nadla/iStock via Getty Images

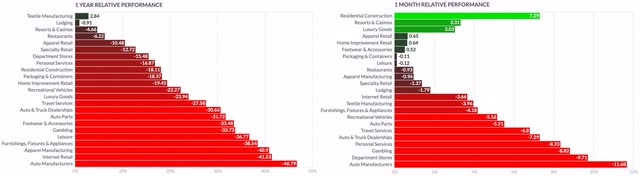

The consumer cyclical sector in the U.S. is among the worst performers losing about 33% of its value in the past year. Companies in this sector can be particularly affected by rising inflation and a higher cost of capital, while many suffer from bottlenecks among the supply chains, as well as headwinds caused by pandemic-related restrictions, geopolitical tensions between the U.S. and China, and the ongoing war in Ukraine. Looking at more specific industry groups, auto manufacturers have been laggards during the past year and are still significantly underperforming in the most recent weeks. But the industry is undergoing the biggest disruption since introducing internal combustion engine [ICE] vehicles and is offering major opportunities for investors in the coming years. That is why it’s worth considering investments in this industry despite the recent weakness, while it’s important to compare companies in order to evaluate their relative capability to consistently create value for investors.

In this article, I compare two very different companies not only based on their history, as Tesla, Inc. (NASDAQ:TSLA) will celebrate 20 years since its foundation in 2023, and General Motors Company (NYSE:GM) is a long-standing American company, founded in 1908, but also in terms of their structure, strategies and execution. Tesla is known worldwide for its pioneering role in electric vehicles [EV], autonomous vehicles [AV], energy generation, and storage systems. General Motors has instead only recently committed to invest $35B in developing its fleet of EVs and AVs between 2020 and 2025, exceeding GM’s investments in ICE vehicles development, as the company intends to sell 1M EVs annually in North America by 2025, a target that would project GM to likely lead the market while it took Tesla over a decade to hit that threshold in its global annual sales.

While the global automotive market is projected to grow at only a 3.71% Compound Annual Growth Rate [CAGR] through 2030, the global EV market is expected to grow at a 22.5% CAGR during the same period. It is expected to expand to a total value of $1.1T, mostly driven by the broader adoption of passenger EVs, strict government restrictions and regulations addressing vehicle emissions, followed by the development of two-wheelers and commercial vehicles.

The fast development and implementation of technologies such as Artificial Intelligence [AI], Machine Learning [ML], the emergence of the Internet of Things (“IoT”), cloud computing, and faster and more reliable connectivity, as well as the miniaturization of electronic products which integrate increasingly wider varieties of digital technologies, are among the major factors driving the global AV market. It is forecast to grow at 22.6% CAGR through 2030.

GM’s over-dependence on ICE vehicles is still limiting its growth and the successful achievement of its ambitious goals will depend on its execution capabilities to grow consistently above the market’s growth rates in the coming years. Tesla will undeniably face much stronger competition, and despite having the advantage of being a forerunner in the EV market, the company will most likely have to diversify in terms of products and price segments in order to maintain its leadership position. Despite GM’s strategy to switch to EVs, the company will have to deal with its legacy in the ICE business for many years to come, while Tesla can fully concentrate its resources on the fast-growing and future-oriented markets.

An in-depth company comparison

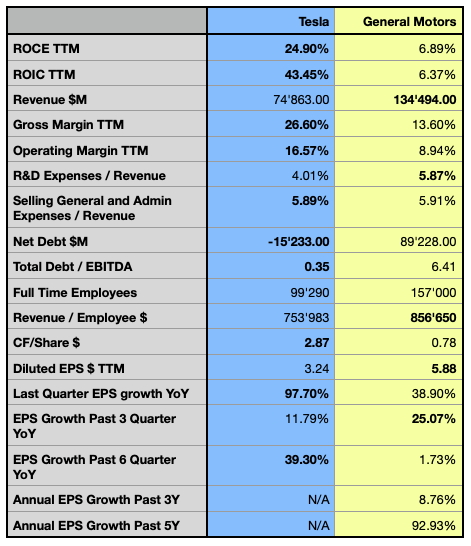

Author, using data from S&P Capital IQ

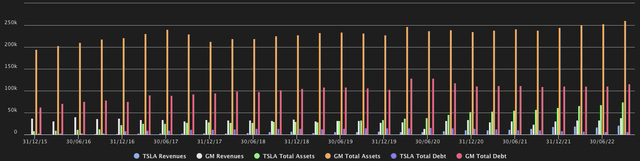

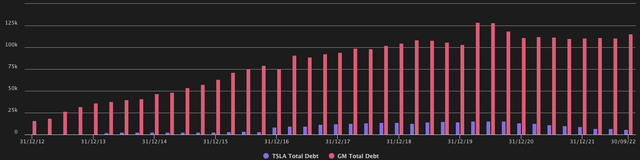

The financial comparison highlights the major relative strengths and weaknesses of the two companies. In terms of their Return on Invested Capital [ROIC], a very important metric I consider when pondering an investment decision, as a company must be able to consistently create value to be a sustainable investment, Tesla has been reporting significant losses until 2018, and could successively sequentially increase its capital allocation efficiency over the past few years. General Motors’ metric is instead hovering around 4.5% on average in the past 5 years, as the company seems to struggle to improve its capital allocation efficiency, as it carries a huge amount of debt of approximately $115.44B, compared to Tesla’s strong balance sheet reporting only $5.87B of total debt, and a negative net debt position of over $15.23B. The latter could employ its cash position and even increase its capital allocation efficiency, observed in the relatively large spread between its ROIC and the Return on Capital Employed [ROCE].

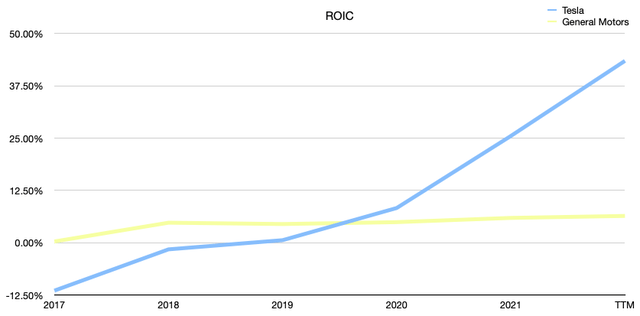

Author, using data from S&P Capital IQ

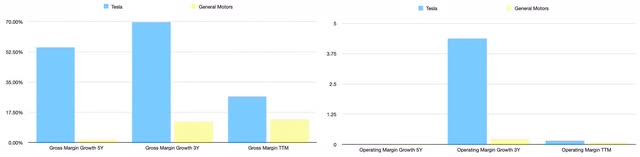

In terms of gross margin, without surprise, Tesla could achieve higher growth rates over the past few years, while it is worth mentioning that both companies could accelerate their margin expansion over the past 3 years when compared to a 5-year period. While GM’s gross margin has been fluctuating between 10-15% over the past 10 years, Tesla’s metric is still more volatile, but could overall achieve higher levels, as the company’s fleet comes with a premium price tag.

On the operational side, the companies have an even more divergent profile. Tesla broke even in terms of operating margin only in 2019, after reporting significant losses the years before, the company has since reported massive growth in profitability, by even almost doubling GM’s most recent margin, which has been hovering between 2% and 9% for the past decade, while the company could recently accelerate its operational profitability from 3.45% CAGR in the past 5 years, to 23.11% CAGR over the past 3 years.

Author, using data from S&P Capital IQ

Tesla reportedly has a much more cash-rich business than the analyzed peer, while only GM is paying a dividend again since September 2022, after halting the payout in April 2020. Despite its annual yield being now only 0.47%, the company recently also increased its share buyback program from the remaining $3.3B to $5B. Despite Tesla not buying back shares until now, during the latest Q3 earnings call the company’s CEO Elon Musk hinted at the likelihood of a buyback in the order of $5B to $10B but also underscored that this decision was pending board review and approval.

GM’s dividend and share-buyback programs are unnecessarily draining money out of the company when instead its main goal is achieving a successful transition to EVs, and the company could instead de-leverage its hugely indebted balance sheet and improve its relatively low capital allocation efficiency. The industry’s disruption affects both companies which face many capital-intensive years while having a cash-rich business and increased optionality in their capital allocation capacities will be of primary importance, and will consistently affect the companies’ valuation. Investors who look for an interesting dividend yield can find much better stocks to own, while in this industry for the coming years, I would watch out for the company with the better overall value creation and stronger balance sheet.

General Motors reports significantly higher EPS in the last few quarters, despite the company having a history of higher volatility in this metric. Tesla achieved higher growth in the last quarter and seems set for reporting consistently higher growth over the next few years, as the company is well-positioned in its industry and is capable of significantly increasing its profitability. While Tesla has massively reduced its debt dependency over the past two years scaling back from over $15B in 2020 to under $6B total debt at the end of Q3 2022, reporting a leverage ratio of only 0.35, GM took on massive amounts of debt over the past 10 years, resulting in a leverage ratio of 6.41.

The stocks’ performance

Considering both stocks’ performance in the past 5 years, TSLA greatly outperformed all the analyzed references, reporting a monumental performance of over 580%, while GM lost about 15% over the analyzed period, reporting the worst performance of the analyzed references. On a yearly time frame, TSLA has instead been suffering significantly, losing over 51% of its value, while its major references such as the S&P 500 (SP500), the Nasdaq technology index, tracked by the Invesco QQQ ETF (QQQ), as well as the Consumer Discretionary Select Sector SPDR ETF (XLY), have all been more defensive.

Author, using SeekingAlpha.com

Despite losing over one-third of their value, GM and competitor Ford Motor Company (F) have been overall more resilient than TSLA in the past year, despite the latter having shown significant relative strength during the sporadic market rallies. In the actual market environment, it’s important for investors to observe a stock’s relative strength compared to its references, in order to spot future likely leaders. It seems that despite the fact that TSLA may have been over-hyped in the past years and its valuation is now proportionally adjusting, the stock could quickly rebound in more favorable moments when investors’ risk-aversion is dissipating.

In the next section, I will show how the next few years are forecasted to play out for both companies and if the actual stock price may offer an interesting opportunity, while also assessing the risks in different scenarios.

Valuation

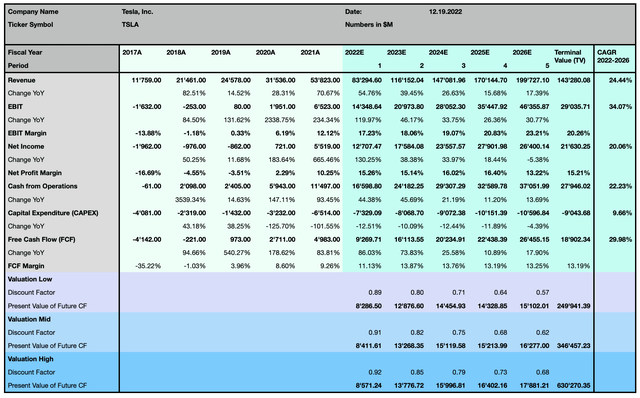

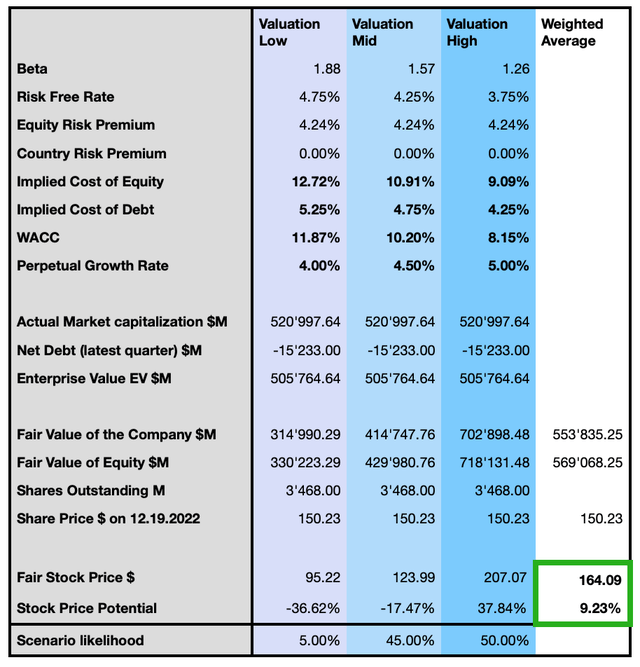

To determine the actual fair value for both company’s stock prices, I rely on the following Discounted Cash Flow [DCF] model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the WACC and the terminal value. As forecasted by the street consensus, Tesla is anticipated to generate 30% Free Cash Flow [FCF] CAGR over the coming 5 years, with its operating and net profitability increasing at respectively 34% and 20% CAGR, while its revenue is projected to expand at massive 24%, above the expected growth in both the global EV market and the global AV market.

Author, using data from S&P Capital IQ

The valuation considers a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

I compute my opinion in terms of likelihood for the three different scenarios, and I, therefore, consider the stock to be slightly undervalued by 9% at the current level, with a weighted average price target of about $164.

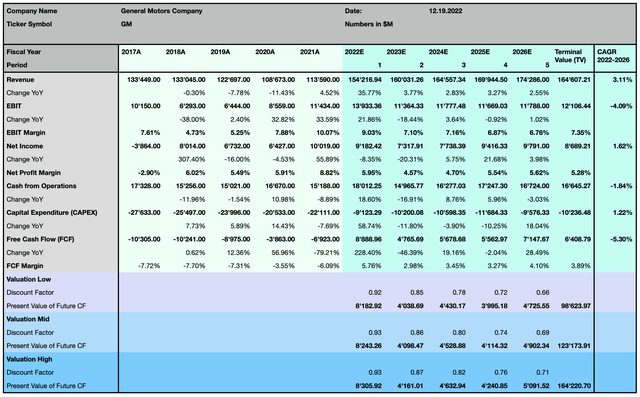

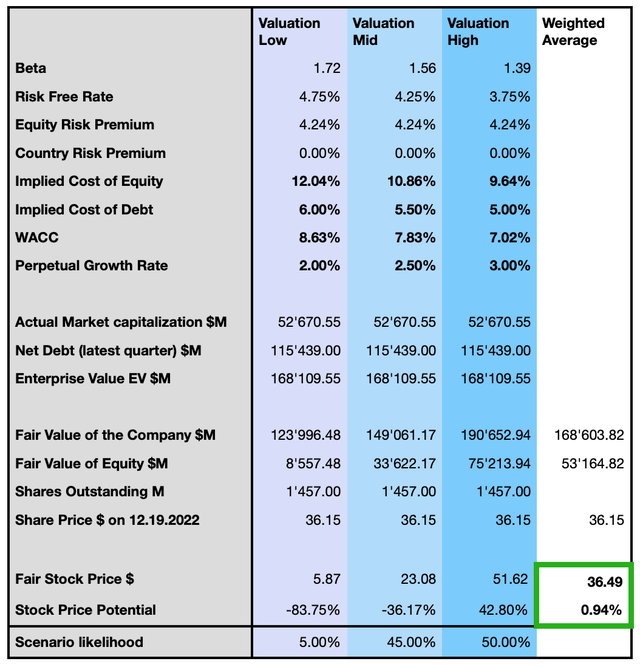

General Motors is forecasted to expand much slower than its peer, with its sales growing at only 3.11% CAGR over the next 5 years, even slower than the expected expansion of the global automotive market. Its operating profit margin overall is expected to shrink at 4% CAGR, while its net profit is seen slightly increasing over the forecasted period, but likely reporting years of great variance in this metric, as the company is massively investing in its EV fleet. The company’s FCF growth is anticipated to slow down by about 5% CAGR over the coming years, while it has to be noted that the company is anticipated to report a significant positive FCF in the current year, after 8 years of negative FCF, and is projected to significantly decrease its capital expenditures when compared to the past few years.

Author, using data from S&P Capital IQ

I then consider the same three scenarios affected by the company’s fundamentals and by the exogenous factors.

The two modelizations suggest TSLA may offer substantially higher expected growth, while it also seems that the company bears a lower downside risk under the considered assumptions. GM is seemingly fairly valued when considering the weighted average price target, and although offering higher returns in its most optimistic scenario, the company also bears the highest risk of seeing its share significantly drop in the other two scenarios, despite what I consider the most pessimistic to be very unlikely. Overall, I consider Tesla’s outlook and valuation to be the most promising not only in terms of above-market growth rates but because the company is expected to greatly improve its profitability and as we have seen in its financials, it is capable of significantly creating value for its investors.

Investors should consider that those forecasts are based on a relatively conservative assumption in terms of perpetual growth rates, higher discount rates, and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price.

Outlook and Risk discussion

Tesla owns a strong brand, ranked in position 12 in Interbrand‘s Best Global Brands, while none of GM’s brands is ranked in this classification. The company reached a valuation of over $1T in 2021 and surpassed the market capitalization of Mercedes-Benz Group AG (MBGAF, MBGYY), Ford, General Motors, Toyota Motor Corporation (TM, TOYOF), and Volkswagen (VWAGY, VLKAF, VWAPY) combined. Although the actual market capitalization is significantly lower than in 2021, TSLA’s valuation highly depends on achieving the discussed growth path and being capable of maintaining its leadership position in the increasingly competitive EV and AV market. Loyalty will be of primary importance in the future, as trust needs years to build but can be lost in a moment. GM may have loyal US customers but, e.g., in Europe, its brands are less known and Europeans recognize mostly German cars for their high quality, design, and safety, while American cars are seen as less desirable. Despite being a much younger brand, Tesla has already managed to create outstanding brand awareness also on an international scale. Its strong brand will most likely help the company to grow faster than its competitor on a global scale.

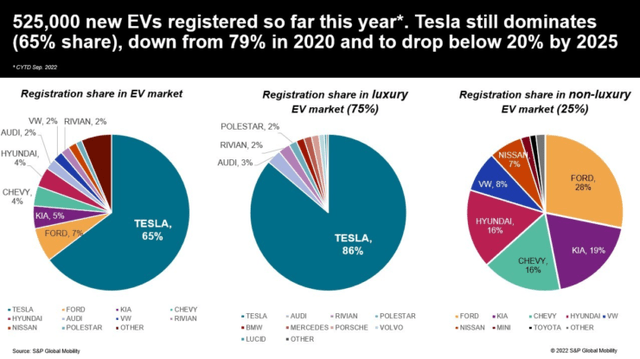

S&P Global Mobility, Data through September 2022

Tesla’s actual dominance in the U.S. EV market is mostly attributed to the fact that EVs are currently acquired by buyers with higher incomes than the average demographic profile of buyers of passenger vehicles. Much of the projected share loss is to EVs priced below $50,000, a Manufacturer Suggested Retail Price [MSRP] range where Tesla isn’t really competing yet. Although, Elon Musk confirmed that the company is working on a new, less expensive platform, which the CEO forecast to exceed the production of all other Tesla vehicles combined. Going forward, the EV market will probably be much more fragmented and competitive pressure in all price categories will arise, while for the moment many manufacturers are still struggling with supply chain challenges and bottlenecks, mostly because of production cuts caused by China’s draconian zero-COVID-19 policy, semiconductor shortages, production capacities constraints, geopolitical and trade tensions, and inflationary pressure which drive up the costs.

Both companies are lacking in diversification, although Tesla is aiming to ramp up its Tesla Semi heavy-duty truck production, as the company recently delivered the first of its fleet to PepsiCo (PEP) in California, marking the company’s debut in the commercial vehicle segment, and is expected to build 50,000 units annually by 2024. Tesla has also a bigger portion of international sales, while GM is overdependent on the US automobile market.

Other than general quality issues EVs are also carrying significant risks of battery malfunctions, not only affecting safety, which is the first and most important rule in car manufacturing, but also the performance and the range of the vehicles. The average EV range increased from 79 miles (or 127 km) in 2010 to 217 miles (or 349 km) in 2021, while the maximum range is achieved by Lucid Group’s (LCID) Lucid Air, with 520 miles (or 837 km) comes at a high price of $170,500. Tesla’s Model S reaches 405 miles (or 652 km) at approximately 62% of the competitor’s price, and Tesla’s Model 3 reaches 358 miles (or 576 km) costing approximately 45% less than the Tesla Model S. Safety and deterioration in terms of battery life is a highly sensitive argument for EVs and the better manufacturer will see a significant impact on its brand awareness. Building your own most important and strategic hardware gives you the advantage of having an exclusive and proprietary technology which then can be better integrated with the whole system and the in-house developed software and has the advantage of being more flexible for future updates and developments. Apple (AAPL) has demonstrated it with its Apple silicons, after decades of dependency on Intel’s (INTC) CPUs. Tesla has been relying on Panasonic (OTCPK:PCRFY, OTCPK:PCRFF), LG Energy Solutions, and CATL (SHE:300750) for its battery supply, but has recently also started its own battery production. GM is developing its own Ultium battery platform which will probably be a significant strategic advantage, as shortages in batteries supply are one of the actual issues affecting the production capacities of EV manufacturers. The company’s announcement to expand in the residential and commercial energy storage and management business where Tesla has been active for several years is expanding its total addressable market [TAM] by an estimated $125B to $250B, while it will also allow GM to increase their competencies and brand awareness in the EV industry. Manufacturing highly efficient and long-lasting batteries will certainly be one of the major competitive advantages, and Tesla’s experience with third-party batteries, its economy of scales, and its long presence on the EV market, energy storage, and management business will in my opinion give the company an edge over competitors in the foreseeable future, while GM has still to prove to be able to deliver on its ambitious promises.

The AV market will be another important strategic segment with fierce competition, as multiple manufacturers are committed to developing their own solutions based on different technologies, and most of all security challenges and multiple international regulations, or the lack of it and the consequent restrictions, are adding to the complexity of manufacturing and commercializing self-driving vehicles.

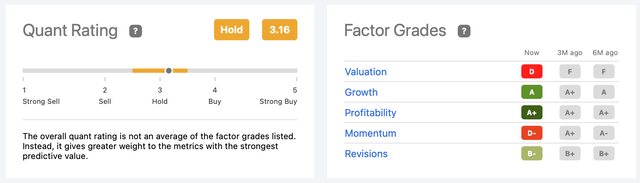

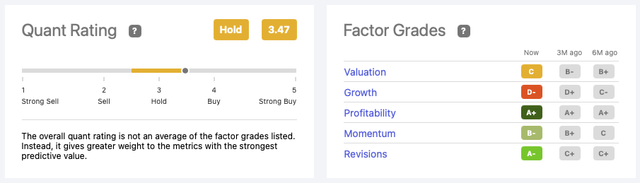

Tesla is rated with a Hold rating from Seeking Alpha’s Quant Rating over the past 3 years, and holds position 13 out of 33 in the automobile manufacturers industry.

General Motors has instead been alternatively qualified between a strong buy and a hold position in the past 3 years, most recently being rated again as hold, and is ranked 9th out of 33 in the automobile manufacturers industry. The two companies are, without surprise, ranked differently in terms of growth and momentum, while profitability seems to be the strongest point for both peers, valuation is seen as a major problem for Tesla, and growth seems to be the less favorable factor for GM.

The Verdict: Which stock is the better buy?

While Tesla is the pure player in EVs, leading the U.S. market, GM is heavily investing in its EV fleet and both companies are facing increasingly strong competition from local but also international manufacturers. From an investor’s point of view, it’s important to consider the company’s ability to create value for its shareholders, while minimizing the risks, and in those terms, Tesla offers a better profile. Past performance is not a guarantee for future results, but TSLA seems to be set for further substantial growth, although those opportunities may be predominately priced in.

Despite GM investing in higher growth opportunities, the company will have to deal with its slow-growing legacy in the ICE vehicles business, is carrying massive debt exposure in its balance sheet, and needs to address its weak profitability, as it is struggling to increase its ROIC. GM’s ROIC is significantly smaller than its WACC, which means that the company is seemingly destroying shareholder value. This situation is not sustainable and the company should take serious steps to address its profitability. To do so, the company could choose to increase its prices, reduce its cost basis, or scale back in investments, as the actual expansion in the EV market is necessary but put the company’s balance sheet under considerable pressure. Investors should closely observe this metric, as it is an important indicator of the company’s ability to build sustainable value in the long term; until GM’s ROIC stays under its WACC and isn’t consistently growing, I would not consider any long-term investment in the company.

Tesla went through significant uncertainty in the past years, but the company could more recently report stronger financials and offer consistently higher profitability, while the company is even forecasted to improve its metrics in the coming years. Owning the more cash-rich business, Tesla could even further increase its already superior capital allocation efficiency, giving the company more flexibility also to return capital to its investors. GM’s very ambitious target to sell 1M EVs annually in North America by 2025 requires almost perfect execution, and leaves little space for unexpected complications. It will be hard to reach, as the macroeconomic environment and the intrinsic situation in the automotive industry seem not to be as favorable as the management may expect.

I recognize TSLA as my favorite pick in terms of opportunities and financial strength, and I also welcome its strategic choices and favor its vehicle fleet and future developments, but its actual valuation seems to offer only a slight undervaluation, while it reflects the future opportunities under the actual assumptions. The industry is still in an unfavorable downtrend, and while there may be some opportunities, I want to see some headwinds clearing up before considering substantial investments in that group. GM’s stock seems to be priced fairly, and under the considered fundamental elements, is not offering an appropriate entry point at present time. I don’t exclude reviewing my rating if a better opportunity would show up or if the underlying conditions lead to a more advantageous valuation. I categorize both TSLA and GM as an actual hold position but would definitely favor TSLA as my investment choice – as soon as the underlying market conditions offer a better framework – as the company is positioned to continue to lead the industry’s disruption, which is offering great opportunities for investors in the coming years.

Be the first to comment