dan_prat

Investment thesis

The recent pullback in oil prices provides an opportunity to further position for what is still a very tight global oil supply/demand environment. I personally favor Canadian oil sands, with Suncor (SU) being by far the biggest stock position in my portfolio. I recently bought some Canadian Natural Resources (NYSE:CNQ) stock after I sold some Suncor stock near recent highs. The pullback provides an opportunity to re-position by buying more oil stocks in expectation of a next step up in oil prices going into the fourth quarter of this year and beyond. With the reduction of my position in Suncor and buying CNQ stock, I am still maintaining the same level of stock exposure to the oil & gas sector, but I am gaining some diversification, which is part of my new long-term investment strategy starting this year.

CNQ financial results and profile

It goes without saying that the most important factor that will affect the value of CNQ stock going forward is the oil price outlook. Having said that, it is very important to be invested in the right stock that provides the best-perceived risk-reward option for investors, based on one’s goals and expectations.

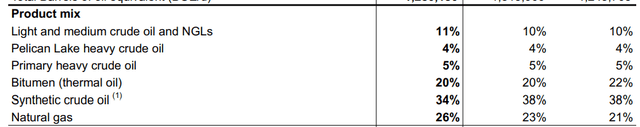

For the first quarter of this year net earnings came in at $3.1 billion, which was a healthy increase compared with the same quarter a year ago of $1.34 billion. Revenues came in at $12.1 billion, which suggests a healthy profit margin within the current context. Total production of oil gas, NGLs came in at 1.28 mb/d equivalent, which was an improvement of just .03 mb/d compared with the same period from a year earlier. I should mention that this is not a pure oil sands company by any means, given that 26% of its production is natural gas, and a sizable portion of its liquids production is not oil sands-related.

CNQ’s midstream and downstream revenue came in at $269 million for the quarter. Unlike Suncor, it does not have a very robust presence outside of the upstream segment. In theory, this should make the stock a little bit more volatile comparatively speaking, moving in tandem with oil & gas prices to a greater degree than Suncor.

It should also be noted that CNQ’s natural gas share of its upstream segment is significantly higher than that of Suncor. This makes for an intriguing case in favor of CNQ, given the global natural gas supply situation, especially centering around the energy divorce that Russia and the EU are going through. The North American market is going through a process of tying itself to the EU market through LNG exports. Other producing regions are seeing a similar trend, while EU natural gas prices are set to remain very high for the foreseeable future, meaning that there will be some convergence in prices happening, which should benefit gas producers this decade.

For most of the last decade, natural gas production was seen as a bit of a liability for oil & gas producers around the world, but especially in North America, where prices remained very low throughout the period. We are seeing a fundamental change happening, and I don’t believe that the market has caught on just yet.

The global oil market outlook suggests we may be destined to experience constant scarcity for the foreseeable future. Canadian oil sands producers are among the last few companies on earth where there can still be significant sustained supply growth.

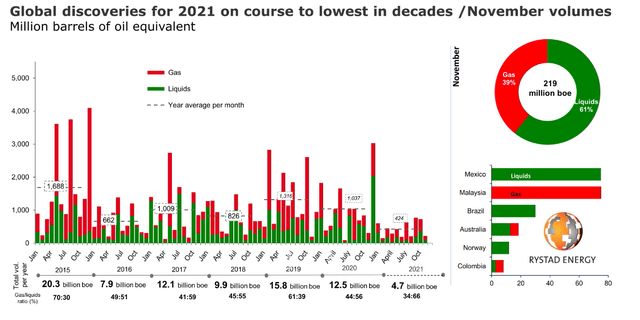

As I pointed out on many previous occasions, perhaps the most relevant chart out there, which is poised to affect us all directly or indirectly this decade is the Rystad global oil & gas discoveries chart, which suggests that last year the world discovered about 5 billion barrels of conventional oil-equivalent, while we produced and consumed about 45 billion barrels of oil equivalent.

The trend we are seeing did not just happen. The world failed to discover as much conventional oil & gas every year this century except for two years It is also not an issue of investment, but rather one of geology. The global oil industry is actually spending about twice as much on its upstream as it did at the beginning of the century, as I pointed out in a recent article. We have been drawing down excess discoveries from the second half of the last century, and the industry has been working hard to enhance recovery rates from existing fields. This helped to prevent global conventional oil & gas production from declining, but continued production growth is now out of the question. We will be lucky to see a very long production plateau.

The unconventional boom of the last decade provided us the last ten years of normalcy, without which the world would have entered a scarcity crisis about a decade ago. With the shale industry that provided the bulk of global unconventional oil & gas supplies last decade, now showing signs of stagnation, Canadian oil sands are increasingly the only game left in terms of global oil production increase prospects. That is not to say that there won’t be some bright spots along the way in the global conventional oil & gas industry. It is just that it will at most be just enough to offset declines in production elsewhere. All this adds up to a rough global supply/demand scenario. It is arguably a bright outlook for Canadian oil sands producers, who are sitting on generous reserves, that only a few years ago much of the investment community seemed to have dismissed as stranded assets.

Investment implications

As a somewhat conservative, cautious investor, I still prefer Suncor stock, due to a more balanced upstream-downstream ratio, which should protect the stock price from extreme swings, within a very volatile industry. At the same time, CNQ probably has more upside potential in the event that oil & gas prices see further upside from current levels. I am personally most interested in having oil sands exposure when it comes to my energy company investments. Adding CNQ to my already substantial position in Suncor stock does not offer me diversification in this regard, but it does offer some protection from company-specific issues that can always arise with any company that might affect its stock price.

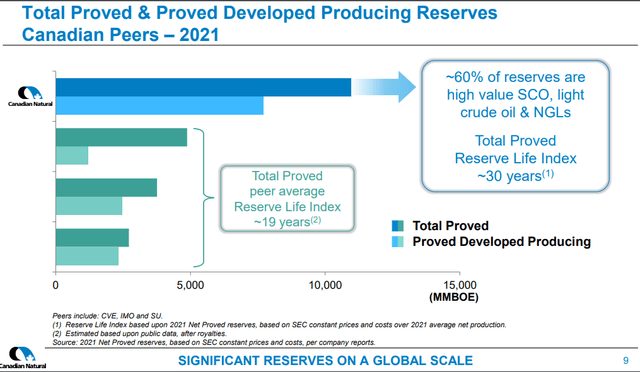

I am most interested in exposure to oil sands within the oil & gas industry because these companies offer something that contrary to market sentiment, I value, namely reserve life as an asset, and I believe that the market will soon come around to this reality as well.

CNQ’s upstream reserves are comparable with Suncor’s in terms of reserve life. In this regard, they are both about as attractive, even though there are some fundamental differences in terms of reserves, such as the conventional to unconventional mix, or the oil versus gas differences. In this regard, I feel that the market is slightly underestimating the long-term value of that natural gas. Global natural gas demand is likely to see much more robust demand growth compared with oil, given its bridge fuel status when it comes to global efforts to reduce emissions. In this regard, CNQ may have an advantage over Suncor. On balance, in the absence of extreme company-specific issues intervening going forward, both stocks should perform rather well. Being invested in both provides some protection from unforeseen company-specific issues.

As far as risk factors, not only to CNQ but also to the entire Canadian mining industry, the main issue I see becoming a potential negative, stems from green initiatives that the Canadian government is pursuing. The oil & gas industry is expected to cut emissions by 40% from 2005 levels by 2030. Most people rightly point out the fact that it would have a devastating effect on the industry. My take on it is that Canada’s many past emissions targets were missed in the past decades. This time it will be no different. Its reliance on commodities extraction, combined with high demographic growth rates driven by its immigration policies, makes it impossible to meet the goals it proposed. At some point, there will be an admission to the situation by the political elites, as was done in the past. The alternative of inflicting the kind of severe economic pain that such drastic cuts in emissions would entail is unthinkable. So my take is that the Canadian oil & gas industry will get a pass.

I should also point out that pressures to continue to allow the Canadian oil industry to expand production will likely come from the international arena. With global conventional oil production facing stagnation at best, the US shale industry showing signs of maturing and perhaps stagnating, we can hardly afford the Canadian oil sands sector to start shrinking as well. Contrary to peak oil demand forecasts of the past decade or so, there is to date no sign that global oil demand is ready to peak. Any recent pullbacks have been the result of recessions. In conclusion, the Canadian oil sands industry will continue to thrive, because the world needs it too. CNQ has the reserves and the proven financial performance to be considered as one of the potential winners within the current global energy supply context.

Be the first to comment