IBM earnings will set the stage for many Big Tech names as we should get a good idea on business spending and currency headwinds. David Ramos

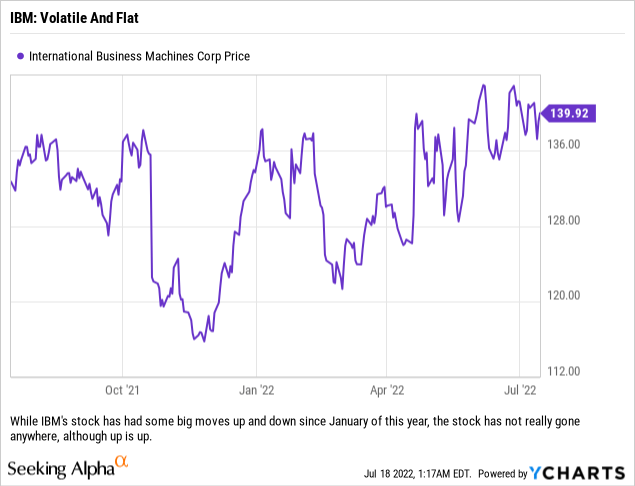

As many of our readers know by now, we have spent the majority of 2022 looking to bolster our equity portfolios with names that should be able to better withstand a higher interest rate environment and a potential recession. Focusing on companies with stable revenues, relatively predictable earnings and respectable dividend yields has helped shelter us from some of the carnage that has resulted from the bear market. One name that has been a surprise in our portfolios in 2022 is International Business Machines (NYSE:IBM). IBM has returned 4.68% while also paying what was a nearly 5% yield; so the YTD total return is above 7%. Not bad at all when the market has entered a bear market and the S&P 500 is down over 18% in the same period.

While we like IBM long-term, in a bear market the best plan of action is to always be willing to take action. We have been selling covered calls on IBM shares we own in various portfolios throughout 2022 when it made sense, but with earnings season upon us, we revisited the stock and IBM’s business prospects to see how we would trade the stock across various client portfolios.

Main Points That Changed In Our Thesis

Part of managing money is revisiting portfolio holdings and past trades. One exercise we like to do each morning is browse through the portfolios and see if there is anything that we are no longer interested in owning at current prices or based off of recent news (and if we identify anything, then we have to decide the best way to trade those holdings moving forward). Doing that exercise this weekend caused us to take a deeper look at IBM and weigh how we thought the stock might perform with earnings coming out Monday night.

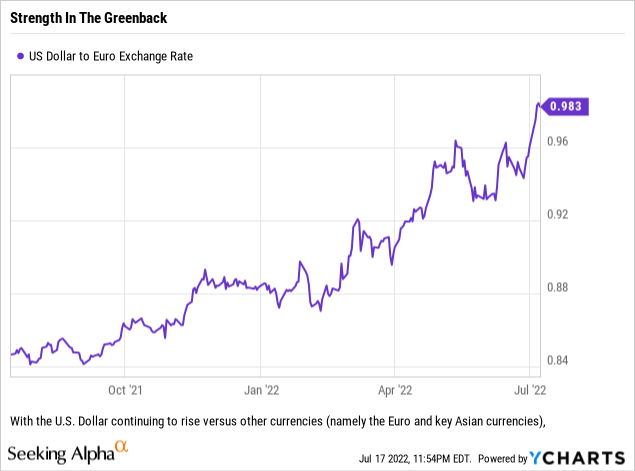

With the U.S. Federal Reserve raising interest rates at a relentless pace while Japan, the EU and China all struggle economically right now and hold off on tightening, the U.S. Dollar has been on a tear.

Why does this matter? Well based on 2022 Q1 revenues, the Americas represented 50% of IBM’s revenues. The company’s revenues in Europe, Middle East & Africa (EMEA) and Asia Pacific were 29.58% and 20.42%, respectively. So even if IBM is extremely well hedged on the currency front and finds a way to offset currency headwinds with new business, with over 50% of revenues coming from outside of the United States, and a reluctance of other central banks to move aggressively (namely the EU and Japanese), then eventually the U.S. Dollar’s strength is going to provide a significant headwind. Will that be this quarter, next quarter, or a year from now? We are not sure on the exact timing, but we do know that the impact will eventually be felt and that it could be sooner rather than later.

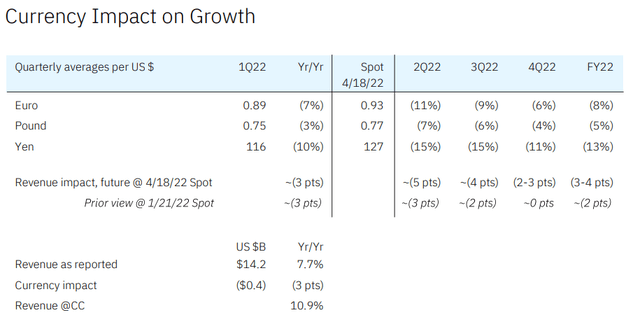

IBM has even discussed this in previous quarter’s earnings calls, with the below slide attached to their Q1 2022 quarterly results materials.

IBM has already started to prep investors for USD strength causing its business some problems moving forward. (IBM Investor Presentation Q1 2022, Graphs)

While currency is a real concern, we also have some questions about IBM’s ability to recognize revenue on historical timelines. We have heard stories from friends in the industry where they are unable to bill for IT consulting services, or those on the other side of the deal not paying for IT consulting services because they are waiting to take delivery of product for installation, etc. So although the good news is that we have heard of many businesses looking to outsource tasks right now due to the tight labor market, the bad news is that there seems to be an issue for some companies with being able to do the contracted consulting work because projects are getting delayed as customers await delivery of key materials or products. This might not be an issue for IBM currently, but it is a troubling theme we have been hearing more and more about.

How To Trade

We think that there are three points with which to view trading IBM around earnings.

If you already own the shares: This is the boat that we are in across the majority of our personal portfolios. We believe that holding the shares remains prudent, however we also think that it is wise to attempt to create as many income streams from the shares as possible in a bear market, so we recommend selling covered calls on IBM shares sometime Monday before the market closes. We are focused on the July 22, 2022 $145 Calls and will target $2.01/share or higher in order to book a $200+ option premium after fees (or roughly a 1.4% yield from the option premium). With this trade, the stock would have to rise more than 5% for us to “lose” and if we do get called on our shares, we are confident that there are other names we could purchase that would deliver the same yield and possibly better growth prospects.

If you want to buy shares for a long-term investment: While we understand the allure of the dividend and predictable cash flows that the business generates, we think that investors should be very methodical in how and when they enter trades in this market. So if an investor wants to add exposure to IBM, we believe that rather than buying shares outright they should look at utilizing the options market to choose their entry level and potential dividend yield. If it were a trade, we needed to place for one of our portfolios, and we do have a client portfolio or two that this trade may work for, then we would focus on the July 22, 2022 Puts utilizing either the $130 or the $132 strikes. We prefer the $130 contract due to the liquidity but recognize that some readers may see the $1.15/share premium as “not worth the work” because of the 0.88% yield on the premium. Utilizing the $132 puts and the expected $1.52/share premium delivers a 1.15% yield on the premium. We would point out that either trade is acceptable in our book because if exercised, you would own IBM shares at a level that yields at least 5% (assuming no dividend cut).

If you want to trade earnings: We recommend against trading IBM shares specifically for earnings and we do believe that the currency headwinds and supply chain issues might impact the business faster than some expect. If one was to play this name for earnings, we would look to buy the July 22, 2022 $145 Calls below $2/share during Monday’s session while also buying the July 22, 2022 $135 Puts below $2.30/share. Basically, the stock will have to move 7% one way or the other to make money and depending on your ability to exit the losing side of the trade it could be less.

Conclusion

In a bear market, any time you can find a way to exit a position and get paid to do so, you have to look at that as a win. We believe that managing positions is the best way to manage your overall portfolio in a market such as this because even though you run the risk of the tail wagging the dog, you should have another opportunity (and usually in a short period of time) to re-enter the trade at the same price, or a better price, from where you were forced to exit. The one item that might impact how readers approach IBM in the current market and how they use the options market to move in and out of positions is the company’s dividend. There is probably less than a month before the stock goes ex-dividend, so utilizing the current week’s contracts makes a lot of sense because if they are exercised on you, then you can utilize IBM’s weekly options contracts moving forward in order to reestablish the position, if desired. That strategy would give you two weeks to try and reenter the stock.

Be the first to comment