Leestat

Thesis

Investors in leading US independent natural gas exploration and production (E&P) player Southwestern Energy Company (NYSE:SWN) have benefited tremendously in 2022, as it posted a YTD total return of 45.5%.

Therefore, despite its relatively aggressive hedging program, which has significantly reduced its average post-hedging realized prices, the market has still rewarded its investors.

The company is confident in the near- to the medium-term outlook of the US natural gas market, given the need for energy security and its role in the world’s energy transition to cleaner fuels. Also, it would progressively roll off its hedges from 2023, allowing Southwestern Energy to realize more of the strength in the underlying commodity prices moving ahead.

However, we assess the post-Q2 price action for Henry Hub natural gas futures (NG1:COM) has weakened considerably after posting its highs in August/September. Therefore, it could weigh on the company’s H2’22 results but could be mitigated by the performance of its hedges. Hence, the company’s more conservative approach to its hedging program could continue to help reduce the impact on its underlying profitability, providing more visibility for its debt reduction program and subsequent use of its $1B share repurchase authorization (representing 13.3% of its current market cap).

We deduce that SWN has likely formed a short-term bottom at its September lows. However, we are concerned with the price action in the underlying futures market. While we believe the natural gas market has been pricing in a coming economic recession, we urge investors to remain patient as further near-term demand destruction could impact the earnings estimates of SWN as its hedges roll off. Hence, it could lead to value compression as the market adjusts its expectations for Southwestern Energy’s forward profitability profile.

Accordingly, we rate SWN as a Hold for now.

NYMEX Market Volatility Would Likely Continue

The energy crisis in Europe has continued to batter the EU, even as they consider strategies to limit the escalating impact of rising energy costs while dealing with record inflation levels. As a result, slower growth and rising costs have posed significant challenges politically among the EU partners. In addition, the challenges of imposing price caps have also been discussed widely, which could exacerbate the European crisis unless demand is rationed further to curb consumption.

However, Dutch TTF futures have already responded to the macroeconomic slowdown, portending a near-term recession is increasingly likely. The IMF and World Bank have warned that we are increasingly close to a global recession, hobbled by the energy crisis and rising inflation. Bloomberg reported:

The heads of the International Monetary Fund and World Bank warned of a rising risk of a global recession as advanced economies slow and faster inflation forces the Federal Reserve to keep raising interest rates, adding to the debt pressures on developing nations. – Bloomberg

Notably, Dutch TTF futures have collapsed about 55% from their August highs, while Henry Hub futures have fallen nearly 35% from their August highs. Hence, we believe the market has been anticipating further demand destruction, given the rapid surge of natural gas futures in 2022.

The critical question for investors is how it would affect the underlying performance of SWN moving ahead, with potentially weaker near-term demand in mind.

SWN Could See Markedly Slower Growth

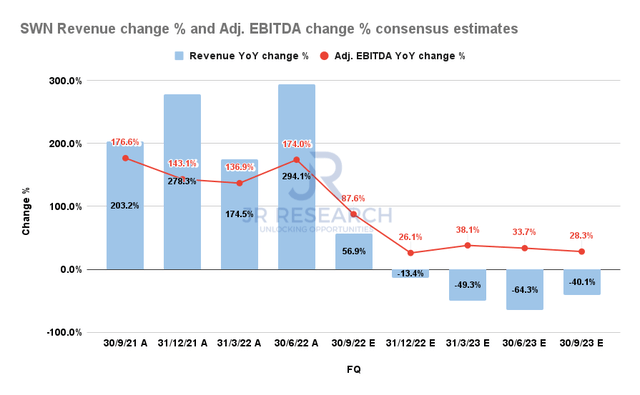

SWN Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) have modeled for Southwestern Energy’s revenue growth to fall markedly to 56.9% in FQ3, with its adjusted EBITDA growth moderating to 87.6%.

Therefore, SWN is still expected to post remarkable metrics, given much easier comps against FY21’s performance with the surge in natural gas prices in 2022. However, SWN could see its growth moderate further through FY23, in line with our thesis of further demand destruction.

Therefore, the critical question is whether the market has appropriately de-risked Southwestern Energy’s execution risks in its valuation.

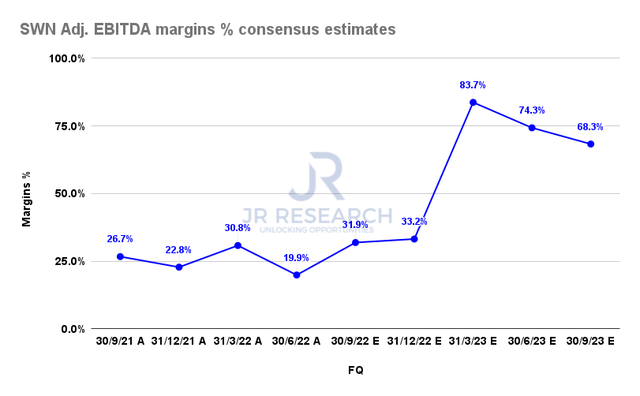

SWN Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

However, Southwestern Energy’s near-term profitability impact should be mitigated given its aggressive hedging program. In Q2, the company posted a post-hedging average realized natural gas price of $2.68 (Vs. discounted unhedged price of $6.48).

However, as those hedges roll off, SWN’s profitability metrics would be more exposed to the movements in the underlying commodity markets, which could worsen downside volatility if demand destruction worsens. We believe that remains the most significant risk to SWN’s thesis as it could result in substantial revisions to its margins, putting pressure on its valuation.

Is SWN Stock A Buy, Sell, Or Hold?

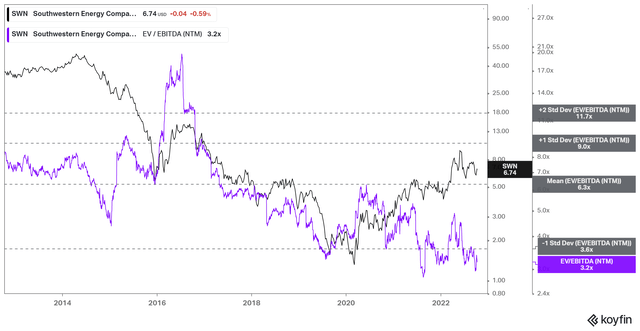

SWN NTM EBITDA multiples valuation trend (Koyfin)

SWN’s NTM EBITDA multiples remain below the one standard deviation zone under its 10Y mean, in line with the lows seen in 2021.

Hence, we assess that the market has not re-rated SWN despite its robust performance in 2022 as it anticipates further macroeconomic uncertainties impacting its estimates.

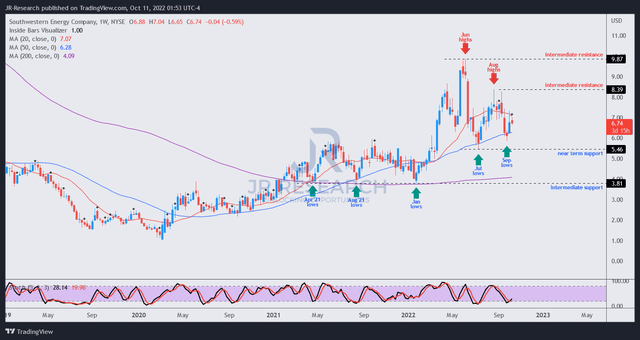

SWN price chart (weekly) (TradingView)

Moreover, we gleaned some red flags in SWN’s medium-term chart, as seen above.

We observed that SWN formed a lower high price structure that came well below June highs. Therefore, it suggests that buying momentum has likely weakened since June and could find further resistance moving ahead.

Notwithstanding, SWN’s July lows appear robust for now. But we believe the next pullback should give us more meaningful clues to the market’s directional bias on SWN.

We see a potential re-test of its near-term support, as the current rally seems to be losing upward momentum. A failure to hold its near-term support could see SWN falling toward its more robust intermediate support zone. Hence, we assess that the reward-to-risk profile is not attractive at the current levels but is relatively well-balanced.

Given worsening macroeconomic headwinds that could impact the natural gas market further, we encourage investors to watch the action from the sidelines for now.

We rate SWN as a Hold.

Be the first to comment