karenfoleyphotography/iStock Editorial via Getty Images

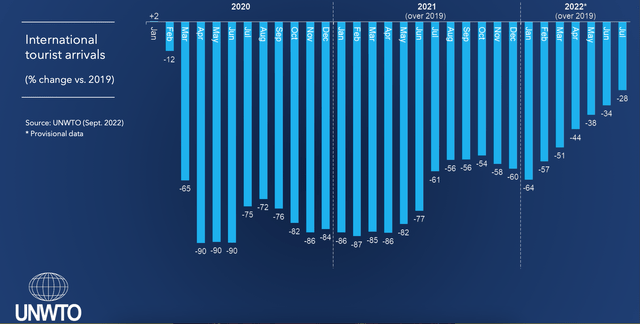

Global tourism is on the mend. The latest numbers up to July 2022 show that while it’s not yet at pre-pandemic levels, the figures are just 28% down from their 2019 levels compared to a 61% gap in July 2021. In fact, the decline in tourism was at 64% even in January this year but has been shrinking consistently since (see chart below).

And that’s not all. 78% of the respondents from a panel of experts surveyed by the UNWTO in September this year expected better or much better tourism prospects for the remainder of the year. While this is a slight decline from the 83% that expected the same in the survey round in May, quite likely as tougher economic conditions and rising prices weigh on consumer spending, it’s still an appreciable number.

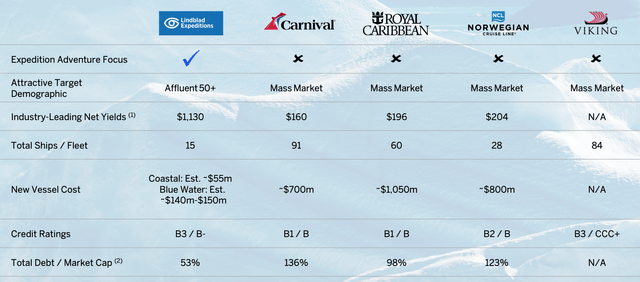

Luxury tourism, however, is less likely to suffer setbacks to tourism because of a sagging economy in any case. And that’s where Lindblad Expeditions Holdings (NASDAQ:LIND) comes in. The expedition cruise and land-based adventure travel provider attracts affluent customers, with an average trip lasting 8 days and an average price of $14,000. It might not be a mass market player but could still hold potential considering that the adventure tourism market is projected to grow by ~18% between 2021 and 2026 to reach a size of a huge $1.8 trillion.

Reviving fortunes

The company’s fortunes have revived quite a bit already in the first nine months of 2022 as well after revenues started inching up in 2021 following the pandemic. They rose by a huge 272% year-on-year (YoY) and have even surpassed their 2019 levels. This is due to both the resumption of its cruises as well as the acquisition of three companies. With Off the Beaten Path, it now provides outdoor Adventure and National Parks, Classic Journeys that engages in cultural and culinary exploration with walking tours and with the acquisition of Duvine Cycling + Adventure Co, which as the name suggests, it now organises cycling tours.

While it still clocked operating losses for the nine-month period, there’s hope. In the third quarter of 2022, the company finally swung back into an operating profit after nine quarters of losses as the company continued to ramp up operations post-pandemic.

High debt, low liquidity

However, for sectors like travel that were among the worst affected during the time, it’s essential to look not just at their current performance but also at their debt situation. LIND for instance, saw an over doubling in its total debt between the end of 2019 and 2021. At the end of September this year, its debt ratio was at 1.1x, which is actually an increase from just below 1x at the end of 2021. This is despite the fact that it made all three acquisitions last year through cash and stock. To be fair, it’s far from the worst, but it’s not comfortable enough for me either.

If its liquidity ratios looked alright, I’d be less concerned, but that’s not the case either. Its current ratio, for example, is at 0.6x which has also worsened from 0.7x for 2021. Its cash ratio at 0.4x doesn’t inspire confidence either. Considering that it has only had one-quarter of operating profits so far encourages even more caution for now.

The company does point out that its debt is much better placed than its peers. In a comparison provided in an investor presentation in May 2023, its total debt to market capitalisation was at 53%. In comparison, cruise providers like Carnival Corporation (CCL), Royal Caribbean (RCL) and Norwegian Cruise Line (NCLH) (see chart below). But right now there’s still a question mark on the attractiveness of the tourism segment as a whole, so it’s not an entirely convincing argument from the stock investment perspective.

Favourable market multiples

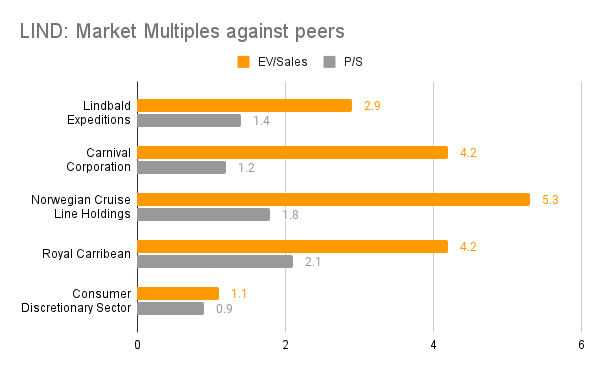

Yet, compared to these companies, on average Lindblad Expeditions Holdings looks a tad undervalued. Since the sector has seen a rise in debt recently, here I consider EV/Sales besides the more standard price-to-sales (P/S) metric since it gives a fuller picture. The average EV/Sales is at 4.1x for them, while LIND is at 2.9x.

Similarly, the P/S on average is at 1.6x compared to LIND at 1.4x. Investors are already showing a favourable inclination to its stock, which has risen by an impressive 25.8%. It would be easy to think of it as a run-up in beaten-down stocks as the broader markets have been more optimistic recently. But one look at its price chart reveals that the big spike came for it after it released its earnings in early November. In other words, LIND’s performance is actually the big reason for the run-up, though it helps that the markets are less gloomy as such. The fact that we haven’t seen any new variants of coronavirus as we prepare to get into the thick of winter in many parts of the world, is also encouraging.

Source: Seeking Alpha

Even though all the travel stocks mentioned have higher valuations than those for the consumer discretionary sector, I do think that based on LIND’s comparison with other cruise operators at least, some short-term upside is possible. I reckon it’s about 10-15%.

What next?

If the company continues to make progress, the picture could look even better. This is especially so as it focuses on luxury tourism, typically for the over 55s. It might even be a short-term buy for risk-tolerant investors. But I think there are also risks associated with the stock. It’s still broadly loss-making and its high debt and poor liquidity are challenges too. This is one to circle back to in a few months’ time for me and assess how the situation evolves. For now, however, I wouldn’t take action on it.

Be the first to comment