Thesis

Hercules Capital, Inc. (NYSE:HTGC) is a leading internally-managed business development company specializing in venture debt financing, focusing on expansion or late-stage high-growth companies.

Its portfolio is mainly centered on technology and life sciences companies, and it has invested in companies that growth and tech investors should be familiar with. Its public listed portfolio companies consist of familiar names like Fastly (FSLY), DocuSign (DOCU), Enphase (ENPH), and Proterra (PTRA).

The company is focused on “higher-quality” companies in its underwriting process and derives most of its income from interest (>95% as of Q2). In addition, nearly 95% of its debt investments are floating-rate with a fixed floor, allowing the company to benefit from the Fed’s aggressive rate hikes.

Notwithstanding, its portfolio value has also been impacted significantly due to the equity bear market, leading to value compression in its portfolio companies. As a result, HTGC has collapsed nearly 40% from its April 2022 highs, as its NTM dividend yields reached 13.3%.

Our assessment suggests that HTGC remains precariously configured in the near term, with the potential for more near-term downside volatility. However, we also gleaned that its valuation has likely been de-risked adequately for long-term investors to consider adding exposure at the current levels, supported by a robust dividend yield.

Therefore, we postulate that the reward-to-risk profile for HTGC is attractive at the current levels but urge investors to layer in over time, leveraging on the market pessimism to add exposure.

As such, we rate HTGC as a Buy, with a medium-term price target (PT) of $15 (an implied upside of 30%).

Hercules Should Benefit From The Fed’s Hawkish Push

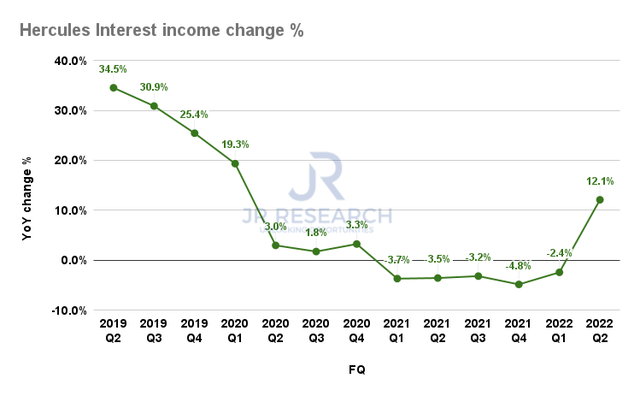

Hercules Interest income change % (Company filings)

Hercules highlighted that it’s a beneficiary of the Fed’s aggressive rate hikes, as it lifted its interest income markedly in Q2, as seen above. The company posted a 12.1% YoY uptick in Q2’s interest income, supported by its robust origination volumes.

Even though we are potentially moving closer to the Fed’s current median terminal rate (4.6%), Hercules Capital’s financing terms are embedded with a base floor to mitigate the impact of rate reversion moving forward.

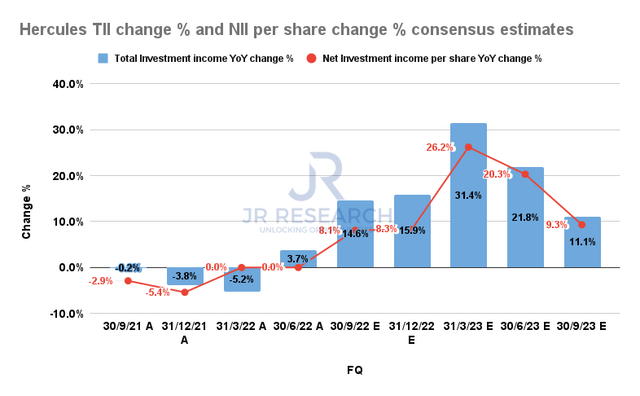

Hercules Total Investment income change % and Net Investment income per share change % consensus estimates (S&P Cap IQ)

Furthermore, the company emphasized that it continues to see high-quality investment opportunities, as its average credit underwriting score moved higher in Q2 despite the market downturn. As a result, it has tightened its scope of companies but does not expect origination opportunities to slow down materially.

The consensus estimates (bullish) suggest that Hercules Capital’s total investment income (TTI) growth should remain robust through 2023 amid the Fed’s hawkish push, as seen above. Moreover, it’s also expected to lift its net investment income (NII) per share growth through FQ1’23 before tapering.

But The Market Is Concerned With Value Compression

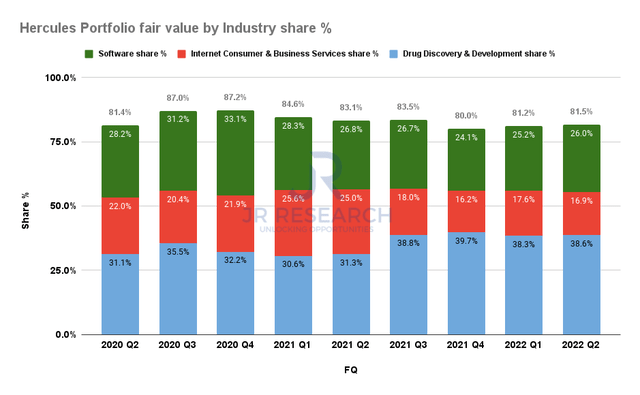

Hercules Industry share of portfolio fair value % (Company filings)

Hercules Capital invests primarily in technology and life sciences companies, which have consistently accounted for over 80% of its portfolio fair value over the past two years.

Consequently, the battering in the public market has also not spared the valuations of its portfolio companies, as Hercules Capital’s net asset value (NAV) per share got pummeled.

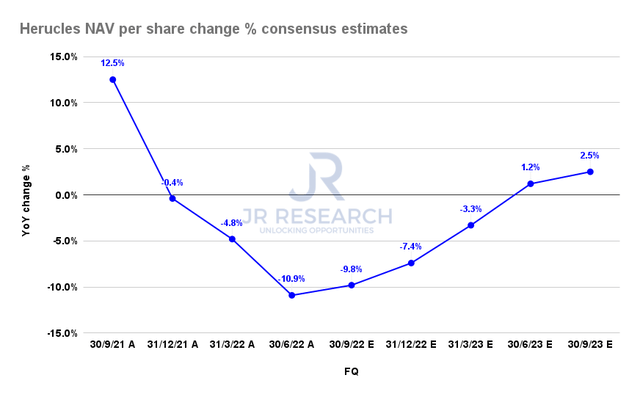

Hercules NAV per share change % consensus estimates (S&P Cap IQ)

Notwithstanding, the consensus estimates suggest that Hercules Capital’s NAV per share decline could have hit a nadir in Q2 after falling nearly 11% YoY. However, the recent battering in HTGC suggested the market could have shifted its perspective.

We postulate that the market is likely pricing in a global recession that could impact its portfolio companies further. Hercules Capital suggested that it has yet to see material credit deterioration or significant challenges in its portfolio companies seeking financing at its Q2 call.

However, we deduce that the market has likely de-rated HTGC further to account for more significant stumbles if the global economy moves into a deeper recession in 2023. As a result, we believe its Q3 estimates could be at risk, with a NAV per share bottom likely shifting further to Q3/Q4. Therefore, investors should be prepared for a likely cut in Hercules Capital’s NAV per share estimates moving ahead, but it should have been reflected in the recent downward move.

Is HTGC Stock A Buy, Sell, Or Hold?

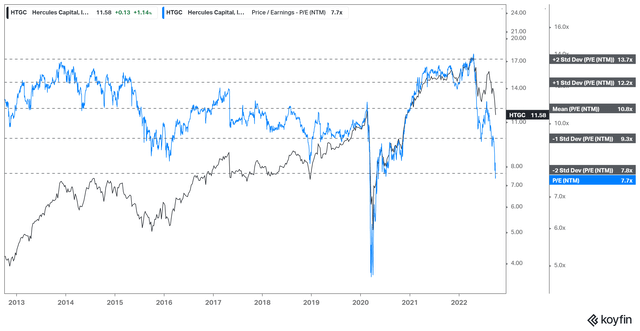

HTGC NTM NII per share multiples valuation trend (koyfin)

As seen above, HTGC’s P/NII per share has been sent falling well below its long-term mean, in line with the two standard deviation zone under its 10Y mean.

Barring the dramatic collapse in its earnings estimates seen in the 2020 COVID pandemic, we postulate that the market had de-risked HTGC sufficiently. We believe the market has been anticipating further cuts to the valuation of its portfolio companies, given the specter of a global recession.

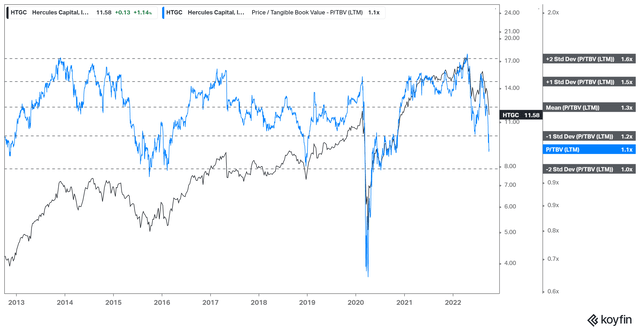

HTGC TTM P/TBV valuation trend (koyfin)

Also, its TTM tangible book value (TBV) multiples have fallen closer to the two standard deviation zone under its 10Y mean. Despite the potential for further downside volatility if the market decides to de-risk HTGC further, we see an attractive mean reversion opportunity to the upside at these levels.

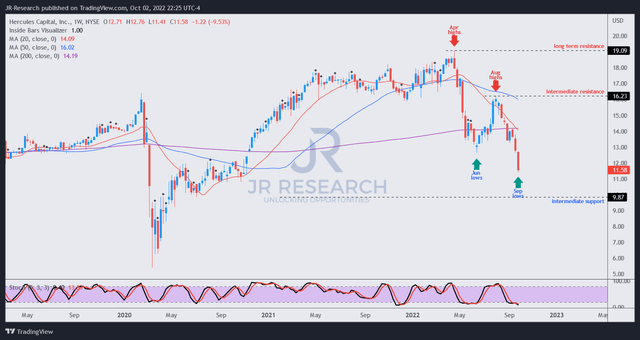

HTGC price chart (weekly) (TradingView)

As seen above, HTGC remains in a medium-term bearish flow, but the recent downward move forming its September lows is emblematic of a rapid capitulation to force a bottom.

Therefore, we assess that the selling downside could subside over the next five to eight weeks if it can form a consolidation base.

However, investors should be prepared for near-term downside volatility, as the market could use the current pessimism to force out more weak holders before reversing its momentum.

Accordingly, we rate HTGC as a Buy with a medium-term PT of $15.

Be the first to comment