(Note: This article appeared in the newsletter on May 21, 2022, and has been updated as needed.)

International Petroleum (OTCPK:IPCFF)(IPC:TSX) is a Canadian company that reports in United States dollars. It is also a part of the Lundin Group of Companies. The company has been repurchasing shares for some time. Management recently announced that more than 6 million shares have been purchased and retired since the repurchase began. Recently, the company announced an acceleration of that share repurchase program by way of a Dutch Tender Auction. The auction resulted in more than 8 million shares purchased. The two actions should reduce shares outstanding by roughly 10% when the auction process was completed in June. That makes this one of the larger percentage reductions of the number of shares outstanding in the industry. Shares outstanding are now heading towards the 140 million count.

Management explained during the conference call that they can effectively purchase production (using the 2P measure of the reserve report) at about a 40% (approximately) discount to its value. Therefore, this was a far better use of funds than expanding the capital budget.

Debt had already been repaid so that the debt ratio was below 0.5. Management really did not see a need to reduce debt further than that. This management, like many that were buying projects when commodity prices were considerably cheaper, does not currently see the bargains that were once available. Therefore, this management will likely wait for bargains to appear in the future that fit the strategic criteria.

Management Experience

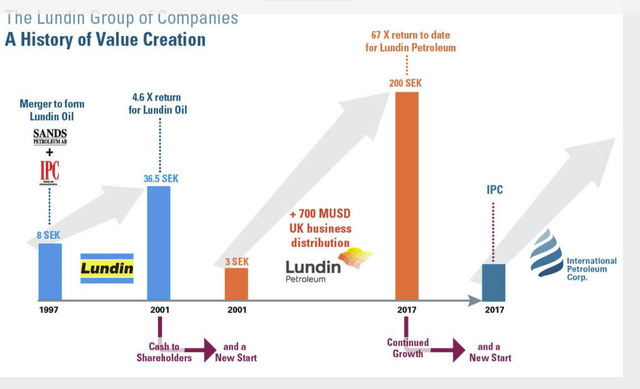

The Lundin family is involved in a fairly large group of companies. Much of the management of this company has prior experience with the growth and sale of companies that are part of the Lundin Group of companies.

Prior Management Experience Within The Lundin Group Of Companies (International Petroleum Website May 21, 2022.)

This management has considerable past experience. There is also the considerable resources of the Lundin family interests that will help if necessary. The Lundin Family will control the companies that are part of the group through various interests and holdings.

Generally, a company like International Petroleum is built to appeal to an eventual buyer for a price that the major shareholder would agree is a good price. Investors get to invest alongside that major shareholder in a situation like this and benefit from the considerable experience of that shareholder.

Those additional resources of the major shareholder give a company like this a competitive edge. The major shareholder has a reputation and a track record to defend every time a new company is created. So far, management has been very conservative about debt. That eliminates a frequent new company risk factor.

As with the case of many companies, the management had announced a fairly disciplined capital budget that does not appear to be increasing with the strong commodity prices. That may change in the fall because many Canadian companies reduce operations during Spring Break-Up. That allows for capital revisions before the resumption of normal operating activity once the lull ends.

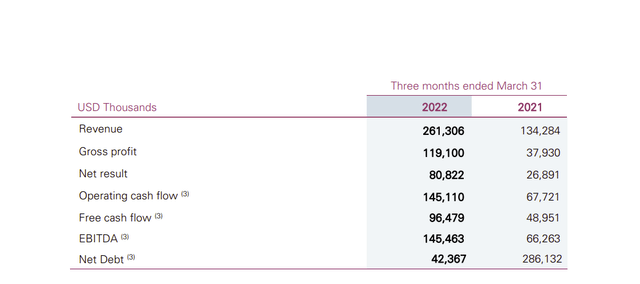

International Petroleum Summary Of First Quarter 2022, Financial Results (International Petroleum First Quarter 2022, Earnings Press Release)

This management is forward looking enough to repay debt and issue bonds to empty the bank line. Any company that is part of the Lundin Group of companies will increase production through purchases whenever it is cheaper to do so. Much of the previous debt repaid represents acquisitions from a time when commodity prices were far lower, and few buyers were able to purchase the bargains available.

As a result, management is able to show long term production growth from those acquisitions without expanding the capital budget. It does appear as though management will have a stronger second half once operations get underway after the Spring Breakup. But I think this management, like many in the industry, is waiting for the long-term industry outlook to “settle down” before committing to a lot of growth.

In the meantime, this management will likely keep as many strategic options available as possible by doing share repurchases rather than initiating a dividend. During the conference call, management appeared to imply that there were far more (and better) uses of cash than initiating a dividend.

Since this group of companies generally has a strategy of growing companies and maximizing enterprise value, it makes sense that a dividend would be a lower priority than is the case for many Canadian companies of their size.

Operations

The company has a fair number of recent purchases with which it can choose to grow production in the future. Management does in fact have several future plans to potentially grow production. But it is not so wedded to a plan as to blindly pursue that plan when market conditions change. That is best illustrated by the recent announcement to accelerate share repurchases rather than raise the capital budget or initiate a dividend. Shareholders have a very definitive signal from this management that it will do something positive about the relatively cheap share price.

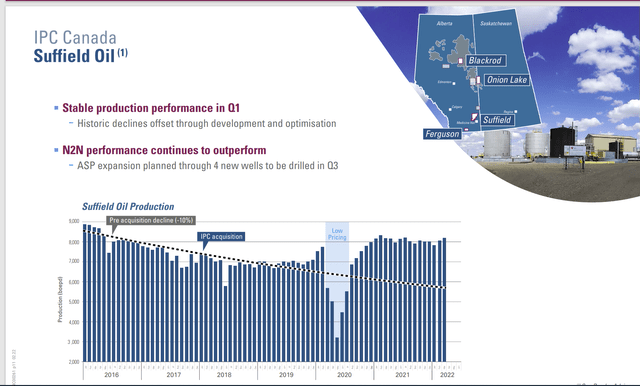

International Petroleum Location Of Projects And Suffield Operating History (Earnings Conference Call Slides May 2022.)

International Petroleum has a variety of projects that produce everything from mostly natural gas to thermal production, and then various oil weights of production. That thermal production, in particular, will make earnings more volatile than is typical of the upstream industry.

The very strong balance sheet has enabled management to shut-in production, when necessary, without having to worry about finances. In fact, this management really did not worry about declining production in any of the projects when commodity prices weakened. Now, with a far better selling price atmosphere, this management is looking to maintain, and in some cases, restore production.

Actual production growth may happen when other cash uses are not competitive. Despite that strategy, the acquisitions have led to impressive production per share growth over the long term. Investors can count on company growth to continue in the future one way or another.

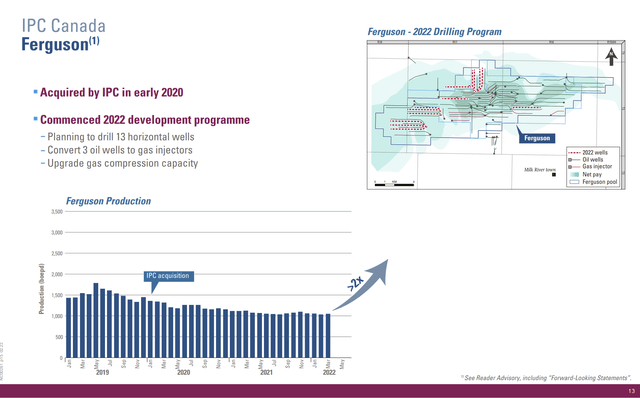

International Petroleum Production History And Guidance For The Ferguson Project (International Petroleum First Quarter 2022, Earnings Conference Call Slides May 2022.)

The one project that will increase production past the acquisition production levels is one of the smaller projects. This particular production, which used to be Granite Oil (OTCQX:GXOCF), is a medium grade oil that was getting to be an increasing challenge for Granite as industry conditions steadily worsened.

Clearly the project needed someone with deeper pockets than the little company had at the time. Now, management appears ready to develop this resource that has a lot of potential. It will be interesting to see how this proposed strategy turns out after years of frustration.

Summary

International Petroleum is a Canadian company with some international exposure that has unusually deep experience through the association with the Lundin Group of companies.

Growth will come from whatever is cheapest at the moment. The emphasis at the current time is building a very profitable company. Clearly the cash flow is excellent, and the production balance has allowed the company to participate in the commodity price improvement of nearly every commodity sector.

The conservative debt strategy combined with the association with the Lundin Group of companies lowers the risk of principal loss in the long term. That considerable experience raises the chances of considerably above average appreciation. Management is often the most important asset or liability not on the balance sheet. This management is a huge asset to potential investors. The long-term outlook for this group of companies is typically excellent. This one is no exception.

Be the first to comment