J Studios/DigitalVision via Getty Images

When I first covered Canoo (NASDAQ:GOEV) at the start of 2021, the company was facing a future characterised by pertinently rising consumer EV demand and fervent investor enthusiasm toward EV upstarts going public. Indeed, the months that followed the initial shock of the pandemic saw what had been a trickle of EV companies going public turn into a gush of pre-revenue EV producers with little more than CGI images of their flagships and pie-in-the-sky financial projections. Canoo was able to raise $600 million of gross proceeds on the back of this, a SPAC-induced bubble that has now burst along with the collapse of growth stocks and the broader stock market.

Since this time, the world has changed dramatically with multi-decade inflation, outlandish energy prices, and a hawkish FED all but guaranteeing the United States falls into a recession. For Canoo this could not have come at a worse time. A declining stock market and negative economic growth do not present the best conditions for tapping the capital markets to plug a liquidity gap. Hence, when Canoo released its fiscal 2022 earnings reports, it soberly stated that substantial doubt exists about its ability to continue as a going concern.

Can Canoo Raise Enough Funds To Bring Its EVs To Market?

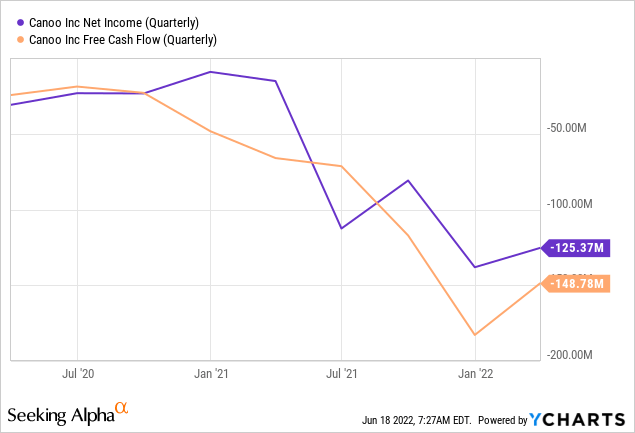

Canoo has stated that it has adequate access to the funds required for it to remain a going concern for at least 6 months to a year. The company last released its earnings result for its fiscal 2022 first quarter which saw total operating expenses come in at $140.8 million, up from $97.1 million in the year-ago quarter. Net loss at $125.4 million was also up from its year-ago figure.

The company’s free cash flow for the quarter was negative at $148.8 million, also up significantly from its year-ago period. This is to be expected as Canoo starts to ramp production to meet its preorders and growing pipeline. The company announced total preorders were at 17,500 with a projected value of $750 million. Canoo is moving to start the production of its $34,750 Lifestyle Vehicle this year, with other models following soon after. Whilst initial plans were to accomplish this through VDL Nedcar, a Netherlands-based contract manufacturer, management has now opted instead for onshoring production.

Cash and equivalents as of the end of the last reported quarter came in at $104.9 million, sequentially down from $231.8 in the previous quarter. The current rate of cash burn against this liquidity position would essentially mean the company would likely not have enough money to last another full quarter. This is as guidance for the fiscal 2022 second quarter put operating expenses at $95 million to $115 million with capital expenditures of $85 million to $105 million. However, Canoo has been able to raise $50M in a private placement offering with entities affiliated with its CEO. This was through the sale of 13,698,630 shares at a price of $3.65 each.

Further, Canoo stated that it has access to $600 million in accessible capital to support its Start of Production. This is from a new $300 million PIPE and a $300 million universal shelf. The company is targeting production volumes of 3,000 to 6,000 vehicles in 2022, increasing to 14,000 to 17,000 vehicles in 2023, and then 40,000 to 50,000 vehicles in 2024.

Where Is Canoo Going?

If Canoo is able to survive the coming storm, then the company should be able to ride the wave of electrification as the USA goes through a structural shift to zero-emission vehicles on the back of the need to reduce dependence on fossil fuels to address climate change. This shift is also set to ramp up as charging infrastructure develops and more state and federal government support for EVs is rolled out.

That Canoo is now fighting for its life against a rising wave of EV demand is a sad consequence of the collapse of the stock market over the last few months. It really should not have been this way, the transition to EVs has important consequences for our planet. Canoo, for all its faults, does not deserve this now precarious situation of raising cash in a market where liquidity is evaporating on an almost daily basis. To go bankrupt now, so early into the transition, would be brutal.

Making cars is hard. It is also really expensive, takes a long time and requires a deep pool of liquidity. To do so as a startup with capital market conditions as deteriorated as they are is a Sisyphean undertaking. Canoo might be able to survive though. Being able to pull itself from the brink would place it back on a path to fully realising the opportunities posed by the generational shift to EVs.

Be the first to comment