SeregaSibTravel/iStock Editorial via Getty Images

Introduction

As a dividend growth investor, I sometimes revisit companies I sell. I sell companies when they slash their dividends. I try to establish a logic for me to return to investments that have failed me. Sometimes I even acquire shares again in companies that have cut their dividend. It was the case of Kinder Morgan (KMI).

One stock I held in the past was Carnival Cruise (NYSE:CCL). Carnival Cruise suffered immensely from the pandemic, as it forced the company to shut down its entire operation for more than a year. I sold my shares as soon as the dividend was eliminated. Therefore, I avoided most of the share price decline that followed as investors understood the gravity of the situation. In this article, I will revisit the company to see if it’s worthy for patient dividend growth investors with a long investment horizon.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Carnival Corporation operates as a leisure travel company. Its ships visit approximately 700 ports under the Carnival Cruise Line, Princess Cruises, Holland America Line, P&O Cruises, Seabourn, Costa Cruises, AIDA Cruises, P&O Cruises, and Cunard brand names. The company also provides port destinations and other services, as well as owns and owns and operates hotels, lodges, glass-domed railcars, and motor coaches.

Fundamentals

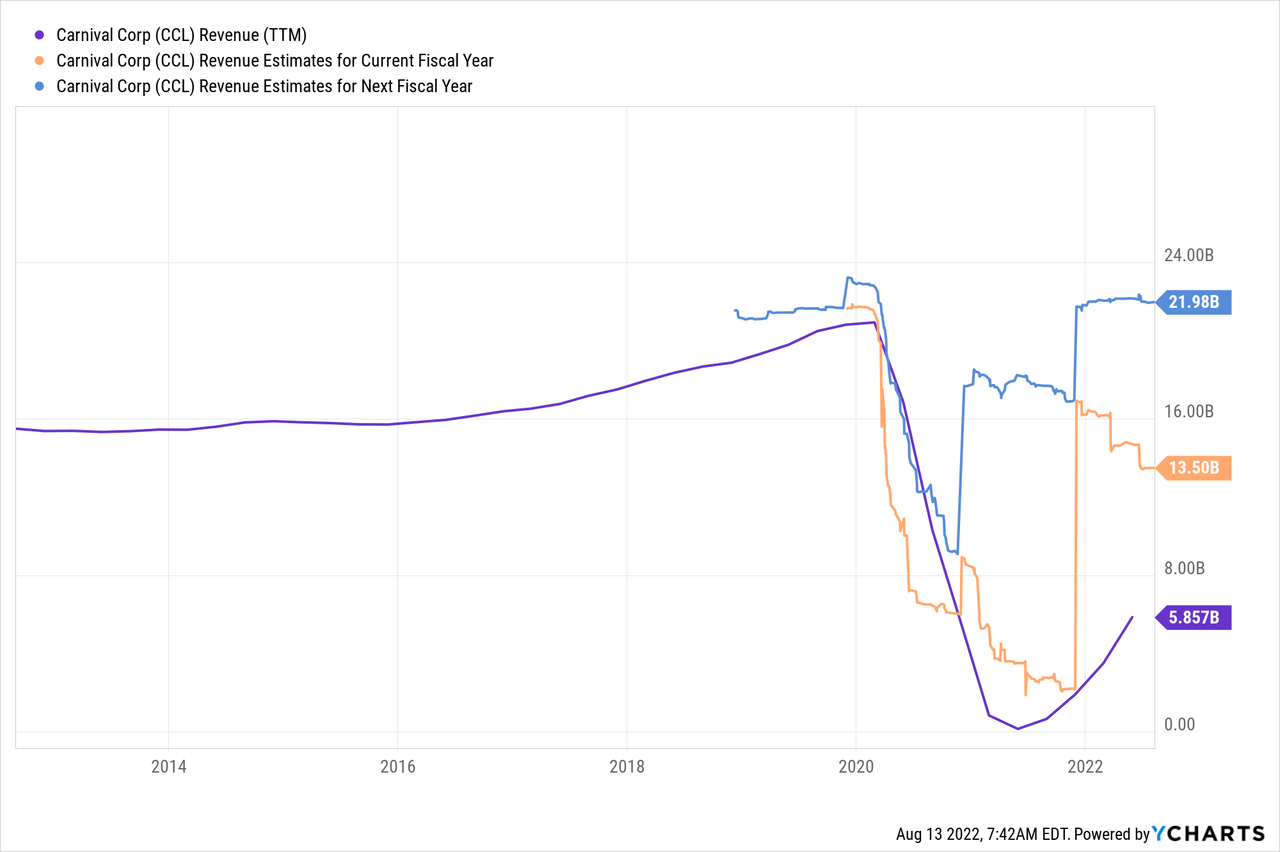

Carnival Cruise enjoyed a steady increase in sales up until the pandemic in 2020. 2019 was a record year for the company and the first time that Carnival Cruise exceeded $20B in revenues. The pandemic has ruined their growth plans, and sales were close to zero in four consecutive quarters. However, we see a recovery in sales in 2022, as the company released its Q2 report, which showed a 50% sales increase compared to Q1. According to analysts’ consensus, as seen on Seeking Alpha, the company is forecasted to more than double sales in 2022, and in 2023 the company should reach all-time high revenue.

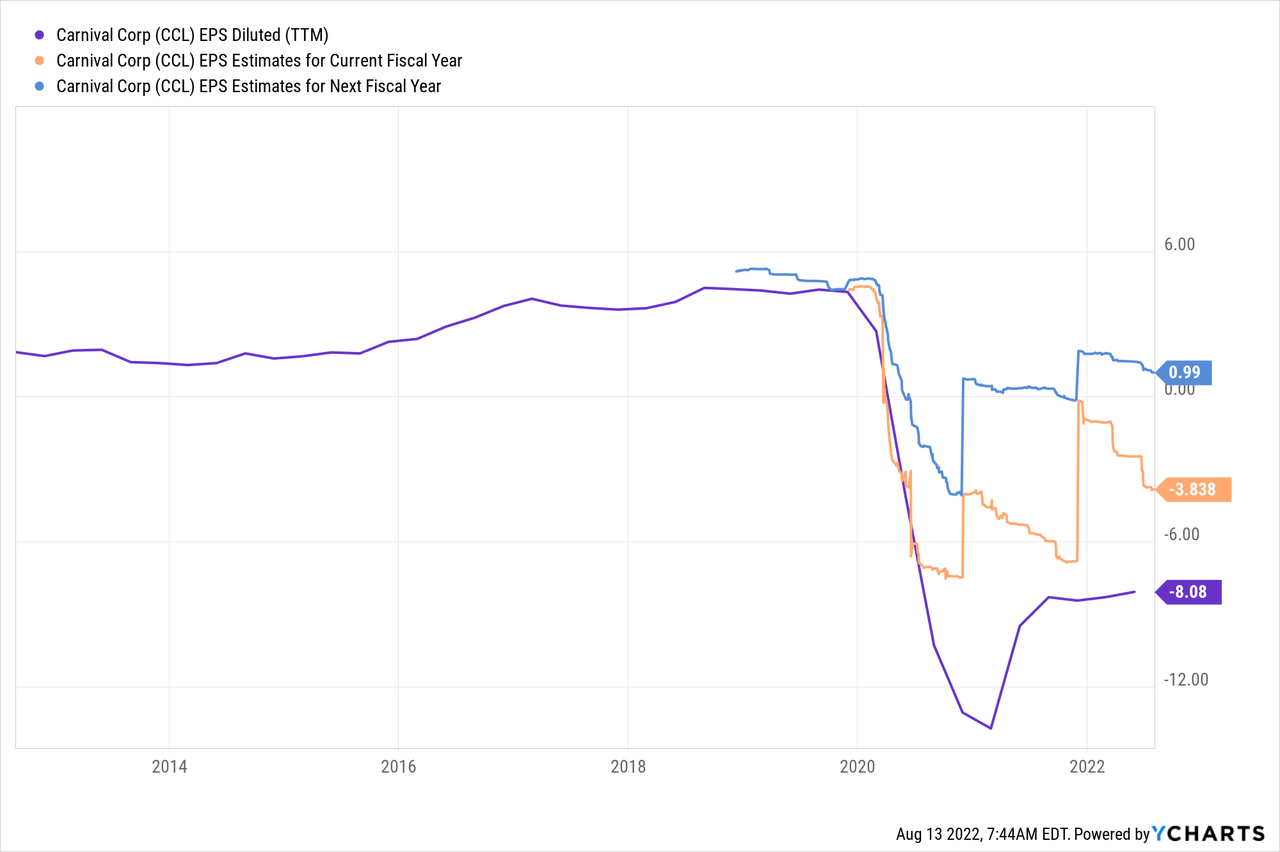

The EPS (earnings per share) is a more challenging metric for Carnival Cruise. The company has lost billions of USD and had to take on debt to stay operational. Expenses are up, and so are the number of shares outstanding. Therefore, recovering the EPS of 2019 will take longer than 2023. However, investors can see the light in Q2 as the company kept losing money, but cash from operations finally turned positive. According to analysts’ consensus, as seen on Seeking Alpha, the company is forecasted to decrease its losses in 2022, and in 2023 the company should reach full-year profitability with an EPS of $1.

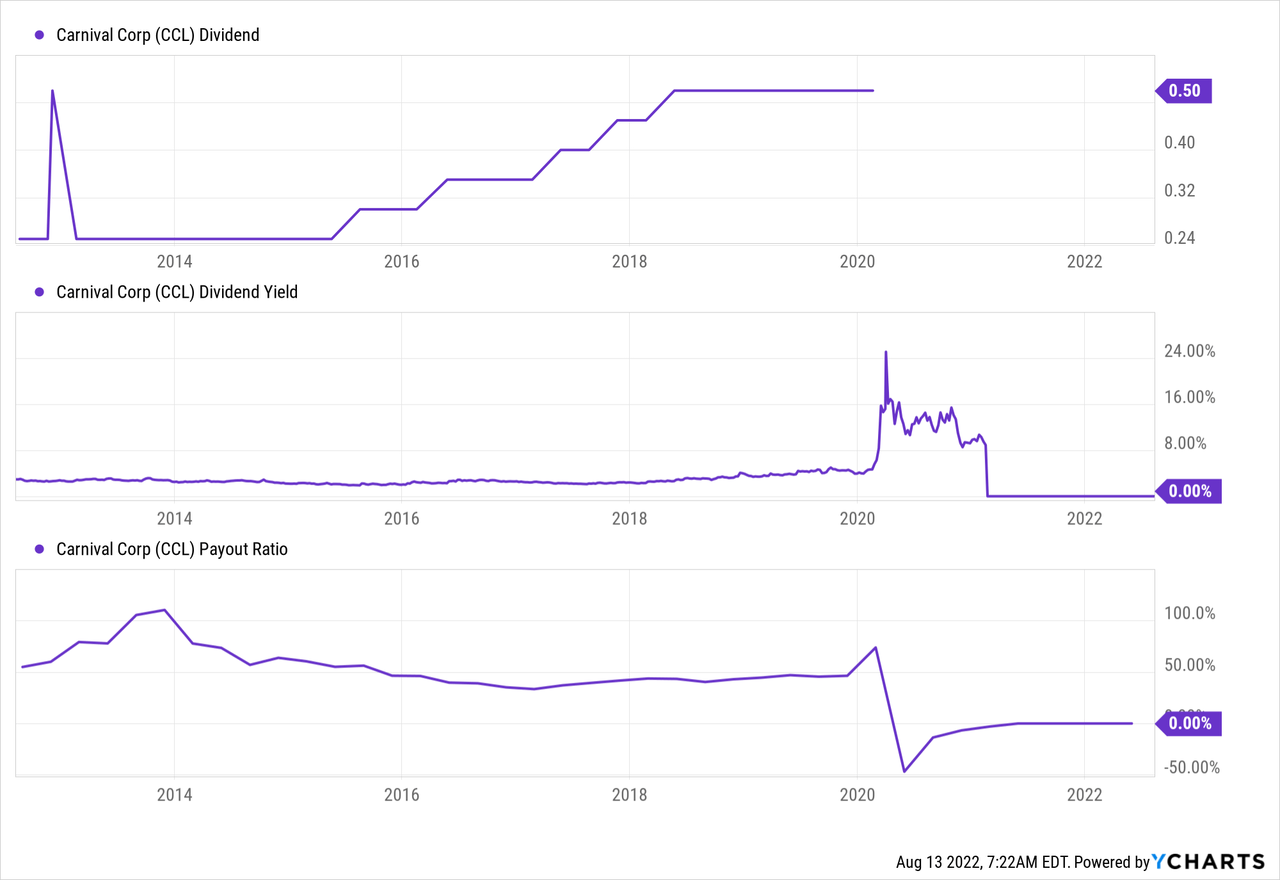

The company was paying dividends to its shareholders reliably. It cut the distribution in 2008 during the financial crisis but has since adopted a more conservative policy. However, no policy could sustain the dividend during the pandemic when the dividend was much higher than the sales. Therefore, the dividend was eliminated and will only be reinstated once the company stabilizes and deleverages its balance sheet as the debt serves as an operational risk.

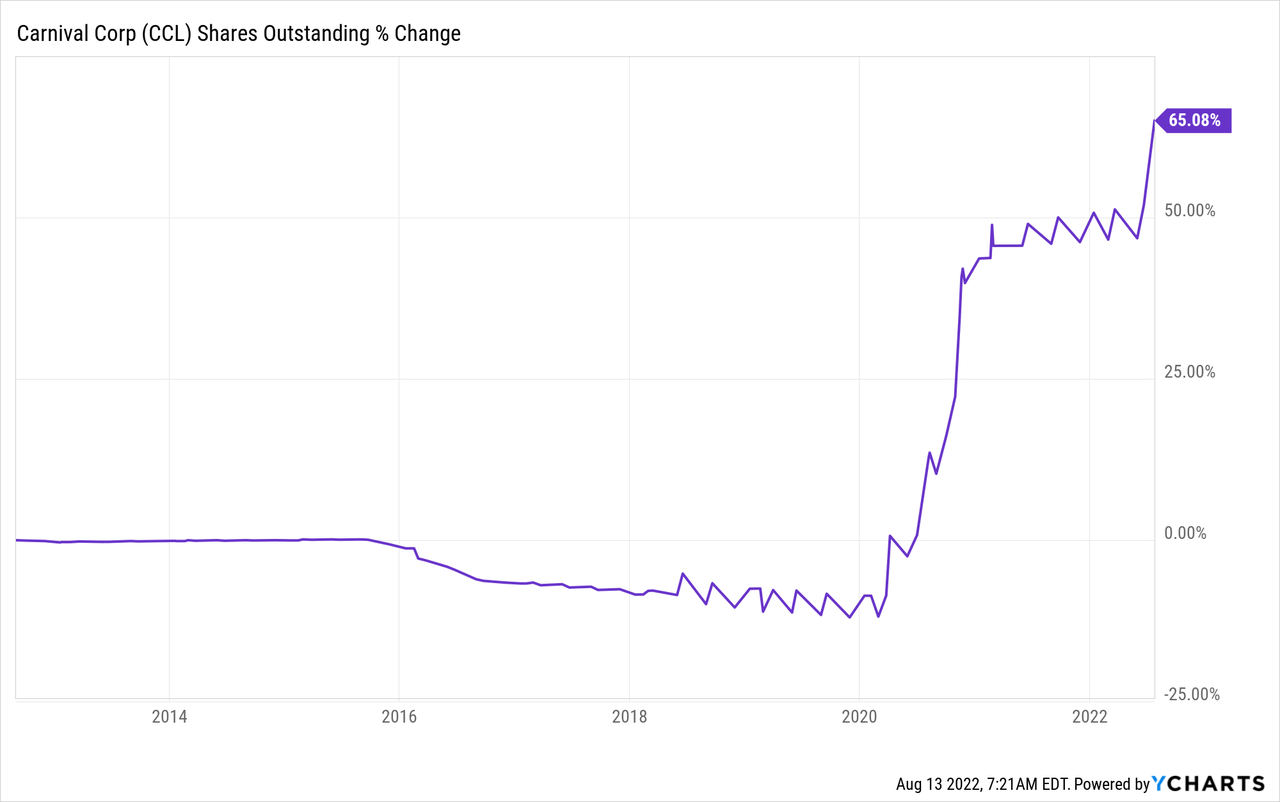

In addition to dividends, companies tend to return capital to shareholders via buybacks. Buybacks support EPS growth in the future, thus allowing the increase the dividends faster and return of more capital. Carnival Cruise has diluted its shareholders with aggressive share issuance as the company was forced to raise money to survive. This dilution means it will be harder to recover the EPS as there are many more outstanding shares.

Valuation

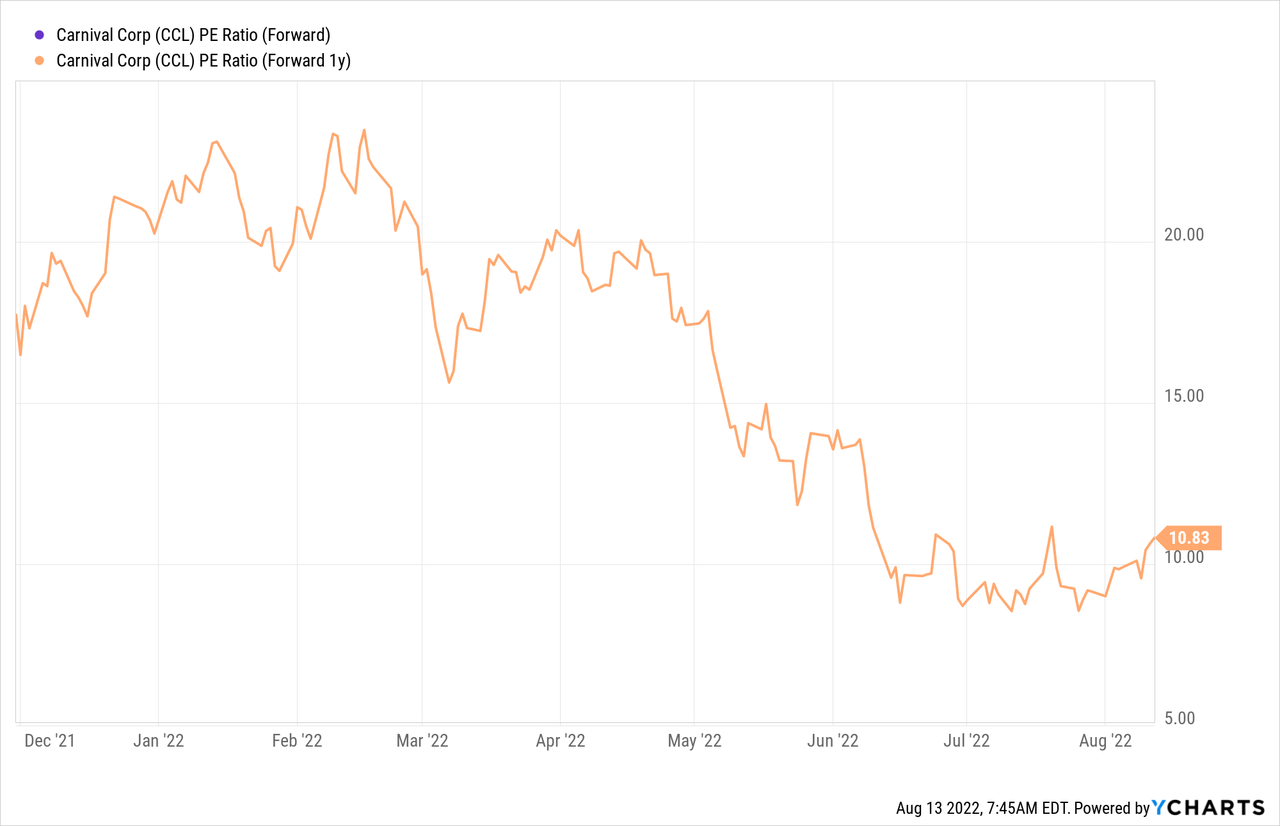

The P/E (price to earnings) ratio is tricky to analyze Carnival Cruise’s valuation. The reason for that is that the company is still losing money. However, when looking at the forecasted EPS for the fiscal year ending in November 2023, less than 18 months away, the valuation seems attractive as the company is trading for less than 11 times forward earnings. It is much more beautiful than it was just several months ago.

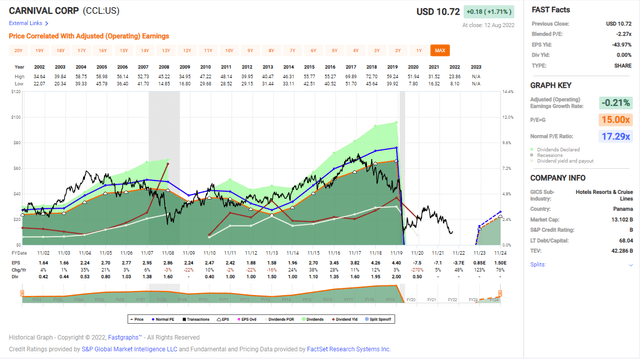

The graph below from FAST Graphs also emphasizes that in terms of valuation, Carnival Cruise is attractive. The company’s average valuation in the last twenty years was around 17, and up until the pandemic, the company grew at 6% annually. Right now, investors can take advantage of the forecasted faster growth of the company together with the current depressed valuation, which is significantly lower than the average.

To conclude, Carnival Cruise has weak fundamentals. Due to the pandemic, its sales and EPS reset, it carries much more debt, and it stopped paying dividends. Moreover, it issued more shares, so recovering back to 2019 will take longer. However, the company offers an attractive valuation that may appeal to long-term patient investors. The company looks like a long-play game on its ability to recover and return to normal.

Opportunities

The most important growth opportunity is the world returning to normality. We see improving metrics for Carnival Cruise as people have enough confidence to order cruises. Sales are growing double digits quarter after quarter, cash from operations is positive, clients are spending on board, and bookings are booming. All in all, it seems extremely promising for Carnival Cruise.

The scale is another critical opportunity for Carnival Cruise. The company is the largest cruise company in the world. Carnival Corporation held a dominant position before the pandemic with passenger and revenue market shares at 47.4% and 39.4%, according to the NIH. It allows the company to operate worldwide and capitalize on growing demand and lucrative markets. It also means that once the industry is entirely online, it will have a significant upside as the company has a massive fleet.

Another advantage of buying shares in Carnival Cruise is if you are a client of the cruise company. The company offers enticing shareholder benefits, and it is a meaningful opportunity for clients who tend to use their services. Clients who own shares in Carnival get $50-$250 onboard credits. You need to hold 100 shares, which costs ~$1,000 at the current price. It means that even one cruise a year will get you back 5%-25% of your investment. It is lucrative if you are a cruise lover and gives you a significant incentive to invest.

Risks

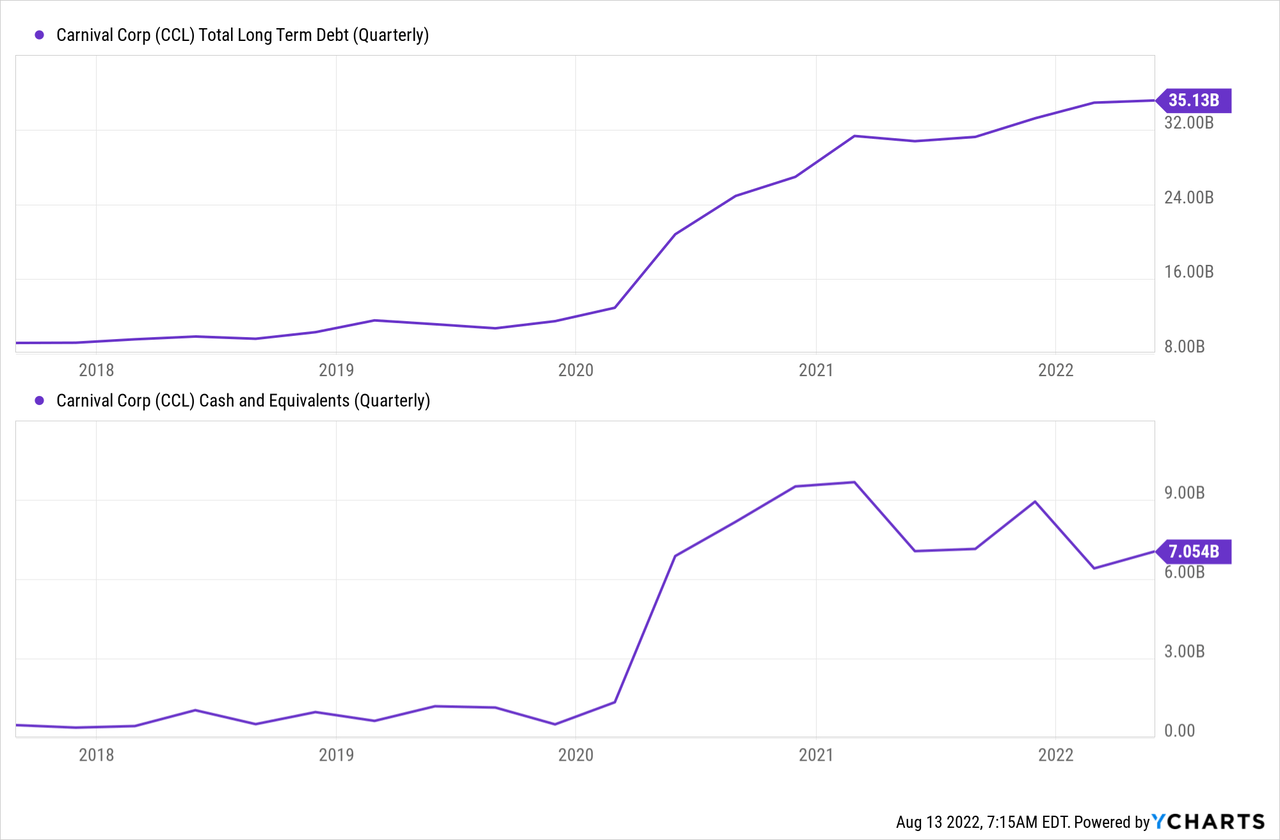

The first risk for the company is its debt level which has almost tripled since the pandemic started in 2020. The company will have to stabilize its balance sheet before paying a dividend, and it will have to do it to regain its investment grade credit rating and gets its operations up and running. The debt will weigh on its operations as the interest rate rises, requiring more free cash flow. The company also has more cash and equivalents than before the pandemic. It will likely use some to lower the debt level.

Another risk for the company is inflation. Inflation affects Carnival cruise mainly due to higher fuel prices and labor costs. It also has to pay more for food and other materials, but fuel and labor are the most significant. It is challenging for a cruise liner as companies sell tickets in advance, and with an inflationary environment, it is harder to price the product.

Another risk for Carnival Cruise is the risk of the current recession. The company’s recovery relies heavily on people returning to everyday life. It means limited unemployment and high spending. An ongoing recession implies that consumers may limit discretionary spending significantly as they are bracing for impact. It will have a significant adverse effect on the rate at which Carnival Cruise is recovering.

Conclusions

Recovery now is a very plausible option as we see booking leading to sales that lead to cash from operations. It will eventually lead to returning to profitability next year. The current valuation makes investing in Carnival Cruise attractive, yet the present risks remind us that while there is a significant upside, there is also a considerable downside. It is a high-risk, high-reward play.

Investors with high-risk appetites may consider buying shares now and hopefully enjoy the entire upside while dealing with the risks regarding the uncertainty. Investors with a lower risk appetite may wait until the company initiates a dividend once more, showing high confidence that the situation is stable. The company is a risky BUY, in my opinion, as long as investors consider the risk.

Be the first to comment