jetcityimage

Thesis

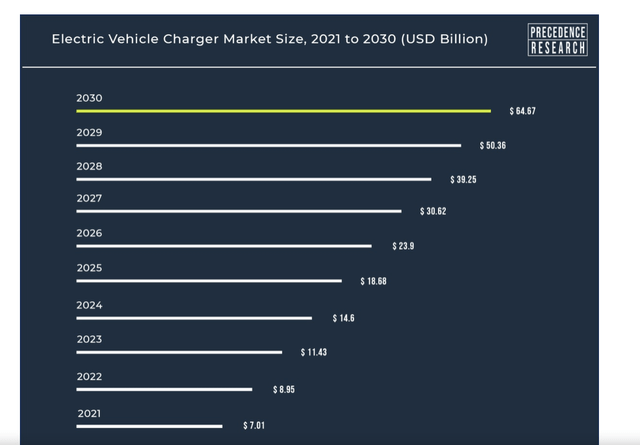

The electric vehicle market is arguably the most competitive industry today. While it may be impossible to know how many players there are globally, there’s a lot of money to be made. However, one does not need to invest directly in electric vehicles to play this industry. Like cars that need gas, electric vehicles need power to operate. According to Precedence Research, the global EV charging market is expected grow at a CAGR of 28% through 2030 to $66 billion. One company, ChargePoint Holdings, is trying to capitalize on that (NYSE:CHPT).

EV Charging Market 2021-2030 (Precedence Research (Global News Wire))

The Company

ChargePoint operates the world’s largest network of electric vehicle charging stations. With over 188,000 activated ports, 12,000 direct connection and another 320,000 ports accessible via roaming, ChargePoint’s penetration into both the U.S. and Europe is unmatched. The company makes money through a portfolio of hardware (charging stations) and software solutions.

On the software side, ChargePoint generates revenue through a number of initiates. The first is its subscription service, which boasts a number of benefits for its commercial and fleet customers. One of which is “host management”, a solution offering commercial customers the ability to selectively charge individuals. For instance, commercial customers can make charging free to the general public or to a select group of paying customers. “Host pricing” allows customers to change prices based on data collected from customers. Both of these features are enhanced by ChargePoint’s data analytics module. By collecting data on customers, ChargePoint provides commercial and fleet customers with optimal customer pricing and fleet management (for fleet customers).

ChargePoint’s unique investment proposition is its penetration into every type of customer. While much of the cloud based software solutions are enhanced to support commercial and fleet management, ChargePoint is aggressively pursuing residential customers too. With ChargePoint home charging, residential customers can get a lifetime subscription with various utility plans for managing their home use. For multi-family properties, ChargePoint is offering the ability for the software to bill tenants based on usage and for the property manager to set the price.

Performance

ChargePoint delivered $241 million in revenues in FY22. This was a 65% increase over the previous year. 72.1% of this growth was attributable to the hardware charging stations that ChargePoint sells. The remaining 22.1% came from subscription revenue. While the sales mix hasn’t changed much since FY2020, ChargePoint does have a goal of having recurring, software revenue account for half of overall sales in the future. This is a great strategic goal because there is a clear indication the software side will have a much better gross margin with scale. For instance, in FY22, direct costs associated with software sales accounted for 58% of that segment’s sales while costs associated with the hardware side were 84%.

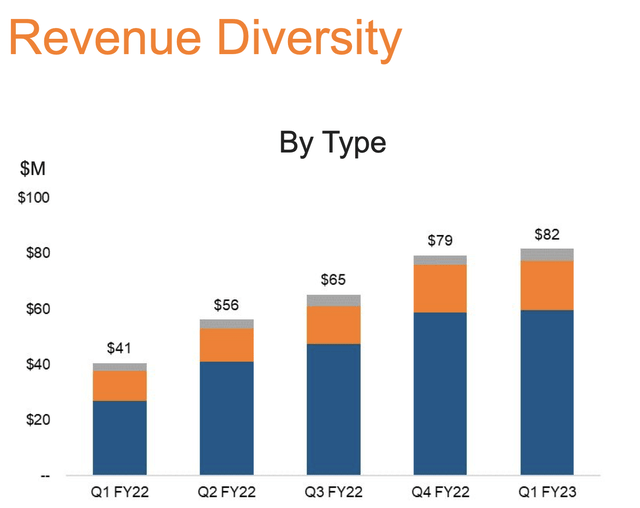

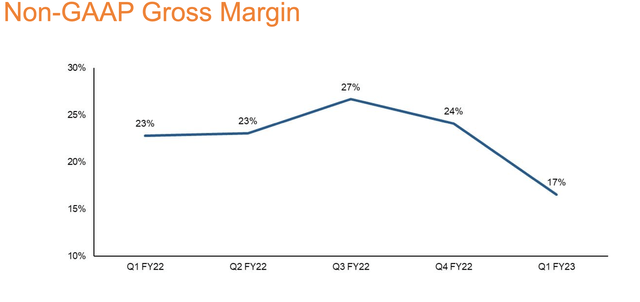

Overall, gross margins are not painting a pretty picture right now. Look at the two images below for quarterly revenue and gross margins.

Quarterly Revenue (ChargePoint) ChargePoint Gross Margin (ChargePoint)

The second image clearly shows the volatility of the gross margin here quarter over quarter. This volatility is directly related to the company’s aggressive pursuit of customer acquisitions and an abundance of supply to fulfill its “land and expand” model. You can see that in action by seeing the rise in quarterly revenue in the first image. The problem here is that it is relying on the growth in demand of the overall EV industry to reach a point of economies of scale. If that demand is never met or is at a much slower rate than expected, ChargePoint may reach a point of maximization, where it can no longer grow. While I don’t see this happening, it is a realistic risk to consider.

ChargePoint’s operating expenses paint a similar picture. OPEX was 101% in FY22 and is currently at 103% this year. Research & Development is contributing the most to this unprofitable business, accounting for 60.2% of revenues in FY22. Selling, General & Administrative creeped up, accounting for around 30% of revenues each. Again, the story is the same. To engage customer acquisitions and build a moat around its highly competitive business, these costs must continue to increase in the short term. However, in the long term, scale will allow the company to eventually keep operating costs relatively fixed.

Scalability

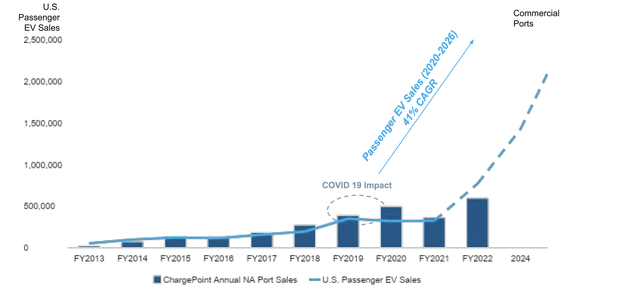

ChargePoint is not only unprofitable, but is diverging further away from profitability with each passing quarter. The company’s biggest challenge is scaling to a point of profitability. However, the image below shows that there exists a positive correlation between EV penetration and ChargePoint’s sales. According to ChargePoint, passenger EV sales are expected to grow at a CAGR of 41% through 2026. Therefore, mass adoption of EV by the general market should pose well for ChargePoint’s scaling challenge.

Correlation EV Penetration & ChargePoint (ChargePoint)

While the high operating costs in the last section are worrisome, there is something to be said about investing heavily into initial customer acquisition costs; account expansion, something ChargePoint is proving successful at. The company’s top 25 customers have spent a 10.5x cumulative spend since their initial purchase. Likewise, one fortune 50 company’s annual expenditure has reached a whooping 28.5x cumulative spend. These multipliers are quickly growing and are a reflection of the ecosystem ChargePoint is creating by initially selling the hardware and keeping the customer engaged with the software to create a long term value proposition for each customer.

One final thing that I do think will support ChargePoint’s growth in scale is its focus on level 2 charging. Most modern homes and buildings require 240 volt outlets, which is consistent with a level 2 charger. Furthermore, level 2 chargers deliver an average of 32 miles of driving range per hour of charge, significantly higher than the 4 miles delivered in a level 1 charger. Therefore, I believe mass adoption of level 2 chargers will be more consistent with the growth in passenger EV sales.

Risks

Scaling will remain the biggest challenge for ChargePoint in the near future. While it seems to be aggressively pursuing its “land and expand” model, it is relying on the sustained hyper growth of electric vehicle adoption by mass markets globally. Unfortunately, EV charging cannot succeed without enough electric vehicle adoption globally. However, this seems highly unlikely. In addition to the uncountable new EV vehicle manufactures globally, many of the large automobile players like Ford are quickly rolling out EV lines. While they can go into charging, ChargePoint’s aggressive expansion strategy coupled by first mover advantage should create some very strong barriers to entry, even by big players in the main space.

Another risk is related to its future leverage. While the company is sitting comfortably at a healthy positive working capital balance of $275 million and moderate debt levels of $69 million, I believe to truly scale it will eventually dry up its cash flows. Think about it, at a current revenue run rate of around $80 million a quarter and a 100% operating expense rate, growth is being fueled with high costs. To truly penetrate the market, the company will need to spend hundreds of millions each quarter to maintain its run rates. Furthermore, while R&D spend is 60% of revenues now, the competition it faces has likely hundreds of millions dollars more to spend on R&D, something I am sure one of the larger players will pursue with their newly launched EV lines. This means that its R&D spend will likely remain sustained at these levels for a long time.

Bottom Line

ChargePoint’s stock is down 30% this year. While this may seem like a mouth-watering buying opportunity, one must balance the risks here with the bigger challenges in the macro environment. With inflation at all time highs and an inevitable recession approaching, household disposable income is being eroded. This means luxuries like vehicles will see reduced demand. While many may argue that inflation induced gas prices will lead many to buy EV’s we have to remember that the majority of the market is still using gas powered vehicles and with reduced income, vehicles become unaffordable.

I do believe that if scaled correctly, ChargePoint can become a highly successful, profitable business, but I am waiting on the sidelines until I see a clear indication of where this company is heading.

Be the first to comment