solidcolours/iStock via Getty Images

In Ray Bradbury’s classic novel Something Wicked This Way Comes, it’s a brisk October day when a mysterious carnival appears in a small town, bringing with it intrigue and horror.

That same horror and intrigue have gripped Amarin Corporation (NASDAQ:AMRN) and its investors over the past 30 months, a period during which the stock has lost over 90% of its value on the heels of a painful court decision that stripped away an important U.S. patent protection for their lone drug, Vascepa.

Now, as summer nears its finale and we approach those crisp October days once more, there is a reason for investors to be hopeful. That reason is famed activist biotech investor Alex Denner, backed by a 10-figure account through his investment firm, Sarissa Capital.

Activist to the Rescue?

Denner comes from the Carl Icahn investing tree and sports a PhD from Yale University, along with a fierce reputation and a deep list of industry connections. Last November, Sarissa took a 6% stake in Amarin, making it Denner’s sixth largest position and stirring talks of a potential buyout. There is precedent for such moves under Denner’s influence, such as The Medicines Company, Ariad, and Bioverativ.

However, since buying into Amarin, Denner has seen the share price continue to decline while Vascepa steadily loses market share to generic competitors and Amarin burns through their cash pile attempting to establish a sales force in Europe.

Revenue Struggles

When you look at the fundamentals here, they’re a mess. In the recently reported second quarter. Amarin lost nine cents per share on $94 million in revenue, representing a decline of 39% from the same quarter last year. For the full year, the sales range should be $325-375 million, down from their peak of $600 million in 2020.

Cash on hand totaled $650 million at the beginning of 2020, but it now stands at half of that, an amount the company ominously notes in its quarterly report should sustain it for the next 12 months.

Revenues have declined from over $150 million per quarter in 2020 to less than $100 million per quarter, and they continue to slide.

European sales, where the company received marketing authorization in February 2021, have been a slow grind with no signs of growth over a year into their launch there.

In the United States, no fewer than three companies are selling generic versions of Vascepa, while generic Lovaza – consisting of a mixture of omega 3s – has actually grown in sales since Vascepa received an expanded label from the FDA in 2019.

More Struggles

Throwing further shade on the operation is the persistent effort of Cleveland Clinic cardiologist Dr. Steven Nissen, who has vociferously questioned the mineral oil placebo used in Amarin’s REDUCE-IT trial, the results of which supported a new FDA-approved indication for Vascepa to prevent cardiovascular disease in certain patients.

Nissen raises the specter that the placebo group was negatively impacted by taking mineral oil and that the difference in the two groups is not attributable to the benefits of Vascepa, but rather to harm caused by mineral oil.

Such rationale flies in the face of scientific reason, and a unanimous AdCom vote in support of the expanded label for Vascepa should have been the end of the discussion. Yet almost four years later, Nissen and a few media outlets continue to hammer on the topic and attempt to sow doubt regarding Vascepa’s efficacy.

It’s fair to wonder whether Nissen holds a grudge against Amarin because he oversaw a failed trial of another omega-3 drug that was attempting to compete with Vascepa. In any case, the ongoing efforts to discredit the drug have done nothing to help Amarin’s cause.

Amarin also continues to fight a legal battle for induced infringement of their CVD label, which in theory is off-limits to generic competition but in practice has seen doctors, insurers, and pharmacies routinely switch out Vascepa for a generic thousands of times.

Although a judge determined that generic manufacturer Hikma had not done anything that amounted to induced infringement, he allowed a lawsuit against insurance provider HealthNet to move forward. That case offers a narrow hope of Amarin regaining some protection for their broader CVD label if insurance companies are found to be infringing by enticing patients to take the generic version based on the pricing tier.

While novel from a legal standpoint, that case could take years to play out and the ramifications of any decision are uncertain. For long-term investors, the best scenario is that the company hands over the reins before any such litigation plays out.

A Glimmer of Hope on the Technical Front

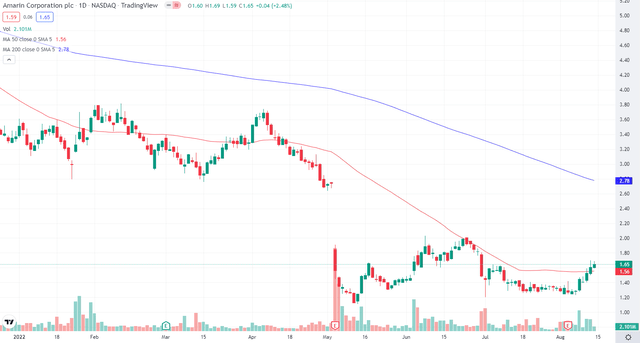

The biotech sector is well-known as a volatile one where companies can quickly boom or bust. Amarin epitomizes those cycles, trading near $2 in mid-2018, then launching over $20 following the release of REDUCE-IT trial data that September. Four years later, the price has come full circle and the stock trades under $2 again.

Even today’s meager share price offers some technical hope, though. The stock just closed above its 50-day moving average for the first time in months, and it now eyes a tasty gap at 2.67, where it could meet the rapidly descending 200-day average as well.

Absent any news around Alex Denner’s plans, however, the stock could quickly retreat on its gains and re-test the 52-week low of 1.10.

Year-to-date chart of AMRN (TradingView)

Time for Amarin to Move On

The bottom line is that Amarin has fought the good fight with Vascepa and lost. They have lost in court, in the media, and at the pharmacy. A drug with great promise is being squandered every day that it is under control of current management.

The best – in fact, the only – hope for Amarin is for Alex Denner to wield his influence and spin proverbial straw into gold by locating a willing company to buy them out.

At a minimum, Amarin needs to establish a significant partnership deal that goes well beyond the typical agreement to hand over a few million dollars and later pay a 15% royalty on the drug. Better yet, they need to turn over the whole business in a sale, and investors should jump at anything north of $5 per share given the current situation with the stock trading near multi-year lows under $2.

I believe a total sale price of $2.5-3 billion (equivalent to roughly $6-7 per share) is a reasonable and attainable goal. Amarin has little hope of becoming profitable any time soon, they have no pipeline beyond Vascepa, and their position in the world’s largest pharma market is greatly compromised by competition.

Conclusion

Last year, I downgraded my own outlook on Amarin from bullish to neutral, fearing the go-it-alone approach in Europe would be an arduous task.

While it might seem odd for me to tag this ticker as bullish now, the explanation is simple: I believe Alex Denner will successfully execute a sale of Amarin for a price well above the current market cap, and investors who stick around for that day will be well-rewarded.

Of course, Denner is not infallible and Amarin management might choose to seek their own path and keep Denner sidelined – a process seen at Ironwood, where the company refused Denner a seat at the table for almost two years.

If that’s the case here, then investors can find much better plays in biotech land with companies that have better sales or better pipelines. But for those who believe that Denner can successfully negotiate a sale of Amarin, the next six months offer a unique opportunity to make a sizeable profit and to see a happy end to the company’s saga.

Be the first to comment