JHVEPhoto/iStock Editorial via Getty Images

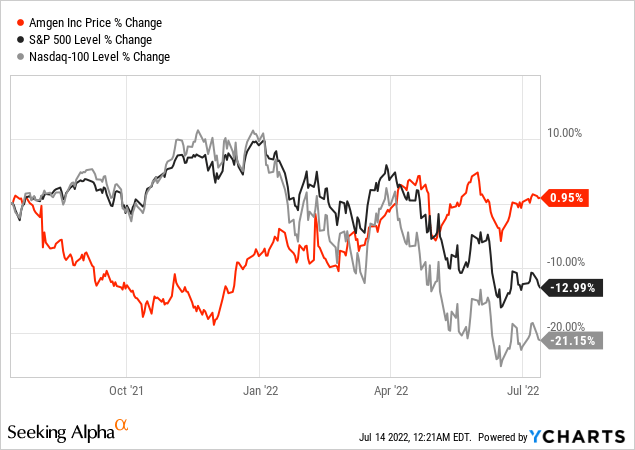

When trying to invest in the current environment – the stock market already in a bear market combined with a looming recession in the United States – it is especially important to find recession-proof companies and stocks to invest in. And when looking at Amgen Inc. (NASDAQ:AMGN) over the last year, the stock actually increased 0.95% and it clearly outperformed the U.S. stock market.

In the next few quarters, it is not so important to find businesses that can deliver high growth over the short term, but rather identify stocks that may help us to protect our investment. Having a portfolio that is stable is a great achievement during a bear market. And Amgen is certainly a candidate as we can expect the business to perform stable in case of a recession and the stock is also trading for reasonable valuation multiples which is limiting the downside risk.

Quarterly Results

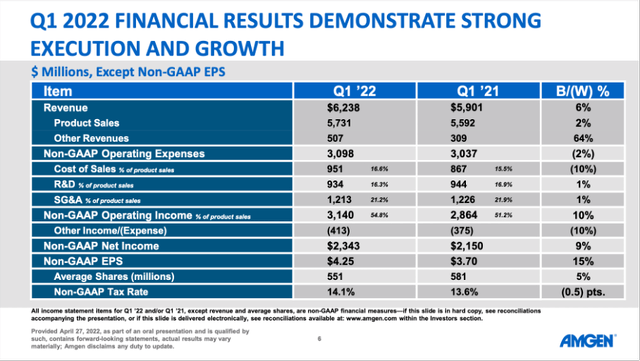

When looking at the quarterly results for the first quarter of fiscal 2022, we see a solid performance for Amgen. Total revenue increased from $5,901 million in Q1/21 to $6,238 million in Q1/22 – resulting in 5.7% year-over-year growth. Operating income could also increase 17.4% year-over-year from $2,129 million in the same quarter last year to $2,500 million this quarter. And while operating income increased, diluted earnings per share declined from $2.83 to $2.68 – resulting in 5.3% year-over-year decline. And finally, free cash flow increased slightly from $1,938 million in Q1/21 to $1,974 million in Q1/22 – reflecting 1.9% year-over-year growth.

Growth

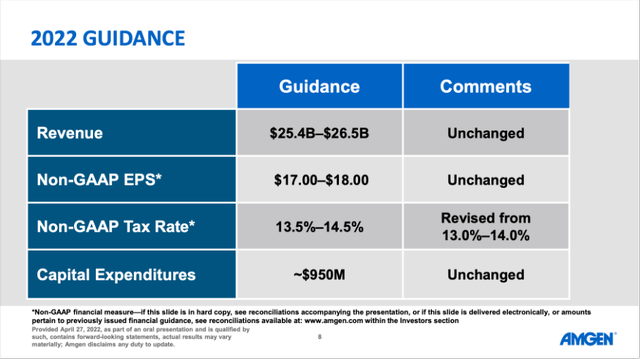

When looking at the guidance for fiscal 2022, management is expecting sales to be more or less stable with revenue in a range between $25.4 billion and $26.5 billion. Earnings per share on a GAAP basis however are expected to grow between 20% and 30% year-over-year to a range of $12.53 to $13.58. Non-GAAP earnings per share on the other hand are expected to be in a range of $17.00 to $18.00 and compared to $17.10 in fiscal 2021 this would result in low-single digit growth rates.

However, as long-term investors we are not so much interested in the performance of the next few quarters, but rather the next few years.

Revenue Growth

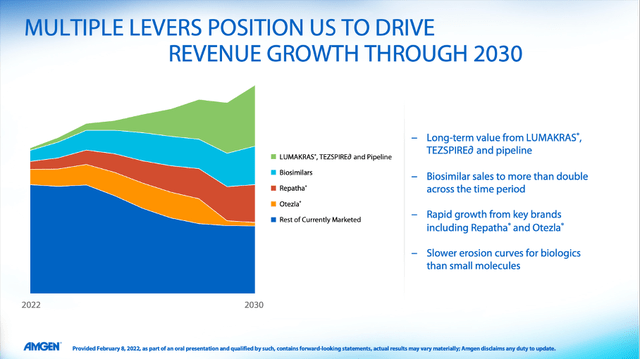

First and foremost, Amgen can grow by increasing its revenue and when talking about revenue growth the company is mentioning several different aspects.

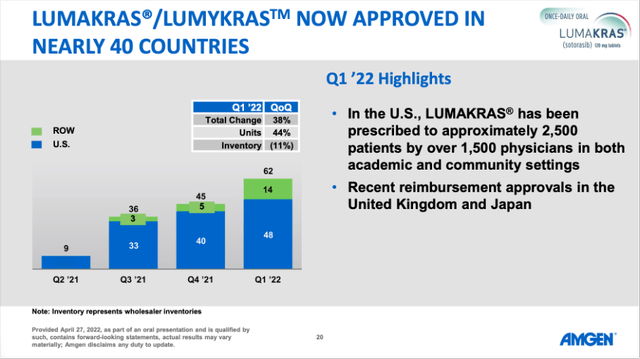

Amgen Business Review Meeting Presentation

We can start by looking at Amgen’s biosimilar portfolio which is expected to more than double in the years until 2030 and this will certainly contribute to top line growth in the coming years. Additionally, Amgen has high hopes for LUMAKRAS which was launched about a year ago and is now approved in nearly 40 countries with additional regulatory reviews under way. In the first quarter of fiscal 2022 it generated sales of $62 million and the trailing twelve months sales are $152 million. While we can be optimistic about LUMAKRAS reaching blockbuster status, there are already some warning signs about growth rates slowing down (see here and here).

And not only recently launched products can contribute to growth. Although Otezla sales declined a bit year-over-year (primarily driven by a lower net selling price), Amgen is optimistic about continued growth for Otezla as well as Repatha. And when talking about revenue growth we also must look at patent expiration dates as they usually lead to declining revenues. However, Otezla is patent protected until 2028 in the United States (composition and compounds patent) and Repatha is patent protected until 2029 in the United States (for antibodies) and until 2028 in Europe (for compositions).

When talking about growth it is also important that current top performing products will continue to generate high amounts of revenue in the years to come. And we should especially look at Prolia which lost patent protection recently in the European Union and will lose patent protection in the United States in 2025. Aside from Prolia, we should also mention Enbrel, which generated $4.4 billion in sales in fiscal 2021 (and is therefore responsible for a large part of revenue). But Enbrel is keeping important patents (for DNA encoding fusion protein and methods of making fusion protein) until 2029.

Share Buybacks

When talking about ways to grow, we must mention share buybacks again as they are an important instrument for Amgen. During the last bull market, many companies used share buybacks, but Amgen spent a lot of money on share buybacks in the last ten years and decreased the number of outstanding shares by 29.63%. This resulted in a CAGR of 3.45% in the last ten years and it is certainly a way for Amgen to continue growing.

And management will continue to use share buybacks as an important capital allocation tool. In fiscal 2022, Amgen will spend between $6.0 billion and $7.0 billion on share repurchases. Considering a market capitalization of $130 billion it is enough to repurchase about 5% of the outstanding shares this year and will make a meaningful contribution to bottom line growth.

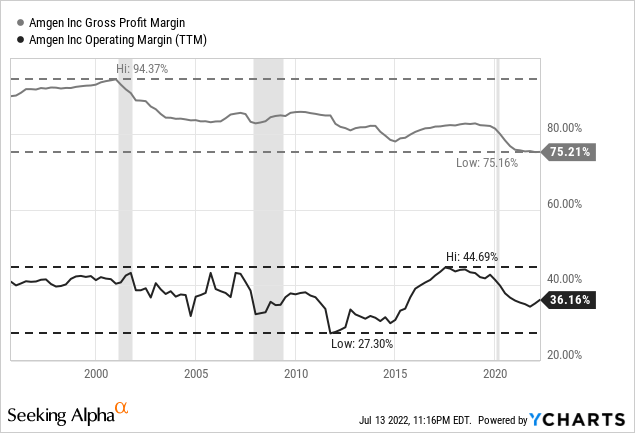

Improving Margins

A final way to grow in the coming years is by margin improvements. However, I don’t think Amgen will be able to increase its margins in the years to come. When looking at past data, we can see a more or less stable operating margin that is fluctuating a bit over time but is giving us no hints that Amgen might be able to improve margins. And the gross margin declined over the last few decades, which is not surprising when considering a gross margin of 94% in the early 2000s which is almost impossible to maintain. A gross margin of 75% is still extremely high and most businesses won’t ever be able to achieve similar margins.

But Amgen does not need improving margins as growth from increasing revenue and share buybacks is more than enough.

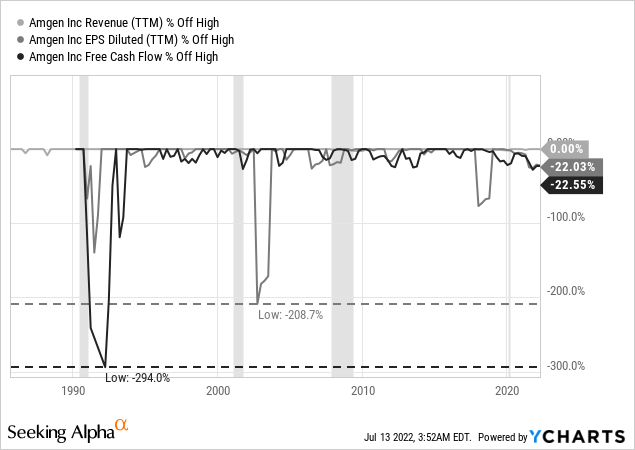

Recession

I already mentioned above that Amgen is a good pick for a potential recession as healthcare companies are usually very stable performers in case of a recession. This is not surprising, as people also get sick during economic downturns – and considering the mental stress during an economic downturn due to job loss, assets declining in value or potential home losses, people might get even more sick.

And when looking at data since the 1980s, we can see that revenue almost never declined – not even in case of a recession. And although we can’t state the same for earnings per share or free cash flow, it becomes obvious that Amgen is performing pretty well during recessions. Small fluctuations in free cash flow occurred all the time and not just during recessions. While we can’t claim that Amgen is able to increase revenue, EPS and FCF every single year, we also should not assume the next recession to have a huge negative effect on Amgen.

Intrinsic Value Calculation

When calculating an intrinsic value for Amgen, we can use a discount cash flow calculation and as basis we can use the free cash flow of fiscal 2021, which was $8.4 billion. The next step is usually to determine realistic growth rates for the years to come and to be honest I would not calculate with a lower growth rate than 3% for Amgen, which the company can achieve solely by share buybacks.

Of course, Amgen needs similarly high levels of free cash flow to continue buying back shares. And free cash flow is only generated when Amgen is continuing to launch new and successful products to the market. When looking at analysts’ estimates, we can see an expected growth rate of 2.7% until fiscal 2031. And while that growth rate is ridiculously low in my opinion (especially when considering past growth rates), it would lead to an intrinsic value of $217.79 for Amgen and the stock would be almost fairly valued (assuming 10% discount rate).

While this might be our bear case scenario, we can be a little more optimistic (and probably also realistic) and assume about 5% annual growth (stemming from revenue growth and share buybacks). When calculating with 5% annual growth instead, we get an intrinsic value of $304.90, and Amgen seems undervalued right now.

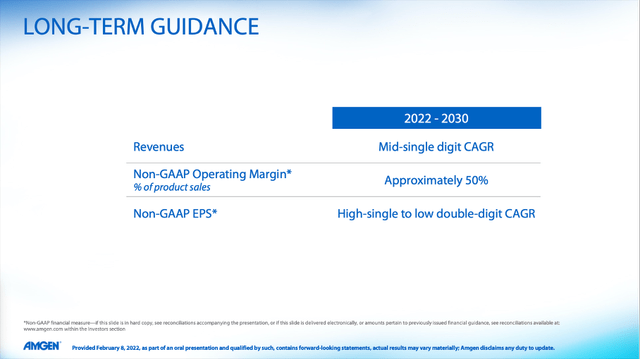

And aside from this base case scenario, we can also be more optimistic and calculate a bull case scenario. During its last “Business Review Meeting,” the company issued a long-term guidance, and not only is management expecting revenue to grow in the mid-single digits for the years until 2030, but it is also expecting non-GAAP earnings per share to grow in the high-single to low double-digits.

Amgen Business Review Meeting Presentation

When calculating with these assumptions (let’s still be cautious and calculate only with high-single digit growth rates of 9% for the years until 2030 followed by 6% growth till perpetuity) we would get an intrinsic value of $461.68. Amgen would truly be a bargain at this point.

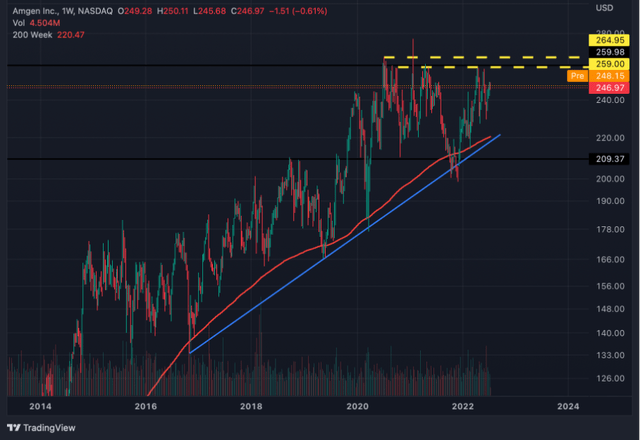

Technical Picture

We can also look at the technical picture a bit and while Amgen was moving in kind of an upward channel in the last few years, we can also describe the picture as messy. While many other stocks saw impulsive upward waves in the last few years, Amgen could also double in value since 2016 but the stock price moved back and forth and corrected very often. Since 2016, the 200-week simple moving average was basically the support line for Amgen’s stock.

On the upside, we have a resistance level between $260 and $265, which is in place since 2020. It seems possible that Amgen might break out above $260 and that a bullish impulsive wave might follow. But it also remains possible that Amgen will move in a similar way upward as in the last few years and we see small bullish waves followed by similar steep corrections. And we can assume that the blue trendline as well as the 200-week simple moving average (red line) will be support levels.

Conclusion

Even when acknowledging the difficulties to estimate revenues for pharmaceutical companies in the years to come and even when not sharing the optimism of Amgen’s management about double-digit EPS growth in the years to come, Amgen seems to be undervalued.

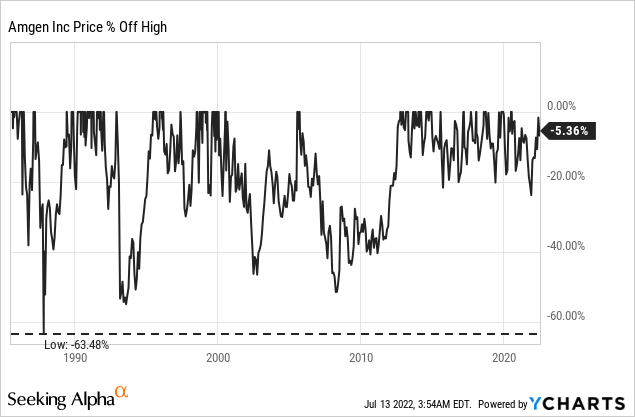

And when considering that Amgen is rather recession proof, it could be one of the better picks for the next few years, which will not be about spectacular growth, but rather about protecting capital and not getting destroyed by a brutal bear market. However, we should still be prepared losing 40% to 50% during a bear market – similar to past bear markets. Amgen seems undervalued right now, but steep drawdowns during bear markets are always a possibility.

Be the first to comment