Bennett Raglin/Getty Images Entertainment

Investors have been very short sighted in regards to Shopify (NYSE:SHOP) throughout the pandemic, causing a dramatic boom and bust in the stock. While Shopify has a strong business with appealing long-term prospects, in the near term it is dealing with massive infrastructure investments, a post-COVID normalization of consumer spending, a possible recession and a changing privacy landscape. Given these near-term headwinds Shopify’s stock is still not particularly cheap.

Consumer Spending

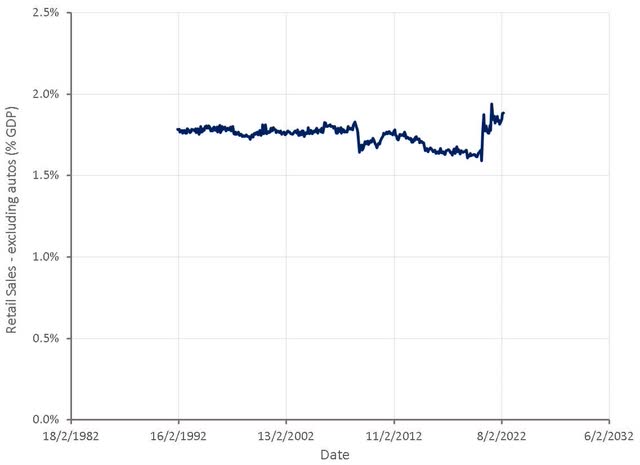

Shopify was one of the biggest beneficiaries of the pandemic, but as a result is now facing headwinds from a normalization of consumer spending and a shift in spending back to brick-and-mortar businesses. Both of these changes are likely still playing out, as retail sales would need to fall approximately 15% to return pre-pandemic levels and ecommerce would need to fall 6% to reach the pre-pandemic trend level.

Figure 1: Retail Sales – excluding autos (source: Created by author using data from The Federal Reserve)

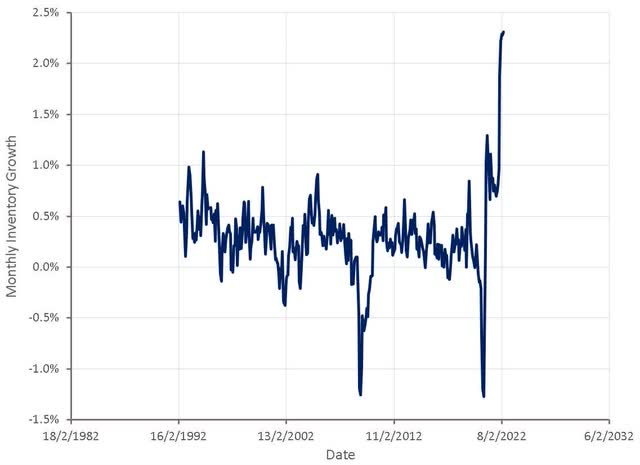

A number of data points indicate that the effects of the pandemic on the economy are waning. Mobility data shows that individual behavior has largely returned to pre-COVID norms. Retail inventories are currently growing extremely rapidly, implying that sales are currently not in line with the expectations of retailers and that many have over ordered. This is supported by freight data that indicates volumes are rapidly dropping off.

Figure 2: Monthly Retail Inventory Growth – excluding autos (source: Created by author using data from The Federal Reserve)

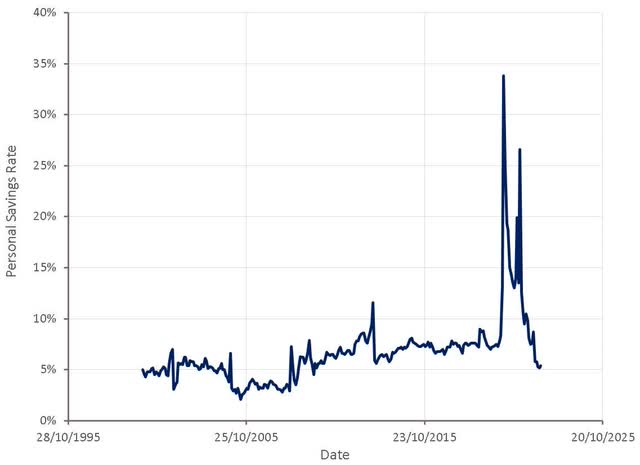

The personal savings rate is also at the lowest level in over a decade, which likely means that current levels of consumer spending are unsustainable. A reduction in consumer spending and a shift in spending from goods to services would both be negative for Shopify.

Figure 3: Personal Savings Rate (source: Created by author using data from The Federal Reserve)

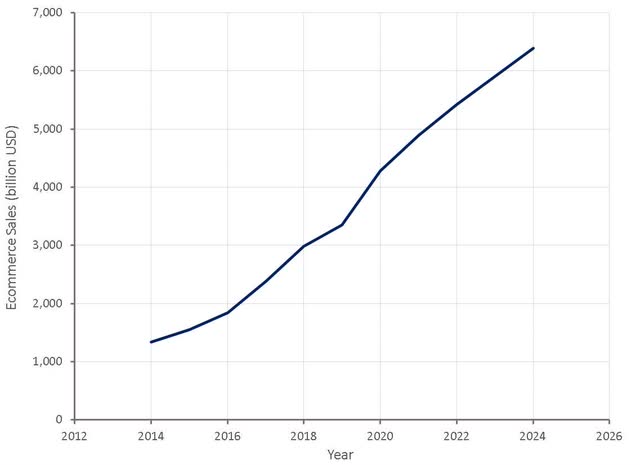

The COVID-19 pandemic accelerated the global trend towards digitization, but as the effects of the pandemic unwind there is a question of how much of this change is only transitory. While the underlying growth trend in ecommerce is likely to remain in place, an extended period of stagnation could occur due to the acceleration caused by the pandemic.

Figure 4: Ecommerce Sales (source: Created by author using data from Shopify)

A slowdown in consumer spending coupled with excess inventories and deflating asset prices could spillover into a recession with potentially dire consequences for many DTC companies. The impact of a recession is unclear as the DTC business model has rarely been tested by poor economic conditions. Ecommerce was just 3.6% of total U.S. retail sales during the global financial crisis, making it difficult to draw any lessons. Research indicates 41% of ecommerce businesses have done nothing to prepare for an economic crisis. If a deep recession were to occur, Shopify could permanently lose a large number of customers.

Shopify

Shopify offers a commerce platform designed for small and medium-sized businesses. This started as a set of tools to help merchants design, set-up and manage their online store, but functionality has expanded significantly overtime. The initial focus was on areas like domain registration and hosting, website design, search engine optimization, security, payments and analytics.

There were existing tools available at the time Shopify was founded, but these tended to be aimed at larger businesses and it was difficult for SMBs to integrate a wide range of point solutions. Shopify’s initial value proposition was a reduction in the burden of patching together point solutions.

The basis of competition has now likely transformed from ease of use to functionality though, with vendors increasingly offering full stack solutions that provide a single view of the business and its customers across channels.

There is a broader trend towards tools for SMBs becoming features of platforms rather than standalone products. Shopify is well positioned to become one of the primary platforms, which should strengthen its competitive position, expand its addressable market and improve margins. Newer services include:

Shopify Balance is a money management product that helps merchants manage their finances.

Shopify Capital provides merchants with financing to expand their business. In Q4, Shopify advanced nearly 324 million USD, up 43% from the same period last year. Shopify has lent a cumulative total of over 3 billion USD since 2016. Long term this is likely to be a smart move but in the short term a recession or consumer spending slowdown could create losses. Having never faced a true recession before, it is not clear how this part of the business will perform.

Shopify Plus helps larger organizations to continue their growth journey. In 2021, Shopify introduced a global ERP program so that high-volume merchants can manage their business operations at scale.

Shopify Payments allows merchants to automatically set up payments from all major methods when a Shopify store is created. When merchants use Shopify Payments, they aren’t charged third-party transaction fees for orders that are processed through Shopify Payments or PayPal Express, and they aren’t charged transaction fees on manual payment methods such as cash, COD, and bank transfers.

Shopify Markets is a cross-border management tool that helps merchants identify, set up, launch, optimize and manage international markets from a single store. Shopify Markets centralizes international selling tools, and introduces new functionality to help merchants manage and expand global sales. Merchants can also create markets that target specific countries or regions.

The Shop App is a digital shopping assistant that offers an end-to-end commerce experience. Features include Shop Pay, Shop Pay Installments, real-time order tracking, delivery updates and product recommendations.

Shopify also offers POS software and hardware, a BNPL solution, logistics and advertising solutions.

Omnichannel

Merchants increasingly must find a way to reach customers across channels and provide a seamless experience to remain competitive. This includes brick and mortar retailers increasing their online presence and DTC retailers increasing their physical presence. 32% of brands surveyed by Shopify said they’d be establishing or expanding their use of pop-up and in-person experiences in the next year, while 31% said they planned on establishing or expanding their physical retail footprint.

An increased physical presence is likely to be encouraged by the fact that digital customer acquisition costs are high and high vacancy rates have led to low lease costs. 54% of consumers surveyed say that, over the next year, they’re likely to look at a product online and buy it in store, and 53% are likely to look at a product in store and buy it online. This is not just a generational issue either, as 81% of Gen Z consumers in the US prefer to shop in store to discover new products.

Shopify’s POS integrates with merchant’s ecommerce sites, enabling merchants to easily review a customer’s holistic purchase history. Sales growth on Shopify’s POS outpaced ecommerce throughout 2021 and Shopify saw a 22% growth in the number of merchants using Shopify POS globally.

Shopify have been investing in APIs to connect merchants with buyers across surfaces for years, including transactions on partner platforms, like Meta (META) and Google (GOOGL) (GOOG). While still a small percentage of GMV, orders completed on key partner services more than quadrupled year-over-year.

Social Commerce

Direct-to-consumer competition is increasing and rising digital advertising costs are putting pressure on performance marketing driven business models. The cost per click for paid search ads increased by 15% between the second and third quarters of 2021 alone, and some brands have seen ad costs increase 5x to drive the same amount of traffic. A changing privacy landscape is also likely to have a continuing impact on how customers are acquired online, as declining returns on ad spend is forced brands to prioritize customer lifetime value and brand loyalty. As a result, social commerce is likely to be an increasingly important tool for ecommerce.

Brands can use social commerce for marketing, customer service, shoppable advertising and to build a community. Social commerce can also support brand building, which increases customer lifetime value and conversion rates, as well as attracting new customers. Sales through social media channels around the world are expected to nearly triple by 2025. China is the global leader in social commerce, with almost half of Chinese internet users shopping on social platforms compared to about 30% in the US.

Shopify allows merchants to create, run and optimize social campaigns across TikTok, Instagram and Facebook. Shopify also provides insights which can be used for targeted marketing and cross-selling across customer segments. TikTok shopping brings organic product discovery and shopping tabs to TikTok. Shopify also has a Spotify channel for musicians.

Privacy

Attitudes towards privacy on the internet are changing and this is having a large impact on how businesses attract customers. This impacts both Shopify’s ability to attract merchants to their platform and the ability of merchants to attract customers. At the heart of this is Apple’s (AAPL) App Tracking Transparency initiative, which has reduced the ability of advertisers to target potential customers and attribute conversions. ATT has notably had a large impact on Facebook but is negatively impacting all businesses that rely on targeted advertising.

It is likely that the impact of ATT on Shopify’s business is still evolving and there is potential for the impact to decline as adtech solutions evolve. Shopify could also build their own advertising network to assist merchants and strengthen the company’s competitive position, with Shopify Audiences a potential step in this direction. Shopify Audiences is a data exchange network which uses conversion data aggregated across merchants to propose an audience for a particular product based on past transactions. This audience can be used when advertising on Facebook, Snapchat (SNAP), Twitter (TWTR), etc. and should result in lower customer acquisition costs.

Connected TV

Connected TV is another area where Shopify is integrating with partners to provide merchants customer acquisition tools. This is an important channel as spending on connected TV ads is expected to grow by double digits over the first half of this decade. Roku (ROKU) have developed a tool that allows Shopify merchants to build, buy and measure TV streaming advertising campaigns. Interest in the capability has been strong, with Roku’s beta partnership goals filled in just one day.

Logistics

Shopify has been relatively slow in moving into logistics, but now appears to have committed to the development of a logistics network as a necessity. Supply chain management and fulfillment are some of the biggest challenges merchants face. For this reason, many merchants struggle to scale their business, even after they have product-market fit. Shopify is creating an end-to-end software and logistics platform that is fully integrated into the Shopify ecosystem. It aims to simplify logistics across the supply chain, from inventory inbounding to inventory distribution and D2C order fulfillment and returns. This includes managing and prioritizing orders, adding notes and tags, editing orders, creating and purchasing shipping labels, and managing returns.

The Shopify Fulfilment Network allows merchants to outsource inventory management and fulfillment. Merchants can also use one of Shopify’s premium third-party logistics (3PL) partners with seamless integration into their Shopify store. Shopify are consolidating their network to larger facilities and will operate more facilities themselves, while still leveraging partners where it makes sense.

Shopify expect to be able to deliver packages in 2 days or less to more than 90% of the US population. Over the next 3 years, Shopify plan to expand 1 day delivery coverage in the US and offer enhanced returns functionality. They are also planning on handling progressively larger merchants with a broader set of needs. Shopify are also developing a proprietary warehouse management system, which is now running in key warehouse locations and will handle all order volume by the end of Q2 2022.

When the Shopify Fulfillment Network was launched in 2019, Shopify expected to spend 1 billion USD over 5 years. Through 2021, Shopify has spent 117 million USD, which includes funding cash operating losses and a small amount of CapEx. CapEx related to Shopify Fulfillment Network will start to ramp in 2022, with an expectation of approximately 1 billion USD in capital expenditures over 2023 and 2024. Shopify expects fulfillment volumes to progressively scale toward the end of 2023 and into 2024.

Shopify acquired Deliverr for approximately 2.1 billion USD (approximately 80% cash) to strengthen their fulfillment network. Deliverr provides an asset-light, technology driven service that connects all stages of a merchant supply chain and manages distribution and fulfillment.

Developer Platform

The fact that Shopify provides a platform for developers is an important scale-based advantage. Third-party developers build apps for Shopify’s platform that help solve problems for merchants. Developers are attracted to the platform with the greatest number of merchants and merchants are attracted to the platform with the most functionality. 75% of merchants use Shopify apps and on average install 6 apps.

Competitive Positioning

Shopify’s competitive landscape is somewhat complex, particularly as companies offering tools to SMBs begin expanding functionality and encroaching on each other’s markets. Direct competitors include:

- Woocommerce

- Wix (WIX)

- Squarespace (SQSP)

- Magento (Adobe (ADBE))

- Weebly (Square (SQ))

- BigCommerce (BIGC)

- eBay (EBAY)

- Amazon (AMZN)

Functionality like payments, financing, business management and logistics is expanding competition though. It is possible that functionality like point-of-sale terminals, BNPL and accounting software become features of commerce platforms, rather than standalone products.

Not controlling a shopping surface represents a risk to Shopify, as a number of competitors are able to aggregate demand for merchants (Amazon). Shopify’s competitive position could be improved significantly if they controlled a distribution channel with a large number of consumers, although integrations with social media platforms like Tik Tok, Instagram and Facebook may accomplish the same thing to some extent. Shopify does have the Shop App, although this is on a relatively small scale.

Shopify’s inability to aggregate demand is weighed against the fact that they offer merchants control over the relationship with end customers. If a consumer searches a third-party marketplace or ecommerce site and selects a merchant’s product from among thousands of search results, the consumer is more likely to remember the brand of the third-party site than the brand of the merchant. Experiences that enable merchants to connect directly with consumers allow merchants to make a memorable impression.

The rising importance of logistics also calls into question Shopify’s positioning relative to Amazon. Shopify offer a neutral alternative to Amazon but they don’t have the scale based advantages that Amazon does (logistics, demand aggregation). Amazon has best in class logistics, which Shopify will struggle to compete with. This may limit Shopify’s success in some categories but is unlikely to be fatal. For items with high value per unit of weight, delivery costs are unlikely to be important. Sensitivity to delivery speed is also likely to vary significantly across categories. For many items consumers are likely to be unconcerned about waiting a few additional days.

Amazon’s GMV in 2021 was 600 billion USD in comparison to Shopify’s 175 billion USD GMV. This difference in scale could make it difficult for Shopify’s logistics to compete effectively against Amazon’s. This is difficult to assess though as economies of scale in logistics will be localized to some extent, and hence cannot be evaluated on an aggregated basis.

Valuation

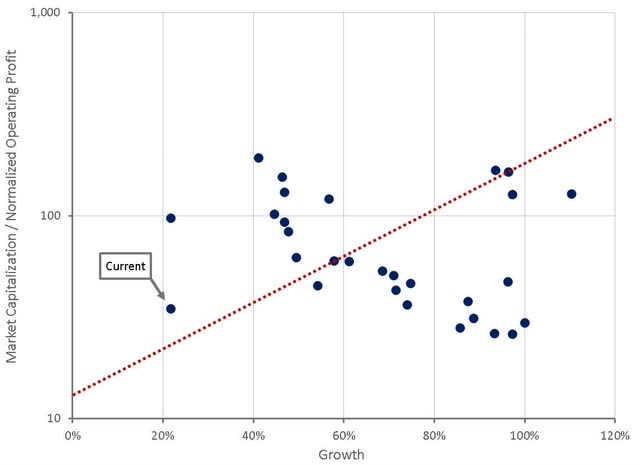

Investors over extrapolated Shopify’s growth during the pandemic, causing the stock to run ahead of the fundamentals of the business. As growth and profitability have normalized, investors have reassessed Shopify’s business, causing a dramatic drop in valuation. Shopify likely still has a large growth runway ahead of it. There are an estimated 12–24 million ecommerce sites across the globe and Shopify estimate that their addressable market is approximately 150 billion USD.

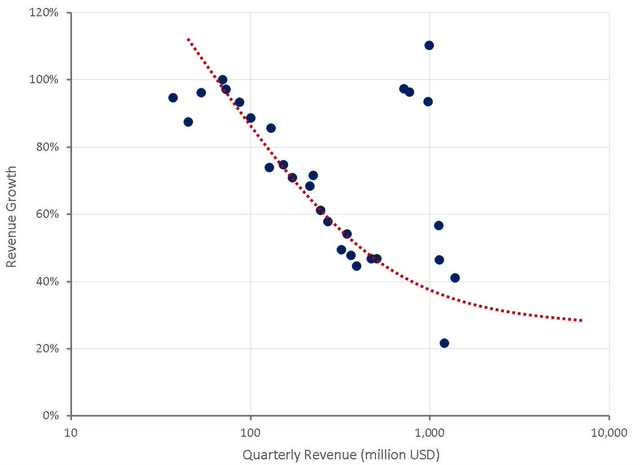

Figure 5: Shopify Revenue Growth (source: Created by author using data from Shopify)

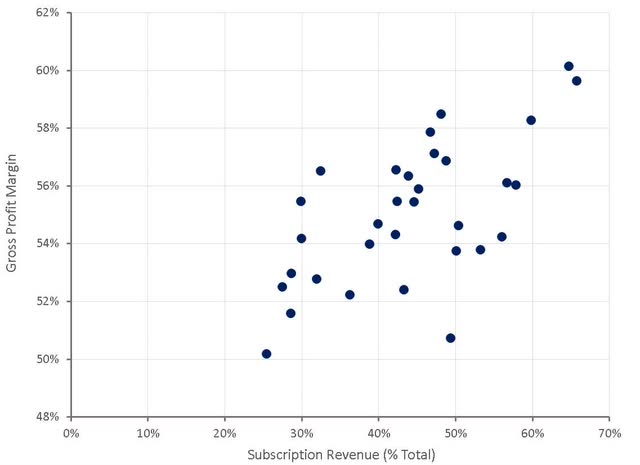

In addition to a normalization of growth, Shopify faces declining gross profit margins as the merchant business becomes relatively more important. The majority of merchant solutions revenue comes from Shopify Payments.

Figure 6: Shopify Gross Profit Margins (source: Created by author using data from Shopify)

Shopify’s logistics business will also potentially drag on margins going forward, limiting profitability and hence the multiples that Shopify trades on. Shopify’s stock is probably now reasonably valued if growth can reaccelerate, but if growth declines further the stock may continue to fall.

Figure 7: Shopify Relative Valuation (source: Created by author using data from Shopify and Yahoo Finance)

Conclusion

With a looming recession, fallout from privacy initiatives and a changing competitive landscape, Shopify’s stock is still not cheap. Shopify has a strong competitive position though and if they can execute on logistics and navigate a more privacy focused internet the business should continue to perform well.

Be the first to comment