Scruggelgreen/iStock via Getty Images

I’ve lived in Wisconsin since the day before I turned 5. I grew up, went to school, raised a family, and formed businesses that transact nationally and internationally. Throughout my experience, I understood that my Midwest US location carried a discounted perception to our capacity and capabilities. Because of this, I feel a particular kinship to Minot, North Dakota/Minneapolis, Minnesota-based Centerspace (NYSE:CSR).

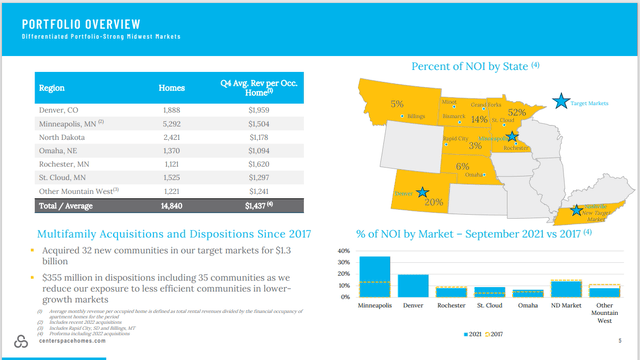

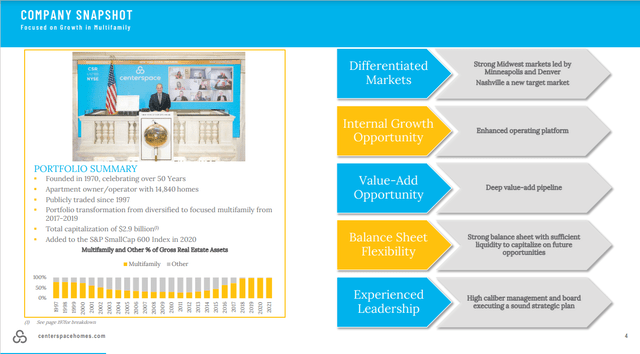

Beginning in 2017, Centerspace undertook an arduous transition from a diversified property REIT founded in 1970 to the Midwest market multifamily REIT they are today. The transition was successful and transformative. I consider CSR to be a value and growth opportunity in today’s multifamily investment pursuit. This company is under-covered and unknown to the broader institutional investment community.

Centerspace Today

When you think about Centerspace today, you have to understand that 2021 was a transformative year and that it was the time when they concentrated their portfolio in the Minneapolis/Minnesota markets.

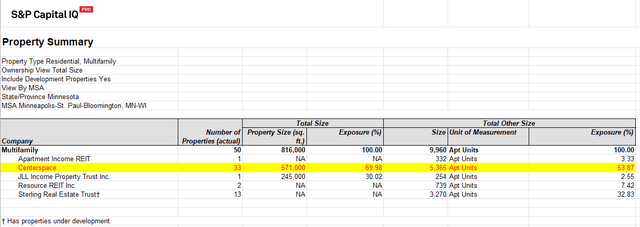

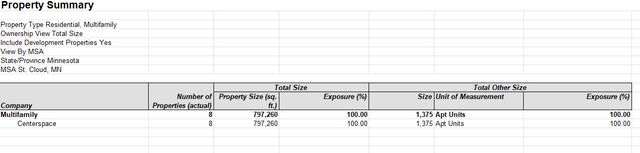

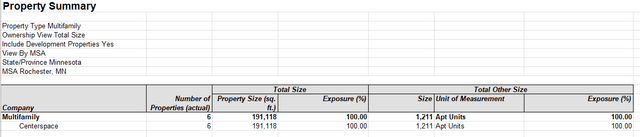

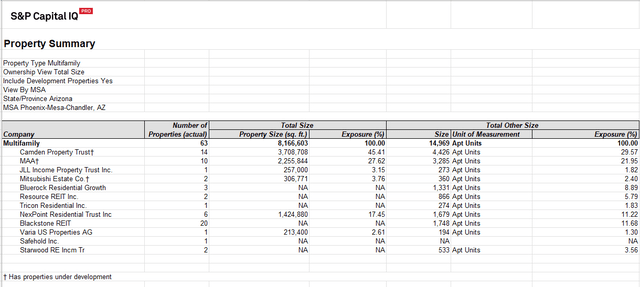

Centerspace S&P Capital IQ S&P Capital IQ S&P Capital IQ

With over 50% of their assets located in Minnesota, CSR is geographically concentrated. It should also be noted that Centerspace is the only public REIT presence in these markets.

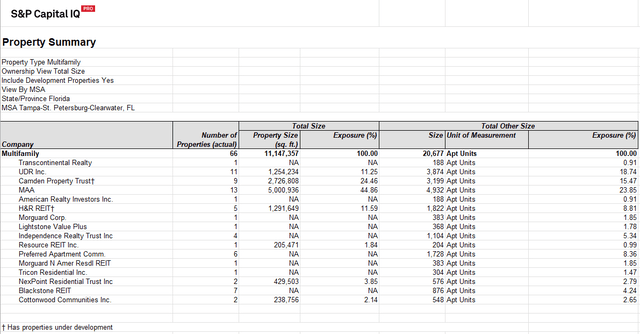

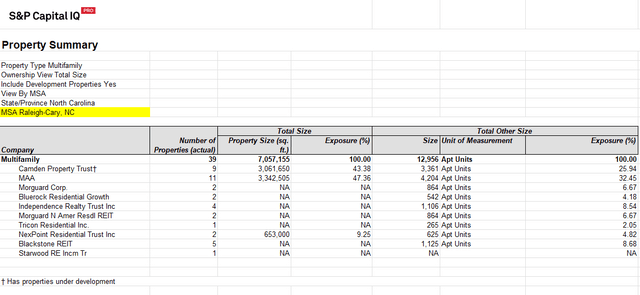

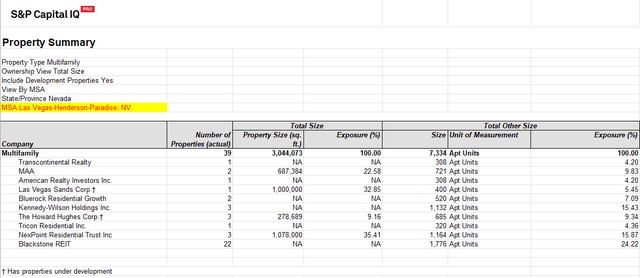

If you click to the hot multifamily markets of Phoenix, Tampa, Raleigh, Las Vegas, things get a bit crowded. The high population and job growth in these markets have created demand that has pushed rents and property values higher at a double-digit annualized pace.

S&P Capital IQ S&P Capital IQ S&P Capital IQ S&P Capital IQ

We started building our sunbelt multifamily exposure dating back to 2013 with positions in Independence Realty (IRT), Alpha Pro Tech (APT), and Bluerock Residential Growth (BRG). The best came in 2015 with the arrival of NexPoint Residential Trust (NXRT). NexPoint continues to be the multifamily REIT with the fastest FFO/share growth prospects, but you must always be on the lookout for new opportunity.

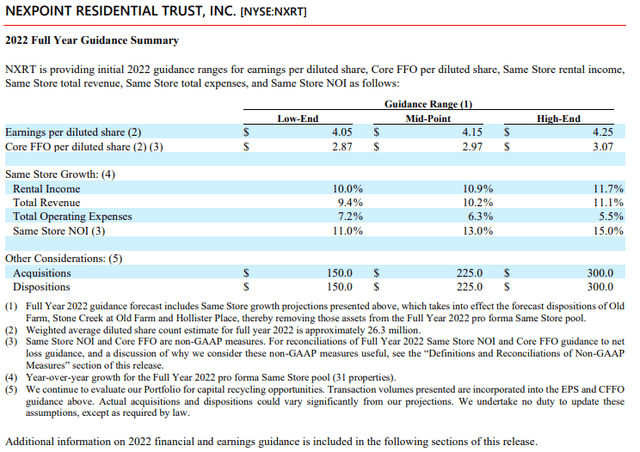

NXRT 2022

A public company since 2015, NexPoint Residential’s quarterly reporting is a graduate-level distillate of real estate finance; they stretch to the limits and always meet them (I chose NXRT because they are also a geographically concentrated multifamily REIT that gets too little respect). The table below describes a mid-point 2022 FFO/share forecast of $3.02; at today’s price of $90.31, that values NXRT at 29.9x 2022 FFO.

Making new investment in the sunbelt at these high multiples might be a mistaken anticipation that rents can rise at double digits indefinitely. In looking to deploy new investment into multifamily, I will be looking for growth at a more reasonable price. I might look to Minneapolis.

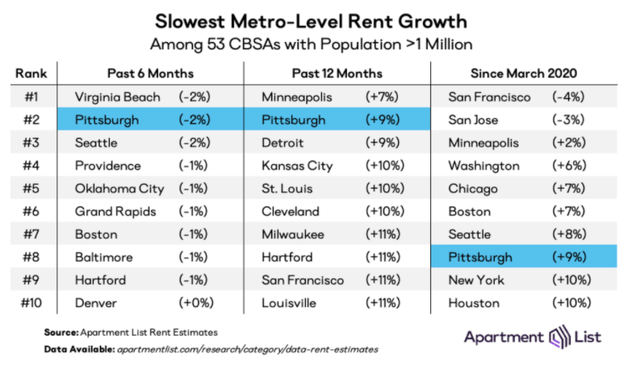

Minneapolis

Every month, Apartment List creates incredibly valuable data about rents and occupancies in the nation’s top 100 markets. The only reason Minneapolis was on my radar is because it has been a perennial laggard since the pandemic began. In this month’s report, however, Minneapolis has crawled out of the bottom 10.

Centerspace knows its markets. It recently loaded up in Minneapolis. It is forecasting modest growth.

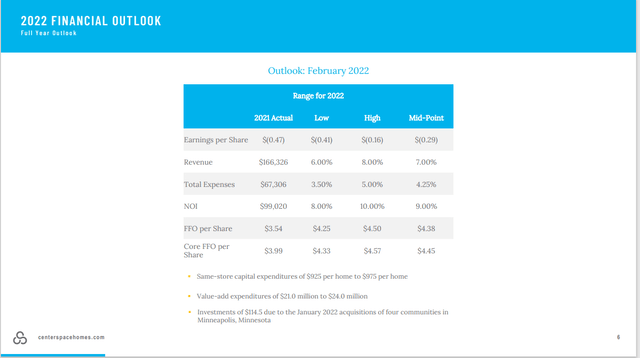

CSR 2022

Centerspace is still in the proving grounds stage and their 2022 FFO forecasts reflect a conservative posture. They are in Minneapolis and St. Cloud, Minnesota, not Phoenix and Atlanta, the epicenters of U.S rent escalation. The table below describes a mid-point of $4.38 FFO/share; at today’s price of $98.52 that values CSR at 22.5x 2022 FFO. CSR is a demonstrably cheaper stock. It is growth at a reasonable price.

Different, But the Same

The sunbelt is the market of hot migration and job growth. The Midwest is comparatively stagnant. Phoenix gets a new Intel (INTC) chip foundry and Minneapolis must make do with ongoing operations at 3M (MMM), General Mills (GIS), and Target (TGT). The University of Minnesota provides a steady stream of talent for the dozens of tech startups in the Twin Cities MSA. Minneapolis is not Las Vegas, but it is a vibrant economy.

Centerspace has positioned itself outside of the hyper-competitive sunbelt markets. At current market pricing, it presents value in multifamily investment.

Be the first to comment