U. J. Alexander/iStock Editorial via Getty Images

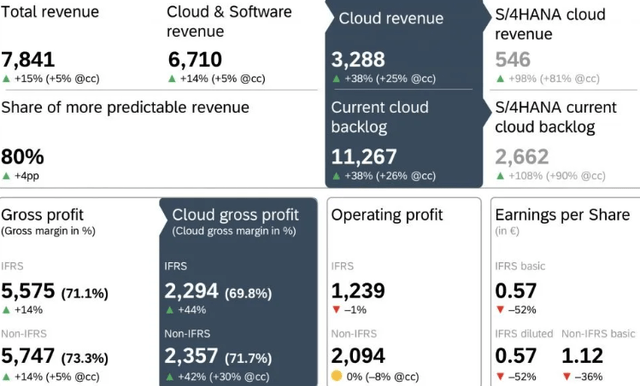

SAP (NYSE:SAP) is one of our favorite bull stocks at TechStockPros. Our bullish sentiment on SAP is based on our belief that the company’s cloud business will drive top-line growth in 2023. SAP is one of the oldest Enterprise Resource Planning (ERP) tech companies. Hence, we expect the company to retain and increase its customer base as it aids businesses’ digital transformation to the cloud. SAP’s newest introduction in the HANA family, S/4HANA, has already boosted cloud revenue with S/4HANA’s current cloud backlog increasing to 108% Y/Y in 3Q22.

We believe it’s a question of when, rather than if, the cloud will be a significant growth driver for SAP. The cloud transition is underway for many businesses using SAP’s ERP solutions. We believe SAP is improving its position in the cloud market with the introduction of S/4HANA. We expect SAP to be a major benefactor of the business and enterprise shift to the cloud and recommend investors buy the pullback.

Strong appetite for cloud

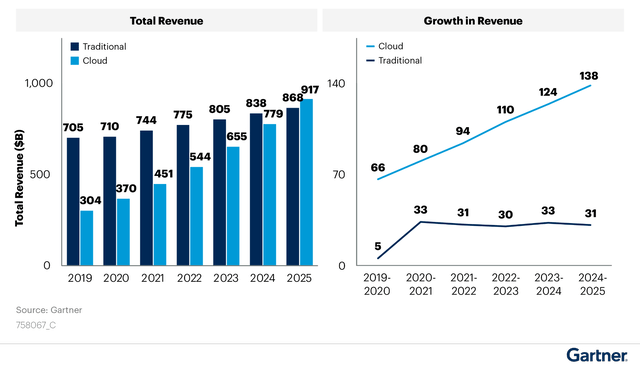

SAP’s Cloud revenue grew 35% Y/Y in 3Q22, and we expect it to continue growing throughout 2023. Around 53% of small-to-medium businesses surveyed by SAP reported spending more than $1.2M annually on the cloud compared to 38% last year. We expect cloud adoption will drive SAP’s revenue and margins in 2023. SAP’s current cloud backlog has increased 27% Y/Y in the third quarter. Gartner backs the global cloud shift narrative expecting Enterprise IT spending on public cloud computing to overtake traditional IT spending by 2025. Gartner forecasts that almost two-thirds of spending on application software will be on cloud technologies in 2025. According to Computer Economics, Cloud infrastructure has grown from “an average of 2.3% of the total IT operation budget in 2021 to 5.7% in 2022”. SAP already has over 230M cloud users. We believe SAP is well-positioned to benefit from cloud application and cloud infrastructure spending as they remain top IT spending priorities this year.

The following table outlines SAP’s 3Q22 revenue by segment.

Around 39% of companies report transitioning at least half their applications to the cloud, compared to 29% in 2019. We expect SAP’s S/4HANA, a mission-critical control center, to benefit from the demand tailwinds in the cloud as it helps businesses pursue digital transformation. S/4HANA has already proven its success, even during market downtrends, growing 98% Y/Y in 3Q22. We believe SAP’s upgrade cycle with S/4HANA will drive the company’s growth compared to its peers.

Sticky ERP customer base driving growth

SAP’s ERP customers are sticky, and we believe SAP’s upgrade cycles in the HANA family will make customer transitions to competition less likely. Gartner Magic Quadrant named SAP the leader in cloud ERP service-centric businesses. The EPR industry alone is estimated to grow at a CAGR of 9.4% by 2030. We believe SAP’s focus on shifting to the cloud will provide the ERP giant with a clear runway to outperform expectations.

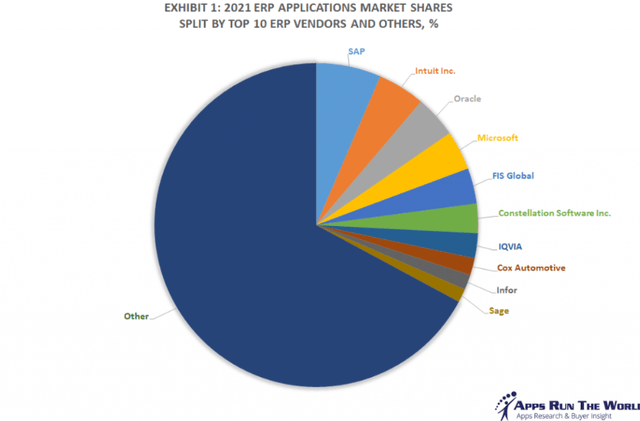

The following graph outlines the ERP applications market shares in 2021.

SAP led the pack with a 6.5% market share in 2021, and we expect the company to improve its position in the market going forward.

Relatively resilient to IT budget cuts

Inflationary pressures and rough macroeconomic headwinds are causing businesses and enterprises to cut back their IT spending budgets. We’re not too worried about SAP feeling the pressure of budget cuts as companies are shrinking their data center footprints in favor of the cloud, according to a Computer Economics report. We expect IT spending to weaken but believe spending on Cloud to remain relatively strong. We believe SAP’s move into the cloud is crucial for the company to maintain profitability as cloud infrastructure, cloud storage, and software-as-a-service (‘SAAS’) cannibalize on-premises software and storage and data centers.

The following graph outlines the global shift to the cloud.

Risks to our buy-thesis

SAP is not immune to macroeconomic headwinds; the company’s 3Q22 missed EPS expectations achieving an EPS of $1.11 compared to the expectation of $1.23. We believe SAP’s biggest challenge will be transitioning customers from the license to the subscription model. The company struggled with declining software licenses and support revenues as it shifted to the cloud. In 3Q22, SAP reported software licenses and support revenues declining 3% Y/Y, achieving €3.422B.

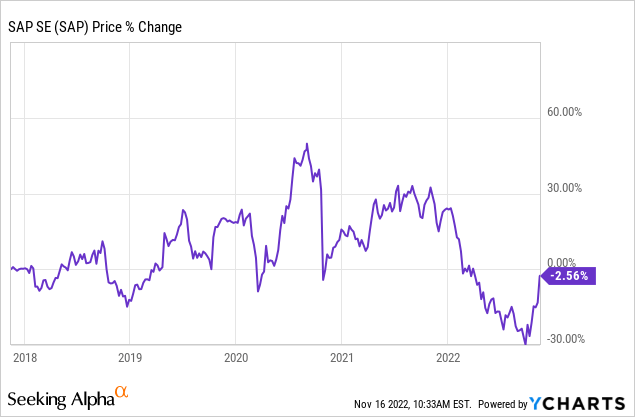

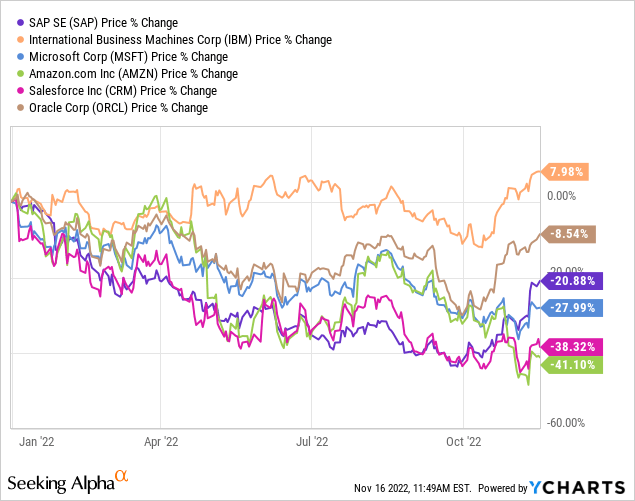

Stock performance

SAP is down around 3% over the past five years. YTD, the stock is down 21%, underperforming competition with Oracle (ORCL) down almost 9% and IBM (IBM) up around 8%. YTD, SAP outperforms Salesforce (CRM), down around 38%, Amazon (AMZN), down almost 41%, and Microsoft (MSFT), down 28%. We recommend investors buy the pullback as we expect SAP’s cloud revenue to accelerate growth in 2023.

The following graphs outline SAP’s stock performance over the past five years and YTD.

TechStockPros

TechStockPros

Valuation

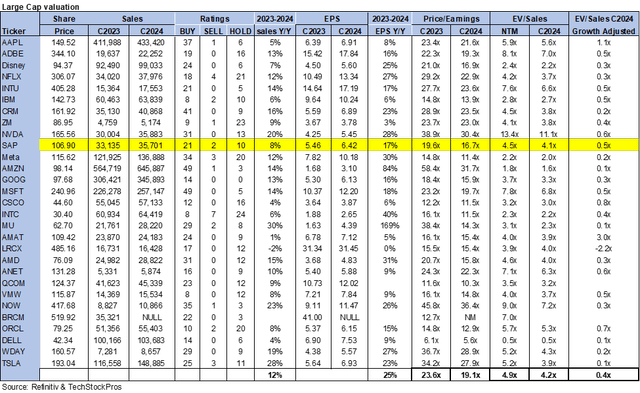

SAP is relatively cheap, and we recommend investors buy the stock at current levels. On a P/E basis, the stock is trading at 16.7x C2024 EPS $6.42 compared to the peer group average at 19.1x. The stock is trading at 4.1 EV/C2024 sales versus the peer group average of 4.2x. We expect SAP’s cloud expansion and global customer base to enable the company to grow meaningfully in 2023 and recommend investors buy the stock.

The following graph outlines SAP’s valuation in comparison to the peer group.

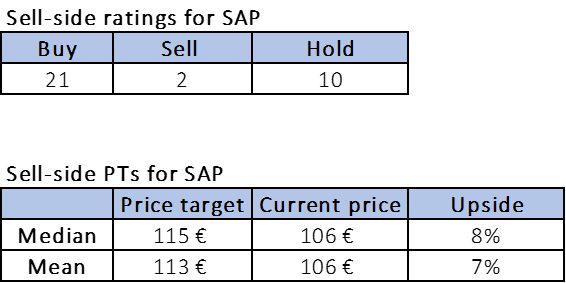

Word on Wall Street

Wall Street is bullish on SAP stock. Of the 32 analysts covering the stock, 21 are buy-rated, ten are hold-rated, and the remaining are sell-rated. The stock is trading at €106. The median and mean price targets are set at €115 and €113, respectively, with an upside of 7-8%.

The following graph outlines SAP’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We’re bullish on SAP as we expect demand tailwinds in the cloud market to boost the company’s top-line growth in 2023. SAP operates in a booming, and competitive market, and we believe the company’s expansion of its cloud offerings with SAP HANA and S/4HANA to enjoy increased demand as businesses pursue digital transformation. SAP is trading cheaper than its peer group average, and we believe this offers an attractive entry point to invest in the company’s 2023 growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment