Alena Kravchenko

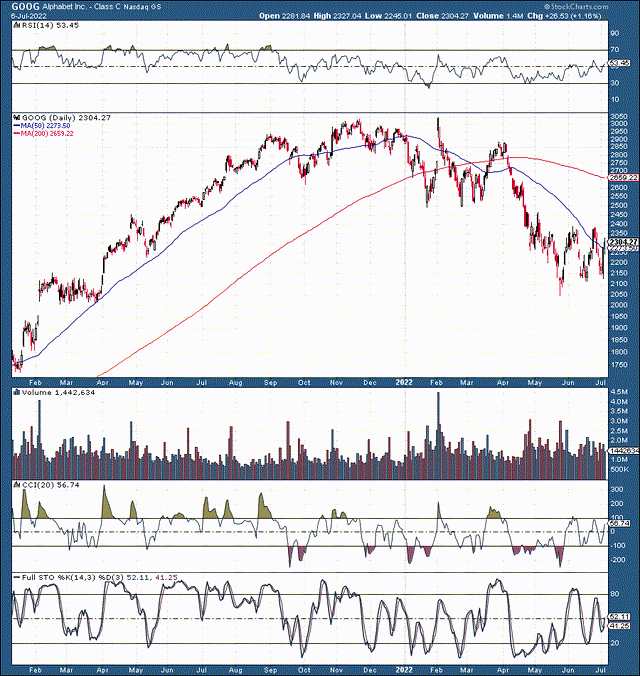

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), also known as Google, has been battered senselessly since the bear market began. The tech giant’s stock cratered by 33% from peak to trough. However, as investors show more interest in quality, badly beaten-down tech companies, Google’s shares are making a comeback.

Google went through a massive correction, declining by 33% to the critical support level of around $2,100 – 2,000. Now the stock is making a series of constructive higher lows and higher highs. While there is no guarantee that Google’s stock won’t make new lows in the near term, the downside is likely limited from here. On the other hand, there is significant intermediate and long-term upside potential for Google’s shares. The company remains the dominant force in the lucrative global search market.

Moreover, Google has various thriving secondary businesses and ventures that should develop into booming enterprises in the future. Additionally, the company’s share price should benefit from the company’s upcoming stock split. Oh, yes, and considering the company’s roughly 15% revenue growth rate and 17-18 forward P/E multiple, Google’s stock is dirt cheap here.

Global Search – Google is King

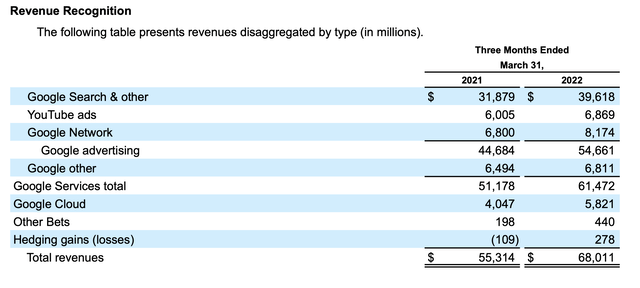

Google Search and “other” accounted for 58% of Google’s revenues last quarter, a whopping $39.62 billion. The company is an advertising giant, and approximately 80% of the company’s revenues come from ad dollars. Total ad revenue was $54.66 billion last quarter. Thus, Google search accounted for 72.5% of all ad revenues.

Google Revenues

In addition to massive ad revenues, we see significant growth numbers. Google’s search revenues surged by 24% YoY. Total ad revenues increased by more than 22% in this time frame. Google’s booming cloud segment revenues skyrocketed by 45% YoY, and total revenues increased by approximately 23% in the quarter, illustrating robust growth and massive profitability potential for Google.

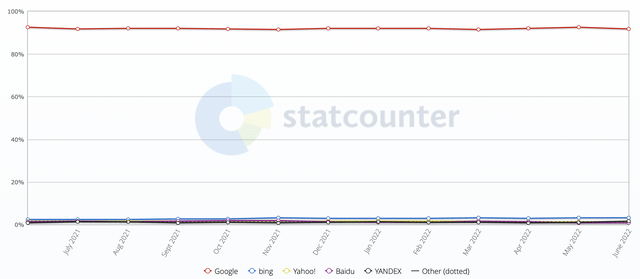

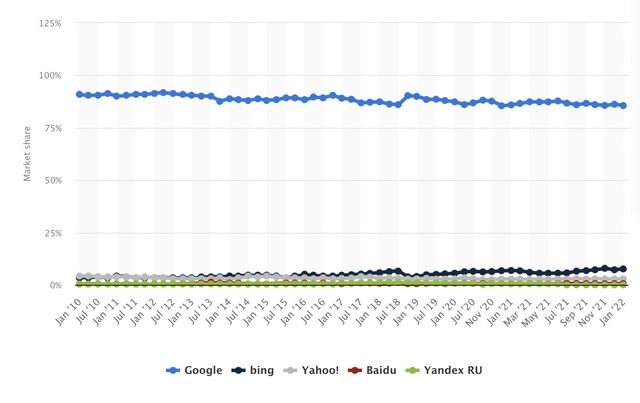

Worldwide Desktop Search Market Share

Google continuously dominates the global search market. We’re looking at a longer-term chart here, and Google’s market share has decreased from roughly 90% to around 85.5% in about 12 years. Since Baidu (BIDU) is mainly in China, and Russia’s Yandex (YNDX) is in big trouble like most other Russian companies, Google’s only competitors are Yahoo (APO) and Bing (MSFT). Yahoo has been stagnant, but Bing has gained a small share in the market in recent years. However, due to Google’s global search dominance, it is doubtful that Bing will take a significant market share away from Google.

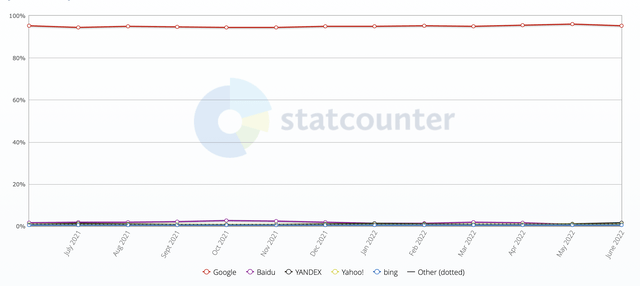

Worldwide Search Market (All Platforms)

Search share (gs.statcounter.com)

Looking at “all platforms,” Google’s search dominance becomes more apparent, as Google search accounts for roughly 92% of the entire market. Bing is only at about a 3% market share here, and the other search engines are relatively insignificant.

Worldwide Mobile Search Market

Search share (gs.statcounter.com)

Now, the big one, mobile search, Google’s dominance is massive here at a staggering 95%. Bing only has about 0.5% share in the lucrative mobile search market. Therefore, there is a high probability that Google will continue dominating in search. Fortunately, the global search advertising market should continue expanding, providing increased revenue for Google as the company advances in the coming years.

Google’s Massive Opportunity

The global search advertising market was valued at approximately $164 billion in 2020. From 2021 to 2028, the CAGR will likely be about 8.6%. In 2020 mobile search accounted for about 65% of the market share. Moreover, the mobile segment is expected to have a faster CAGR of over 9%. The desktop segment is expected to register a CAGR of about 7.5% from 2021-2028. Therefore, global search ad revenues could be around $318 billion in 2028. If Google maintains a market share position of 90% or higher, the company’s revenues could be about $286 billion in the search ad market alone.

In 2021, Google Search and “other” registered about $149 billion in revenues, so we may look at approximately a 100% increase in revenues through 2028. In addition to search, Google has other highly profitable businesses that should account for more revenues over time. For instance, YouTube’s ad revenues surged 38% YoY to $31.7 billion in 2021. Google’s cloud segment revenue skyrocketed by 48% to $19.2 billion in 2021. Therefore, Google has other substantially profitable, high-growth segments beyond search, but the company is likely to expand into many new industries as it advances. By 2028 search ad revenues should represent fewer than 50% of Google’s total revenues, implying that we may see the company’s revenues approaching $600 billion by then.

Google’s Bright Future

In addition to Google Search, YouTube, Google Cloud, and other highly profitable segments, the company will likely venture into many other areas. Google has a heavy presence in the lucrative mobile phone market with its Android OS, which owns about a 72% market share in the smartphone market. In the future, Google will probably use its dominance in the smartphone OS market to expand into wearables and other hardware.

Google is also making a push into Online TV with Android TV. The company is developing more smart devices for the home, with Google Home, a new Chromebook laptop, a new VR headset, and more. Google is a leader in AI and machine learning, which sets it up to do well in various healthcare industry segments.

In addition, machine learning and AI fuel Waymo’s dominance in self-driving technology. Google is also the top corporate clean power buyer, setting the company up for opportunities in the renewable/clean energy industry. Gaming, travel, media, and even banking and defense are several opportunity areas Google is likely to excel in as the company moves into the future.

The Stock Split – Another Constructive Catalyst

After the close on July 15th, Google’s stock will go through a 20-1 stock split. Therefore, if you own 50 shares at $2,300, get ready to own 1,000 at about $115. The stock split is a very constructive phenomenon, as the company’s stock price has become relatively high. A lower share price will make the stock more accessible to the mass population/retail investors, and Google’s shares should experience an increase in demand. Moreover, a lower stock price will enable more options strategies in Google’s shares. Therefore, the upcoming stock split is another constructive catalyst to consider if you own Google or are considering buying the stock.

Google: Great Opportunities & The Stock is Dirt Cheap

Google has many positive factors and constructive catalysts. The stock’s technical image is improving, and the shares will soon go through a stock split. Google is the king of search, and the advertising search engine market should expand considerably in the coming years. Moreover, Google has various secondary businesses that deliver high revenues and should continue growing substantially as the company advances. Additionally, Google is well-positioned to expand into numerous future businesses that should develop into profitable enterprises.

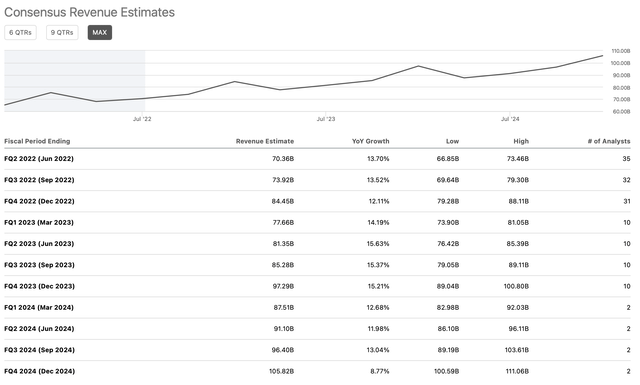

Google is geared up to deliver about $300 billion in revenues this year, roughly a 23% YoY increase. Moreover, the company should provide approximately $345 billion in revenues in 2023, about a 15% YoY increase. Additionally, relatively robust growth (10-15%) should continue in 2024 and future years.

Revenue Estimates

Revenue estimates (SeekingAlpha.com)

Would you believe me if I told you that you could buy all this growth and all this fantastic potential below a 20 P/E? Yes, due to the panic and the displacements in the market, Google is dirt cheap right now.

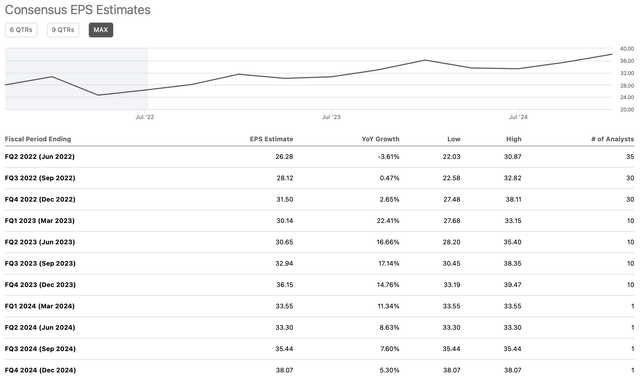

EPS Estimates

EPS estimates (SeekingAlpha.com)

- Last year, Google earned $85.28 per share.

- This year, the company should earn about $110.50 (consensus estimates).

- Next year, Google should earn about $130, per consensus expectations.

So, we’re looking at an EPS growth of approximately 30% this year and roughly 18% in 2023. Furthermore, we should continue seeing EPS advancements as the company’s revenues continue expanding in the coming years. Therefore, while Google is trading at about 17.7 forward (2023’s) EPS estimates now, this valuation and its stock price may not remain down for long. After all, many technology companies with much lower growth rates than Google trade at significantly higher multiples, even in today’s challenging environment.

What Google’s Financials Could Look Like in Future Years

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| Revenue Bs | $300 | $345 | $393 | $448 | $506 | $567 |

| Revenue growth | 23% | 15% | 14% | 14% | 13% | 12% |

| EPS | $110 | $130 | $155 | $180 | $214 | $250 |

| Forward P/E | 18 | 20 | 22 | 23 | 22 | 21 |

| Price | $2,350 | $3,100 | $3,960 | $4,920 | $5,550 | $6,000 |

Source: The Author

While Google’s P/E ratio is down below 20 now, it is probably due to the uncertainty in the market. Typically, Google’s P/E ratio has been around 20-25 and at times higher. Therefore, the low P/E ratio is probably a transitory phenomenon, and we should see multiple expansion when the economy clears up. Using relatively modest revenue and EPS growth projections, we see Google’s stock price can probably double over the next three to five years. The underlying dynamic makes Google stock an excellent risk/reward investment here, with a high probability of significantly higher prices intermediate and long-term.

Be the first to comment