JHVEPhoto

If there was a year for the CME Group (NASDAQ:CME) to really shoot the lights out in terms of both stock and operational performance, given that the Treasury contract remains the largest contract at the CME, accounting for nearly 50% of total volume every quarter and year, 2022 was it.

And yet the stock laid an egg, returning -22.09% as of Friday, November 25th, 2022, versus the SP 500’s YTD return of -14.31%.

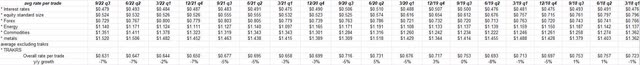

Without burying the lede, here’s one table that highlights the issue perfectly:

CME’s Rate-per-Contract since 3/18 (quarterly earnings)

The RPC data goes back 29 quarters to 9/30/15, not all of which can be cut-and-pasted on the spreadsheet above. Here’s a rolling average of the rate-per-contract from 9/30/22 back to 9/30/15:

| Period | RPC | y.y change |

| 4-quarter | $0.64 | -6% |

| 12-quarter | $0.68 | -3% |

| 20-quarter | $0.698 | -3% |

| 25-quarter | $0.707 | -3% |

| 29-quarter | $0.716 | -2% |

Source: valuation spreadsheet from earnings reports

The set-up for CME coming into 2022 was that with the Fed finally moving off zero interest rates and with the Treasury contract being 46% – 48% of total CME volume, anytime you get a sharp volume increase in the CME’s contracts off that fixed-cost base it usually means higher margins and higher EPS for the exchange giant.

The stock moved sharply higher in Q1 ’22 trading up to $250 per share but since then – despite continued 75 bp fed funds rate hikes and a gradually higher 10-year Treasury yield, increasing from roughly 1.50% as of late ’21 to over 4% in late October ’22, the stock has fallen from $250 in March to today’s $175.

It’s been like the air gradually coming out of the balloon.

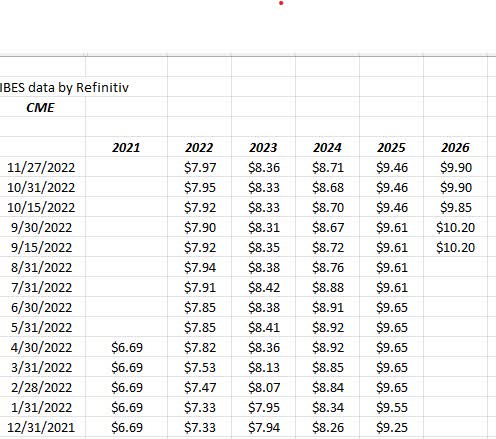

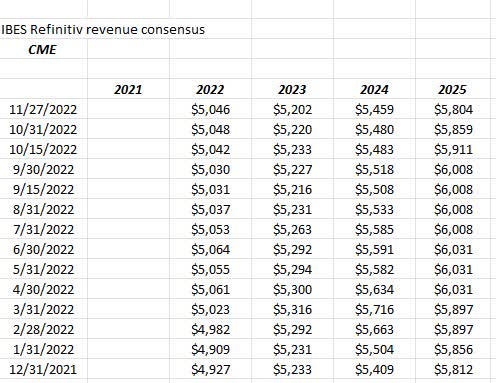

Forward EPS and revenue estimates for CME

CME EPS estimate revisions (IBES data by Refinitiv) CME revenue estimate revisions (IBES data by Refinitiv)

2022’s revenue estimate for CME has risen by 2.2%, which is a positive, but the 2022 consensus EPS estimate has been revised higher by 8.7%, since 12/31/21, a good sign, expect that stock price hasn’t really followed.

The longer run

Terry Duffy, the CME CEO, has mentioned Google Cloud in the past as an ongoing initiative to potentially reduce exchange costs and overhead overtime. CME has done a great job of managing expenses and managing to operating margin targets, with CME’s operating margin peaking at 68% in Q1 ’22 thanks to Treasury volume, but in the subsequent two quarters seeing the operating margin return to 64% and during COVID fall to the high 50% range.

I do think the longer-run problem for CME is price pressure and that RPC and the potential for disintermediation by other exchanges on the CME contracts.

The exchange is trying to lower execution costs and one way to do that is trying to move to the cloud, but I don’t how viable that is under the cloud.

Any exchange – not just the CME – although CME and ICE are two of the best, their only “surety” is to guarantee their standing as a buyer to the seller, and as a seller to the buyer, and assure delivery despite the financial condition of the counterparty, and I just don’t know what role the cloud would play in something like that.

Summary / conclusion

If US inflation would suddenly collapse (probably unlikely) and if the US economy would fall into a steeper recession (again, that seems less probabilistic today, but not so much for the 2023 forecasters, readers and investors could see a Treasury volume spike from those looking to get long, but like in 2020, that volume tends to fade quickly on the long side, and dry up and stay static for many quarters.

CME will likely continue to improve their cost structure and try and improve margins to offset the weakness in RPC, but that too is a tough road to hoe.

When this earnings preview was written in February ’22, the stock had broken out of a technical range that lasted about 6 weeks, and now it’s fallen back to a longer-term range, in a market where the stock should have gained momentum status.

The stock has been sold in client accounts – the vast majority of it anyway – except for two accounts which have lower cost basis on the shares, since 2022 was the perfect setup for major outperformance for the shares, which never happened.

In September ’21, this article was written and it’s exactly what ’22 turned out to be, but it seems as if the RPC pressure has meant revenue hasn’t been what it would ordinarily be for CME in this kind of market.

To the point, the stock has disappointed, and it’s been sold waiting to see what happens next.

CME and the Intercontinental Exchange (ICE) hold wide moats, while the Nasdaq (NDAQ) still has a narrow moat assigned to it. These are tough businesses right now, even though with the economic and capital market uncertainty it would be the ideal place to layoff risk and hedge cash positions.

Be the first to comment