Rawf8/iStock via Getty Images

Introduction

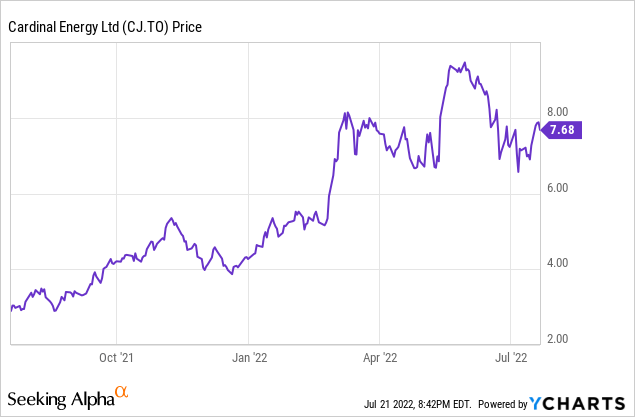

Less than 2.5 years ago, I wasn’t sure Cardinal Energy (OTCPK:CRLFF) would survive the oil crisis and I elected to get the cash payout for the debentures I owned rather than converting them into new debentures which could subsequently be converted into stock at C$1.25. As the shares are now trading at a multiple of that conversion price, I can say I missed out on a huge opportunity but back in 2020 I definitely did not expect oil to move into the triple-digit prices anytime soon.

Cardinal Energy has its primary listing in Toronto where it’s trading with CJ as its ticker symbol. The average daily volume of 1.7 million shares clearly beats the OTC listing where the average daily volume is just around 70,000 shares. That’s still very decent and ‘good enough’ for investors that don’t have access to the TSX, but for the purpose of this article I will refer to the Canadian listing and use the Canadian Dollar as base currency throughout this article.

The Q1 results provide a good starting point to figure out Q2 and FY 2022 earnings

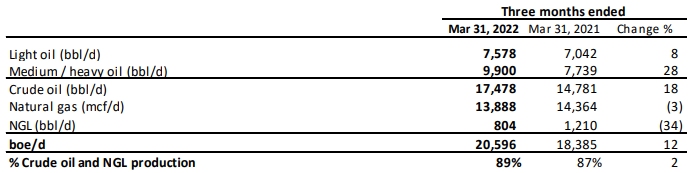

In the first quarter, Cardinal Energy produced approximately 20,600 barrels of oil-equivalent with 89% consisting of crude oil and Natural Gas Liquids. The remaining 11% of the oil-equivalent production rate came from natural gas sales.

Cardinal Energy Investor Relations

With an average received price of C$109.5 for light oil, C$100.4 for heavy oil and just under C$5/Mcf for natural gas, Cardinal Energy definitely capitalized on the high fossil fuel prices.

Cardinal Energy Investor Relations

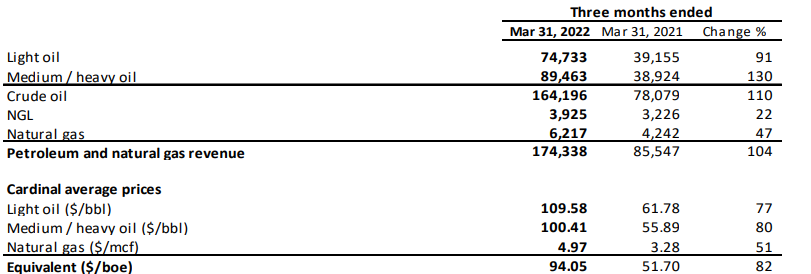

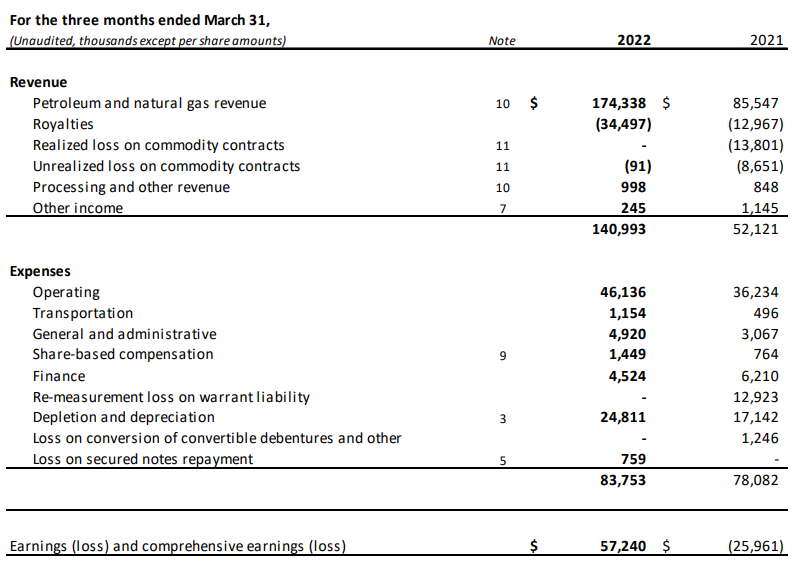

The total revenue came in at C$174M, as shown above, but the average royalty payments came in at around 20% of the revenue so this reduced the net reported revenue to just under C$141M. That’s still almost three times higher compared to Q1 2021 although that quarter included about C$22M in realized and unrealized hedging losses.

Cardinal Energy Investor Relations

The total amount of operating expenses was just C$83.7M and about 30% of those expenses were related to depreciation and depletion. The operating expenses increased as well but this was well-compensated by the exceptionally low transportation costs. At C$1.15M for the quarter, the average transportation cost per barrel of oil-equivalent was just over C$0.60.

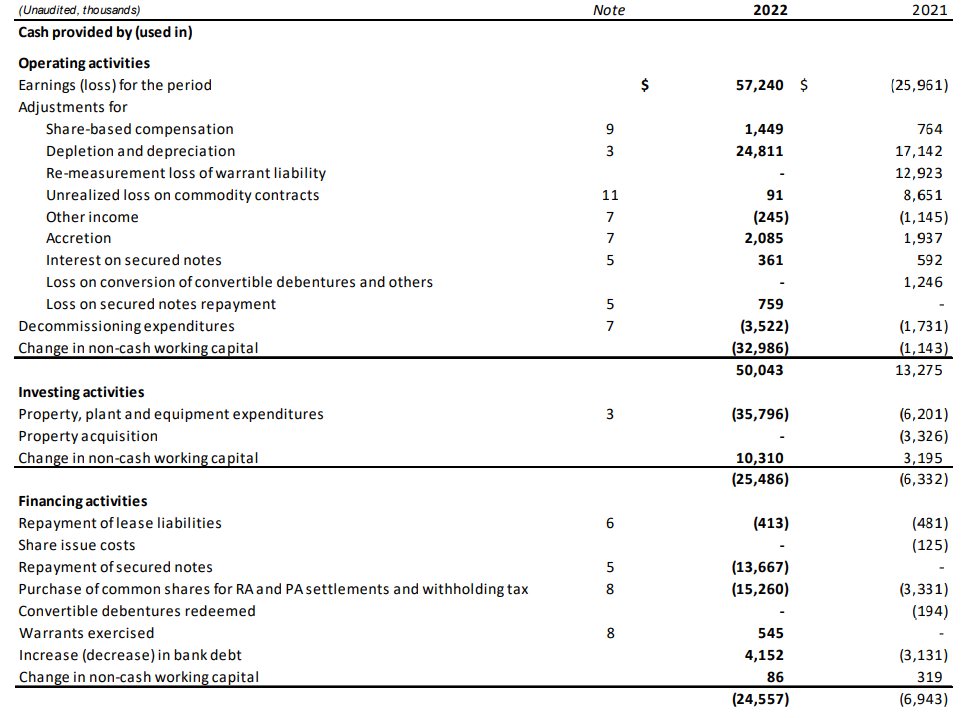

The net income for the quartet was C$57M representing an EPS of C$0.38. On an annualized basis, Cardinal Energy would report an EPS of in excess of C$1.5 based on the Q1 results, and perhaps even higher as Cardinal is rapidly reducing its gross debt and net debt and the lower interest expenses will obviously have a very positive impact on future cash flows.

Looking at the cash flow result, Cardinal reported an operating cash flow of C$50M but this includes about C$33M in working capital investments and excludes about C$0.4M in lease payments. So on an adjusted basis, the operating cash flow was C$82.5M.

Cardinal Energy Investor Relations

The total capex was less than C$38M resulting in a free cash flow result of C$44M. That’s lower than the reported net income but that’s easy to explain: Cardinal spent about 50% more on capex than the depreciation and depletion expenses.

That’s because Cardinal has front-loaded its capex. The full-year capex guidance mentions C$100M which means that the remaining capex will be just over C$20M for the next three quarters which is substantially below the Q1 capex bill. If I would use the normalized C$25M quarterly capex, the free cash flow result would have pretty much mirrored the C$0.38 EPS.

Back from the brink: the balance sheet is clean and the company is paying a dividend

2.5 years ago I didn’t dare to buy the stock as I wasn’t sure Cardinal would survive. I decided to buy the debentures instead and subsequently did very well on those as I more than doubled my money within just a few quarters. Unfortunately, even as things started to look up for Cardinal Energy, I decided to take the cash payout rather than converting debentures into stock. Hindsight is always 20/20 and at the end of 2020 it didn’t really look like oil was heading to $100/barrel so I’d probably make the same choice over and over again.

Meanwhile, Cardinal Energy has done everything right and its net debt has evaporated extremely fast. As of the end of March, the net debt came in at just C$146.5M and as you saw based on the Q1 results, the net debt was decreasing at a rate of about C$50M per quarter (depending on changes in the working capital and capex allocation, of course). That was important because Cardinal had promised its shareholders it would reinstate the dividend as soon as the net debt had dropped below C$100M.

That threshold was reached during Q2, and the company recently paid out its first monthly dividend of C$0.05. On an annualized basis that’s C$0.60 for a dividend yield of approximately 8% based on the current share price.

This is just an interim step. Cardinal pledged to increase the payout as soon as the net debt has dropped to C$50M. Given the pace the debt is being reduced and given the current 50% payout ratio, I expect this threshold to be reached around the end of this year (give or take a few months).

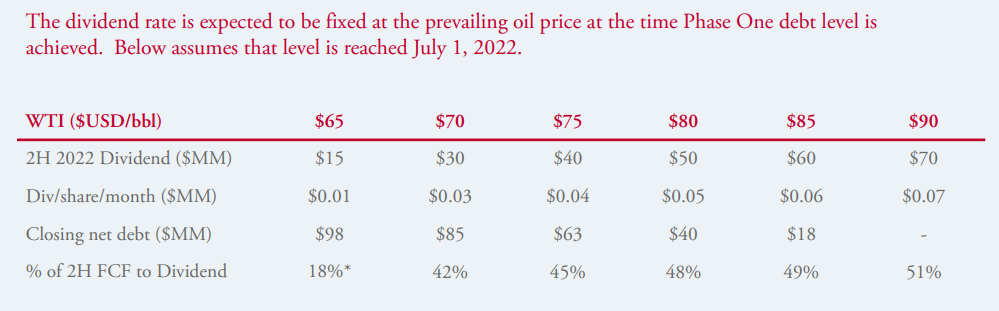

An old presentation published by Cardinal shows what the impact could be. The current presentation no longer contains this sensitivity analysis but an archived version can be found here. Please note the old version used a C$85M capex which has since been revised to C$100M.

Cardinal Energy Investor Relations

The image above is based on a 50% payout ratio. But this enables us to run the numbers using a 75% payout ratio (a 50% increase). At $90 oil, the monthly dividend would increase to C$0.10 for a yield of in excess of 15%. But that also means that if the oil price drops to US$70/barrel, the current monthly dividend could be maintained at approximately C$0.05/month.

Investment thesis

Cardinal Energy has done a tremendous effort in cleaning up its balance sheet and the net debt has now been reduced to less than 0.5 times the free cash flow based on a US$95 WTI oil price. This paved the way to restart dividend payments and Cardinal shareholders can now rake in the cash with an 8% yield based on the current share price but for those who bought in late 2021 (when I elected to receive cash for my debentures upon maturity) when the share price was trading at just around C$1, the yield is even juicier.

I currently have no position in Cardinal Energy. And while the 8% yield is attractive, I don’t think there’s any urgency to get in right now from an income perspective. That being said, the stock is trading at less than 5 times the free cash flow at the current spot prices, so it definitely is a candidate for my watch list, but I already have good exposure to oil and passing on adding Cardinal is just a personal portfolio consideration.

Be the first to comment