Tomohiro Ohsumi/Getty Images News

Introduction

There is no way to predict the market direction, and I certainly will no longer be trying to do so. Instead, I will use probabilities and conservative estimations for my short-term estimations. Either way, I prefer long-term investing with multi-year timelines and high quality companies, but some readers may be seeking safer short-term stores of value. One of the best ways to do so is by relying on momentum, and there is no better place to look than public transit ridership numbers.

Central Japan Rail Company (OTCPK:CJPRY), or JR Central, is the largest of the multiple Japanese rail conglomerates. If you have taken the shinkansen along any point between Tokyo and Osaka, then you have ridden within their domain. As the operator in the highest income regions of Japan, two-thirds of the total GDP, JR Central naturally sees the highest volume and profitability amongst the other operators. As such, the safety of the investment is premier.

Unfortunately, the pandemic forced an end to travel, even with the local population. My investment thesis relies on the slow return to normalcy now that the country is open to international guests, Japan has a new competitive COVID therapy, and the inevitable return in ridership increases revenues and earnings. This article will create a formula guiding towards my estimated one year return, but if you would like a more detailed discussion of the company, please refer to my prior article, here.

Current Ridership Data

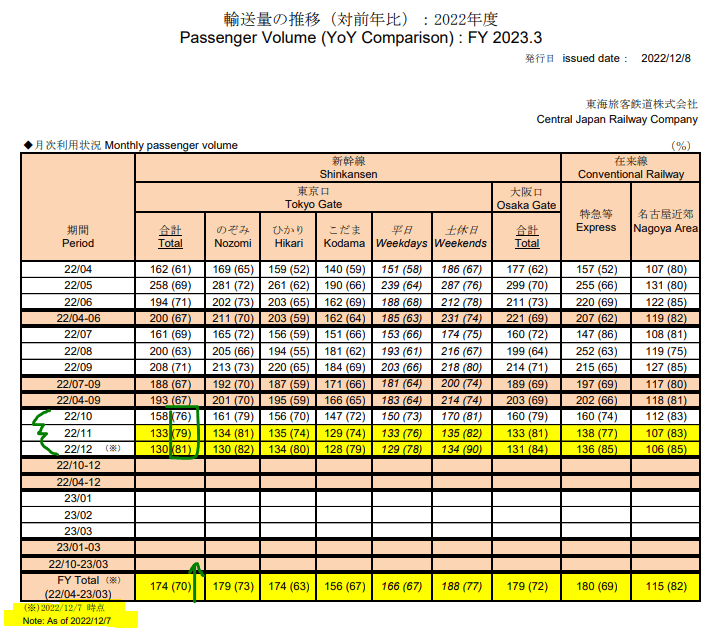

In my prior article, I had believed that business travel would have the highest impact on the return to growth for JR Central, but recent data suggests that opening to the world has had a far higher impact on ridership. Using the rider volume growth rates recently released up to the 14th of December, I will estimate the approximate revenues for the calendar year end 2023. It is also important to note that international guest are now allowed to the country as of October, and this has already led to a jump in ridership.

JR Central Website

Shinkansen Ridership

The shinkansen is the cash cow for JR Central as they operate the lucrative route between Tokyo and Osaka, with stops in major cities such as Yokohama, Nagoya, and Kyoto. However, these same routes were the ones most affected by the pandemic, severely hurting financial performance as long-distance travel was not allowed. These rider volumes will be the most important factors for the opportunity for upside in 2023.

-

From April 2020 to April 2021, full year ridership on the Shinkansen was 32% of 2018 levels from the Tokyo gate and 33% of 2018 levels from the Osaka gate.

-

From A21 to A22, ridership averaged 44.5% of 2018 at both gates.

-

From A22 to December 14th 2022, ridership averaged 70% of 2018 levels.

The subsequent rate of growth is 32.2% per year, and this would suggest that in one year (12/23) the ridership levels will be at 92.5% of 2018 levels.

Conventional Ridership

Conventional Ridership consists mostly of commuter lines around major cities, along with low-margin routes in low population areas. JR Central has less impact from rural regions, and these are just as important for revenue growth as the shinkansesn.

-

From April 2020 to April 2021, full year ridership in the Nagoya area was 64% of 2018 levels, express ridership was 34% of 2018 levels.

-

From A21 to A22, ridership averaged 72% in the Nagoya area and 42% on express routes, compared to 2018 levels.

-

From A22 to December 14th 2022, ridership averaged 82% and 69% of 2018 levels, respectively.

The growth rate per year in the Nagoya area is approximately 9.43%, and 29.4% for express routes. By this time next year, Nagoya area conventional travel should reach 89.7% of 2018 levels, and express ridership is expected to reach 89.3% of 2018 levels.

Revenue Impact

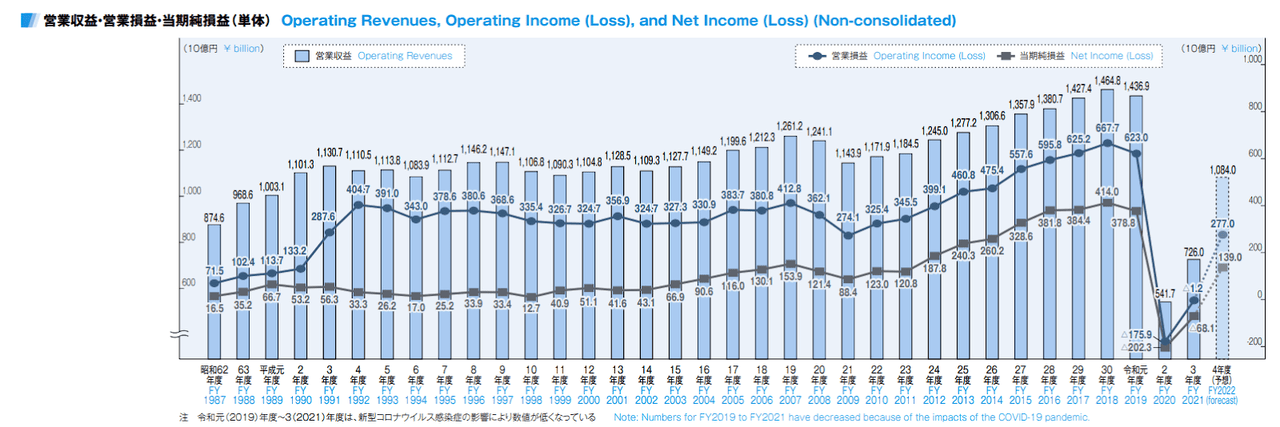

When combined, I expect total passenger traffic to be approximately 90.5% of 2018 levels. Unfortunately, I do not know the comparative difference in ticket prices now for 2023, but I will also estimate this value. First, revenues for 2018 were 1.46 trillion yen across the transportation segment. Then, according to Trading Economics, the total inflation between 2018 and 2022 was about 2.85%. This would account for inflation adjusted 100%-equivalent revenues equaling 1.5 trillion yen. If so, this would account for revenue growth of 26.9%.

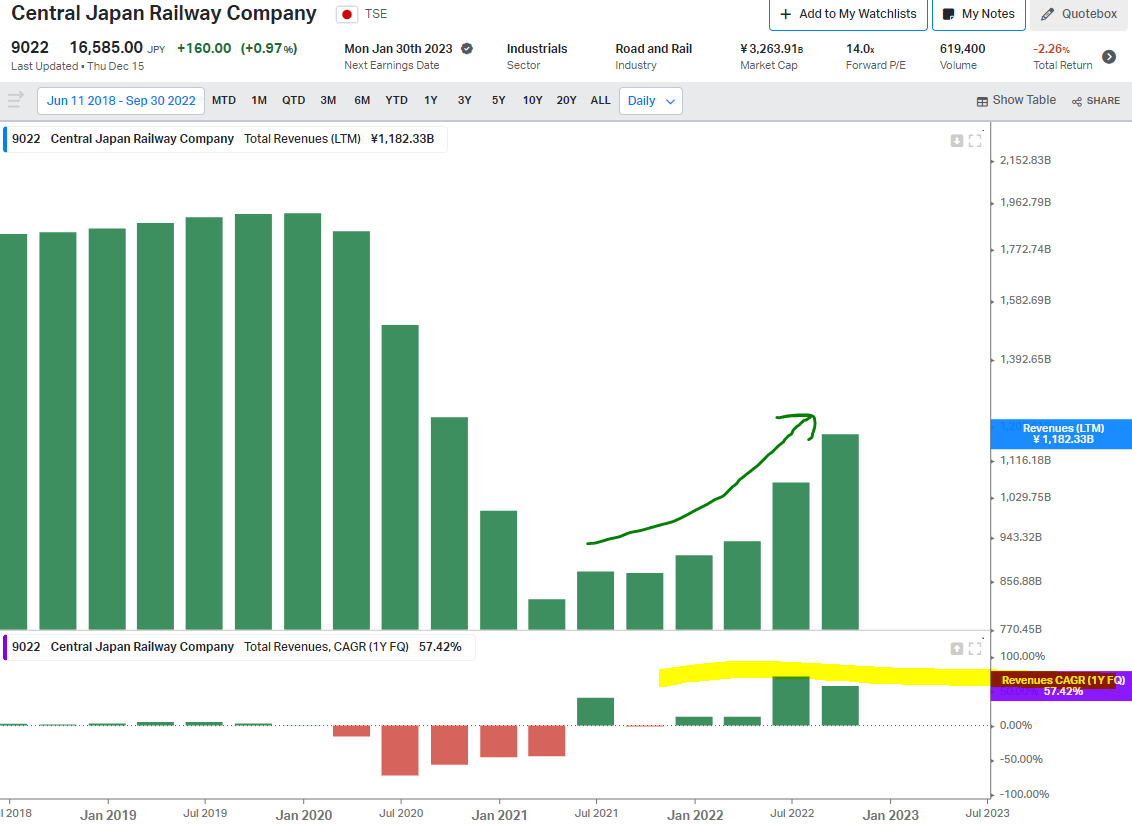

This YoY growth of 26.9% is slightly above the average ridership growth rate of 23.7%, signaling that rising inflation may be a key driver of growth. I could keep extrapolating these calculations down toward total earnings or operating income, but I believe the data speaks for itself so far. Depending on the ticket pricing, revenues are set to grow 24-27% next year. Already we see YoY revenue growth is increasing, with the last two quarters even above 50% on a TTM basis.

JR Central Website Koyfin

Valuation

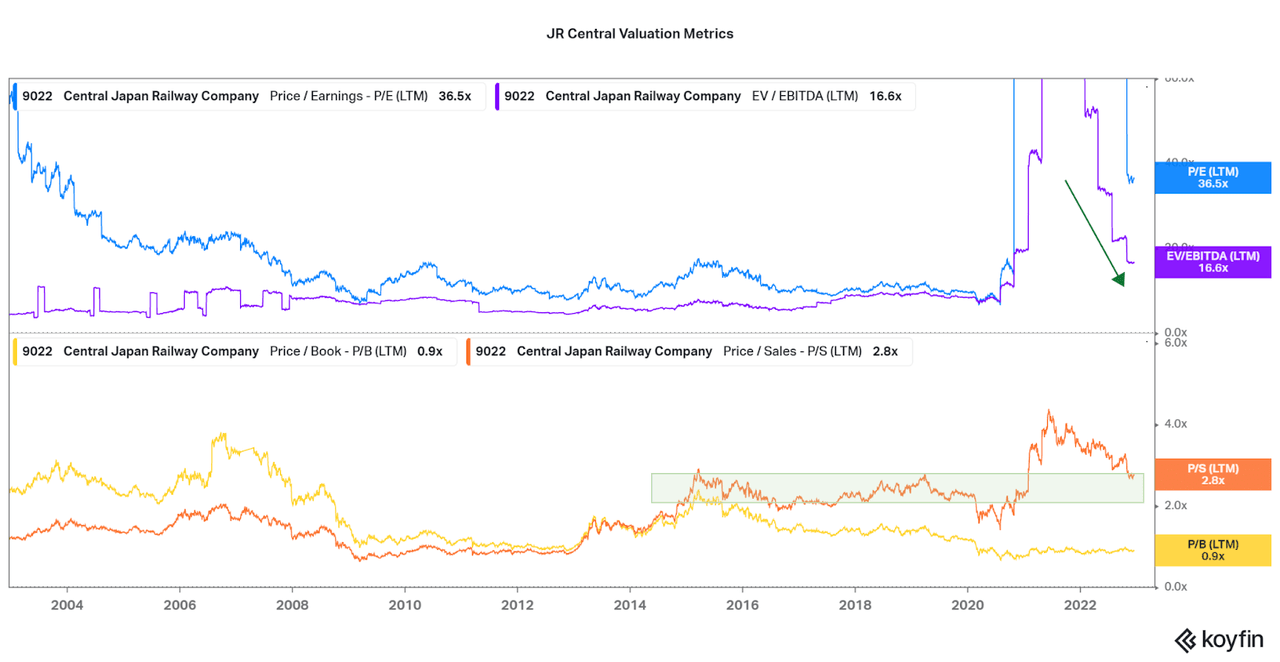

Although, nothing works in stasis, and there are other influencing factors to consider, primarily the valuation. While I would like to suggest investors’ total return will directly reflect the estimated revenue growth, that would only occur if the valuation of JR Central remained the same. However, investors do realize that growth will return and the valuation rose as the market sell-off was far less than the drop off in revenues.

As shown below, profits took a hit and seem overvalued, but it is typical for investors to use weakness to their advantage. However, the profit margins are less useful for us in the short-term due to fluctuations. I will instead focus on the price to sales. With the ratio now reaching 2.8x on a trailing basis, the valuation is now the same as it was back in 2018 with which all our comparisons are based. Considering that revenues are not back to prior levels, but the valuation is, there is already a form of undervaluation occurring. However, it is also necessary to accept that global economic headwinds are far worse here in 2022 and that the valuation will likely not remain trading in line with highs seen in 2018.

The issue is estimating where the valuation will stand in one year’s time. On the chart below, I highlighted areas where I believe the valuation would trade based on organizational differences post-2015. The factors such as operational improvements, profitability from shinkansen demand, and the anticipation of the maglev Chuo Line all support a relatively high valuation. Since the share price remained so strong during the pandemic despite the lack of riders, I expect that the downside probability is extremely low.

Well, let’s suppose the valuation falls to the bottom end of the p/s range of 2.0x. Compared to the current 2.8x, the share price would fall 29%. Adding in the 24-27% expected growth, investors have the potential of negative returns of 2-5%. Not the greatest return, but certainly better than how most other investments have performed over the past year. If the valuation holds anywhere above a 2.1x ratio, then returns should be positive. At the mid-range of 2.4x, investors can expect 9-12% total return over the year in my view.

Koyfin

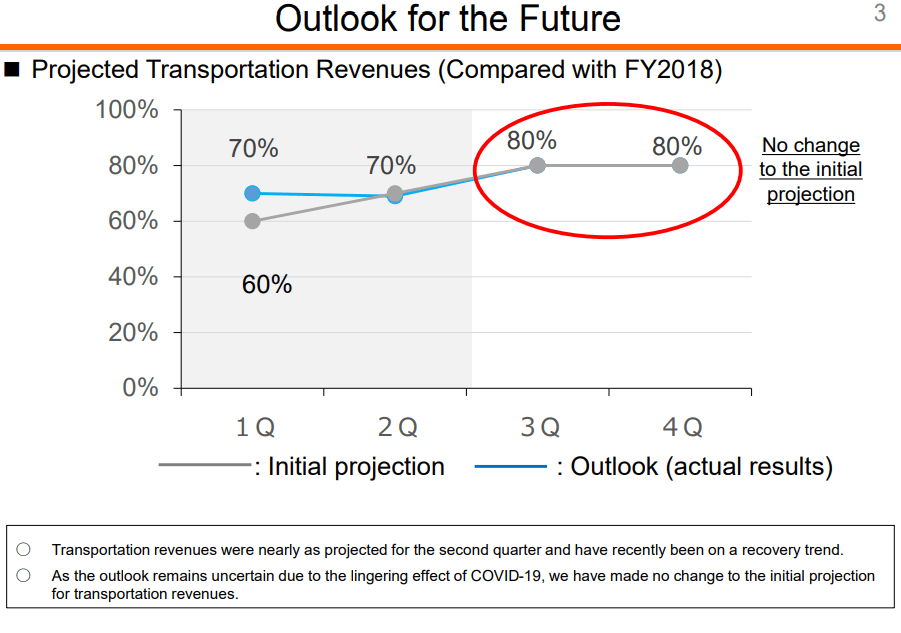

Comparison to Current Guidance

Another useful measurement of future growth is with managerial guidance. In the most recent earnings report, the company failed to raise their guidance despite the growing volume above 80% of 2018 travel levels. I believe the 80% mark will be easily beat in the coming months thanks to favorable travel trends, company provided rider data, and COVID levels. Management also suspects that earnings will be affected, and poor results may lead to volatility at the next earnings report. Those with no holdings can remain patient to see if the shares fall by the next earnings report in late winter.

JR Central 1H23 Presentation

Conclusion

The chance for upside with an investment in Central Japan Railways is quite high in my opinion. From a ridership and valuation standpoint alone, returns are likely above the broader market if economic woes remain. There are two other major, but unpredictable, factors that may assist in upside generation:

-

The yen can continue strengthening compared to the USD. A return to normal levels would allow for 15-20% increase in value for USD-based investors.

-

A reduction in COVID risk due to Japan’s new antiviral therapy, Shionogi’s Xocova. This will allow travelers to feel more comfortable traveling longer distances, increasing ridership.

For more on the Xocova front, check out my article on Shionogi that is set to publish alongside this article. For now, I will leave the key points as reported by NHK:

The ministry says the oral medication, developed by pharmaceutical company Shionogi & Co., has been confirmed to be safe and is estimated to be effective for people aged 12 and older. It says Xocova can be used even by low-risk patients to alleviate mild cases of COVID. Tests show the drug can shorten symptoms by about 24 hours. A course of treatment involves taking one pill a day for five days, and patients should start within three days of the onset of symptoms.

Until now, Japanese hospitals and clinics have been relying on imported COVID drugs that are only recommended for people at risk of serious illness, partly due to a dearth of clinical testing on low-risk patients, but also because of limited stocks.

All-in-all, I feel confident in the fact that ridership levels will continue climbing and it is only natural for JR Central’s share price to follow. As such, the company offers an extremely low-risk, low-volatility opportunity for between 5-15% return through the year. I suspect this may be better than the market if the bearish sentiment remains in the US.

Thanks for reading. Feel free to share your thoughts below.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment