Edwin Tan/E+ via Getty Images

Etsy (NASDAQ:ETSY) is one of our favorite e-commerce platforms and one that immensely benefited from the pandemic. It grew the size of its operations exponentially during that time, although now there is concern that the company will face growth difficulties as the world starts going back to normal.

Forgetting for a moment the pandemic impact and whether the company can retain its new users and gain more, we would like to point out the excellent product-market fit that the company has achieved. Its app has one of the best ratings we have ever seen, with 4.9 stars in both the Google Play Store and the Apple App Store. Reading the comments online, it is also easy to find people that consider themselves fans of the platform and that love shopping on it.

Financials

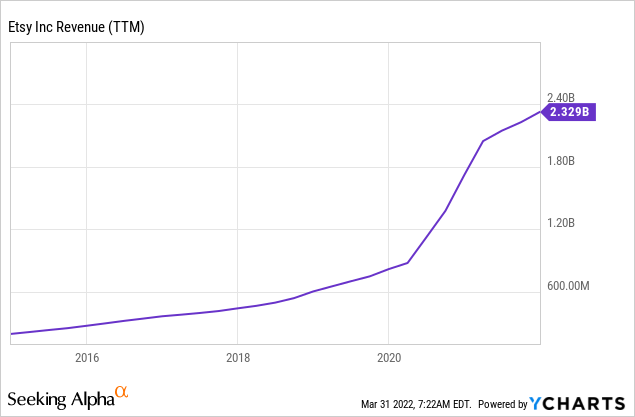

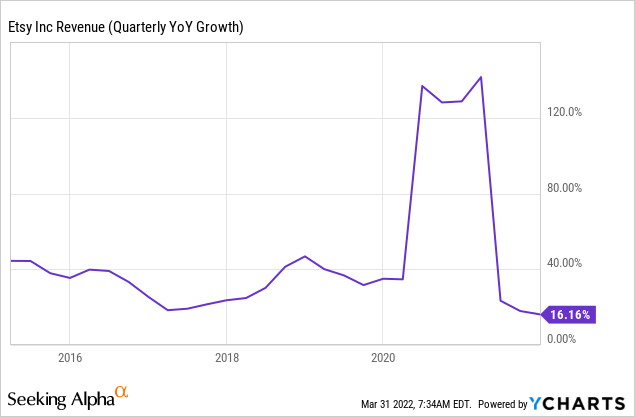

Looking at the company’s revenue, it is easy to see where the pandemic started and when things started to normalize. There is a clear inflection where revenue went almost vertical. What we find very impressive is that revenue has not decreased, it just decelerated as the world started going back to normal.

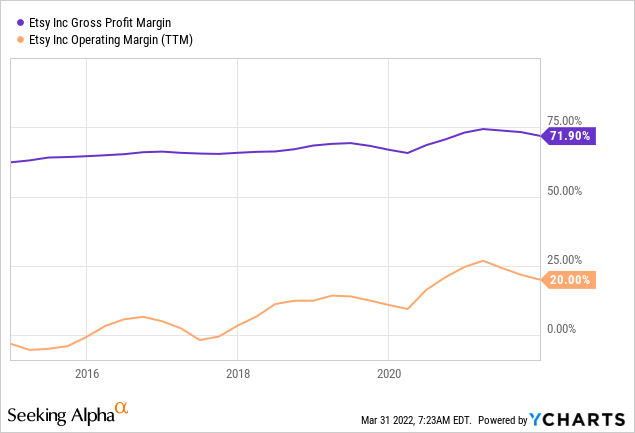

One thing that ETSY has that a lot of other popular software companies we have recently analyzed don’t is operating leverage. As revenues have increased, the operating margin has trended up, even if at times the increase has been lumpy. Before the pandemic, the company was operating near break-even, and now it is very profitable operationally.

Gross profit margins are high and have been increasing. Probably due to the decision to increase the take rate, the company charges sellers. In any case, this sort of gross profit margin is excellent and solidly classes ETSY as a software business with excellent economics.

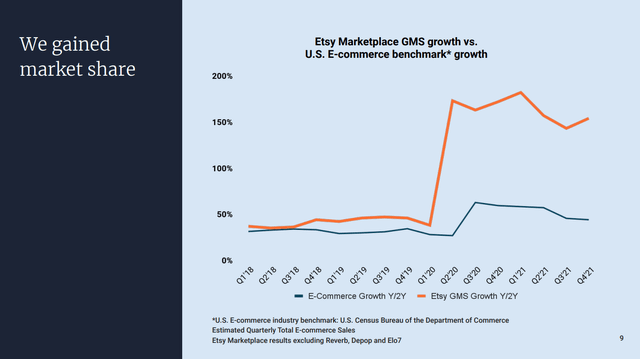

Going back to the gains made during the pandemic, notice how ETSY vastly outperformed the already impressive e-commerce growth during this period. Meaning it took a significant share from other online competitors. Its number of buyers/shoppers almost doubled in two years, and the number of sellers/creators more than doubled. Listings, habitual buyers, and repeat buyers all increased significantly during this period as can be seen below.

ETSY Investor Presentation ETSY Investor Presentation

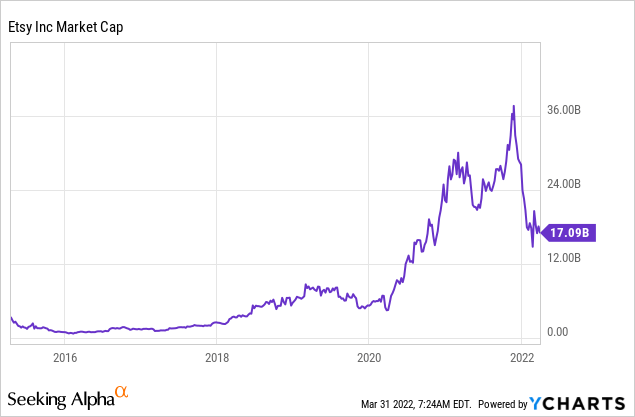

So how much should we pay for this exceptional business? Below, we show the market cap, which at one point in the excitement from the pandemic growth reached $36 billion. Since then, the market cap has been almost halved, and we now think this is a good time to buy the shares. Our main argument is that, despite a slower growth rate, the company is still increasing the size of its “economy”, otherwise known as its GMS. GMS reached $13.5 billion in fiscal year 2021, and if the company manages to continue growing it at least 20-30%, it should be less than two years before GMS exceeds the current market cap.

Another way of seeing ETSY’s valuation is to consider that it is expected to earn ~$4 per share in fiscal year 2022. That places the forward earnings multiple ~30x, which we would argue is very reasonable for a company that is likely to continue growing revenue at 30%+ for the next few years. We believe that immediate comparisons to the pandemic period will be tough, but once it lapses that period, we think growth will return to its historical 30-40% range.

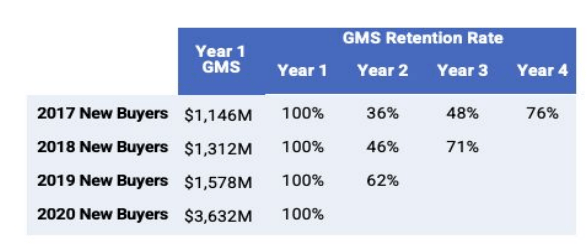

Another sign of the health of the ETSY ecosystem is that newer cohorts are showing improving GMS retention rates. For example, for the 2017 cohort, ETSY only retained ~36% of the GMS from these customers in the second year. However, for the 2019 cohort, it retained ~62% of the GMS from these customers in the second year.

ETSY Investor Presentation

Valuation

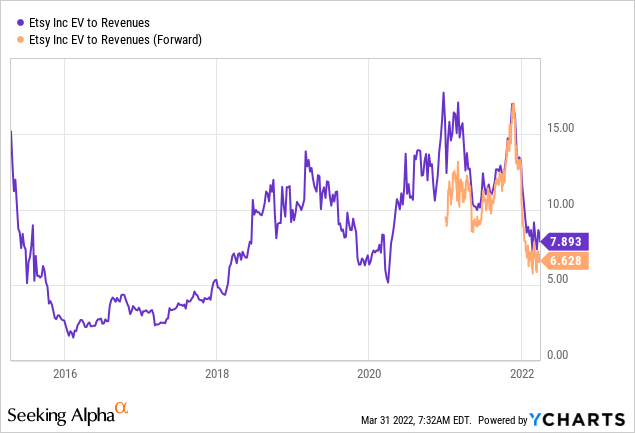

We already discussed some metrics we believe show ETSY is undervalued, but let’s go into more detail. Its trailing twelve months EV/Revenues multiple is ~7.8x and the forward multiple is ~6.6x. This is within the range it traded at before the pandemic, and we would argue a higher multiple is deserved now that ETSY has demonstrated operating leverage and solid profitability. We should remember that, before the pandemic, ETSY was mostly operating close to the break-even point.

What has scared a lot of investors is the growth deceleration after the pandemic, as can be clearly seen below, growth at one point exceeded 100%, and as the world has started going back to normal, we see that growth decelerated all the way to 16%. This is actually below the growth rates ETSY was in the years before the pandemic, so we believe that eventually growth will return to the 30-40% range.

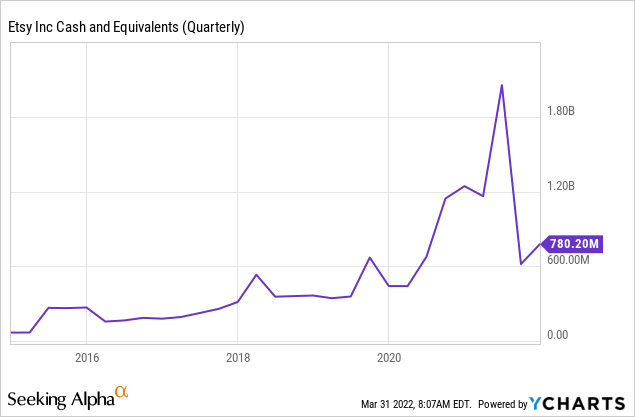

Finally, we are comforted by the significant cash and liquidity that ETSY has, with about $780 million in cash and equivalents. It was close to $2 billion recently, but a significant portion was used for recent acquisitions of Depop and Elo7. Depop is a very popular app with young users for the resale of used clothing, and Elo7 can best be described as Brazil’s ETSY.

Conclusion

We feel confident that ETSY is going to manage to keep most of the new buyers and sellers it gained during the pandemic and that, eventually, growth will return to its historical range of 30-40%. The difference is that the scale the company gained gave it significant operating leverage, making it solidly profitable. We, therefore, believe that while ETSY shares are significantly higher, it can be argued they are actually cheaper since the company is now solidly profitable. We see many opportunities for growth for the company, including international expansion and the new acquisitions. Contribution of recent acquisitions of Depop and Elo7 aren’t reflected in the prior year and are expected to add incremental GMS and revenue in 2022. We believe that, once investors are convinced, growth will resume at a decent rate and that shares will re-rate higher.

Be the first to comment