Darren415

This article was first released to Systematic Income subscribers and free trials on Sep. 25.

Welcome to another installment of our closed-end fund (“CEF”) Market Weekly Review where we discuss CEF market activity from both the bottom-up – highlighting individual fund news and events – as well as top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the fourth week of September. Be sure to check out our other weekly updates covering the BDC as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

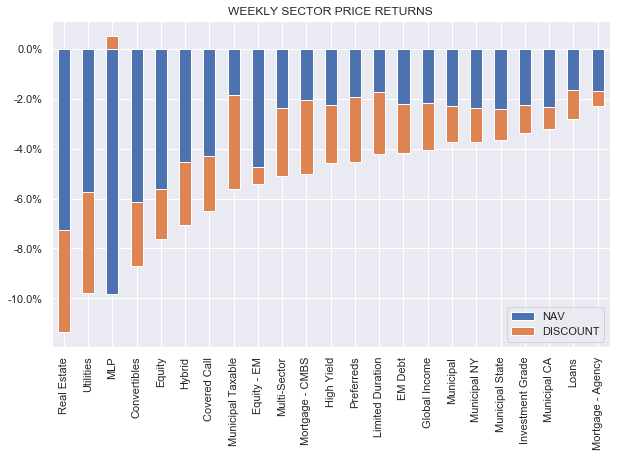

It was a tough week for the CEF sector as all sectors were down with three sectors falling more or close to 10% – REITs, Utilities and MLPs. Discounts were responsible for about half of the drop in CEFs. Most of the drop was in higher-beta sectors like REITs, MLPs, Converts and Equity funds. Despite a sharp rise in Treasury yields, Muni sectors actually managed to outperform.

Systematic Income

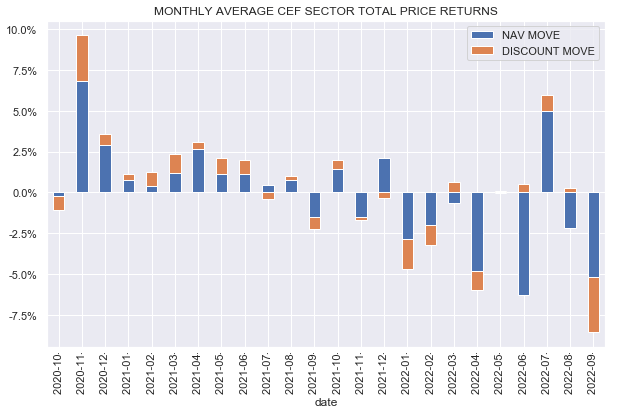

In terms of monthly performance, September now looks even worse than the tough month of June. The big difference is that while discounts actually managed to tighten slightly in June in aggregate, they widened significantly in September. The average CEF sector now stands about 8.5% lower in total return terms over the first three weeks of the month.

Systematic Income

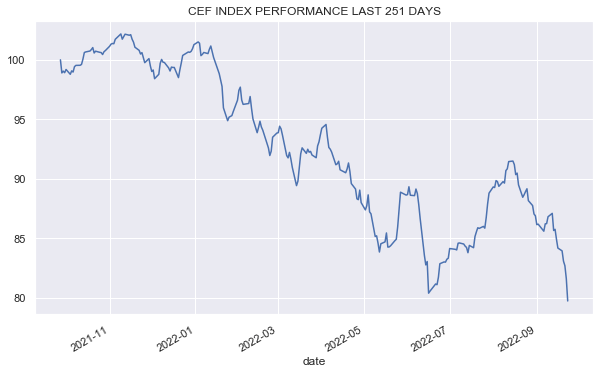

The broader CEF index has now moved below its June low though not by much.

Systematic Income

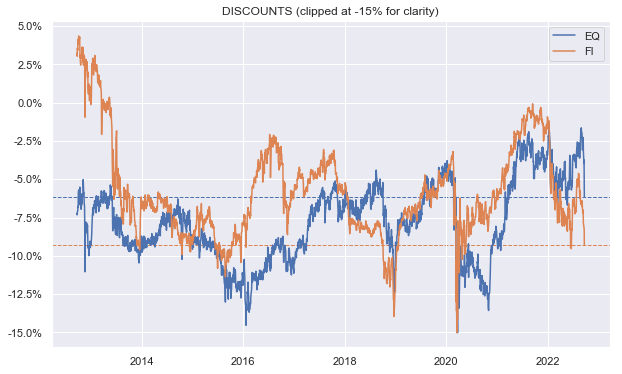

Fixed-income discounts have moved from rich levels of just a few weeks ago to very attractive ones. They have only been significantly wider over the past decade during the Fed autopilot tantrum and the COVID crash though only briefly.

Systematic Income

Market Themes

Fixed-income CEF sectors have taken a lot of pain this year. One recent comment suggested that instead of holding High Yield bond funds, for example, on a standalone basis, investors can just hedge them by being short a Treasury ETF like TLT. Because TLT fell about the same as the average HY bond CEF, as the view has it, investors could have sidestepped the entire rout by shorting TLT while staying long HY bond CEFs.

Conceptually, this is directionally correct. Since a big chunk of the recent sell-off in credit has been due to the rise in Treasury yields, if you were short long-term Treasuries, then you would have been able to avoid most of the drop in credit.

However, once we look at the details of this strategy things get a bit complicated. First, obviously, for investors holding the hedge now, if rates reverse, then the hedge works against you.

The other thing is that TLT is not a good duration match for most HY bonds. Most HY bonds have duration of 4-5 while TLT has duration of around 4x that so using TLT as a hedge means you are basically way overhedged.

This also explains why TLT magically protected all of the sell-off in HY bond CEFs – because it’s much more sensitive to Treasury yields than HY bonds and Treasury yields made a big move this year. In other words, the correct duration-matched Treasury hedge would still have left HY bond investors with double-digit losses.

Three, the hedge bears a cost – if you are short TLT, you are paying implicitly something like 3.8% on it which is where long-term Treasury yields are (in addition to the cost of borrow of the ETF itself). So if HY corporate bonds yield 9%, then after the hedge you are left with a yield around 5% – a much smaller margin of safety to use against any increase in default rates in the sector.

The math was even less compelling at the start of the year where you had to pay a bit less than half of the total HY bond yield away on the hedge (4.3% HY bond yields less 2% Treasury yield). This suggests that, while, in retrospect, hedges look fantastic, they are much more difficult to pull the trigger on at the optimal time.

Of course there are also behavioural implications of hedging – for instance, getting the timing perfect is impossible and some hedgers would have gotten in way too early and/or would have bailed when Treasury yields fell at the start of August. An alternative in an environment when Treasury yields are not attractive is to be in floating-rate assets e.g. bank loans, BDCs, CLO Debt, ABS and others.

Market Commentary

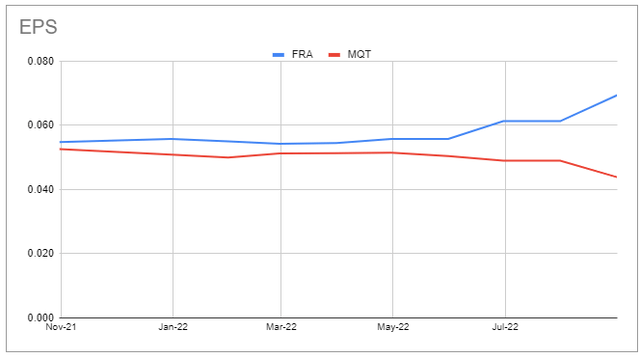

August coverage / UNII numbers were updated in our CEF Tool for BlackRock and Eaton Vance funds (PIMCO and Nuveen August numbers were updated earlier). Pretty similar message as what we saw elsewhere. Floating-rate fund earnings / coverage increased while Muni fund figures continue to fall.

The chart below shows the earnings trajectory of two BlackRock funds: the Floating Rate Income Strategies Fund (FRA) and the MuniYield Quality Fund II (MQT). The picture speaks for itself – loan fund earnings profile looks quite a bit better than that of the Muni fund. This is not to imply we should all pile into bank loan funds but the sharp rise in short-term rates is clearly having an effect and will continue to do so in the medium term.

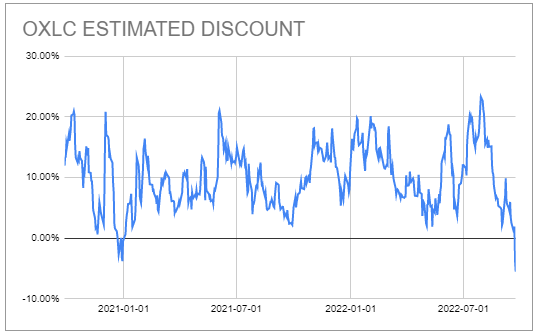

CLO CEF valuations continue to deflate. EIC has dropped very quickly off its weirdly high premium – though it remains somewhat expensive. OCCI is now at around a 20% discount based on our NAV estimate. OCCI has been a historic underperformer; however, OXLC and ECC at a discount can make sense as they will benefit from the very valuable loan reinvestment option. OXLC is trading at the widest estimated discount (we are estimating its NAV as of this writing to be 5.5% below its August level) over the last 2 years.

Systematic Income CEF Tool

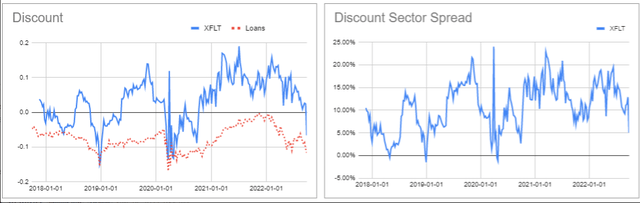

The XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) has also finally gotten less stupidly expensive (the Loans sector which it is compared to below is not the perfect one but it’s a decent proxy). At a nearly 7% discount as of this writing, it can be an attractive lower-beta way to allocate to CLO Equity securities.

The Nuveen Emerging Markets Debt 2022 Target Term Fund (JEMD) has moved its leverage level to zero in preparation for potential termination later this year. Unlike their preferred CEFs which held longer-term assets, JEMD holds very short-dated bonds, so it probably doesn’t make sense for Nuveen to try to turn it into a perpetual fund like they did with JPT or JLS. Overall, despite its very difficult portfolio, it’s done OK – a total price return of -10% this year versus the average PIMCO taxable fund that has delivered a -20% total return. Ultimately, low duration (both interest rate and credit) as well as a term structure which acts as a discount anchor can allow funds even in very tough sectors to do OK.

Stance and Takeaways

Now that the CEF space has pushed below June lows, it makes sense, in our view, to start adding CEF exposure. Recall we previously avoided adding new capital to CEF positions after the June bounce with the view that valuations got very rich very quickly in a deteriorating macro environment and while the Fed was still in the middle of its hiking path. While we view Treasury yields and CEF discounts as attractive, we are cautious about longer-duration lower-quality assets given HY bond credit spreads remain below 5% – more than 1% lower than the level they reached in June. For this reason, it makes more sense to add exposure to funds like the Angel Oak Financial Strategies Income Term Trust (FINS) or the Cohen & Steers Tax-Advantaged Preferred Securities & Income Fund (PTA) which hold primarily investment-grade securities. If and when credit spreads move wider of 6%, lower-quality funds can begin to make sense for new capital once again.

Be the first to comment