imamember/iStock via Getty Images

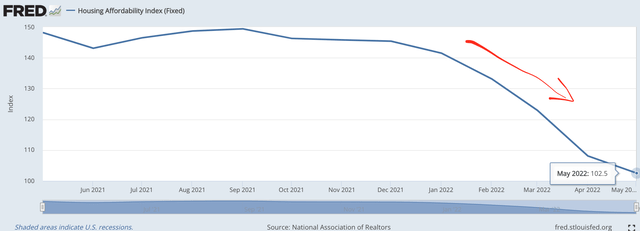

We recently experienced the highest inflation rate since 1981 and thus the Fed is forecasted to slam on the breaks by raising interest rates. Higher interest rates increase mortgage payments and thus affect the affordability of houses to buy. We can see from the chart below the affordability of houses has fell off a cliff since the first quarter of 2022.

House Affordability Index (Fred Economics)

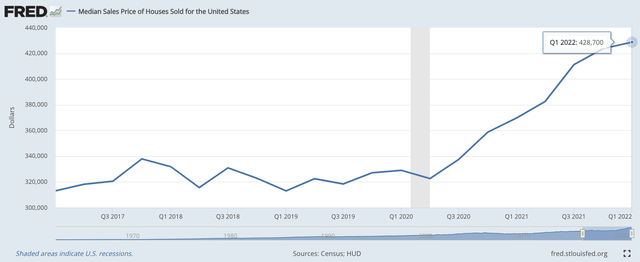

This affordability index is also been driven by rising housing prices, which have been rising faster than the average household income. The Median Sale price for houses sold in the US was a staggering $428,700 in the first quarter of 2022, this is a substantial 33% uptick from the levels seen in Q2 of 2020.

US House Prices (Fred Economics)

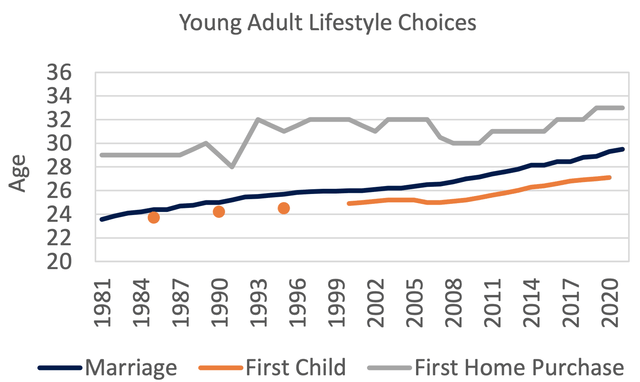

The lack of affordability in housing and many lifestyle changes has caused a drop off in house sales and a surge in those renting. According to a recent study, over one third (35%) of US households rent their homes, with 43 million homes rented. One third of these tenants (34.5%) are under the age of 35, these have been called “Generation Rent”. This younger demographic is getting married, having children, and buying houses much later than prior generations, as you can see from the chart below.

Lifestyle choices (Written Advisors)

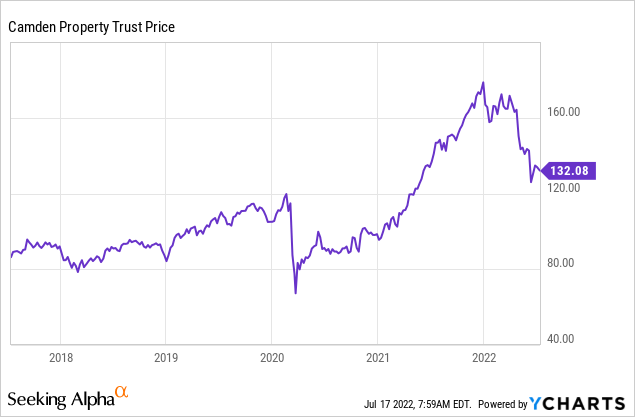

Thus it’s no surprise the US has a record number of single people with 4 out of 10 adults between 25 and 54 not married or living with a partner, up by 30% since 1990. These single people don’t normally require large suburban four/five bedroom homes. Instead, they prefer rental apartments in city locations with greater flexibility. Thus, to ride this secular shift towards apartment rentals, let’s dive into Camden Property Trust one of the largest publicly-traded multifamily REITs in the United States. The stock price has recently pulled back substantially down 23% from the highs in April 2022. The stock is now fairly valued relative to competitors in the industry with high occupancy rates and strong tailwinds. Let’s dive into the Business Model, Financials and Valuation for the juicy details.

Business Model

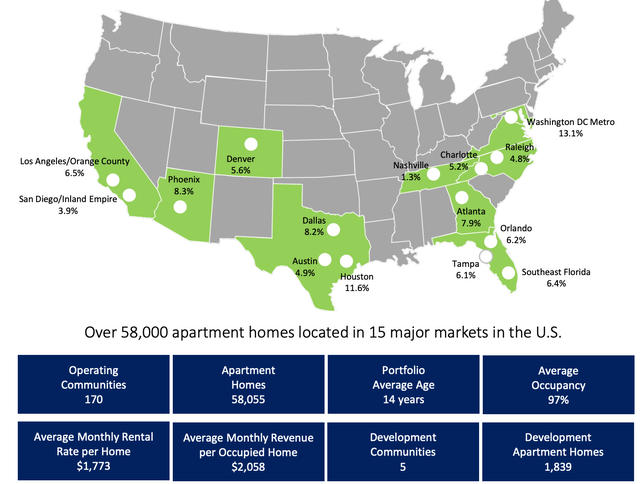

Camden Property Trust owns and operates over 170 properties, which contain over 58,000 apartments across the USA.

Camden Property Trust (investor relations)

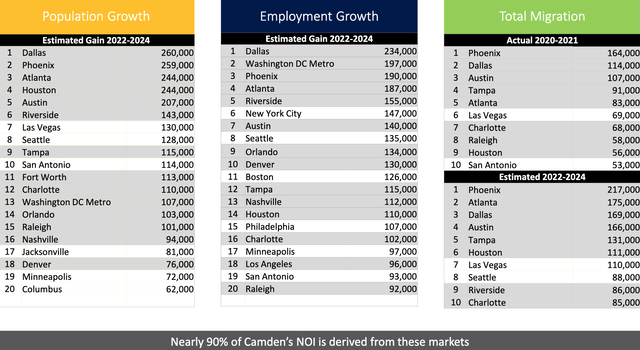

Camden has properties based across 15 markets, with ~90% of its net operating income derived from markets with the highest migration, employment, and population growth. From the chart below it’s clear to see that Dallas, Texas is expected to have the highest population growth of 260,000 people over the next couple of years. This is driven by trends such as remote working and the “Leaving California” movement, due to the high taxes and cost of living in the state. The bureaucracy and high business taxes of California have also caused a swath of businesses to move to Texas and Arizona; for example Elon Musk moved Tesla’s HQ to Texas just last year. As you can see from the chart below employment growth is expected to be 234,000 over the next couple of years in Dallas, where approximately 8.2% of CPT’s apartments are based.

Housing Trends Camden (Investor relations)

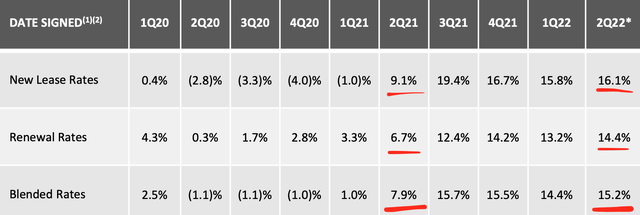

Camden’s properties are well diversified across Urban (40%) and Suburban (60%) apartment units. Its properties are also diversified across the type with 60% low rise, 28% mid rise, 9% high rise and 3% mixed. This diversification ensures the company has a product portfolio which is appealing to various demographics. Its 97.1% occupancy rate is best in class and well above the ~95% average for the apartment rental industry. CPT is expecting a major boost in New Lease Rates, with 16.1% forecasted for the second quarter 2022, up from 9.1% in the prior year’s quarter. Renewal Rates are also expected to reach a record high of 14.4% in Q2’22, up from 6.7% in prior quarter.

Renewal Rates (Investor presentation)

Growing Financials

Camden Properties Trust generated strong financials for the first quarter of 2022. Net Operating Income was $201 million, up 21% from the $166 million achieved in the first quarter of 2021. Adjusted EBITDA also jumped to $183 million, up 26% from $145 million in the equivalent quarter last year.

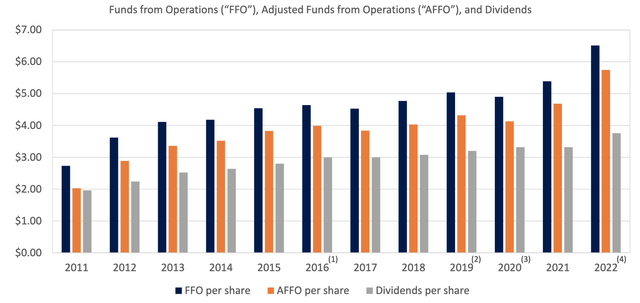

Funds From Operations (Q122 Earnings report)

Funds from operations per share (FFO) has been on an upwards trend over the past decade which is great to see. Adjusted FFO per share was $1.37 in the first quarter of 2022, which increased by 22% from $1.12 generated in Q121.

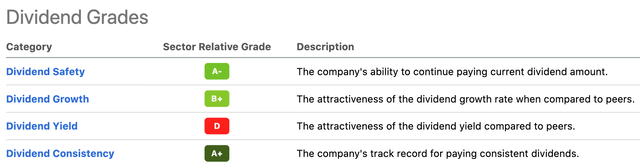

Dividends have also been steadily increasing over the past few years, with a 5-year growth rate of 3.37%. With an A- rating for Dividend Safety, B+ for Growth and A+ for Consistency. The Dividend Yield of 2.85% is not the highest in the sector (hence the D grade) but definitely not bad as very sustainable.

Dividend Grades (Seeking Alpha)

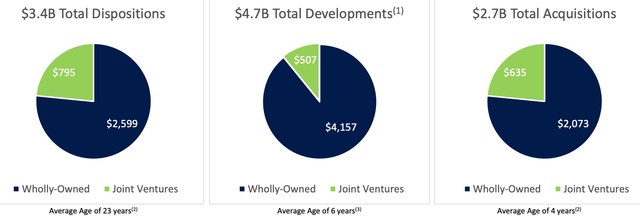

The company’s management has operated a smart strategy of “Capital Recycling”. They made dispositions of $3.4 billion and then used some of that capital to contribute to its $2.7 billion in acquisitions.

CPT Acquisitions (Investor Report 2022)

The company has high debt of $3.4 billion (like most REITs). However, its cash position of $1.13 and rating of A3 Stable (Moody’s) is much better than many other REITs in the industry such as Mid-America Apartment Communities (MAA) and Essex Property Trust (ESS) which are BBB+ rated.

CPT also has a Debt to Capital Ratio and Debt to Equity Ratio of B- (Seeking Alpha) which is great to see. 92.4% of CPT’s debt is fixed rate, which is good news for the rising interest rate environment.

Valuation

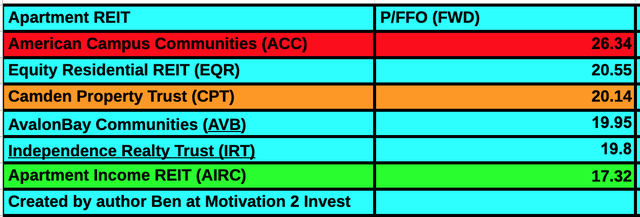

In order to value Camden Property trust, I have compared the Price to Funds from Operations (P/FFO)(forward) multiple across a few Apartment focused residential REITs. As you can see in the table below, CPT has a P/FFO (FWD) multiple of 20.14 which is mid-range relative to the other REITs. For example, American Campus Communities (ACC) is the most expensive with a P/FFO = 26.34. CPT is significantly cheaper than ACC but a little more expensive than AvalonBay Communities (AVB) (P/FFO = 19.95) and Independence Realty Trust (IRT) (P/FFO = 19.8).

Apartment REIT comparison (REIT)

As Camden Property Trust has a strong balance sheet, high FFO growth and is not significantly more expensive than the comparison, I will give it a “Fair Value” and “BUY” Rating.

Apartment Income REIT (AIRC) is the cheapest in my comparison with a P/FFO = 17.32. Thus this is still my number one pick for Apartment REITs, I recently did a full analysis here of that stock.

Risks

Recession/Tenants Not Paying

The annual inflation rate in the US accelerated to 9.1% in June of 2022, the highest since November of 1981. This was mainly driven by large increases in energy and food. As the cost of living increases, tenants get squeezed and may find it increasingly difficult to make rent. Analysts are predicting a “shallow but long” recession, which is forecasted to start in the fourth quarter of 2022. If businesses find their input costs squeezed, they may have to lay off workers which will mean rent payments may be hard to make.

Final Thoughts

Camden Property Trust is leading residential REIT which has strong tailwinds from the “great migration” occurring in America towards places such as Texas and Arizona. The company has a super high 97.1% occupancy rate and is growing its FFO at a rapid clip. Management’s “capital recycling” strategy is working well and the company has a strong balance sheet. The only issue is the valuation, which isn’t really cheap but fairly valued relative to the sector. Overall, this looks to be a great investment for the income investor who wants exposure to the growing apartment rental industry.

Be the first to comment