Surasak Suwanmake

Note:

I have covered Capstone Green Energy (NASDAQ:CGRN) previously, so investors should view this as an update to my earlier articles on the company.

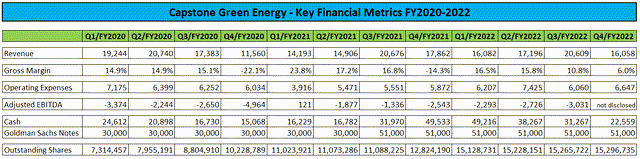

On Thursday, ailing microturbine manufacturer Capstone Green Energy (formerly Capstone Turbine) or “Capstone” filed its previously delayed annual report on form 10-K with the SEC but abstained from announcing Q4/FY2022 results in a separate press release.

Quite frankly, after taking a deep dive into the 10-K, I am not exactly surprised by management’s decision as quarterly results came in well below expectations with revenues of $16.1 million missing consensus expectations of $22.6 million by a mile. Gross margins decreased by 480 basis points sequentially to a measly 6.0%.

Company Press Releases and SEC-Filings

Days sales outstanding (“DSO”) increased by 30% sequentially to 150 days due to “continued delayed collections in all markets due to the COVID-19 pandemic and impacts from the ongoing conflict between Russia and Ukraine“.

Free cash flow was negative by $8.7 million for the quarter and $37.4 million for FY2022. After accounting for the $9.0 minimum liquidity covenant related to an aggregate $51.0 million in Goldman Sachs notes, available liquidity was down to $13.6 million at the end of March.

In addition, CFO Frederick S. Hencken III recently tendered his resignation and has already left the company. Last week, Capstone appointed Scott Robinson as Interim CFO while conducting a nationwide search for a new, permanent CFO.

At the end of March, the company failed to comply with the Adjusted EBITDA covenant governing the Goldman Sachs notes thus resulting in the requirement to negotiate a waiver.

On Wednesday, the parties signed an amendment to the note purchase agreement requiring the company to use “commercially reasonable best efforts” to:

- Raise a minimum of $10.0 million through a sale of common stock by September 14.

- Refinance the notes by October 1.

In addition, Capstone will be required to retain an investment bank for the equity raise by August 10, submit a “revised financial plan” by late August and deliver cash flow forecasts on a weekly basis.

While the company might somehow manage to raise the required $10 million in new equity, conditions are likely to be ugly.

Thirteen months ago, Capstone raised $5 million in a bought deal offering with H.C. Wainwright, with the $5.25 offering price representing an almost 30% discount to the previous close at that time.

Considering the required minimum amount of $10 million and the very weak market environment, potential investors are likely to demand an even higher discount this time.

Assuming the company raises $10 million at a price of $1.50 per share, outstanding shares would increase by almost 45%.

While raising the required amount of equity will already prove difficult, refinancing the notes in the current environment looks almost impossible.

At least in my opinion, the company is likely to default on the Goldman Sachs notes again by October 1.

Bottom Line

After an abysmal fourth quarter performance, Capstone Green Energy defaulted on its debt earlier than expected by me.

While the company subsequently managed to negotiate an amendment to the note purchase agreement, it’s difficult to envision Capstone raising a substantial amount of equity and refinancing $51 million in debt in the current market environment.

Quite frankly, I wouldn’t be surprised to see the company filing for bankruptcy in early October.

At this point, investors should seriously consider selling existing positions. Even a short position should yield decent results, particularly given negligible borrowing rates.

That said, only the most speculative investors should consider shorting a micro-cap stock like Capstone Green Energy. As always, don’t bet the farm on short positions and adequately manage your risk.

Be the first to comment