mi-viri

People sleep peaceably in their beds at night only because rough men stand ready to do violence on their behalf.”― George Orwell

Today, we take our first look at a West Coast biotech targeting diseases of the liver. The stock has also seen some recent insider buying. An analysis follows below.

Overview:

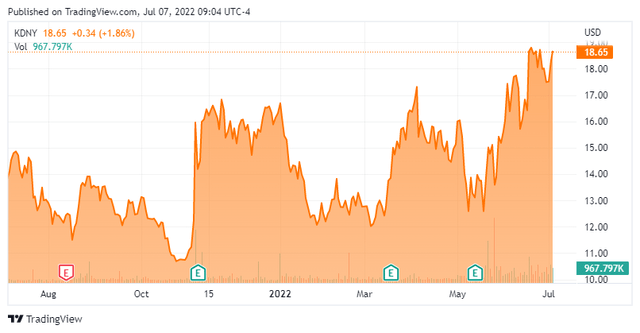

Chinook Therapeutics, Inc. (NASDAQ:KDNY) is a Seattle, Washington based clinical-stage biotechnology concern focused on the development of treatments for kidney diseases. The company has three assets undergoing evaluation in the clinic, of which two are focused on the treatment of Immunoglobin A neuropathy (IgAN). Chinook was formed in 2018 and went public in 2020 when it merged into failed immuno-oncology concern Aduro Biotech, with its first trade conducted at $13.87 a share. Its stock trades near $18.50 a share, translating to an approximate market cap of $1.2 billion, when giving effect to pre-funded warrants and to a presumed greenshoe exercise on its recent (May 24, 2022) secondary offering executed at $14.00.

IgAN

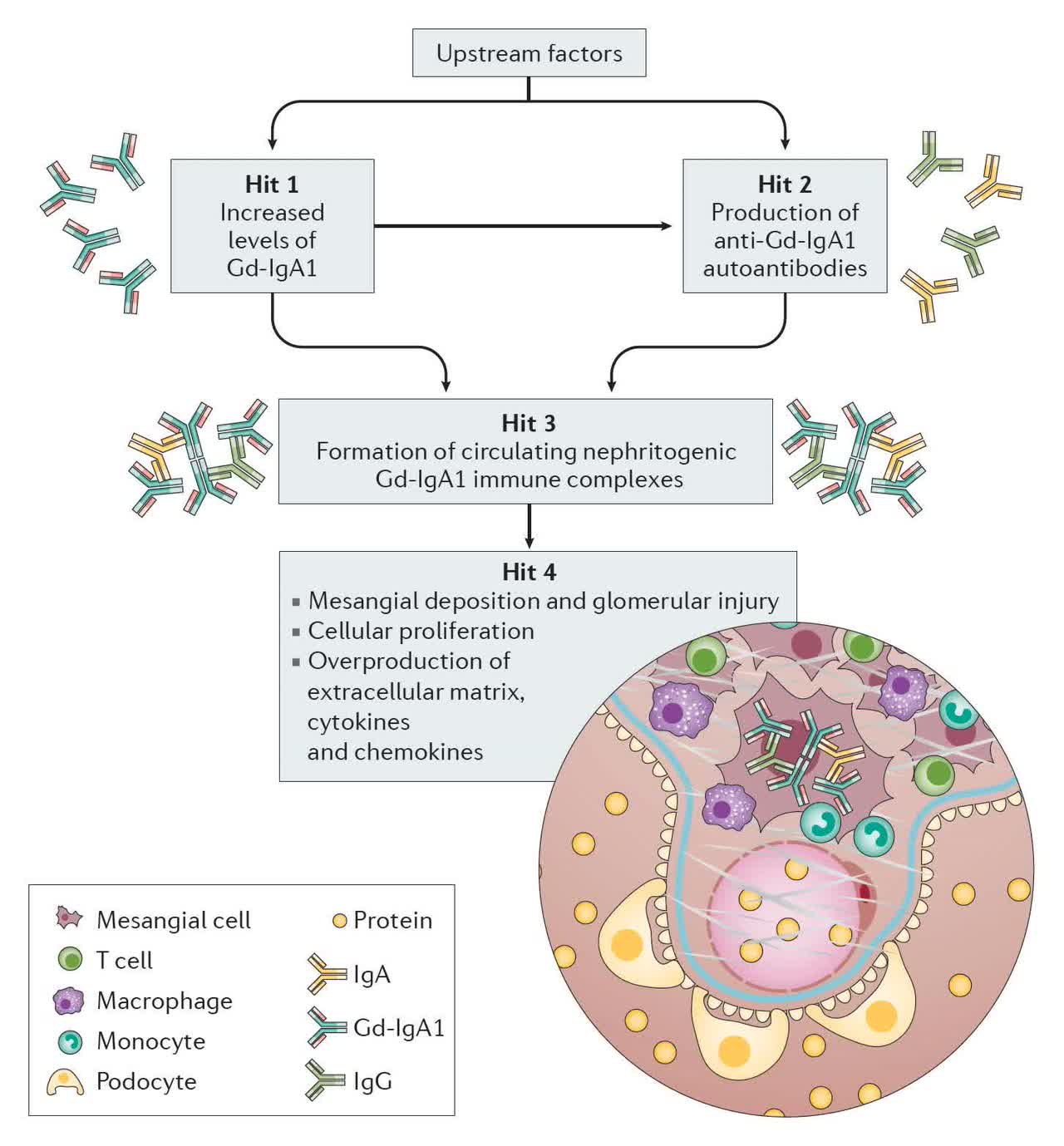

IgAN, also known as Berger’s disease, is essentially an immune response to an outside pathogen during which the body produces the protein Immunoglobin A to help the body fight infection. However, the overproduction of these proteins can lead to the formation of pathogenic immune complexes that get stuck in the kidney, causing inflammation, bleeding, and kidney stones, blocking its ability to filter waste products from the blood, leading to loss of function and failure. IgAN is the most common primary glomerular disease, afflicting more than 500,000 across the U.S., EU, and Japan, with ~45% of patients progressing to end-stage kidney disease. It has been treated off-label with renin-angiotensin system (RAS) inhibitors, chemotherapy drugs, and SGLT-2 inhibitors, until the FDA approved Calliditas Therapeutics’ (CALT) Tarpeyo (budesonide) for IgAN in December 2021.

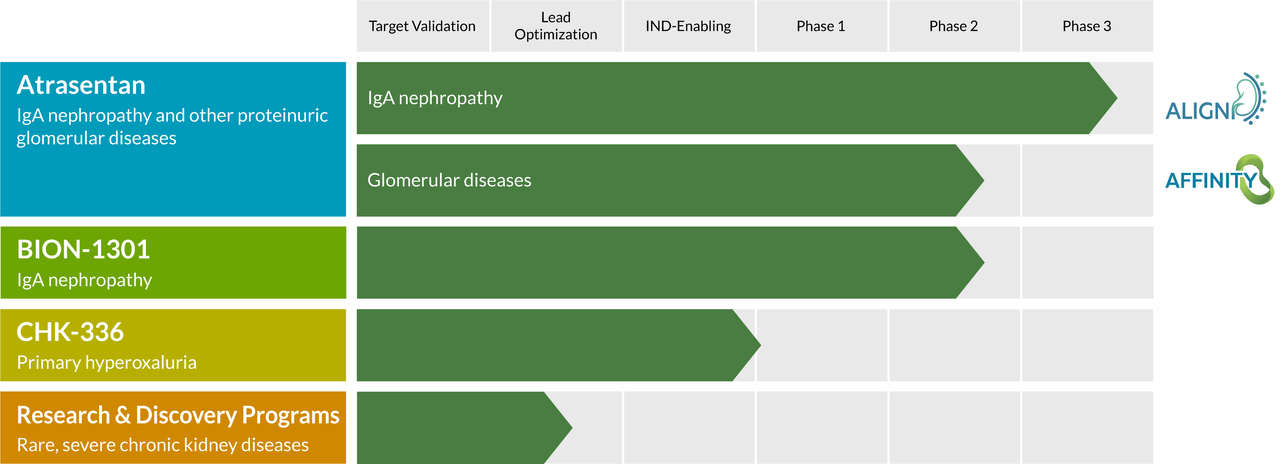

Pipeline:

Company Website

Atrasentan. With still a significant opportunity in front of it, Chinook has two candidates (employing different mechanisms of action) in the clinic pursuing the IgAN indication. The company’s lead asset is atrasentan, an endothelin A (ETA) receptor antagonist. ETA activation by circulating nephritogenic galactose deficient IgA (Gd-IgA) – the pathogenic variant of IgA – is associated with blood vessel constriction and mesangial cell proliferation, leading to proteinuria (high urine protein levels), renal cell injury, kidney inflammation, and fibrosis.

Atrasetan had undergone assessment in over 5,000 patients with diabetic neuropathy, including a Phase 3 trial (SONAR) conducted by AbbVie (ABBV) from 2013 to 2017. Owing to a lower than anticipated accrual of primary endpoint events and a strategic decision by AbbVie to exit the renal care business, the trial was terminated. However, patients who remained on study and reached the primary endpoint of at least a 30% reduction in UACR (urine albumin-to-creatinine ratio), experienced a statistically significant improvement in time to doubling of serum creatinine (p=0.029), a surrogate endpoint for renal disease progression.

Company Website

Chinook in-licensed atrasentan in 2019, issuing AbbVie nearly two million shares of stock, an undisclosed licensing fee, potential milestone payments of $135 million, and royalties on net sales ranging from the high single digits to high teens.

In March 2021, the company entered atrasentan into a 320-patient Phase 3 trial (ALIGN), with the primary endpoint change from baseline in proteinuria in the first 270 patients at six months post randomization. The secondary endpoint is change from baseline in estimated glomerular filtration rate (eGFR) after all 320 patients have completed ~30 months of treatment. The first endpoint is anticipated in 2023 and is designed to support accelerated FDA approval; the second endpoint is expected in 2H25 or 1H26 and is designed to support full FDA approval. Furthermore, based on management’s discussions with regulatory authorities in the EU, Japan, and China, positive results from ALIGN should be sufficient for approval in those territories.

Company Website

Atrasentan is also being assessed in an open-label Phase 2 basket study (AFFINITY) that initially has four cohorts: IgAN patients with lower levels of proteinuria; focal segmental glomerulosclerosis; Alport syndrome; and diabetic kidney disease combined with an SGLT2 inhibitor. The primary endpoint for each ~20-patient cohort will be change from baseline in proteinuria at 12 weeks. Initiated in April 2021, the IgAN cohort demonstrated a greater than 40% reduction in proteinuria in 91% of patients (10/11), increasing confidence in a positive outcome for ALIGN. The other three cohorts are currently recruiting.

Another geography where IgAN is a significant issue is China, where it is believed that at least 800,000 citizens – more than the U.S., EU, and Japan combined – are afflicted. To that end, Chinook established a joint venture called SanReno with Frazier Healthcare Partners, Pivotal bioVenture Partners China, et al to develop and commercialize kidney therapies in China and surrounding territories. The investors poured in $40 million for half the JV while Chinook owns the other half of the voting securities plus an option to purchase five million common shares at $0.01 each. Chinook is also eligible to receive milestones and royalties from this arrangement.

BION-1301. In addition to atrasentan, the agreement includes BION-1301, a monoclonal antibody that inhibits APRIL (A PRoliferation Inducing Ligand), which is a key B-cell modulating factor in the pathogenesis of IgAN. Like atrasentan, it was not developed by Chinook, but rather came as part of its reverse merger into Aduro. Unlike atrasentan, it operates at the initial stage of the pathogenesis of IgAN by reducing circulating levels of Gd-IgA1. This week, this candidate garnered European orphan drug designation for the treatment for primary IgA nephropathy

After demonstrating solid safety, tolerability, and pharmacokinetic profiles in healthy subjects, BION-1301 was introduced initially via IV once every two weeks, then transitioning to subcutaneous injection [SC] at ~week 24 into ten IgAN patients who comprised Cohort 1 in Part 3 of a Phase 1/2 trial with end goals of determining safety, tolerability, proper dosage, and proof of concept. Cohort 1, consisting of a 450mg dose, saw rapid and durable reductions in free APRIL and Gd-IgA with clinically meaningful reductions in proteinuria within three months. Cohort 2 (650mg SC; n=10 to 20) is currently enrolling with initial data anticipated around YE22. Chinook anticipates a pivotal trial for BION-1301 in 2023.

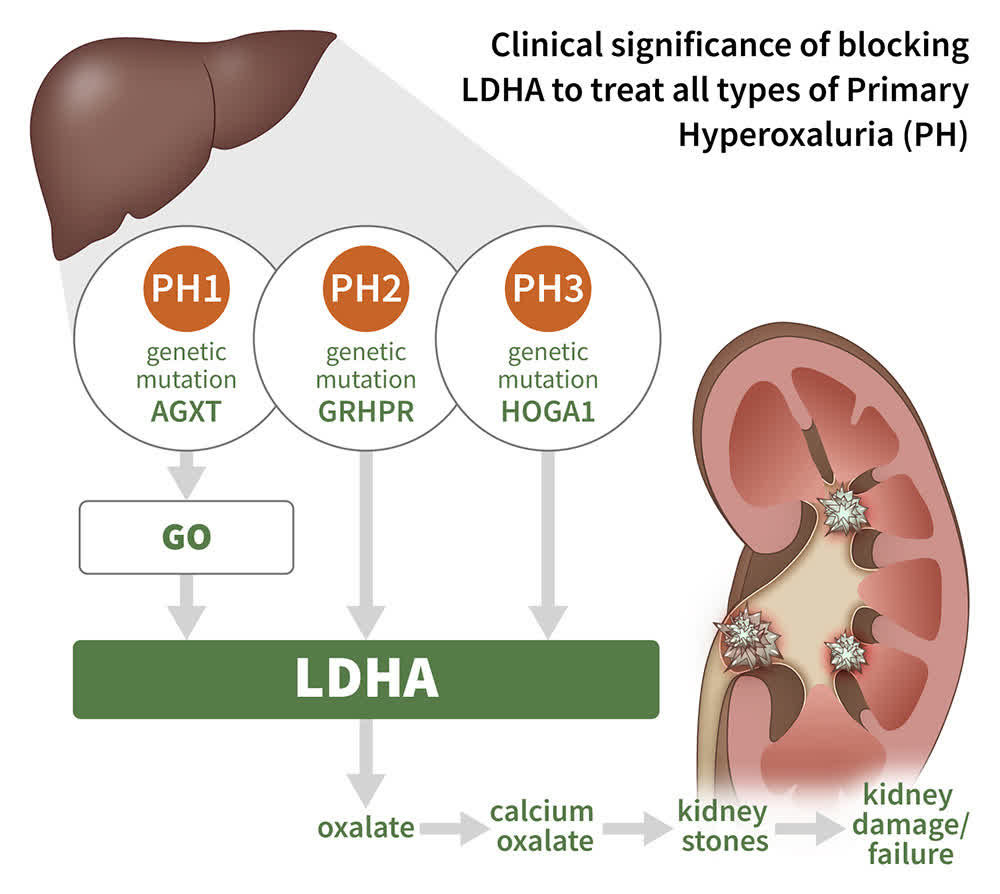

CHK-336. The company’s third clinical asset, CHK-336, is a lactate dehydrogenase inhibitor that is being evaluated in the treatment of hyperoxalurias, which are diseases caused by excessive oxalate, a potentially toxic metabolite that is produced primarily by the liver and normally excreted by the kidney. It is also a byproduct of the breakdown of ascorbic acid (vitamin C). Excessive buildup can lead to kidney stones, which can then lead to kidney failure. The liver-targeting molecule is currently undergoing evaluation in healthy subjects in a Phase 1/2 trial for hyperoxaluria, with an eye towards initiating the proof-of-concept Phase 2 stage in 2023.

Company Website

Balance Sheet & Analyst Commentary:

With cash and marketable securities of $330 million as of March 31, 2022, Chinook had enough capital to enable operations into mid-2024. However, after providing updated information on atrasentan and BION-1301 at the 59th European Renal Association (ERA) in May 2022, the company conducted a secondary offering on May 24, 2022, raising net proceeds of $106.3 million (assuming greenshoe exercise) at $14 a share – after raising $183.5 million at the same share price in November 2021 – laying the financial groundwork for atrasentan’s commercialization. Chinook also has an ATM facility with $40 million remaining.

Street analysts are unanimous in their optimism for the company’s prospects, featuring two buy and six outperform ratings, although only SVB Leerink and HC Wainwright have offered commentary in 2022, with the former upping its price target from $38 to $44 after Chinook provided updates on its two IgAN candidates at ERA and the latter reiterating a buy while maintaining a $28 price objective in February.

CEO Eric Dobmeier followed SVB Leerink’s recommendation and purchased 5,000 shares after the secondary offering at $13.03.

Verdict:

There is significant competition in the IgAN space, with Calliditas already to market with Tarpeyo, but that therapy comes with typical corticosteroid side effects such as hypertension. Furthermore, its 34% reduction in proteinuria levels – although better than the 5% reduction produced by off-label RAS inhibitors – appears inferior to the early data from atrasentan.

The other serious IgAN candidates include:

Travere Therapeutics’ (TVTX) dual (ETA and angiotensin II type 1) inhibitor (sparsentan), for which it has filed a BLA for accelerated approval after demonstrating a 49.8% reduction in proteinuria at 36 weeks, is a looming threat. However, its approval is not a slam dunk as sparsentan has been unable to clearly demonstrate a reduction in eGFR – arguably a better surrogate for end-stage renal disease than proteinuria. Its PDUFA date is November 17, 2022.

Omeros Therapeutics’ (OMER) monoclonal antibody narsoplimab demonstrated 50% to 90% reduction in proteinuria in a Phase 2 trial and is recruiting patients for a Phase 3 study. But the FDA issued a complete response letter [CRL] for narsoplimab after Omeros applied for its approval in the treatment of hematopoietic stem cell transplantation-associated thrombotic microangiopathy. Although the CRL does not look like it will bleed over to the IgAN indication, it has put the biotech in a somewhat challenged position.

Novartis’ (NVS) Factor B inhibitor LNP023 (iptacopan) is undergoing Phase 3 evaluation and is on a similar timeline as atrasentan.

Vera Therapeutics’ (VERA) atacicept demonstrated a 60% reduction in Gd-IgA1 as is undergoing Phase 2 evaluation.

Although the IgAN competitive environment is formidable, Chinook has two shots on goal and has a path to approval with plenty of cash. However, it can be argued that the biggest event for Chinook in FY22 will be the November 17, 2022, PDUFA date for Travere’s sparsentan.

This might make a solid covered call candidate with options expiring on October 21st. Two things prevent me from recommending that strategy, however. First, the stock has run up from $13 to nearly $18 over the past couple of weeks. Second, option liquidity is poor on this name at the moment.

Therefore, this is probably a small “watch item” holding for now and also a name we will revisit towards the end of this year to provide an update.

…some men aren’t looking for anything logical, like money. They can’t be bought, bullied, reasoned, or negotiated with. Some men just want to watch the world burn.”― Michael Caine

Be the first to comment