SolStock/E+ via Getty Images

Happy Independence Day! People around the USA are firing up grills relishing the chance to sit down and relax with friends and family, though the cost of a typical 4th of July cookout is higher than ever in 2022. Still, nothing beats a hot dog, beverage, and fireworks. The stock of the day might be one of the most popular hot dog companies around – Nathans’ Famous.

According to CFRA, Nathan’s Famous (NASDAQ:NATH) together with its subsidiaries, operates in the foodservice industry. The company owns and franchises restaurants under the Nathan’s Famous brand name, as well as sells products bearing the Nathan’s Famous trademarks through various channels of distribution.

It is a $240 million market cap Consumer Discretionary stock headquartered in Jericho, NY. Of course, it is featured annually on the 4th of July as competitive eaters from around the world gather in Coney Island, NY to take down as many hot dogs and buns as possible in 10 minutes.

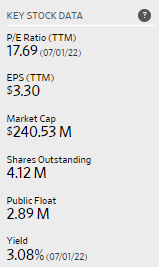

How’s the stock look, though? Is it one you should put in your portfolio? Well, it trades at a reasonable price-to-earnings ratio of 17.7x last year’s earnings, according to The Wall Street Journal. Nathan’s also pays a solid 3.1% dividend yield.

Nathan’s Famous: A Small-Cap With A High Yield

WSJ

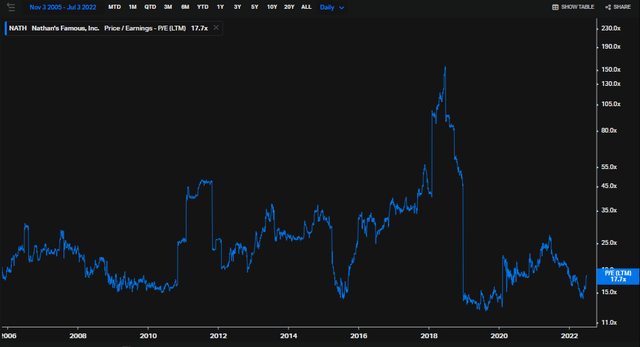

Historically, about 18x last year’s operating profits is a decent valuation on NATH. Consider that it traded considerably above that valuation for much of the last 15 years, according to data from Koyfin charts.

Nathan’s Trades Somewhat Cheap vs the Long-Term Average

Koyfin

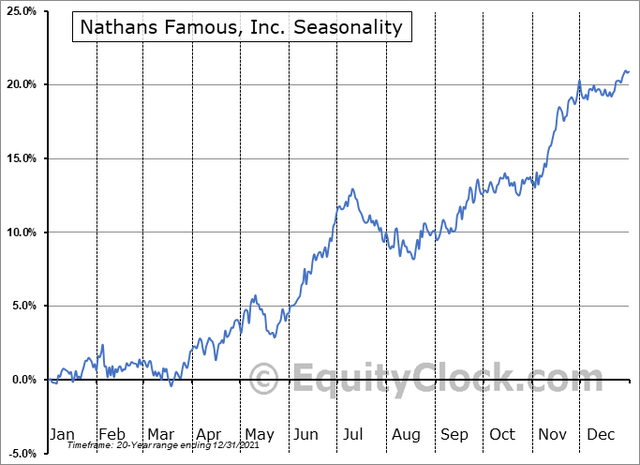

Funny enough, NATH stock tends to peak in early July each year, shortly after the bell rings to wrap up the hot dog eating contest, according to the seasonal chart below from Equity Clock. Looking ahead on the corporate event calendar, NATH has an unconfirmed earnings report slated for Friday, August 5, before the open, according to Wall Street Horizon.

4th of July: A Seasonal Peak?

Equity Clock

The Technical Take

NATH is on the rebound after touching support around $46. On the upside, there’s a broad resistance area from $73 to $80. So, the stock is trendless right now, but you can play the range by adding NATH to your portfolio plate in the upper-$40s and selling shares in the $70s. Also consider bearish seasonal trends now through mid-August before a late-year rally, on average.

On the bullish side of the ledger, the stock did grill the bears by breaking out from a downtrend off the highs a year ago. It’s definitely a mixed technical picture.

NATH Stock: Mixed Technicals, Leaning Bullish

Stockcharts.com

The Bottom Line

Given a breakout from a downtrend and shares that are reasonably priced, I think NATH could rally from here. Also, consider the stock has a yield above 3%. Profits should be taken should shares reach into the $70s while a stop below about $55 is prudent – you can then re-enter the hot dog trade in the $40s.

Be the first to comment