Bill Pugliano

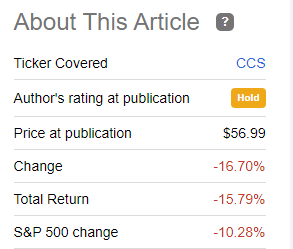

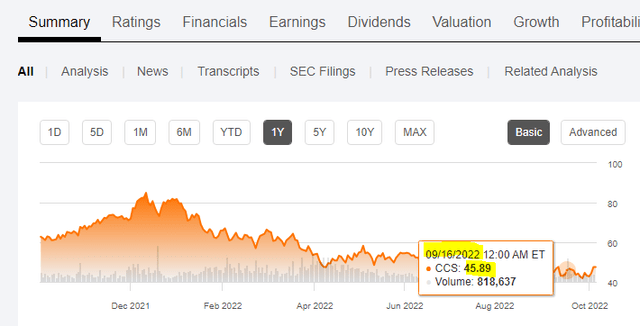

When we last covered Century Communities Inc. (NYSE:CCS), we stayed out, despite what was on the surface, an incredibly compelling valuation. After all, the stock was trading at under 3X earnings. We suggested that the $45 Cash Secured Puts for September 2022, were the best hope we could offer for the bulls.

We like this company and the recent dividend hike that we saw. At the same time, we just don’t think the interest rate risks are fully priced in. If we had to initiate a position it would be via the mechanism shown above.

Source: Valuation Getting Attractive But Risks Remain

The stock is down since then and it has completely validated our decision to stay out.

Seeking Alpha

This was also an interesting demonstration of how cash secured puts can routinely outperform direct long positions during market declines. CCS closed September 16 (option expiration day) at $45.89 and once again dodged the $45 Cash Secured Put strike that we had suggested.

This meant that the option position outperformed the common shares by 29% (+12% versus minus 17%). We look at what lies ahead of these homebuilders in general and CCS in particular as our risks have started playing out.

Interest Rates

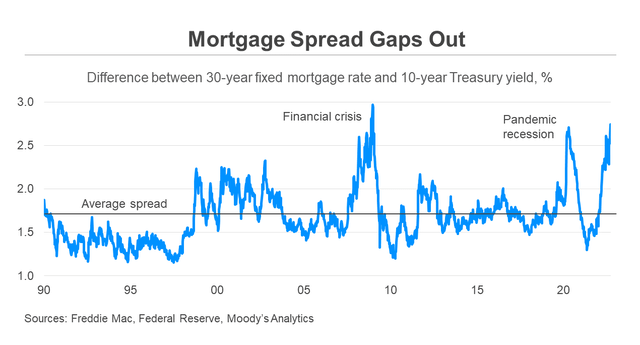

At the forefront of affordability is the drama on mortgage rates. The Federal Reserve turned a complete blind eye to the bubble it was creating in housing in 2020 and 2021 by suppressing rates. Today, it has gone in the other direction to rectify the first mistake and is selling mortgage backed securities into a really bad market.

Yes, we have all heard how mortgage rates were far higher in the 1980’s. The key difference here is the speed of change. The percentage change in mortgage rates over the last 15 months is the fastest ever. It has also come on the back of the highest home price appreciation. The result is that affordability has tanked and is not going to move up. The average person can afford 30-40% less square footage than they could in 2021.

Our outlook here is that we are closer to the end of the hiking cycle than the beginning, but don’t expect robust rate cuts until core CPI starts rolling over. This makes for a challenging time for homebuilders.

The Economy

The intentional collateral damage in the Federal Reserve’s inflation fight has been the economy. JOLTS, the survey which looks at job openings, rolled over recently as the 1-2 punch of higher energy prices and higher rates finally took effect. We are also seeing the IPO babies and bubbles of 2020 and 2021 start to fully implode. They were responsible for a lot of job creation and they will be responsible for a lot of the upcoming job destruction. Conservatively, we expect 50% of those to go to zero. Homebuilding will be a challenging exercise for that reason as well.

Margins

CCS and the other homebuilders like KB Home (KBH), D.R. Horton Inc. (DHI) and Lennar Corporation (LEN)(LEN.B), will see the maximum benefit on the raw materials expense front. If you go back to 2021, the one thing that you kept hearing on conference calls was about lumber prices. That’s done.

Shipping lanes are opening up and backlogs have all been cleared. Combination of lower demand and higher supply means that premium pricing on everything has evaporated. This will help in future construction costs but at the same time, we expect margins to still fall as prices are lowered. Labor costs are still rising and while that may change in 2023, it will still be rough for 2022. Homebuilders have their work cut out for them.

Verdict

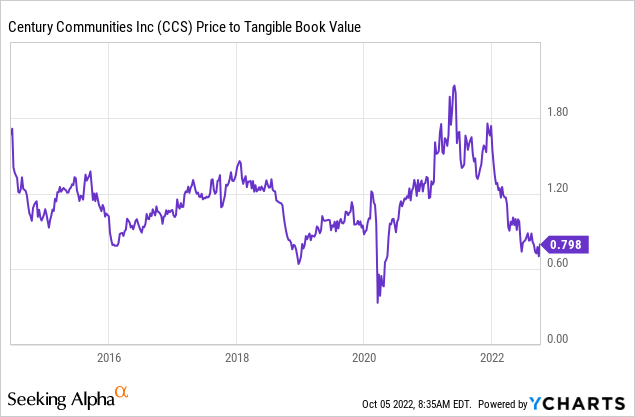

Since our first article, both our suggested option trades have outperformed a buy and hold by over 50%. Of course, at some point CCS will bottom and then the defensive strategy will underperform. We don’t think we are there yet. Yes, CCS is now ridiculously cheap on our favorite measure, but there is still room here to go lower as the fundamentals are atrocious.

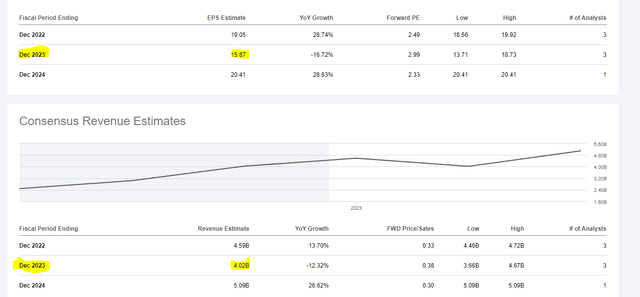

Earnings estimates are still completely removed from reality in our opinion. Consensus expectations are for a 12% drop in revenues and a 17% drop in earnings.

Those are truly laughable forecasts. We would be shocked if revenues only dropped by 25% in 2023 (from current expected 2022 base) and earnings did not drop by at least 50%.

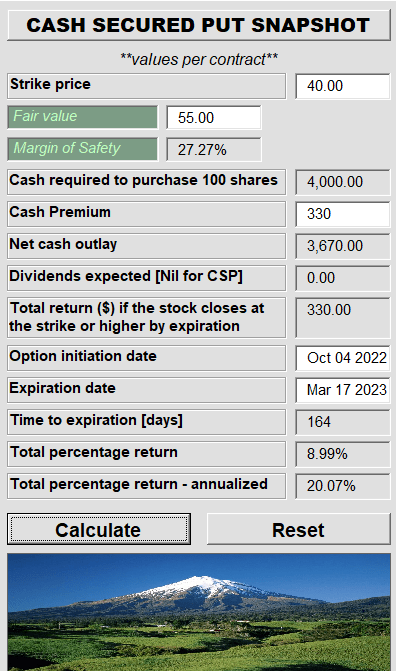

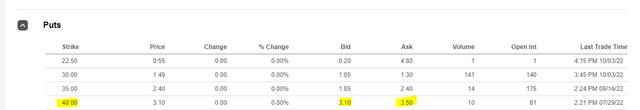

We would stick to the defensive game and consider selling the $40 Cash Secured Puts for March 2023.

If you do end up getting long, it will be below even the current 52-week lows of $39.00.

Author’s App

That is our strategy in this sector and we are sticking to it.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment