ManuWe

Back in May 2022 I wrote an article on Blackstone Inc. (NYSE:BX) with the very same title, “A $1 Strong Buy Trillion Private Equity Juggernaut.”

That was seven months ago, and while my Strong Buy recommendation has not panned out “yet,“ the $1 Trillion AUM (assets under management mark) is inching closer by the day.

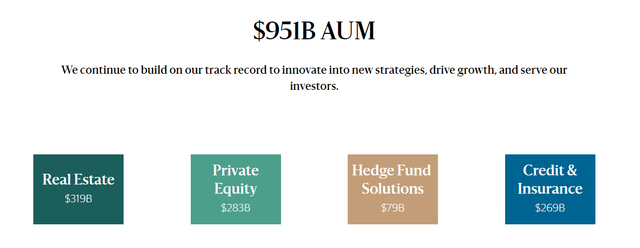

Back then AUM was around $915 Billion and as of Q3-22 the figure has grown to $951 billion, comprised of the following:

- Real Estate $319 Billion

- Private Equity $283 Billion

- Hedge Fund Solutions $79 Billion

- Credit & Insurance $269 Billion

BX Website

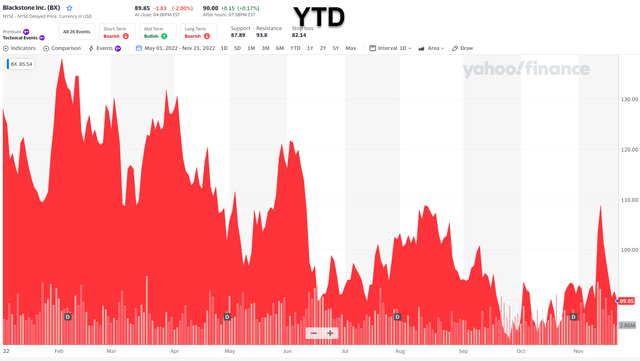

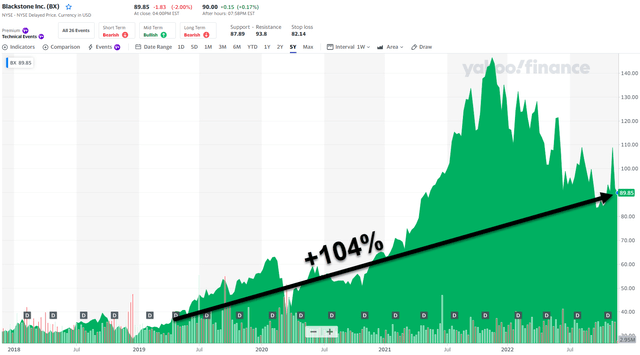

BX shares have declined around 11% since my article in May and shares are down around 30% year-to-date.

Yahoo Finance

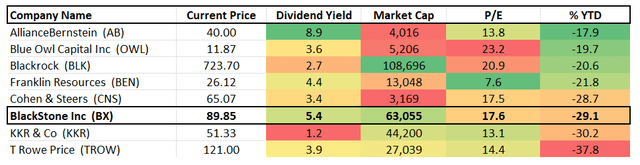

As you can see below, BX has been the third worst performer of the other Asset Managers that we cover. KKR (KKR) and T. Rowe Price (TROW) are the worst performers on the list.

iREIT on Alpha

While rising rates and labor costs remain elevated, we’re still bullish on certain asset managers, especially Blackstone that has become a dominating player with a diverse portfolio that includes investments in energy, travel, leisure, and real estate. On the Q3-22 earnings call BX’s co-founder and Chairman, Steve Schwarzman, said

“Against this highly challenging backdrop, Blackstone delivered excellent results for our shareholders. Fee-related earnings for the third quarter rose 51% year-over-year to $1.2 billion, representing our second-best quarter on record. We generated strong distributable earnings of $1.4 billion, or $1.06 a share.”

As I pointed out, AUM increased 30% year-over-year to a record $951 billion, with strong demand for products across the institutional, private wealth and insurance channels. Schwarzman continued,

“One of our core principles, since we founded the firm in 1985, is to avoid losing our clients’ money, and we’ve done an excellent job of that. As the largest and most diverse alternatives firm in the world, we have unique access to data and insights on what is happening in the global economy, allowing us to anticipate trends and we believe, minimize risk.

We then carefully choose sectors and which type of assets to buy and actively work to build great companies and platforms. We use this advantage as well to help determine areas of focus in the liquid securities area. This synergistic approach has led to distinctly strong positioning across our business today.”

Yahoo Finance

As you can imagine, I like the fact that BX is an asset heavy model with a strong allocation to real estate, approximately 80% of the portfolio is in sectors where rents are growing above the rate of inflation, including logistics, rental housing, life science office and hotels.

In corporate private equity, BX’s emphasis is on faster-growing companies that has resulted in a 17% year-over-year revenue growth in operating companies, led by travel leisure-related holdings.

I often refer to BX as the Berkshire Hathaway for real estate investing and that analogy is fitting as the private equity juggernaut has a long history of outperformance and capital protection.

Recent research from Morgan Stanley estimates that private markets AUM will grow 12% annually over the next five years.

Morgan Stanley also predicts the greatest growth among individual investors, with allocations to alternatives from high-net-worth investors more than doubling in five years to 8% to 10% of their portfolios.

BX designed its vehicle over a decade ago recognizing that it wanted to be the “clear leader in this channel with the largest market share among alternative managers”. In this cycle of complexity, BX has built its brand on safety with diversified levers in infrastructure, real estate and private credit. As Schwarzman pointed out,

“All areas of distinctive competence here at Blackstone.”

Third Quarter Results

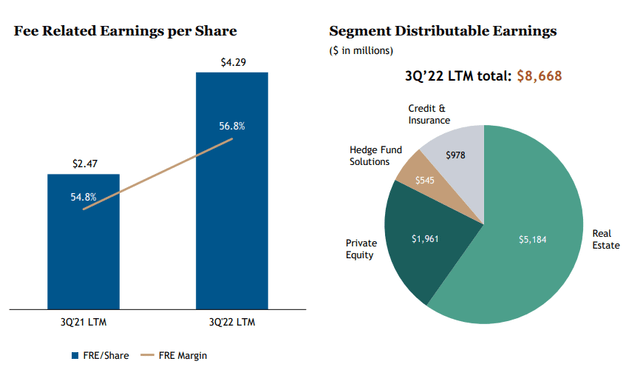

As previously mentioned, BX AUM was $950.9 billion, up 30% year-over-year and Fee-Earning AUM was $705.9 billion, up 34% year-over-year. As mentioned, fee-related earnings were $1.2 billion ($0.98/share) and $5.2 billion over the last twelve months ($4.29/share).

Distributable earnings were $1.4 billion ($1.06 a share) and LTM Total Segment Distributable Earnings were $8.7 billion (an increase of 45% year-over-year).

BX Investor Presentation

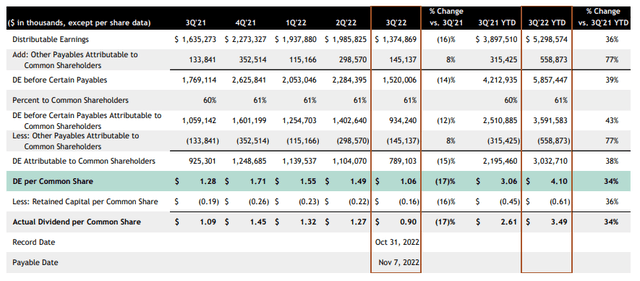

Keep in mind that BX is not a REIT so the payout changes quarterly. In Q3-22 the company said it was paying $.90 per share ($4.94 per common share over the LTM).

$1.4 billion was distributed to shareholders with respect to Q3-22 through dividends and share repurchases, and $7.5 billion over the LTM (repurchased 2.0 million common shares in the quarter and 8.1 million common shares over the LTM).

As noted, BX generated $1.06 of Distributable Earnings per common share during the quarter, bringing the YTD amount to $4.10 per common share.

BX Investor Presentation

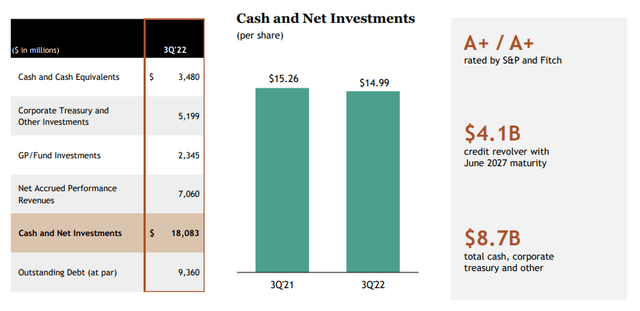

Fortress Balance Sheet

At Q3-22 BX had $8.7 billion in total cash, cash equivalents, corporate treasury, and other investments and $18.1 billion of cash and net investments, or $14.99 per share. The company has a $4.1 billion undrawn credit revolver and maintains A+/A+ ratings.

BX Investor Presentation

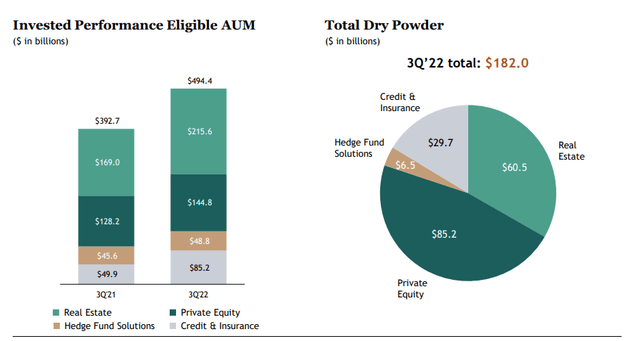

BX has around $182 billion of dry powder, so it can make decisions quickly when there are periods of dislocation, as Schwarzman explains,

“It happened back in Brexit, it happened back in 2008, 2009. We try to take the opportunity to deploy capital on behalf of our investors. So I think you have to be cognizant of the economic challenges in Europe, but open-minded to the opportunities given the repricing that’s underway there.”

BX Investor Presentation

Why I’m Backing Up The Truck…

As most readers know, I spend 90% of my time covering real estate in all shapes and sizes, and as a developer for over 20 years I have learned how to sniff out good deals.

When I was wearing my development hat, I recognized that the best deals are made when you’re in a strong cash position, especially in markets that we’re entering right now. As my friend reminds me, “it’s the golden rule” that counts, or as he explained, “he who has the gold makes all of the rules.”

We’re now entering a cycle in which cash will be king…

Read this quote from BX’s President and Chief Operating Officer, John Gray,

“What’s interesting about the public real estate market, it’s pretty small. It’s probably 7% or 8% of the U.S. commercial real estate market. It trades with a lot of volatility, as you pointed out.

In fact, since 2010, it’s gone up or down in a 60 day period by more than 10%, 50x, which hasn’t happened in the private real estate market during that period, I don’t think at once. And it can of course, trade above NAV and below.

And part of the decline you’ve seen was the public markets heading into this were actually above in many cases the private market, so some of that was giving back. And if you look at the analysts today who cover real estate, they would say you’re trading below the private market. And the short answer is, does it create opportunity for us as the largest real estate investor? It does.

We’ve done many, many public to privates in the real estate space. And generally it’s because the public markets tend to go back and forth between euphoria and depression.

And what we’ve seen here is now the idea is rates have gone up and therefore real estate values go down very, very sharply below the private market value, which can create an opportunity for us, certainly.

And we do believe, if you look at the logistics space at the phenomenal performance that’s happening in markets, the market – the public markets don’t seem to appreciate that. But those can create opportunities over time, similarly in rental housing.”

So you see, BX is a value shopper, just like me… and hopefully you too.

One major difference though…

BX has $182 billion in dry powder.

Now, let me direct you to an article I wrote on BX from June 2019:

“…despite Blackstone’s market-leading position, its partnership structure has been archaic, offering a limited market for shares.

That began to change the day it decided to remove certain ownership restrictions to expand its global investor universe.”

By removing restrictions for a long-only market, BX opted to eliminate the K-1, allowing shareholders to receive 1099s. Eliminate ECI, UBTI, and non-resident state-sourced income. Remove restrictions for substantial portions of index/ETF market. This made BX eligible for inclusion on CRSP, MSCI, and Total Market indices.

“By converting to a corporation – effective July 1, 2019 – Blackstone believes it can double in size to $9 trillion by unhampering long-only and index/ETF investors.”

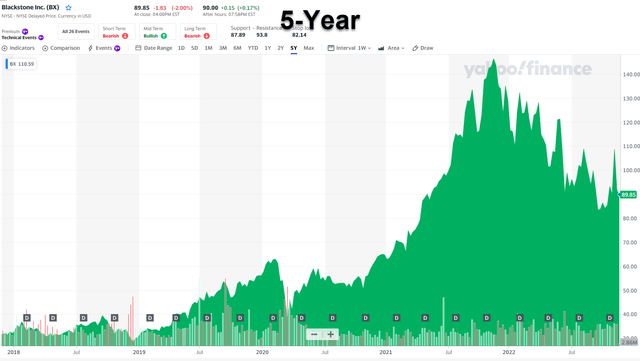

Yahoo Finance

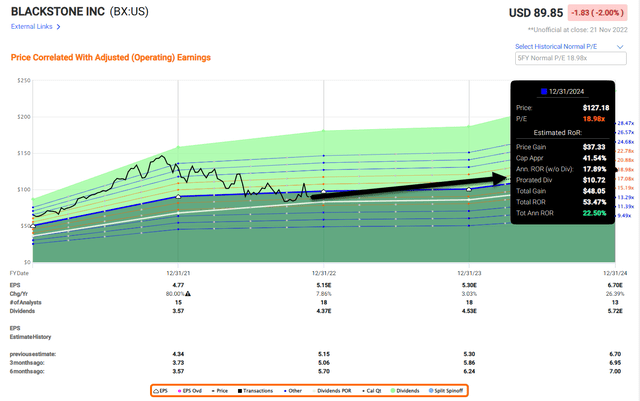

Keep in mind, BX shares were up +200% since the June 2019 article (I referenced) and are now +104% (since I recommended shares in June 2019). Shares almost hit $150 a year ago (Nov 2021), and we believe the company could return 25% annually over the next two years.

At the current rate, AUM could hit $2 Trillion in 2026, which will boost management fees and performance fees. As John Gray pointed out, volatility equals opportunity, and in order to capitalize on the chaos, we fully grasp the concept of “cash is king.”

Maintaining strong buy!

PS: The current dividend yield is a juicy 5.5%.

FAST Graphs

PS: You may be interested in my article (coproduced with Chris Volk) on Blackstone Real Estate Income Trust (‘BREIT), an open-ended private REIT designed to deliver private real estate asset management to retail investors.

Be the first to comment