Marc Bruxelle

2022 has been a bumpy ride for investors, but the energy sector has been a bright spot for some investors. I have been invested in the sector for a couple years, primarily through midstream companies like Enterprise Products Partners (EPD) and Magellan Midstream Partners (MMP). More recently I have been adding to more speculative plays like Laredo Petroleum (LPI) and Pantheon Resources (OTCQX:PTHRF), but the midstream sector continues to draw investors looking for income. One of the largest companies in the sector is Enbridge (NYSE:ENB), the Canadian energy infrastructure giant. Since my last article was on the company was in January, I figured it was time for an update.

Investment Thesis

Enbridge is a solid buy today for investors looking for current income with a side of dividend growth. Shares yield 6.8% after the most recent dividend hike, extending the company’s streak of raises to 28 years. Shares are trading at 9.7x cash flows, slightly below the average multiple of 10.1x. The company is an important part of the North American infrastructure, but one of the things that investors should be aware of is the company’s large debt load. Investors that understand options might find Enbridge to be a good candidate for a short to medium term trade with cash secured puts. I think the risk/reward for investors is good, and Enbridge is the ideal stock for investors looking to invest in the midstream sector while avoiding the K-1 tax form of an MLP.

Company Overview

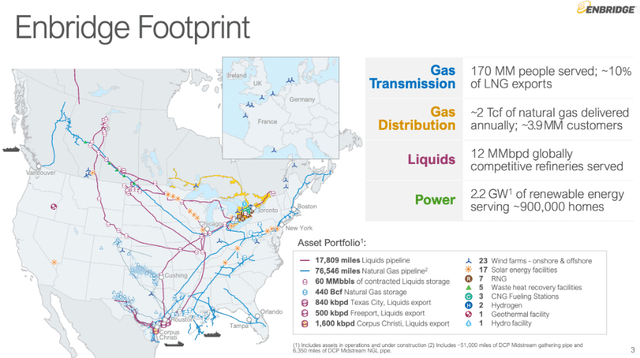

Enbridge is a vital part of North America’s energy infrastructure. While the company has been experimenting in the so-called renewable energy space, the traditional pipelines, storage facilities, and export terminals make up the lion’s share of the Enbridge’s business. Below is a visual representation of the company’s impressive asset base.

Enbridge Assets (enbridge.com)

This set of assets provides the company with an impressive moat. I skimmed the most recent 10-Q, and I didn’t see much to worry about. One of the things that always stands out when looking at Enbridge’s balance sheet is the amount of debt on the liabilities side. I don’t think it will cause any problems for the company, and bond investors are fine lending to the company with extremely long maturities (several recent issuances mature in over 60 years). However, with $74B in long term debt and another $6.4B (both amounts are Canadian dollars) in the current portion of debt, prudent investors shouldn’t ignore it either.

Valuation

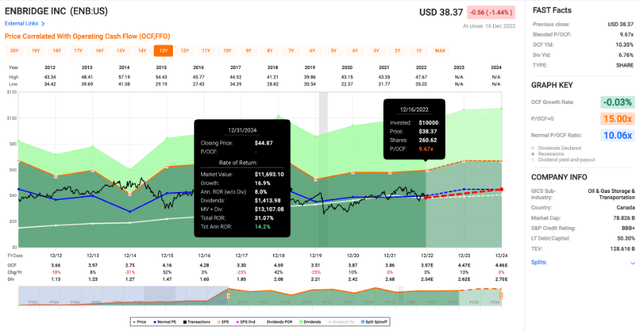

Shares of Enbridge are basically flat on the year (-2%), but I think income investors looking for a relatively low risk investment should take a closer look at the stock. Shares are trading at 9.7x cash flows today, just slightly below the average multiple of 10.1x over the last decade. Cash flow per share growth is expected to be pretty good in 2023, and the company confirmed that expectation with its recent 2023 guidance.

Price/Cash Flow (fastgraphs.com)

While I wouldn’t be expecting meaningful multiple expansion from here, I doubt we will see multiple compression. Enbridge is not very exposed to commodity price swings, so the estimates for future years should be pretty close to the target. I think double digit returns are possible, driven by earnings growth and the dividend yield approaching 7%.

Impressive and Consistent Dividend Growth

Enbridge recently announced another dividend hike with a 3.2% increase, which gives the company a 28-year streak of dividend increases. That puts the yield at 6.8%, which makes the company a good candidate for investors looking for current income with a side of dividend growth. The pay-out will bounce around a bit because Enbridge is not a US based company. The dividend fluctuations are due to changes in currency conversion rates. Due to the fact that Enbridge is a Canadian company, dividends are also subject to foreign tax withheld if shares are held in a taxable brokerage account. Combined with Enbridge’s high yield, these factors could make the company a good candidate for holding in a retirement account.

Cash Secured Puts

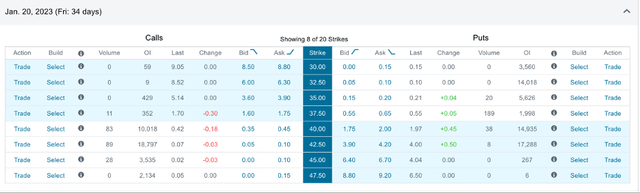

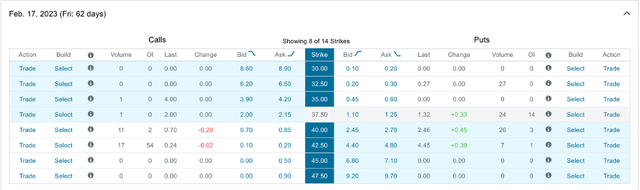

For investors familiar with options, Enbridge might be a good candidate for selling cash secured puts. I picked out a couple of options chains over the next couple months that might be a decent short to medium term trade. Like I mention any time I talk about selling puts, this strategy works best if you are fine with either side of the trade. You either end up owning the shares at the strike price, or you collect the premium.

1/20/2023 Options Chain (schwab.com) 2/17/2023 Options Chain (schwab.com)

Assuming you can sell a put with a $40 strike expiring in January for $2.00 in premium when the market opens on Monday (these chains are from the weekend), that represents a 5% return in a month if shares rally above $40. If shares drop further, you could likely collect $2.50 or $3.00 in premium making the trade even more attractive. The same trade can be made for February, where you can get slightly higher premiums for a two-month trade. If you do get assigned on these trades, you can also turn around start selling covered calls if you are more interested in the options income over holding onto shares.

Conclusion

For US investors willing to deal with a K-1, I prefer tax advantaged MLPs like EPD. It’s just one example, but with units trading at 7x cash flows with an 8% yield, it looks more attractive to me than Enbridge. Enbridge is slightly more expensive at 9.7x cash flows, but it is expected to grow at a solid clip in coming years. The 6.8% yield is expected to grow in coming years, and the most recent 3.2% hike marked the 28th straight year of dividend increases. I like the idea of selling cash secured puts, which gives investors a chance to generate even more income. I’m still bullish on Enbridge, and investors looking for current income with a side of dividend growth might want to take a closer look at Enbridge before the new year.

Be the first to comment