Rawpixel

I profited handsomely when the market overreacted to the troubles Norwegian Cruise Line Holdings (NYSE:NYSE:NCLH) was going through. Specifically, I bought in March of 2020 during the early, terrifying stages of this pandemic you may remember called “Covid.” My reason for going long the stock at that time was that the market had become irrationally pessimistic. Thirteen months later, I determined that excessive optimism had been replaced by excessive optimism, so I “disembarked” from the shares. The problem I saw in April of 2021 is that the market was pricing the shares as though the business had returned to normal. It certainly had not, so I took my leave of the investment. My timing was good enough, because the stock spent the remainder of the year grinding ever lower.

In February of this year, I looked at the stock again and determined that it wasn’t yet a buy, in spite of the much lower price. For those who insisted on going long, I recommended call options. In April of this year, I made what I now consider to be an embarrassingly tautological argument, namely that Norwegian Cruise Lines is a permanently changed business, so any comparisons to prior periods should be treated with a healthy dose of skepticism. A better and more humble man than me would just let this track record speak for itself. I’m not that man, though. I’m a sometimes boorish braggart and for that reason I want to point out that I’ve successfully surfed the waves of excessive pessimism and excessive optimism here. The shares have fallen recently in price, yet again, so it’s time to review the name in order to see if it makes sense to buy back in.

I’m going to go in a slightly different direction, this time, though. I, and I’m sure all of you, have limited capital to invest in the cruise line industry. Given that investing is a relativistic game, and that we’re always searching for the best risk adjusted returns, I’m going to try to decide which of Norwegian Cruise Line Holdings and Carnival Corporation (NYSE:NYSE:CCL) are the better risk adjusted investment at the moment. I’m very open to the possibility that neither stock is worth buying at the moment, but investing is an innately relativistic game, and thus I need to compare X to Y here.

Welcome to the thesis statement portion of the article. This is where I offer you the “gist” of my thinking in case you couldn’t be bothered to read the title or the bullet points above. In my view, it’s a bit eccentric to ignore titles and bullet points and land 390 words into the article and expect a summary of my findings, but I’m not going to judge, and it’s a free country. I’m of the view that Carnival Cruise Lines is the better investment at the moment. The company has managed to control costs much better than Norwegian Cruise Lines has, and the shares are somewhere between 32% and 80% cheaper. Thus, on a risk adjusted basis, I think Carnival Cruise Lines is clearly the winner here. I’m a fan of preserving capital, though, and I think the absolute best risk adjusted play here is to buy the March Carnival Cruise Lines calls with a strike of $7.50. These give investors much of any upside we’re going to get at a fraction of the downside.

Comparative Financials

Given that this is a comparison piece, I have limited space to drone on about the myriad problems here. If you’re interested in my issues with the capital structure, I would urge you to check out my earlier work on Norwegian Cruise Lines. I do need to make one observation here, though.

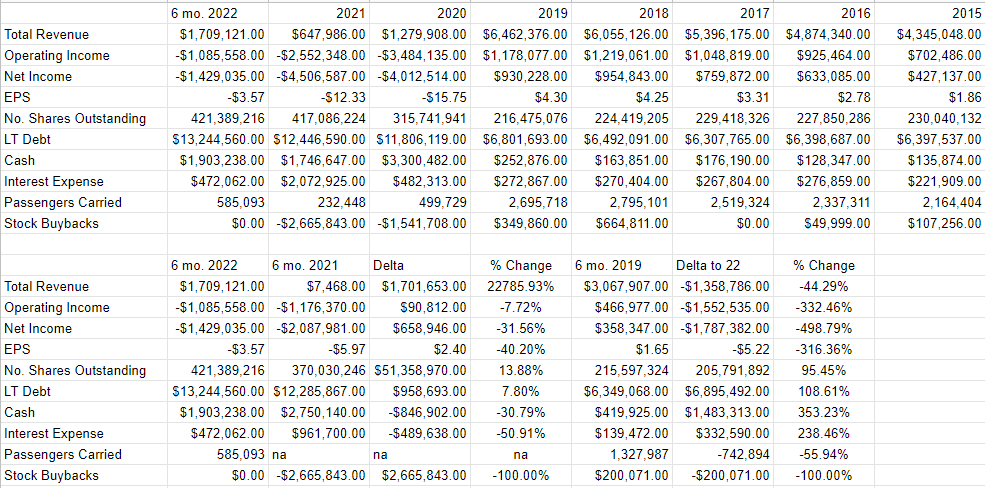

In spite of the fact that the company generated 44.3% less revenue for the first six months of 2022 than they did in the six months before the pandemic, costs increased 7.46% from then to now. The company’s total fuel expense is the biggest culprit here, up 59% from 2019, but payroll, marketing, and “other” are also up by 11.3%, 27.65%, and 33.5% respectively. Interestingly (to me anyway), although the company carried 742,894 or 56% fewer passengers for the first six months of 2022 relative to the same period in 2019, they spent only 8% less on food.

In my view, in order to think that better days will return for this firm, you need to believe that fuel expenses in particular will normalise, and that enormous marketing efforts currently undertaken will convince people to return to the waves. I’m not optimistic, but I’ll buy the shares if they’re sufficiently cheap.

Norwegian Cruise Lines Financials (Norwegian Cruise Lines investor relations)

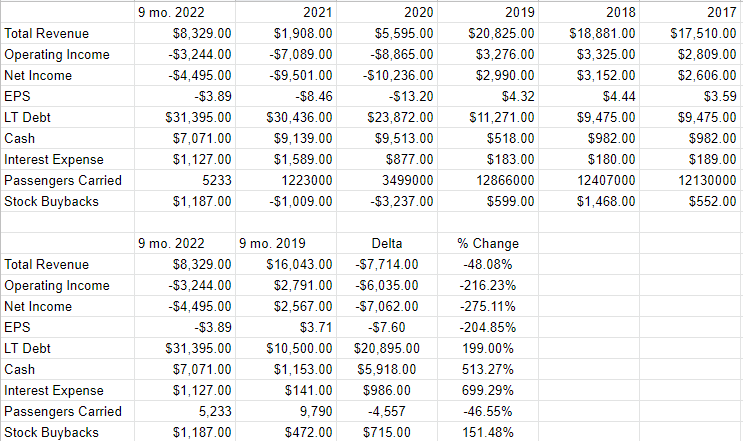

When we review the recent financial statements of Carnival over the past little while, a very similar, though slightly different, story emerges. Just like its competitor, Carnival carried substantially fewer passengers during the first nine months of 2022 relative to 2019. In particular, passenger count dropped by 46.55% from 2019 to 2022, which is why revenue declined fully 48% from that period to now. The consequence of this is well known, with net income swinging from a positive $2.56 billion in 2019 to a gargantuan loss of $4.495 billion in 2022.

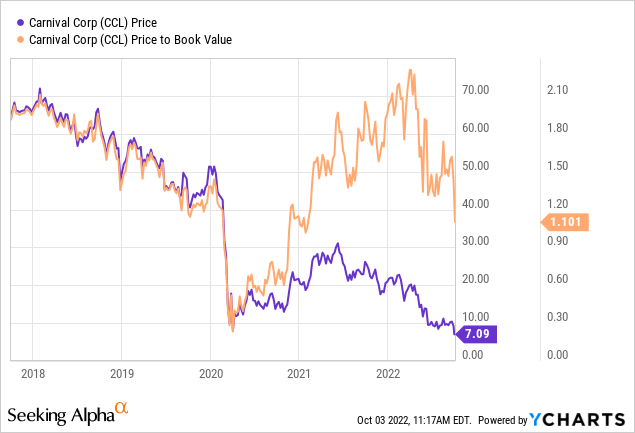

At the same time, the capital structure has deteriorated massively, with long term debt up by about $20.895 billion over the past three years. In fairness, cash has also increased by $5.9 billion, but there’s no denying the added level of risk on the balance sheet.

Finally, like their competitor, Carnival spent substantially more for fuel in 2022, with that expense being about 31% higher than it was in 2019. Unlike Norwegian, Carnival has kept costs in check. For example, food expense has declined from 2019 to now, as you’d expect. If you’re interested in the specifics, the company spent $235 million, or 28.6% less on food during the first nine months of 2022 compared to the same period in 2019. The same can be said of commissions, payroll, selling and administration, etc. Unlike the story that has emerged at Norwegian Cruise Lines, most of the variable costs at Carnival are truly variable.

All of that said, this remains a troubled company, and it has not returned to anything like its pre-pandemic self. I’d be willing to buy, but would need to pick up the shares at a fairly healthy discount. It’s time to see which, if either, of these stocks are sufficiently cheap to consider.

Carnival Cruise Lines Financials (Carnival Cruise Lines investor relations)

Let’s Get Ready to Rumble!

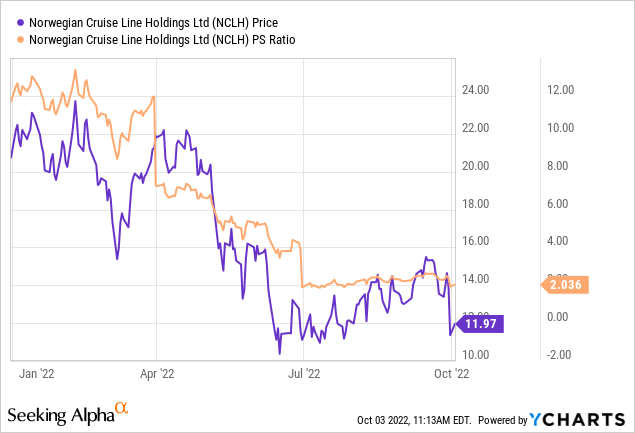

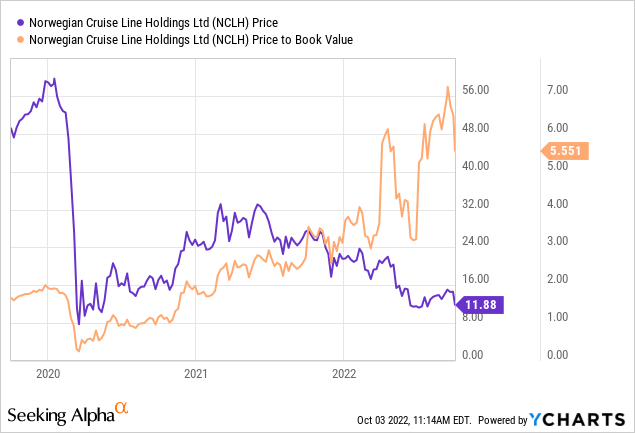

My regulars know that I’ve talked myself out of some profitable trades with the words “at the right price”, but I’d rather miss out on some gains than lose capital. My regulars also know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs and turns them into a final service, hopefully for a profit eventually. In this case the “delivery of fun vacations at sea and ashore!” The stock, on the other hand, is an ownership stake in either of these businesses that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future demand for majestic views from the upper deck. These stocks also move around because they get taken along for the ride when the crowd changes its views about “the market” in general. So, some portion of Norwegian Cruise Line’s 46% drop in price this year can be attributed to the 24% drop in the price of the S&P 500. So, stocks get buffeted around by a host of factors, ranging from company specific problems to the crowd’s rapidly changing views about “the market.”

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I absolutely hate to remind all of you about this yet again, but this is exactly how I made a very decent return on Norwegian Cruise Line stock. There was a discrepancy between expectations and reasonable, though still downbeat, reality. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

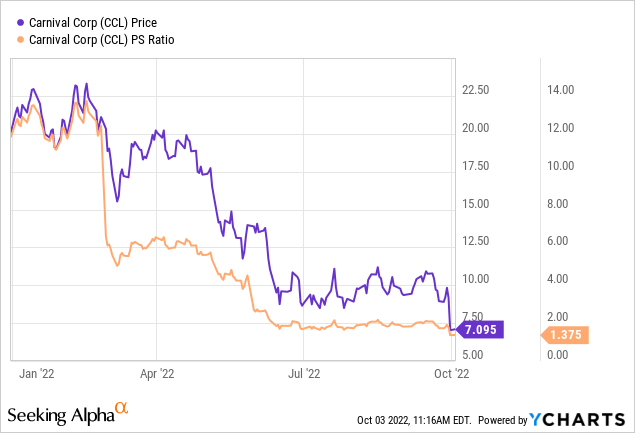

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. At the moment, this is the relative valuation between these two stocks:

So, depending upon how you measure it, the shares of Carnival Cruise Lines are somewhere between 32.5% and 80% cheaper than those of Norwegian Cruise Lines. This is odd, especially in light of the fact that Carnival seems to have done a better job of cost control. I’d normally not make as much of a “thing” about cost control, but these businesses are very much in survival mode, and so any dollar saved is critical.

Thus, in my view, if someone is absolutely champing at the bit to buy a cruise line at the moment, I think Carnival makes the most sense. Their financials are “less bad” than those of Norwegian, and the stock is materially less expensive after the recent drop in price.

Options As Alternative

My regular readers know that I’m absolutely obsessed with trying to make their lives as easy and fulfilling as possible. One of the many ways I try to make your lives easier is by giving you options that I think offer higher risk adjusted returns. At the moment, Carnival Cruise Lines is trading for ~$7 per share. An investor who is interested in buying a cruise line would be relatively better off buying Carnival than Norwegian as I’ve already discussed. At the same time, I think a person would make higher risk adjusted returns buying calls on this stock rather than the shares themselves. Specifically, I like the March Carnival Cruise Lines calls with a strike of $7.50, which are currently asked at $1.52. If the shares rebound from here, the investor will pick up most of that upside, at far less capital at risk. If the shares continue to languish, obviously the calls will do badly, but I think they’ll do relatively less badly than the stock. Thus, on a risk adjusted basis, I think calls win here. If you’re going to insist on buying a business like this, I think calls are the way to “play” that thesis.

Holding all else constant, if Carnival matches Norwegian on a price to sales basis, the shares will rise to about $10.35 per share, and in that circumstance, the call buyer will do well. If they continue to languish, the calls will expire, but in my view that’s a better outcome than tying up much more capital in the vain hope of a quick turnaround.

Be the first to comment