Pattanaphong Khuankaew/iStock via Getty Images

A Quick Take On CCC Intelligent Solutions

CCC Intelligent Solutions Holdings Inc. (NYSE:CCCS) reported its Q2 2022 financial results on August 4, 2022, beating expected revenue while missing forecasted EPS estimates.

The company provides software to insurance companies seeking to increase the automation of their various operations.

Interested investors could make a case for acquiring the stock of CCCS, but given the likely downward pressure on business activity as the U.S. heads into a slowdown/recession, I’m more cautious, so I’m on Hold for CCCS in the near term.

CCC Intelligent Solutions Overview

Chicago, Illinois-based CCC Intelligent was founded in 1980 to help property and casualty insurance companies with software that increases their operational efficiency.

The firm is headed by Chairman and Chief Executive Officer, Githesh Ramamurthy, who joined the company in 1992; was previously a founding member of Sales Technologies, later acquired by Dun & Bradstreet.

The company’s primary offerings include:

-

Customer experience

-

Workflow

-

Artificial intelligence

-

Network management

-

IoT and Exchange

The firm acquires customers via its direct sales and marketing teams as well as through partner referrals.

CCC Intelligent Solutions’ Market & Competition

According to a 2022 market research report by Allied Market Research, the market for claims processing software was an estimated $33.9 billion in 2020 and is forecast to reach $73 billion by 2030.

This represents a forecast CAGR of 8.3% from 2021 to 2030.

The main drivers for this expected growth are a desire for insurance companies to automate its claims processing approach and manage the entire claim lifecycle from first filing until closure.

Also, N. America represented the greatest revenue by region in 2020. However, the Asia Pacific region is expected to grow markedly through 2030.

Major competitive or other industry participants include:

-

Mitchell International

-

Guidewire

-

Applied Epic

-

Pega Claims Management

-

LexisNexis Carrier Discovery

-

Duck Creek Technologies

-

Quick Silver

-

Hyland Software

-

FINEOS

-

VENTIV

CCC Intelligent Solutions’ Recent Financial Performance

-

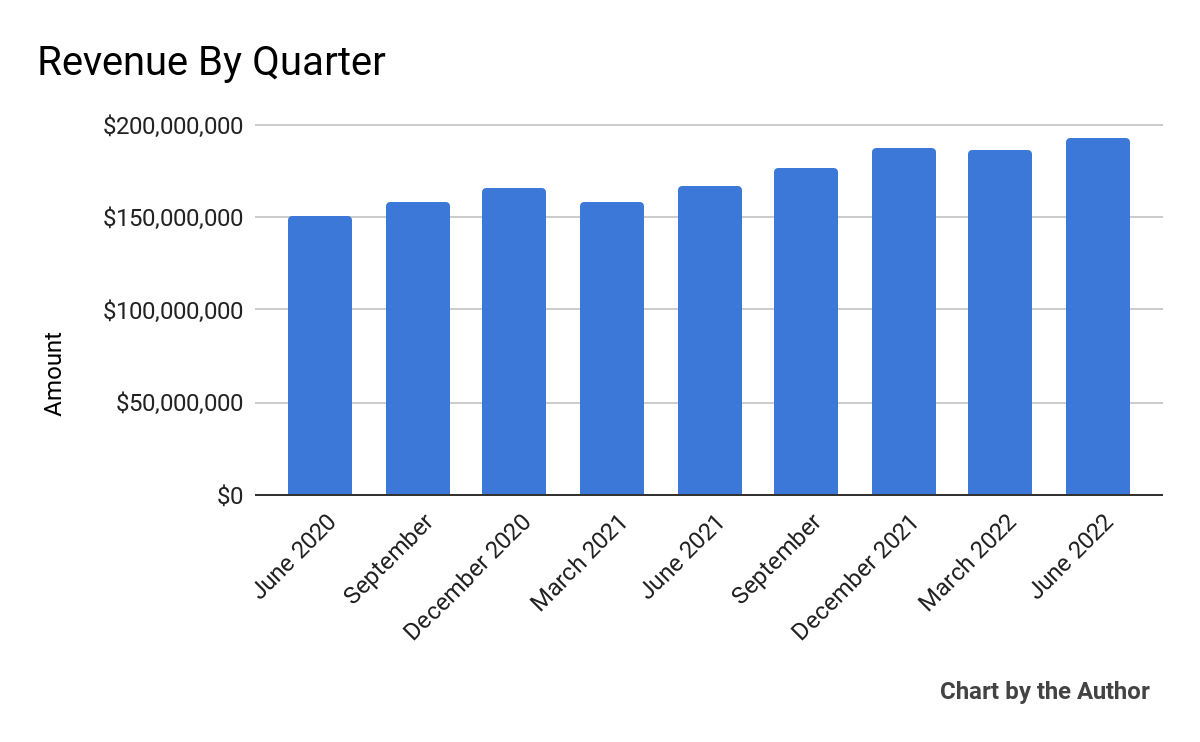

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

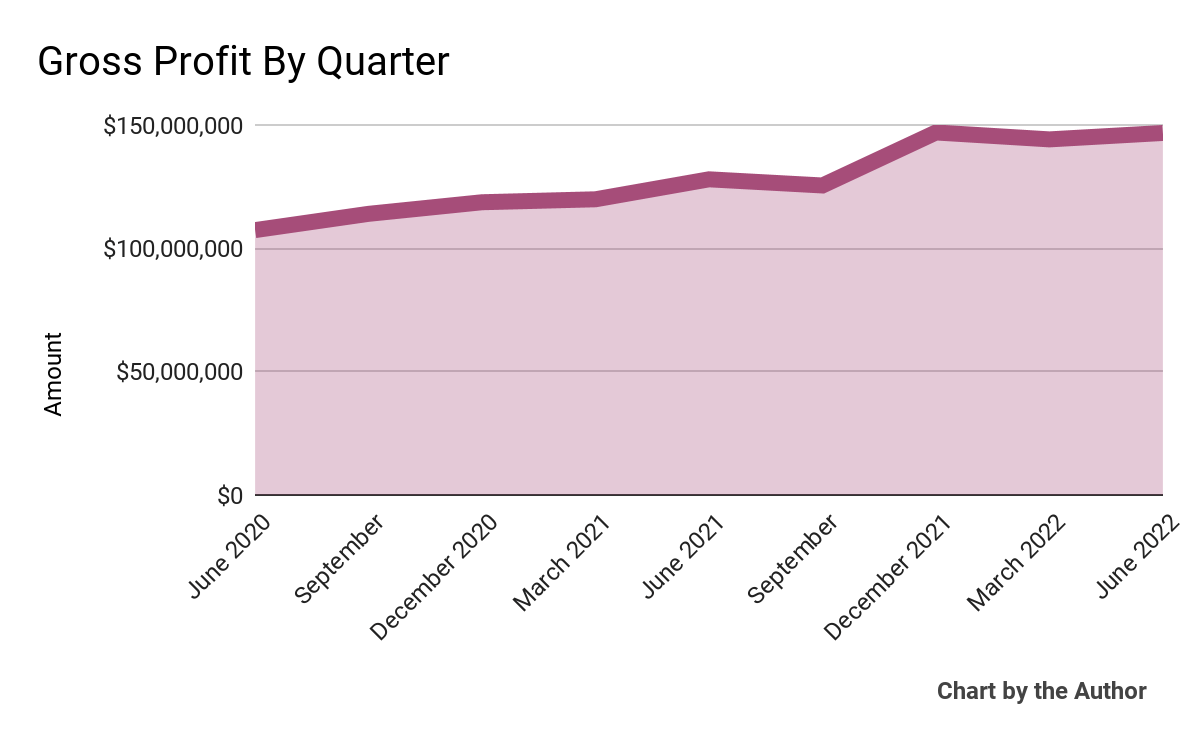

Gross profit by quarter has followed a similar trajectory as total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

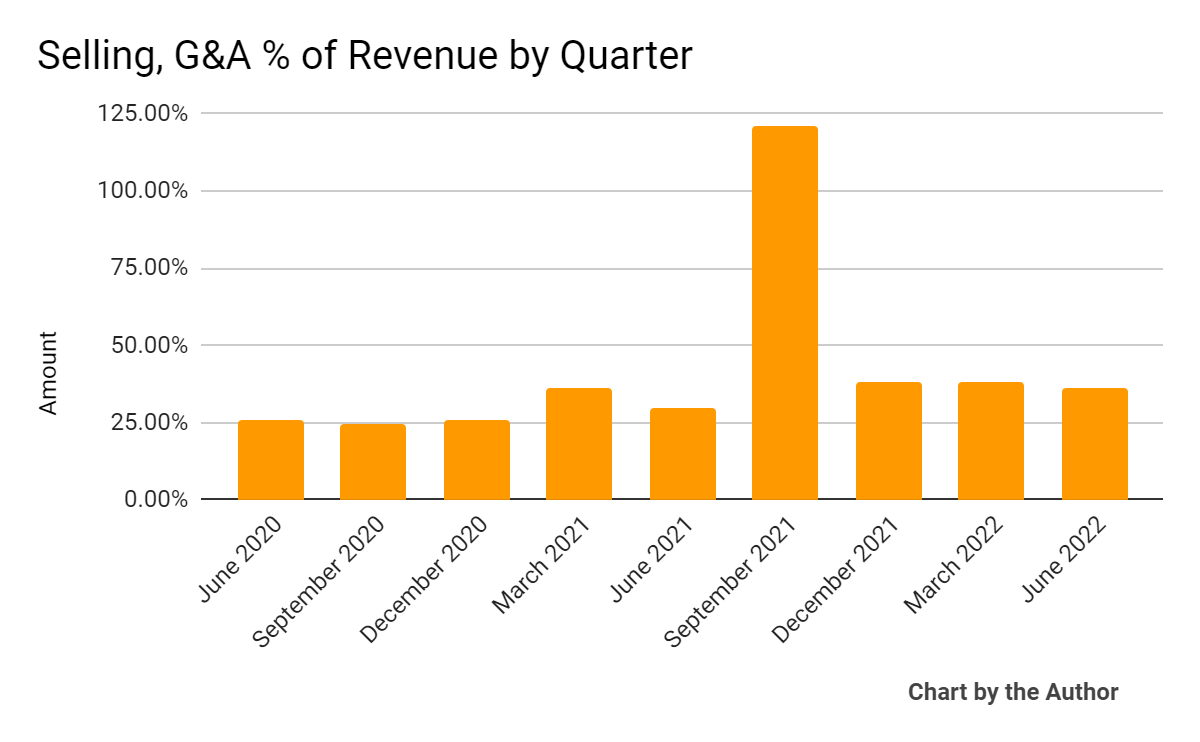

Selling, G&A expenses as a percentage of total revenue by quarter have been trending higher in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

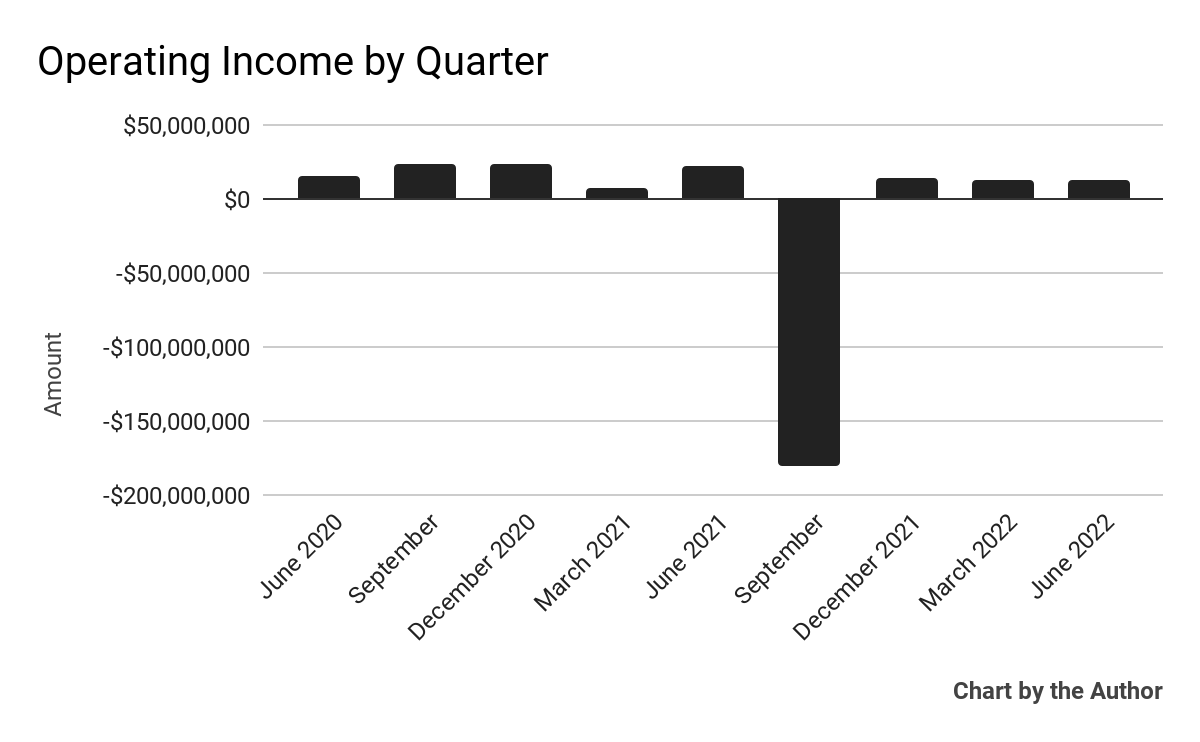

Operating income by quarter has largely been flat, with one glaring exception:

9 Quarter Operating Income (Seeking Alpha)

-

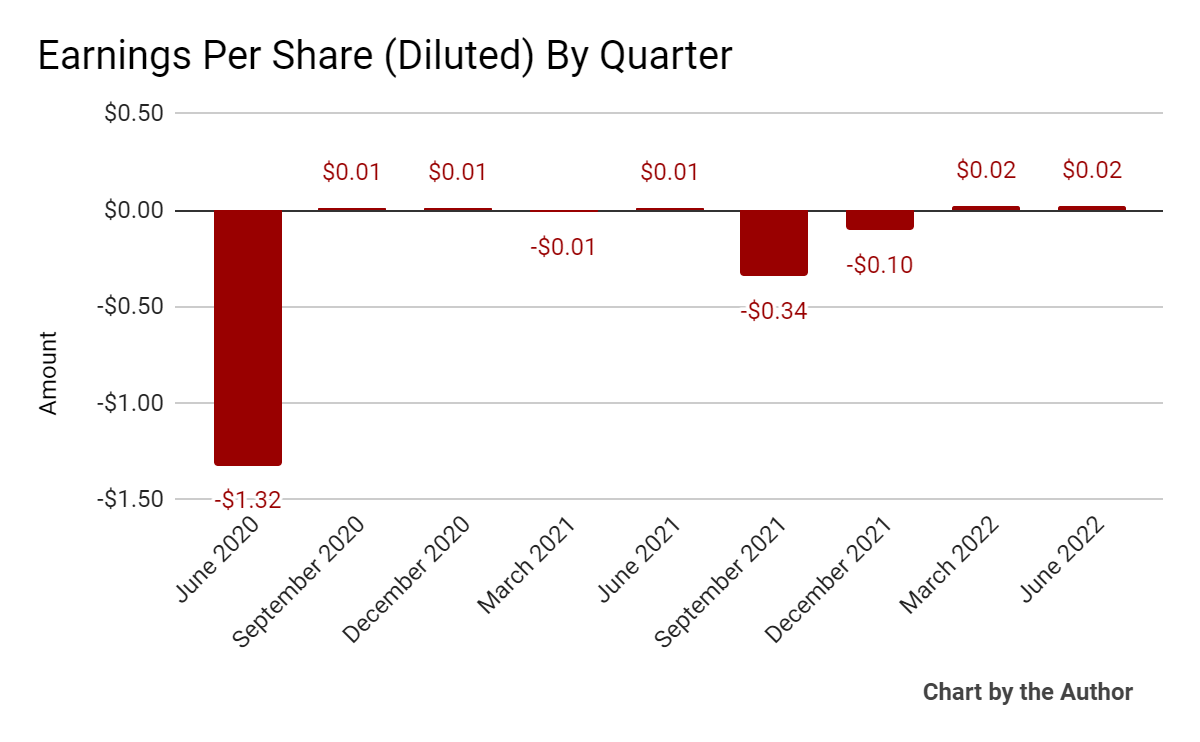

Earnings per share (Diluted) have been positive in the two most recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

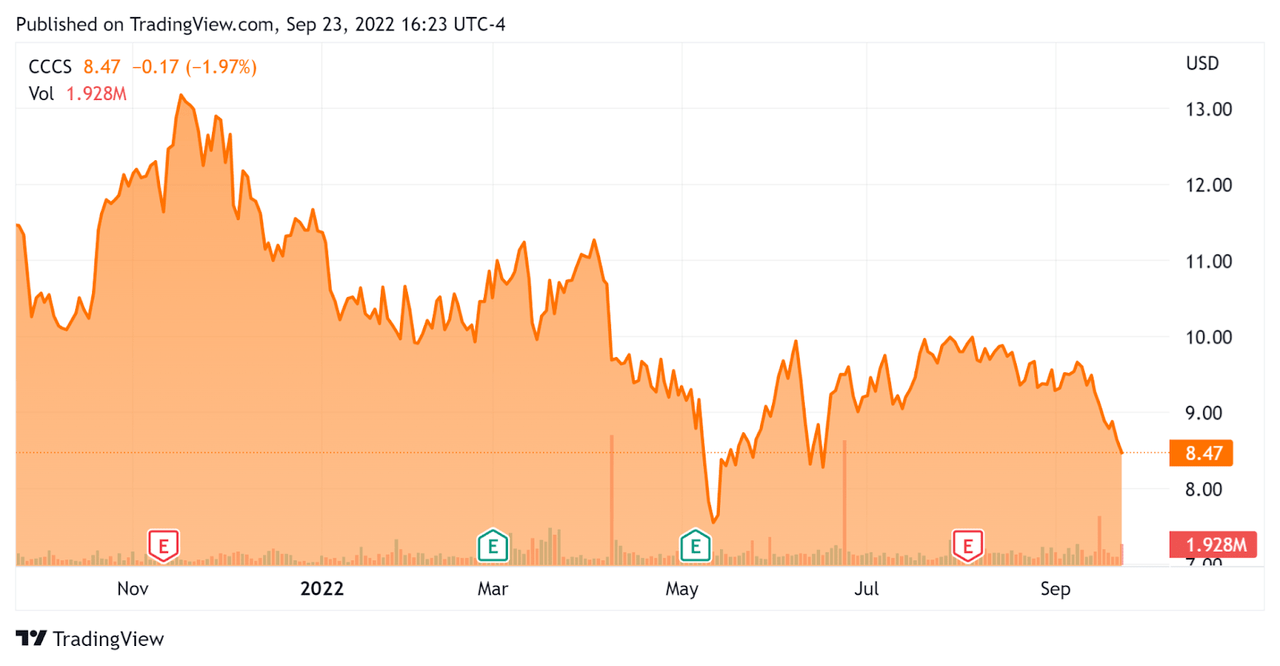

In the past 12 months, CCCS’s stock price has fallen 26.2% vs. the U.S. S&P 500 Index’s drop of around 17%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For CCC Intelligent Solutions

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

8.22 |

|

Revenue Growth Rate |

14.8% |

|

Net Income Margin |

-29.6% |

|

GAAP EBITDA % |

-4.5% |

|

Market Capitalization |

$5,470,000,000 |

|

Enterprise Value |

$6,110,000,000 |

|

Operating Cash Flow |

$155,200,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.40 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Guidewire Software (GWRE); shown below is a comparison of their primary valuation metrics:

|

Metric |

Guidewire Software |

CCC Intelligent Solutions |

Variance |

|

Enterprise Value/Sales |

5.64 |

8.22 |

45.7% |

|

Revenue Growth Rate |

9.3% |

14.8% |

58.2% |

|

Net Income Margin |

-22.2% |

-29.6% |

33.4% |

|

Operating Cash Flow |

-$37,940,000 |

$155,200,000 |

-509.1% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

CCCS’ most recent GAAP Rule of 40 calculation was 10.3% as of Q2 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

14.8% |

|

GAAP EBITDA % |

-4.5% |

|

Total |

10.3% |

(Source – Seeking Alpha)

Commentary On CCC Intelligent Solutions

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted growing momentum with customers adopting its Estimate-STP (Straight Through Processing) system, which quickly turns collision damage photos into estimates, potentially sharply reducing the typical $150 – $200 cost for producing an estimate.

Management believes selling tools to the auto insurance & claims markets are recession resilient, as auto insurance is a legal requirement in the U.S.

In addition to creating efficiencies, CCC’s software is also helping clients deal with increasing complexity in automobiles and supply chain challenges.

As to its financial results, total revenue rose 16% year-over-year and above its previous guidance range.

Adjusted EBITDA grew by 22% year-over-year and was also ahead of guidance.

The company’s net dollar retention rate was 111%, indicating solid product/market fit and good sales & marketing efficiency. 111% was “above” the firm’s “historical average.”

CCCS’ Rule of 40 results have been disappointing, at only 10.3%. And, operating expenses rose by 26.4% year-over-year.

So, operating income and earnings per share were essentially flat sequentially.

For the balance sheet, the company finished the quarter with $227.6 million in cash and equivalents and long-term debt of $777.4 million.

Over the trailing twelve months, free cash flow was $104.6 million, inclusive of a hefty $50.6 million in capital expenditures.

Looking ahead, for the full year 2022, management raised revenue guidance to represent 13% growth year-over-year at the midpoint of the range and adjusted EBITDA to equal 38% at the midpoint.

Regarding valuation, the market is valuing CCCS at an EV/Sales multiple of around 8.2x.

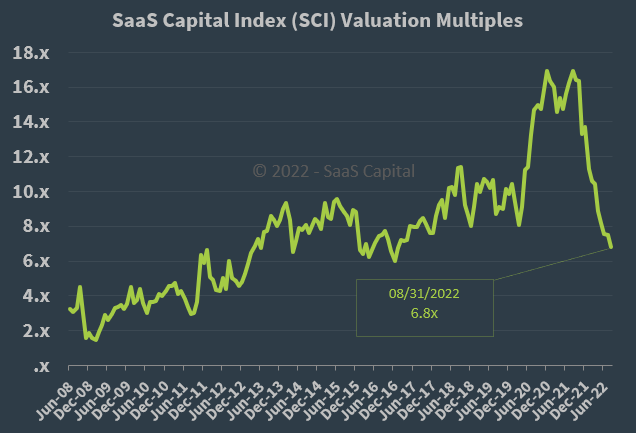

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, CCCS is currently valued by the market at a premium to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

An upside catalyst could include a pause in interest rate hikes, reducing the cost of capital and improving the valuation multiple for the stock.

CCCS appears well positioned within an arguably recession-resilient industry.

The company’s revenue growth and earnings trends are positive but rather uninspiring.

Interested investors could make a case for acquiring the stock of CCCS, but given the likely downward pressure on business activity as the U.S. heads into a slowdown/recession, I’m more cautious, so I’m on Hold for CCCS in the near term.

Be the first to comment