DonNichols

On Wednesday, November 9, 2022, Nevada-based natural gas utility Southwest Gas Holdings, Inc. (NYSE:SWX) announced its third-quarter 2022 earnings results. At first glance, these results were rather disappointing, as the company reported a net loss during the period although it did post a fairly significant revenue increase. This is not exactly unusual for natural gas utilities though as many of them post losses during the third quarter of a year. This is because utility-supplied natural gas is primarily used for space heating and there is much less demand for that during the summer months.

These results were still slightly worse than last year, though, as the company’s net loss was larger than it was a year ago despite the revenue increase. The company is positioned to improve going forward, though, and it will likely deliver the slow and steady growth that we expect from utility companies and hand investors a reasonable total return over the next few years. Unfortunately, the valuation may arguably be a bit high at this time and the company has still not decided the future of a few of its operations, so it might be best to watch on the sidelines until the shares trade for a more attractive price.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Southwest Gas Holdings’ third-quarter 2022 earnings results:

- Southwest Gas Holdings reported total revenue of $1.1256 billion in the third quarter of 2022. This represents a 26.66% increase over the $888.7 million that the company reported in the prior-year quarter.

- The company reported an operating income of $49.7 million in the most recent period. This compares quite favorably to the $32.8 million that the company reported in the year-ago quarter.

- Southwest Gas Holdings added an additional 40,000 natural gas customers over the past twelve months.

- The company reiterated that it is still reviewing strategic alternatives for its MountainWest and Centauri business units. The firm specifically stated that this may include a sale or spin-off of the Centauri unit.

- Southwest Gas Holdings reported a net loss of $12.3 million during the third quarter of 2022. This compares rather unfavorably to the net loss of $11.6 million that the company reported in the third quarter of 2021.

One of the defining characteristics of utility companies like Southwest Gas Holdings is that they enjoy remarkably stable cash flows over time regardless of conditions in the broader economy. This makes sense, since they provide a service that is generally considered to be a necessity for our modern way of life. After all, there are very few homes in the United States that do not have space heating, and in many cases, this heating is provided by natural gas. As such, most people will prioritize paying their natural gas bills over making discretionary purchases.

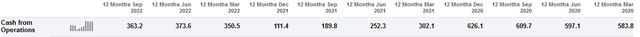

This is especially important today because the pervasive inflation has strained the budgets of many families. There are also numerous predictions that the United States will enter into a recession within the near future if it is not already in one and recessions also tend to reduce the ability of many people to make discretionary purchases. The fact that they will prioritize paying Southwest Gas Holdings in such a situation is something that is quite nice to see, then. We can see this overall stability by looking at the company’s trailing twelve-month operating cash flows over time. Here they are:

(All figures in millions of U.S. dollars.)

We can admittedly see some fluctuations here, but Southwest Gas Holdings is not exclusively a natural gas utility. In fact, during the third quarter, the natural gas utility operation only accounted for $303.944 million, or 27% of the company’s revenue. It accounts for more of the company’s revenue during the colder months of the year but it still only represents about 40% of the company’s total revenue over the trailing twelve-month period. The fact that nearly 60% of the company’s revenue comes from non-utility operations accounts for much of the fluctuations that we see here. These two business operations are also the ones that the company is considering potentially selling, as mentioned in the highlights. We will discuss that situation later in this article.

Investors are naturally interested in much more than just stability. Fortunately, Southwest Gas Holdings is positioned to deliver growth over the coming years. The company is planning to do this by growing its rate base. The rate base is the value of the company’s assets upon which regulators allow the company to earn a specified rate of return (usually around 10%). As this rate of return is a percentage, any increase in the rate base allows the company to adjust its prices so that it can earn this rate of return. The usual way that the company will increase its rate base is by investing money into modernizing, upgrading, and possibly even expanding its utility-grade infrastructure.

During its third-quarter earnings call, the company stated that it plans to invest $2.5 billion to $3.5 billion into its natural gas distribution infrastructure over the next five years, which should allow it to grow its rate base at a 5% to 7% compound annual growth rate over the period. This does not necessarily mean that the company’s earnings per share will grow at the same rate for a few reasons including the significant proportion of its business operations that is independent of the regulated utility.

There is one other way that a utility like Southwest Gas Holdings can grow. That is by expanding its customer base. This is not really a reliable method with which to grow though since these companies are largely confined to a single geographic area and so are dependent on population growth in that area. Southwest Gas Holdings does have an advantage over many of its peers in this respect, however. Southwest Gas serves both Phoenix, Arizona, and Las Vegas, Nevada. These are two of the ten fastest-growing metropolitan areas in the United States. In fact, Phoenix saw its population increase by 10.5% over the 2015 to 2020 period and Las Vegas saw a 10.4% increase over the same period. This was likely a major source of the 40,000 new natural gas customers that the company added over the past year.

We see further evidence of this as a source of growth because home buyers tend to greatly prefer natural gas for cooking and heating and will frequently pay more for a house that has gas access compared to an all-electric house (see here). Thus, Southwestern Gas appears well-positioned to deliver growth via this method as well as by growing its rate base. This is something that we should very much appreciate as investors.

The company’s largest business segment is Centauri, which is a utility infrastructure services business. This company works with other utilities and helps to construct and maintain their networks. It is thus something of a general contractor that works specifically with utility companies. During the third quarter, this business unit reported total revenue of $758.466 million, representing 67.3% of the company’s revenue during the quarter. This was also a record for Centauri, driven partly by the need to rebuild the infrastructure that was destroyed by Hurricane Ian and other storms throughout the nation. This business unit is also quite well-positioned for forward growth. During the third quarter, the company received a contract to perform onshore assembly, fabrication, and port logistics for an offshore wind project in the northeast. Southwest Gas Holdings did not state who awarded this contract but I would not be surprised if it is one of the projects that Ørsted (OTCPK:DNNGY) is working on. The contract should result in $217 million in revenue over its lifetime but the company did not state when the contract would start nor how long it would last. As management seemed to be excited about it during the earnings call, we can assume that it will likely result in a boost to the company’s financial performance in the near future, though.

This is far from the company’s only project, as it currently has a $500 million backlog in renewable energy projects alone. Unfortunately, management once again did not provide any further insight into the timing of these projects but the company did say that Centauri should be able to grow its adjusted EBITDA at a 9% to 11% compound annual growth rate over the 2023 to 2026 period.

As stated earlier in this article, Southwest Gas stated in its earnings call that it is conducting a strategic review concerning the future of Centauri. The company is attempting to determine whether to sell the business unit or spin it off. This dates back to an announcement that the company made on March 1, 2022, that it intends to turn Centauri into an independent company. It is therefore very interesting that Southwest Gas stated in the earnings report that it is still conducting a strategic review. The original plan was to spin off Centauri in the first half of 2023, but the company’s new statements seem to cast some doubt on this:

“The company’s Board of Directors continues to review strategic alternatives for MountainWest and Centauri, including a sale or spin-off for Centauri.”

As such, it appears uncertain exactly what will happen here. With that said, Southwest Gas did enter into a cooperation agreement with Carl Icahn, who was one of the original investors pushing for a spin-off in order to unlock value. It thus seems likely that something will probably happen here but possibly not under the original timeline. It also may not be a spin-off if the company can find someone to purchase Centauri for a reasonable price. It is thus difficult to predict what effect this will have on the share price of Southwest Gas nor when the said impact will occur, however, we can expect the company’s revenue to decline substantially following any sort of disposition of Centauri due to the firm representing 67% of revenue.

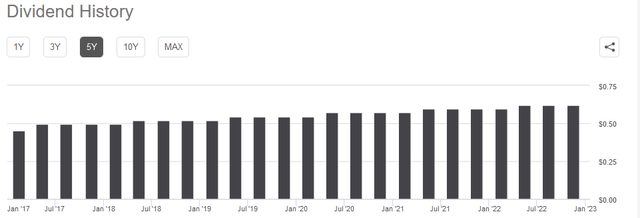

In addition to the generally stable cash flows, one of the biggest reasons why investors purchase shares of companies like Southwest Gas Holdings is the high dividend yields that they typically possess. Southwest Gas itself currently boasts a 3.80% forward yield, which is certainly attractive in today’s market. The company also has a long track record of boosting its dividend every year:

This track record of growing dividends is quite nice to see during inflationary times like today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. The fact that it increases the dividend helps to offset this effect and helps to maintain the purchasing power of the dividend. Unfortunately, Southwest Gas Holdings has not increased its dividend by nearly enough to offset the inflation rates that we have seen over the past year. The dividend growth is still much better than a static dividend, though. As is always the case, it is critical that we ensure that the company can actually afford the dividend that it pays out. This is because we do not want to be the victims of a dividend cut that reduces our income and almost certainly causes the stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. A company’s free cash flow is the money that is generated by the firm’s ordinary operations that is left over after it pays all its bills and makes all necessary capital expenditures. This is the money that can be used for things such as reducing debt, buying back stock, or paying a dividend. During the trailing twelve-month period, Southwest Gas Holdings reported a negative levered free cash flow of $466.4 million. This is not enough to pay any dividend but the company still paid out $154.9 million over the period.

It is not uncommon for utilities to finance their capital expenditures through the issuance of debt and equity. They will then pay their dividend using their operating cash flow. This is because of the enormous costs involved in constructing and maintaining utility-grade infrastructure over a wide geographic area. During the trailing twelve-month period, Southwest Gas Holdings had an operating cash flow of $363.2 million, which was enough to cover its $154.9 million dividend with a great deal of money left over. The company’s dividend is probably reasonably secure and it will probably increase again following the first quarter as it usually does.

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a natural gas utility like Southwest Gas Holdings, we can value it by looking at the price-to-earnings growth ratio. This ratio is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. There are very few companies that have such a low ratio in today’s overheated market, however. Thus, the best way to use the ratio is to compare Southwest Gas Holdings to some of its peers in order to see which company has the most attractive relative valuation.

According to Zacks Investment Research, Southwest Gas Holdings will grow its earnings per share at a 5.00% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 3.43 at the current stock price. Here is how that compares to some of the company’s peers:

|

Company |

PEG Ratio |

|

Southwest Gas Holdings |

3.43 |

|

Atmos Energy (ATO) |

2.50 |

|

NiSource, Inc. (NI) |

2.60 |

|

New Jersey Resources (NJR) |

3.04 |

|

Northwest Natural Holdings (NWN) |

4.38 |

As we can see here, Southwest Gas Holdings does appear to be a bit expensive relative to its peers. When we combine this with the uncertainty surrounding the Centauri situation, it may be advisable to hold the stock if you already have it or to sit and wait for a better opportunity to buy in. However, a spin-off or a sale at a good price could prove to be an upward catalyst so it is a good idea to watch the situation closely. It may also be a good idea to slowly dollar-cost average into the stock while waiting for the conclusion to the situation. The company should still be able to give an 8% to 10% total return (earnings per share growth plus the dividend) so having a small position certainly would not hurt.

In conclusion, we largely saw what we expected to in these results. The company’s utility business continues to be a relatively stable entity that delivers relatively mild amounts of growth over time. The company’s infrastructure services operations could prove to be a wild card as the ultimate resolution of its disposition is uncertain. It may make some sense to hold onto the Southwest Gas stock or slowly acquire it despite the high valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment