Michael Vi

Following a marginal earnings beat in Fiscal Q2 and a notable earnings miss in Fiscal Q1, DocuSign, Inc. (NASDAQ:DOCU) came back strongly in the fiscal third quarter of 2023, registering a meaningful earnings surprise on December 8 that helped its shares soar. Since the release of Q3 earnings last week, DOCU stock has surged more than 33% so far, but the company has still lost 64% of its market value this year.

There is little doubt about DocuSign’s disruptive nature – the company is leading the global e-signature solutions market, and this market is growing fast. For investors, however, knowing that DocuSign is a disruptive business is simply not enough. Time and again, disruptive businesses come and go, changing the lives of people for the better but without making a meaningful impact on the lives of their shareholders. This could be because of intensifying competition, a lack of desire as a company to adapt and thrive, or simply the result of poor business decisions. With DocuSign yet to break through to profitability despite years of double-digit revenue growth, it’s reasonable to evaluate whether DocuSign is a disruptive business that would go on to make money for its shareholders or whether the company will eventually shed its market value further in the coming years.

The Long-Term Demand Environment Is Positive For DocuSign But Short-Term Challenges Persist

There are a few reasons to believe that the demand for digital signature software will grow exponentially in the next 10 years. According to Fortune Business Insights, the global digital signature market was valued at $3 billion in 2021 and will grow at an impressive CAGR of 36.1% through 2029, propelling the industry valuation to $35 billion.

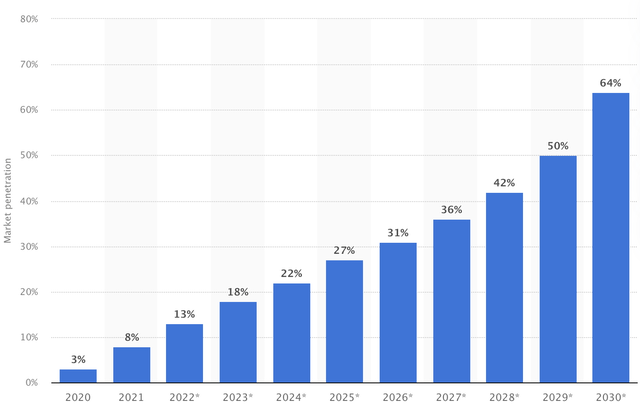

First, the rising internet penetration rate will help DocuSign win new international customers. According to data from Internet World Stats, 69% of the global population now has access to the Internet, and in densely populated Asia, the internet penetration rate is at an impressive 67.4%. Populous countries such as India, China, Malaysia, Thailand, and Pakistan have unveiled multi-billion-dollar IT infrastructure development projects, and these investments will help Asia’s internet penetration rate merge – at least partially – with the developed world. As of today, more than 93% of the population in North America have access to the Internet, to give some color. As illustrated below, Statista projects that 64% of the global population will have access to not just the Internet but 5G speeds by 2030.

Exhibit 1: Projected 5G market penetration

A notable rise in Asia’s Internet users will accelerate the pace at which businesses embrace digital signature software and contract life cycle management software. DocuSign, as the leader of both these markets, stands to benefit from this favorable development.

Second, there is a growing demand for secured and verified transactions in a digitalized world, and e-signatures provide a way for businesses to interact with their customers and suppliers in a secure environment. Digital signatures help prevent fraud by authenticating the signers, and these signatures could be linked to an identifiable entity electronically. To avoid tampering with signatures, a business may choose to seal a document via Public Key Infrastructure as well. A digital signature will make it difficult for the signed party to repudiate having signed the document since the signatures can be traced back to the original source. Although many investors believe e-signatures are all about convenience, they are as much about safety as well. In an increasingly digitalizing world, digital signature software enables businesses to not just embrace high-tech products but also ensure data safety.

Third, government intervention to promote paperless transactions will boost the demand for digital signature software in the coming years. These policies are gradually going live in certain parts of the world, although investors might not notice. For example, in Dubai where I live, the government has adopted a 100% paperless initiative. A few months ago, when I visited a government office to renew my wife’s residency visa, I was surprised when the cashier did not give me a receipt when I paid the due amount. When I inquired, I was told that a copy of the receipt has been emailed to me – and there it was. The UAE, with this decision, became the first country in the world to roll out paperless initiatives in full swing.

Elsewhere, in the UK, the government is on the brink of going paperless. Many countries in the Nordic region, Australia, and even the United States have already highlighted the importance of going paperless, and I believe it is a matter of time until paperless policies become the norm, not the exception. For DocuSign, this is welcome news. Digital signature solutions providers will be big winners of this development in the long run, as these companies will play a critical role in helping governments roll out these initiatives.

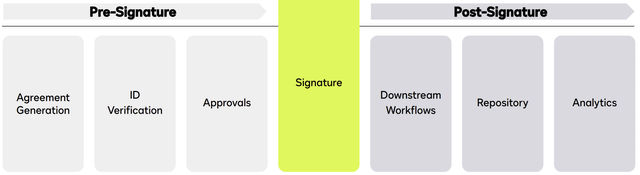

Fourth, digital signature solutions providers are now expanding the breadth of their product portfolio to cater to everything related to the contracts and documentation process, which should help the industry attract and retain customers. If we take a look at DocuSign, the company is building on its strength in the e-signature domain with its Agreement Cloud, which supports contract designing, negotiation, and even identification mechanisms. This expansion in services offering is a tailwind for the growth of the industry as digital signature software products will no longer be looked at as value-added services but as mission-critical business software that improves the efficiency and data safety of any business.

Exhibit 2: DocuSign Agreement Process

For the reasons discussed above, it would be reasonable to conclude that the digital signature software market has a long runway to grow in the coming years. In the short run, however, the industry will face challenges that are mainly stemming from macroeconomic woes. At a time when money is no longer cheap, companies are likely to cut back on spending. This is what we are seeing today already.

Commenting on the demand environment in the recent earnings call, DocuSign CFO Cynthia Gaylor said:

As the macro becomes more challenging, we are seeing softening demand trends materialize, including smaller deal sizes and expansions, with increased customer scrutiny on priorities and budgets in some cases.

In the next couple of quarters, investors should expect a further deterioration of demand for DocuSign’s products as the full impact of the economic growth slowdown starts to take effect.

The Risk-Reward Profile Is Now Attractive

Last December, when DocuSign stock crashed by a staggering 50% following quarterly earnings, I wrote on Seeking Alpha that DocuSign’s risk-reward profile was not attractive enough to invest in the company despite massive losses leading up to the publication of my article. The broad market negativity toward risk assets coupled with interest rate hikes has pushed DocuSign stock further down this year, not surprisingly. Using a discounted cash flow model, I estimated DocuSign’s intrinsic value at $115.07 per share back then (you can find all the assumptions used in my model in the latter half of my previous article). The stock was trading above $135 at the time I came up with my estimate, which forced me to steer clear of DOCU back then.

Today, after making several adjustments to my model to reflect a continued slowdown in demand in the coming quarters, I estimate DocuSign’s intrinsic value at $103.17 per share, which implies an upside potential of around 88%. This, in my opinion, leaves a sufficient margin of safety for growth investors who are waiting to double down the opportunity to invest in high-growth companies at fair prices during this market downturn.

Takeaway

DocuSign, Inc. may not benefit from notable competitive advantages just yet, but there’s no denying that the company is enjoying first-mover advantages in its target market. With favorable macroeconomic factors in play, DocuSign enjoys a long runway for growth. Strategically investing in DocuSign, Inc. stock at these prices – although, will expose investors to temporary losses – is likely to help investors enjoy handsome returns in the long run.

Be the first to comment