Dimitrios Kambouris/Getty Images Entertainment

Introduction:

Capri Holdings (NYSE:CPRI) is a luxury goods retailer and owns the brands Michael Kors, Versace, and Jimmy Choo. The luxury goods market is a growing market that is also recession-resistant which is an especially desirable attribute given the current climate. Capri Holdings is in the midst of organic growth and margin expansion set forth by management which is not being priced in.

Luxury during a recession

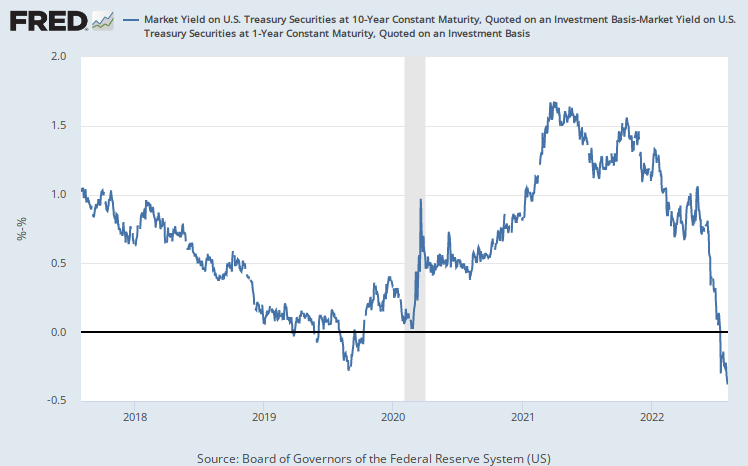

Apparently, the US has officially entered a recession as of Q2 2022. However, it still doesn’t feel like it as employment is still on fire. Further deterioration is likely as my favorite indicator for recessions has finally inverted. The 10-year minus 1-year yield curve inverted in early July. Does this mean that the indicator famous for predicting recessions is now lagging behind them? I think not, as the Real GDP decline in Q1 and Q2 of this year seems to be caused by the inventory cycle. While the yield curve signals how tight/loose the Federal reserve is. Considering the housing market looks to be rolling over, the economy is likely to continue to decline.

Source: Fred

Luxury goods perform quite well in a recession. This is because recessions tend to affect the lower levels of the wealth distribution much more than the top. If we look at top Luxury goods brands during the ’08 recession most barely felt a decline in sales. Out of the five brands I looked at, PVH Corp (PVH), owner of Calvin Klein, was the hardest hit with a 3.7% sales decline in 2009. The rest either barely felt it or actually grew. Capri didn’t have data for the ’08 recession because it IPO’ed in 2011. But Capri should follow the trends of the industry and thus be resilient in a recession especially due to their growth brands.

Sales By Year Various Luxury Brands

|

Year |

2011 |

2010 |

2009 |

2008 |

2007 |

|

LVMH (OTCPK:LVMUY) |

$23.659B |

$20.320B |

$17.053B |

17.193B |

$16.481B |

|

Ralph Lauren (RL) |

$5.66B |

$4.978B |

$5.018B |

$4.88B |

$4.295B |

|

Tapestry (TPR) |

$4.158B |

$3.607B |

$3.23B |

$3.180B |

$2.612B |

|

PVH Corp |

$2.837B |

$2.688B |

$2.398B |

$2.491B |

$2.425B |

|

Burberry (OTCPK:BURBY) |

$1.501B |

$1.280B |

$1.202B |

$.995B |

$.850B |

Source: Table created by author data collected from company 10-Ks.

Luxury Industry Trends

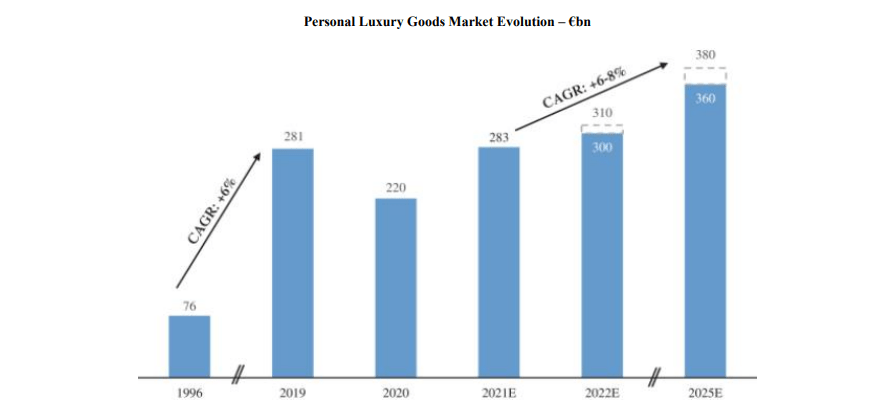

The luxury market in 2021 was $283B. According to Bain, the luxury market is expected to grow at a CAGR of 6-8% from 2021 through 2025.

Source: Bain-Altagamma Luxury Goods Worldwide Market Study, Fall 2021, dated November 11, 2021

Asia will be a big part of the luxury market’s future. China alone will represent nearly 40% of total luxury goods sales by 2025. And in India which only represents 5% of Luxury goods sales now, could dwarf China in the longer term. Other key trends include online purchases becoming more than a third of all sales and younger demographics becoming the dominant purchasers with over 70% share of luxury sales.

The luxury goods market over the past decade has been consolidating. Sales of the top brands have reached close to 33%, vs. 17% in 2000. However the industry is still fragmented meaning we should see continued acquisitions both large and small into the future.

To conclude the luxury market is a rising tide that Capri is poised to take advantage of. Not only is it growing organically but Capri which already has made a couple of acquisitions should be able to continue to acquire other luxury brands. Not to mention Capri has yet to truly go after the Asian opportunity.

Growth

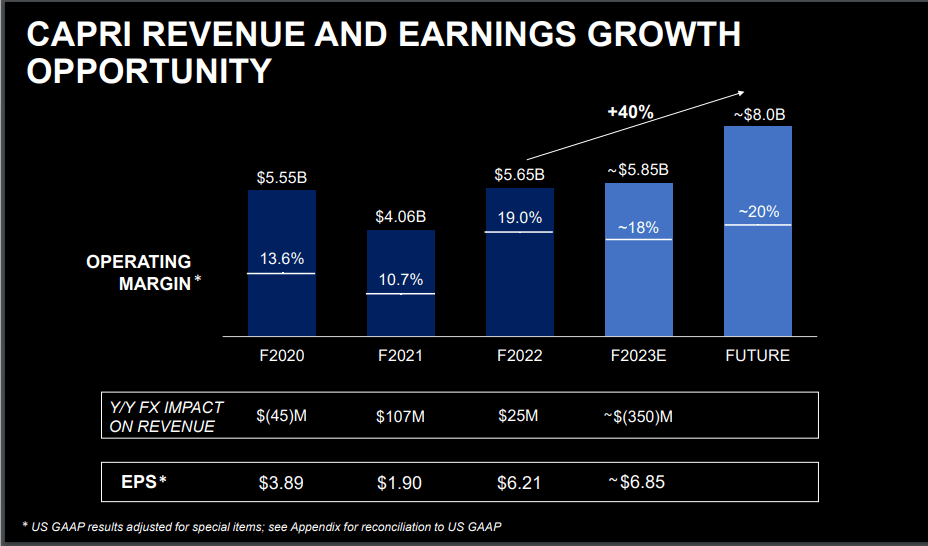

Capri Holdings has ambitious plans for its brands. Capri’s recent investor day has them projecting 8B in revenue compared to 5.65B in FY2022. This is an increase from their previous projection just a couple of months ago of $7B. However, this was their projection from 2019.

Source: July 20 2022 Capri Presentation

The main growth will come from their two recently acquired brands of Versace and Jimmy Choo. When Capri purchased Versace back in 2019, Versace had a little less than 900m in revenue. Capri plans to grow Versace to 2B in revenue with 300 retail locations. So far Capri has grown Versace to 1.08B in revenue in the most recent fiscal year with 209 retail locations.

Jimmy Choo was purchased back in 2018 and had 518m in revenue when first purchased. Capri plans to grow this brand to 1B in revenue with 300 retail locations. So far in the most recent fiscal year Capri has managed to grow the brand to 618m in revenue with 237 retail locations.

The progress of growth for both brands has been slower due to COVID, supply chain issues, China shut down and a strong dollar. This was emphasized in the recent Q1 2022 conference call. In the call growth for all their brands was affected greatly by China’s shutdown and a strong dollar. For example, Versace grew 15% YOY vs the prior year which seems good until they tell you that in constant currency it would have been 30% growth. Versace’s potential 30% YOY growth would have been even higher if not for China. China’s shutdown decreased sales by 20% YOY coming out of Asia. I would say that growth should accelerate after China and the dollar return to normal. But now due to a recession being very likely growth could be weak going forward at least within the next year. Once we get past these never-ending series of shocks growth should accelerate for all brands.

The last brand Michael Kors has been going through a premiumization since FY2016 as Capri had oversupplied the market with product. Sales for Michael Kors have been mostly flat until COVID where it declined. In FY2016 sales peaked at 4.7B and stayed around the $4.5B mark till the COVID years of FY2022. Michael Kors has been reducing the number of wholesale doors from 4038 in FY 2015 to 2742 in FY2022 in an effort to reduce supply. In FY 2020 Capri started to close retail doors because of COVID which combined with negative same-store sales dropped total sales to its lowest figure in FY2021. FY2021 looks to be the bottom however as retail doors increased into FY2022 and Capri is forecasting growth for the brand to the $5B mark.

|

Michael Kors Sales and Door Figures |

||||||||

|

Fiscal Year |

2022 |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

|

Sales( In Billions) |

$3.9B |

$2.9B |

$4.1B |

$4.5B |

$4.5B |

$4.5B |

$4.5B |

$4.7B |

|

Wholesale Doors |

2742 |

2852 |

2982 |

3202 |

3544 |

3607 |

3889 |

4038 |

|

Retail Doors |

825 |

820 |

839 |

853 |

829 |

827 |

668 |

526 |

Source: Table created by author data collected from company 10-Ks.

Where will this growth come from? A large untapped opportunity for the Group is Asia. Currently, Capri only receives 16% of sales from Asia. This is quite low compared to competitors. For example Tapestry & Moncler (OTCPK:MONRF) (OTCPK:MONRY) have 33% & 27% of sales coming from Asia. In Capri’s recent 10-K they mentioned that they planned to double Michael Kors revenue in Asia and focus on expanding Versace and Jimmy Choo’s Market share in Asia.

Another area of growth will be through acquisitions. The luxury goods market is still rather fragmented. This gives Capri numerous options to acquire other brands into their portfolio. Capri has shown they can manage acquisitions quite well, growing both Versace and Jimmy Choo in terms of revenue and profitability. Both acquisitions were purchased at a 2.5 times revenue multiple. This is reasonable for a luxury goods company, especially with the potential growth the businesses have.

Capri’s recent Q1 2022 report shows managements continually execution of their growth strategy. As mentioned Versace was up 15% YOY with Jimmy Choo and Michael Kors being up 21% and 5% YOY or 30% and 9% YOY in constant currency.

Margins

The Michael Kors brand won’t grow as fast as Versace or Jimmy Choo but it’s currently the most profitable segment. Margins have generally increased for every brand and management is targeting future margin increases for both Jimmy Choo and Versace with Michael Kors maintaining their current margins.

|

Operating Margins by Brand |

|||||

|

Year |

FY 2022 |

FY 2021 |

FY 2020 |

FY 2019 |

|

|

Michael Kors |

25% |

25.4% |

20.3% |

20.5% |

21.4% |

|

Jimmy Choo |

15% |

2.1% |

-13.2% |

-2.3% |

3.4% |

|

Versace |

20% |

17% |

2.9% |

-.9% |

-8% |

Source: Table created by author data collected from Capri’s 2022 Investor day

These targeted margin gains for both Jimmy Choo and Versace are definitely possible. Back before 2016, Michael Kors was a fast-growing luxury brand. We can look at how Michael Kors developed to see how realistic Capri’s projections are for the two growth brands. It took 5 years to grow Michael Kors from $377 Million in revenue to over $2 Billion. In those five years margins grew from 6% in 2009 to over 30% by 2013. This shows that it’s not only possible for Versace and Jimmy Choo to achieve their margin targets but they could even exceed them.

|

Year |

FY 2013 |

FY 2012 |

FY 2011 |

FY 2010 |

FY 2009 |

|

Revenue (In Billions) |

$2.094B |

$1.237B |

$.757B |

$.483B |

$.377B |

|

Operating Margin |

30% |

20% |

18% |

11% |

6% |

Source: Table created by author data collected from company 10-Ks.

Another way management could improve margins is to vertically integrate. Most of the manufacturing of Capri’s products are outsourced to third parties. This gives up some margin to the manufacturer. Capri’s plans for the future are to buy manufacturing facilities in Italy for all three brands.

Through growing Versace and Jimmy Choo and vertical integration of the manufacturing process, Capri is poised to increase margins.

Risks

The four main risks for Capri I see are the Michael Kors brand, Margins, China, and Acquisitions.

Michael Kors

The Michael Kors brand represents a majority of Capri’s Revenue and profits. Since 2017 the brand has been struggling to grow and profitability was declining. Looking at Google Trends data as a measure of brand value Michael Kors has yet to recover from 2017 highs.

Source: Google Trends

Management is forecasting that the Michael Kors brand should get up to 5B in revenue and maintain current margins. I think it’s still too early to tell if management can get the brand back to where it was and this is the biggest risk.

Margins

Capri’s current operating margins are the highest they have been in some time. This could be a cause of concern for investors as they could revert back to pre-COVID margins. For the brands Versace and Jimmy Choo I think a reverting of margins is highly unlikely as they are set to grow and as they grow, higher sales leverage should increase profitability. However, for the Michael Kors brand mean reversion could be more likely as profitability was 20% back in 2019 compared to their current 25% operating margins.

China

China has become more hostile towards Taiwan since Nancy Pelosi’s visit on August 5th. China is a very large and important part of the luxury market as a whole and will represent over 40% of the market by 2025. If China pulled Russia on Taiwan and the west sanctioned China in a similar manner to Russia the luxury market would be greatly affected. I have no idea how likely this would be. Capri has a lower percentage of sales coming from Asia than most Luxury companies so they would be more insulated relative to other Luxury companies. However, Capri’s growth plans are heavily reliant on China.

Acquisitions

After Versace and Jimmy Choo achieve their growth targets, acquisitions will become the most likely route for growth. Jimmy Choo was acquired for around $1.2B and Versace for around $2.2B. Both acquisitions were large in proportion to Capri’s revenue. Capri’s management seems to prefer larger, more transformative acquisitions. Transformative acquisitions have a higher failure rate and are more costly when they fail compared to tuck-in acquisitions. This introduces extra risk to the company. So far Capri has been doing well with their acquired brands which inspires confidence in future acquisitions.

Expected Return

At the current share price, my base case expects a 20% annualized return over 5 years. I also present a best and worst case.

|

Worst Case |

Base Case |

Best Case |

|||

|

Current Share Price |

$50 |

Current Share Price |

$50 |

Current Share Price |

$50 |

|

5 Year Revenue Target |

$6.3B |

5 Year Revenue Target |

$7B |

5 Year Revenue Target |

$8B |

|

5 Year FCF Margin |

15% |

5 Year FCF Margin |

17% |

5 Year FCF Margin |

19% |

|

FCF Per Share 2027 |

$6.60 |

FCF Per Share 2027 |

$8.32 |

FCF Per Share 2027 |

$10.63 |

|

Estimated FCF Multiple |

12 |

Estimated FCF Multiple |

16 |

Estimated FCF Multiple |

20 |

|

2027 Share Price Target |

$79 |

2027 Share Price Target |

$133 |

2027 Share Price Target |

$212 |

|

5 Year CAGR Return |

8% |

5 Year CAGR Return |

20% |

5 Year CAGR Return |

32% |

Best Case

My best case assumes management will execute their growth plans of $5B in revenue for Michael Kors, $2B for Versace, and $1B for Jimmy Choo. The blended FCF margin management is projected at 19%. I assume a 20 times multiple as this is a multiple many of their peers in the luxury space are trading at. If all these are achieved at the current price you’ll receive an amazing return of 32% annualized. This does not include any buybacks which could magnify these returns further.

Base Case

For my base case, I assume Michael Kors brand can only achieve pre COVID sales of $4.5B and the other two brands grow slower than expected with a combined $2.7B in sales. I also assume Michael Kors margin reverts to pre COVID of 21% but the other brands maintain the same margins as the best case. This brings down the margin to 17%. I assume a multiple of 16 times FCF as this is an average multiple for a company that can grow around 3%. If all these are achieved at the current price you’ll receive a very good return of 20% annualized.

Worst Case

For my worst case. I assume Michael Kors can’t grow sales from their current $4B mark and margins decline further than pre COVID to 19%. I also assume the other brands grow even slower amassing $2.3B in sales with lower margins than management projected. This gives a blended FCF margin of 15%. I assume a multiple of 12 which is a low to no growth multiple. If all these assumptions come to pass at the current price you’ll receive an average return of 8% annualized. Considering the average return this seems to be the scenario the market is currently pricing in if you assume the average investor desires an 8% return. This seems to be too pessimistic.

Conclusion

To conclude, my base case at the current stock price is projecting a great 20% annualized return. Capri is in a growing market with strong brands that are set to grow in the future.

Be the first to comment