primeimages/E+ via Getty Images

Investment Thesis

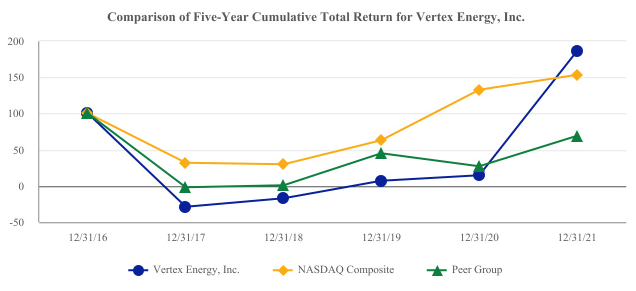

Vertex Energy (NASDAQ:VTNR) stock skyrocketed in 2021 when the company announced its plan to acquire the Mobile, Alabama refinery and related marine terminal and logistics assets from Shell (SHEL). Between April 30th and June 30th, the stock had jumped about 873%, primarily in response to the deal, which, as per the CEO, “will have the potential to generate at least US$3 billion in revenue and US$400 million of gross profit in the full-year 2023, given current project economics.”

Vertex Energy

The deal recently went through, setting a transformational change in motion that will likely lead to the company becoming a leading supplier of both renewable and conventional products in the United States. The company is expecting to complete the planned conversion of the Mobile refinery’s hydrocracking unit by year-end and commence production of renewable diesel fuel in Q1 2023.

I rate the stock as a buy for long-term investors due to its massive expected YoY growth in 2022 and 2023; it will gain momentum through the year and deliver strong performance in the upcoming quarters.

Company Overview

Vertex is an environmental services company that recycles industrial waste streams and off-specification commercial chemical products. Its primary focus is recycling used motor oil and other petroleum by-products. The company is engaged in operations across the entire petroleum recycling value chain, including collection, aggregation, transportation, storage, re-refinement, and sales of aggregated feedstock and re-refined products to end-users.

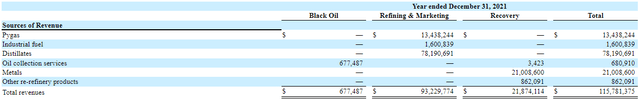

In 2021, vertex aggregated approximately 87.5 million gallons of used motor oil and other petroleum by-product feedstocks and managed the re-refining of approximately 79.7 million gallons of used motor oil with its proprietary Thermal Chemical Extraction Process (TCEP), Vacuum gas oil (VGO), and Base Oil processes. It operates in three segments, Black Oil, Refining & Marketing, and Recovery.

The (Transformational) Mobile Refinery

Vertex has recently closed the deal to acquire Shell’s Mobile Bay refinery, designed to process approximately 91,000 barrels per day of crude oil and products, including LPG, diesel fuel, jet fuel, and gasoline. It also produces low-sulfur VGO/Heavy Olefin Feed and Benzene and has the option to run as a stand-alone refinery, producing base oils or chemicals feedstock. The company plans to make the site its flagship refining asset, positioning Vertex to become a pure-play producer of renewable and conventional products.

The company has already entered into a definitive agreement with Haldor Topsoe to lead the technical implementation of the planned conversion. It intends to complete the refinery’s hydrocracking unit’s conversion to produce renewable diesel fuel on a standalone basis, costing $85 million, by the end of 2022 and commence production of approximately 10,000 barrels per day (bpd) in the first quarter of 2023, increasing to 14,000 bpd by mid-year 2023.

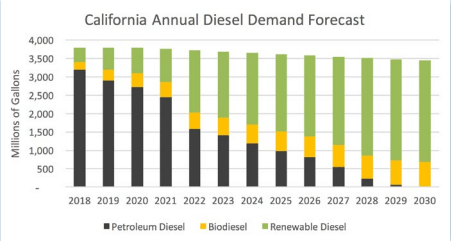

California remains the primary market for domestically produced renewable diesel due to the economic benefits of its use under the Federal Renewable Standards Program and Low Carbon Fuel Standard. Still, with other states following suit, significant, incremental demand is expected to be created during the decade. According to the California Advanced Biofuels Alliance, California renewable diesel demand will increase by 600% over the next decade.

California Advanced Biofuels Alliance

The company has entered into a 5-year offtake contract to supply the entire output of the Mobile refinery with Idemitsu Apollo Renewable Corporation (IARC). Given current project economics, the company anticipates the Mobile refinery to generate at least $3 billion in revenue and $400 million of gross profit in 2023. The refinery transaction and related deals have led analysts to revise their expectations upwards, going through the roof, with more than 10 times improvement in revenue and earnings estimates.

Historically, the company’s revenues increased 146% to $116 million in 2021, up from $47 million in 2020, attributable to the rebound from the COVID-19 imposed hurdles and the higher commodity prices. The increase in prices also pushed the gross margin from 2.21% in 2020 to 3.95% in 2021, an aggregate increase of over 340% ($1 million in 2020 vs. $4.6 million in 2021).

However, the company’s 2023 forecast earnings show a significant increase, with revenue rising from an expected $2.55 billion in 2022 to $3.38 billion in 2023, an expected increase of 133%, and the expected EPS rise from $0.75 in 2022 to $3.16 in 2023, over 4 folds expected to increase.

Since Vertex expects to receive payment based on the spot-market price for each gallon of the renewable diesel produced under the contract with IARC, the company stands to heavily benefit from the high commodity prices around the globe, pitching into the inflated revenue estimates.

Valuation

Due to the recent share price hike, the company’s relative valuation metrics have deteriorated. I deem the forward ratios much more relevant here than the TTM ratios because the company is at a pivotal point, where future numbers are much more pertinent than historical ones.

The stock trades at a forward PS ratio of 0.21, undercutting the industry median of 1.59 by almost 87% and its 5-year average of 0.49 by over 56% because of the positive prospects created by the Mobile refinery transaction.

Similarly, its forward PE ratio of 11.33 is slightly higher than the industry median of 10.68, but considering the upcoming earning growth metrics, the number appears extremely sweet.

The forward PB value of 18.76 is significantly higher than the industry median of 2.1. Still, the company had a YoY tangible book value growth of almost 570% in the MRQ, with a 3-year asset growth CAGR of almost 47% and a tangible book value 3-year growth CAGR of a little over 23%. Future cash flow generation can reasonably be expected to grow in line with sales and other metrics, pouring into asset growth.

If the company was trading at its industry median PS, PE, and PB values, their average comes down to a 12-month price target of $24.28.

Conservative investors should still be wary of the valuation metrics as the stock is vulnerable to volatility and fluctuations. Additionally, the stock may still seem too expensive throughout 2022 as the benefits of the Mobile refinery will not kick in until Q1 2023.

Conclusion

The company’s topline is expected to grow rapidly during the next two fiscal years, boosting the underlying fundamentals. Despite the company’s balance sheet being far from ideal, with an Altman Z score of 1.37 and the company’s EV of about $641 million exceeding its market cap of around $560 million, signifying a risky high debt environment, the recent developments have granted the company a very positive outlook.

Even though the current commodity prices significantly benefit the company, they are extremely riddled with volatility, especially because of the Russia-Ukraine situation, so an accurate estimate is hard to get; however, the company uses hedging instruments to protect itself from price declines up to a certain limit.

The company’s future stock price will be heavily dependent on the performance of the Mobile refinery, which will significantly affect the company’s financial performance. The market sentiment regarding the facility is positive, and analyst expectations reflect this optimistic outlook in their estimates.

One of the things that might also sway the stock price in the coming quarters is the high short-interest of almost 32%, but insider ownership of 27.5% should also ease some investor concerns. So investors need to carefully consider their risk appetite before jumping into the waters.

Long-term investors who prefer timing the markets may do better if they hold their positions until later in the year, anticipating lower valuation metrics and a stronger financial position. However, investors looking for a good renewable energy long-play may still benefit from a buy if their risk appetite can stomach idiosyncratic risks.

Be the first to comment