fizkes/iStock via Getty Images

Paychex Inc (NASDAQ:PAYX) is a leader in human resources (HR) software solutions with a platform that combines payroll, recruiting, compliance, and employee management tools. While macro trends including high inflation, rising interest rates, and slowing economic activity defined 2022; one particularly strong indicator was recurring ongoing job gains. That labor market momentum has been a tailwind for Paychex earnings and is expected to be a theme again in the company’s upcoming quarterly report.

On the other hand, the stock has not been immune to the broader market selloff, down more than 15% year to date, with attention more focused on the forward outlook. An expectation that unemployment climbs through 2023 would likely pressure demand for the company’s core services as a headwind for the stock. That said, we highlight what remains compelling value in shares that trade at a discount to peers while offering a compelling 3% dividend yield. Recognizing the near-term volatility, we view PAYX as a high-quality stock with a positive long-term outlook.

PAYX Key Metrics

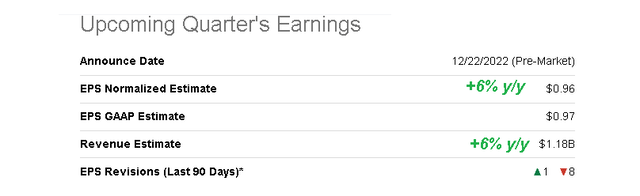

Paychex is set to report its fiscal 2023 Q2 earnings on December 22, before the market opens. The current consensus is looking for a headline EPS of $0.96 on $1.2 billion in revenue, both up 6% year-over-year. Notably, the stock has been subject to a string of EPS revisions lower over the last several months, in part, reflecting more volatile economic conditions.

Seeking Alpha

Overall, the setup this quarter should mostly be a continuation of trends observed in the last few quarters, including what was record sales in Q1 which climbed 11% y/y. Into Q2, the expectation is for some moderation at the top line also considering tougher comparables from last year.

Management has noted positive trends across its core product lines with success in cross-selling clients into its expanded suite of human capital management solutions. Average pricing has climbed compared to last year adding an incremental revenue boost. Favorably, the operating margin reached 41.1% in Q1, up 20 basis points y/y based on an effort at efficiency while benefiting from the scale.

source: company IR

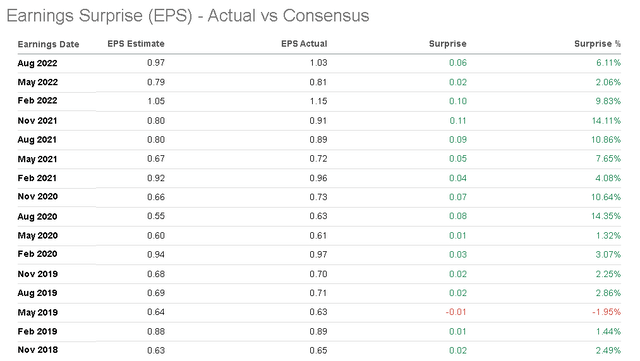

Paychex has a history of beating market estimates with an impressive streak of positive quarterly EPS surprises going back to August 2019. Our interpretation here is that management typically guides with room to outperform. By all accounts, another earnings beat next week is on the table while management comments regarding the current conditions will be more important in terms of how the stock price responds.

Seeking Alpha

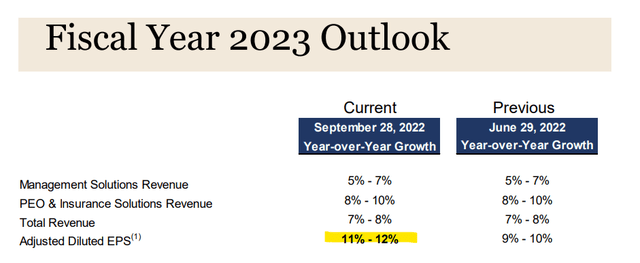

One of the highlights from the last quarter was an update to full-year 2023 guidance with management now targeting full-year adjusted EPS growth between 11% and 12%, from the prior 9.5% midpoint estimate. The shift here reflects momentum in some of the ancillary services and overall higher revenue per client that has been positive for margins. New product launches within the “Paychex Flex HR Tech” platform including a conversational voice assist feature have received positive responses from customers.

source: company IR

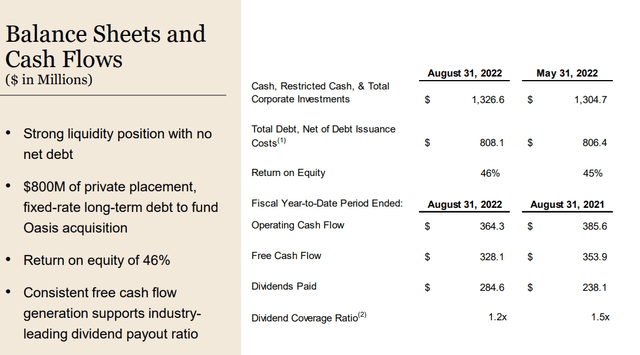

Finally, we note that Paychex maintains a rock-solid balance sheet, ending the quarter with $1.3 billion in cash and equivalents against $808 million in total debt. Positive underlying free cash flows are also well-supportive to the company’s regular dividend which represents a $285 million quarterly payout.

source: company IR

What’s Next For Paychex

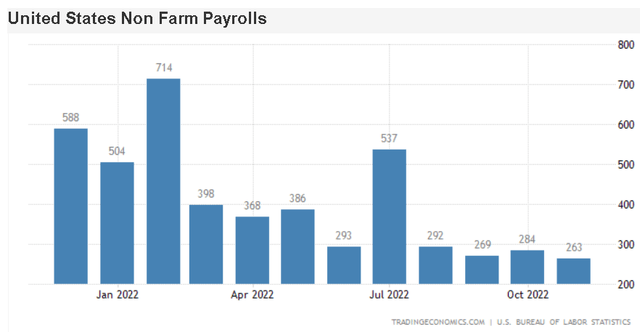

As we mentioned, job data in the U.S. has been resilient over the last several months with the monthly non-farm payrolls figure coming in stronger than expected, including with the November report. Simply put, more people working feeds into Paychex top line growth as employers add roles and users to the HR platform. The trend also provides a growth runway that should carry into 2023 as the larger user base on the platform adds to spending which is positive for Paychex.

source: tradingeconomics

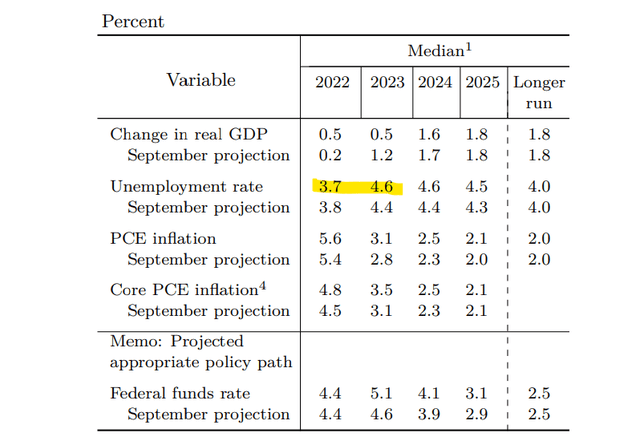

Still, the forward outlook cannot be overlooked considering the official forecast from the Federal Reserve forecasting the U.S. unemployment to climb from the current historically low 3.7% towards 4.6% in 2023. This implies that layoffs across most industries will materialize and the monthly payroll data will eventually print a string of negative numbers.

Keep in mind that there is also a dynamic of rising labor market participation that also impacts the unemployment rate, meaning it’s not necessarily a forecast for “millions” of job losses, but simply weaker conditions going forward. All things considered, as it relates to Paychex, the setup can still be described as stable for operating conditions as core customers remain attached.

source: St. Louis Fed

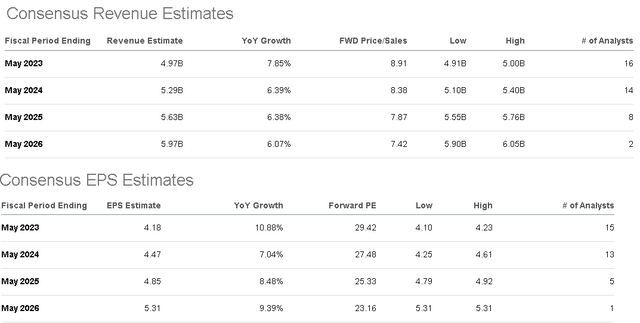

According to consensus, the forecast is that top-line growth continues to be positive with revenues increasing at an average rate of around 6.5% per year through fiscal 2026. An ongoing global expansion and higher pricing can support that upside alongside margins which feed into the expectation for EPS growth to average a stronger 9% over the period.

Seeking Alpha

The attraction for us in PAYX is the company’s pure-play profile in HR SaaS and payroll tools specifically. This is in contrast to several other players in the category that focus on a point solution being payroll processing only or have attempted to expand into other business management segments.

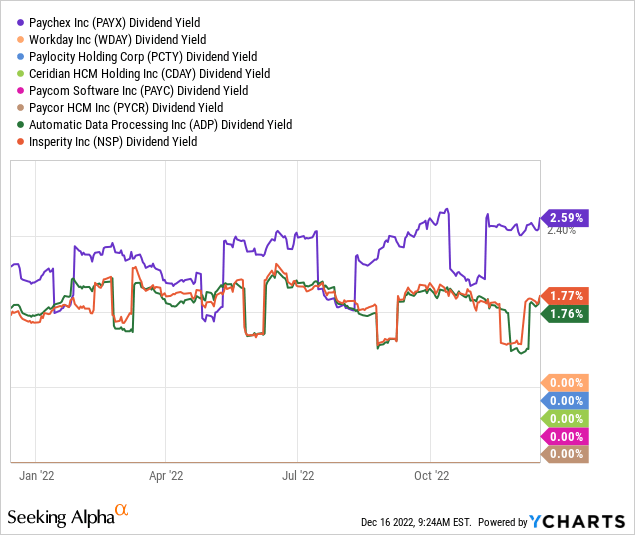

Paychex stands out as presenting the highest dividend yield among peers at 2.7%, compared to 1.8% from Automatic Data Processing Inc (ADP) and Insperity Inc (NSP) while the other SaaS names do not currently offer a regular distribution.

The contrast with Insperity is simply that while the company offers an HR software platform, that business is more on the consulting and services side making it less of a tech name and categorized best as an industrial. Similarly, some of the other players in the category have a business model with a broader scope beyond payroll services. Workday Inc (WDAY), for example, offers accounting and finance management tools where an argument can be made that those categories are more cyclical and exposed to changing economic conditions than HR groups.

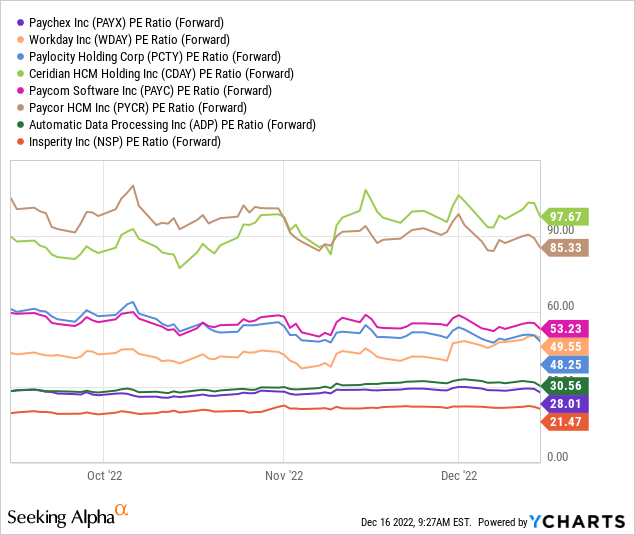

Paychex also screens favorably trading at a forward P/E of 28x compared to a peer group average closer to 50x. The premium relative to the market reflects the category of HR tools that are recognized as being a steady business with consistent cash flows adding to earnings quality. Still, Ceridian HCM Holding Inc (CDAY) and Paycor HCM Inc (PYCR) at 98x and 85x, each respectively, stand out as relatively expensive.

PAYX Stock Price Forecast

The stock price chart for Paychex says a thousand words with shares trading in a relatively tight range between $110 and $130 over the past year. There were some failed breakout attempts to the upside, while the support has held. Even with a positive view of the company, we just don’t see the stock making a new high in the foreseeable future.

We rate shares as a hold balancing what we believe to be a reasonable valuation against the ongoing macro uncertainties. Despite building pessimism in the market, Paychex has proven its ability to maintain profitability and generate steady growth which should limit downside potential. The potential that shares sell off under $100 would represent a tactical buying opportunity and turn us more bullish with an improved reward-to-risk setup.

For the upcoming Q3 earnings report, the operating margin and cash flow trends will be key monitoring points. The upside here would be comments by management suggesting more optimism toward topline momentum into 2023. In terms of risks, a deeper deterioration of the economic environment with accelerating job losses would open the door for another leg lower in shares.

Seeking Alpha

Be the first to comment