deepblue4you

Thesis

Holders in leading Canadian integrated energy company Cenovus Energy Inc. (NYSE:CVE) stock have suffered lately as it continued its slides from its August highs, in line with its industry peers.

CVE remains 37% below its June highs, even though it still posted a YTD total return of 28.3% (including dividends). Therefore, investors who bought into CVE’s growth story earlier in the year still outperformed the broad market.

Notwithstanding, we noted that the market dynamics in WTI crude (CL1:COM) had shifted decisively to the downside since late August. Our assessment informs us that the market has been distributing the gains in oil, drawing in dip buyers astutely before turning down the price further in September.

Cenovus Energy’s revenue and profitability profile is also expected to turn for the worse through FY24, even though production is expected to remain relatively stable. Furthermore, its relatively low dividend yields (TTM: 2.05%) are not likely to provide much assurance to investors as valuation support, despite its share buyback authorization to boost shareholder value.

Notwithstanding, we noted that CVE is likely at a near-term bottom. Therefore, we expect a near-term rally to ensue from here, drawing in more dip buyers seeking to capitalize on the recent steep sell-off.

However, we caution investors from looking to leverage opportunistically into the current levels, as we believe further estimates revisions could be necessary, given the worsening prospects of a global recession.

We believe it’s appropriate to rate CVE as a Hold for now, despite the prospects of a short-term rally, until Wall Street cuts its estimates in unison.

Fears Of A Global Recession Has Ended WTI’s Rally

Energy investors have done well, doubling their bets since the bottom of the COVID pandemic that saw energy stocks fall to unsustainable lows. However, we posit that the medium-term rally in WTI crude has finally stalled decisively since late August, even though resolution over its directional bias took more than a month to pan out.

Notwithstanding, bullish strategists have been trying to find reasons to help prop up energy prices with the familiar thesis of structural demand/supply constraints. Energy Analysis highlighted in a recent commentary: “[We] think the energy transition is going to be moving into another quarter. That is going to herald really the next few years of pain.”

Notwithstanding, the threat of a global recession has threatened to upend the most resilient sector in the S&P 500 in 2022, as calls for OPEC+ to cut production grew louder in the face of further demand destruction.

Moreover, Bloomberg also highlighted in a recent note that it expects oil consumption to peak in 2022 and is unlikely to recover in 2023, exacerbated by the coming global recession. It articulated:

After more than a century of almost continual growth, the world’s appetite for oil is peaking, and will soon enter terminal decline. The state of gasoline is a foretaste of what is to come. Demand for the fuel, which uses more than a quarter of the world’s crude, has already peaked. A global recession on the scale that equity and bond markets are now pricing in could easily push liquid fuel consumption back below 100 million barrels until the middle of the decade. That starts bringing things close to the point where most forecasters see long-run shifts in demographics, economic growth, and technology sending oil into terminal decline. – Bloomberg

Pricing In Peak Growth For Cenovus Energy

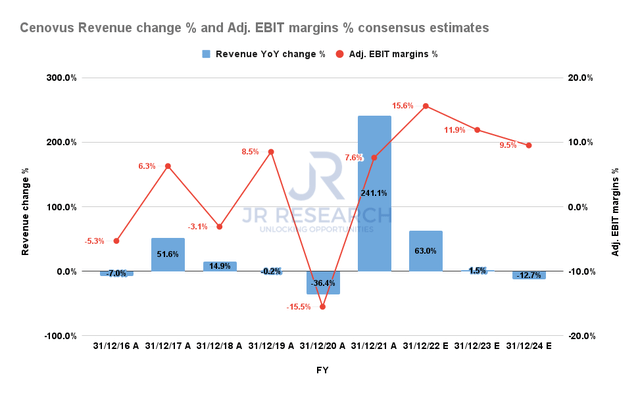

Cenovus Revenue change % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Accordingly, we believe investors must assess whether Cenovus can maintain its growth cadence from FY21/22, given the worsening macroeconomic climate.

Even the bullish consensus estimates suggest that Cenovus’s revenue growth could fall to just 1.5% in FY23 before rolling over to -12% by FY24. Consequently, its adjusted EBIT margins are projected to fall to 9.5% by FY24, close to its pre-COVID highs.

However, we have yet to observe significant estimate reductions by bullish Wall Street analysts on their production/pricing forecasts, given the demand destruction caused by the recessionary pressures. Hence, we urge investors to remain cautious about adding more positions now.

CVE’s Valuation Suggests That The Market Is Not Convinced

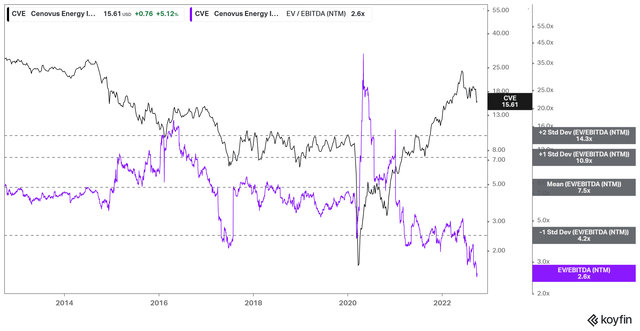

CVE NTM EBITDA multiples valuation trend (koyfin)

The market is not dumb. Everyone can see that CVE last traded at NTM EBITDA multiples well below its 10Y mean, as seen above.

But, investors need to remember that the market knows it, and they need to ask themselves why the market has “refused” to re-rate CVE despite its supposedly “low valuations.”

Energy stocks are still cyclical plays, no matter what you hear from bullish strategists telling you about structural supply constraints underpinned by robust demand fundamentals.

The best time to invest in cyclical plays is when Wall Street goes into a panic frenzy and cuts near-term estimates en masse leading to massive spikes in their EBITDA multiples, like in March 2020.

We believe that the market has continued to distribute the gains in CVE, albeit progressively, drawing in dip buyers along the way. So, until Street analysts go into a panic, continue to wait on the sidelines.

Is CVE Stock A Buy, Sell, Or Hold?

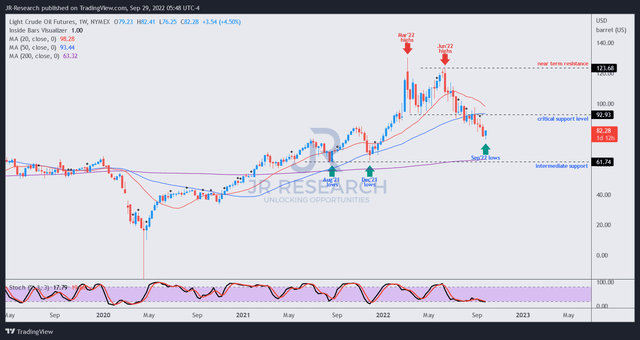

WTI crude price chart (weekly) (TradingView)

When in doubt, we encourage investors to consult price action. Because price action is forward-looking, we consider it the most objective indicator (there’s no 100% objectivity in any analysis) in our repertoire to determine the market’s directional bias.

We highlighted earlier that WTI crude had failed to retake its critical support level after losing it in late August. Also, CL1 lost the 50-week moving average (blue line) that supported its medium-term uptrend since the 2020 COVID bottom.

Hence, we believe that CL1 has lost its medium-term bullish bias decisively, with sellers in significant control. As a result, it will likely impede the recovery attempts by energy stocks if the underlying market is not supportive.

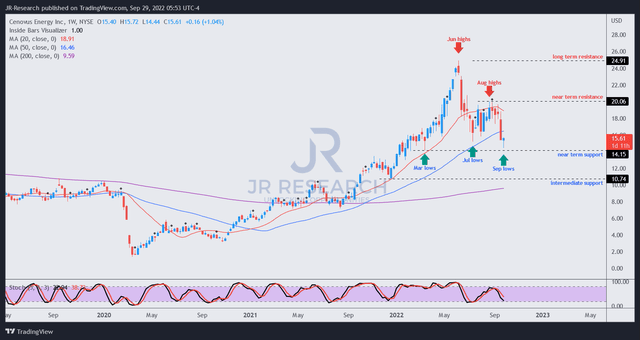

CVE price chart (weekly) (TradingView)

Notwithstanding, we gleaned that CVE is likely at a near-term bottom and could form a short-term rally from here.

However, the lower highs from August that came in below June’s highs do not augur well for CVE. Speculative traders could leverage on the current bottom to enter buy orders with profit targets below August highs as potential exit levels while having appropriate stop-loss risk management.

However, we don’t encourage buy-and-hold investors to add at the current levels, as we believe CVE could likely lose its bullish bias if its short-term rally fails to retake its August highs.

We rate CVE as a Hold and urge investors to wait on the sidelines.

Be the first to comment