expect them to still grow at a consistent and healthy pace due to new brand deals, product launches, and investments in new trends such as e-commerce.

Nevertheless, I do believe its forward P/E ratio is on the higher side compared to some of its competitors who have shown similar or better financial performance statistics. Hence, I am waiting for the price to drop some before I consider Inter Parfums to be a buying opportunity.

Be the first to comment