audioundwerbung/iStock via Getty Images

Don’t handicap your children by making their lives easy.”― Robert A. Heinlein

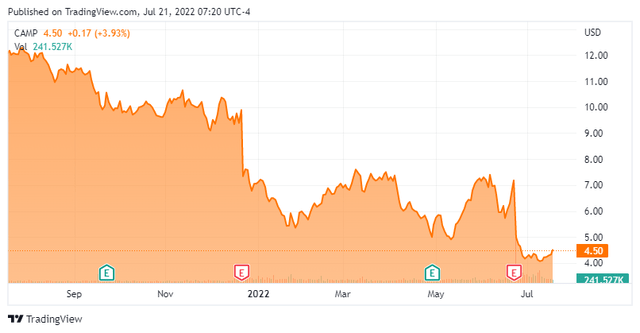

Today, we put CalAmp Corp. (NASDAQ:CAMP) in the spotlight for the first time in more than a year. The company and its shareholders have been under pressure here in 2022. Like so many manufacturers, CalAmp has been hit hard by supply chain issues over the past couple of quarters. However, the company also operates as a subscription service. Recently, the shares have picked up some considerable insider purchases. Better times ahead? We try to answer that question via the analysis below.

Company Overview

CalAmp is based just outside of Los Angeles. The company has two distinct businesses. CalAmp provides CalAmp Telematics Cloud platform which offers cloud-based application enablement and telematics service platforms that facilitate integration of its own applications. The company also designs and builds telematics products, including asset tracking units, mobile telematics devices, fixed and mobile wireless gateways. It is probably best known for its LoJack line which it acquired some years back. The stock sells for around $4.50 a share and sports an approximate market capitalization of just over $150 million.

First Quarter Results

On June 23rd, the company posted first quarter numbers. Overall revenues fell nearly 19% on a year-over-year basis to $64.7 million. The company also had a GAAP quarterly loss of 34 cents a share. Both top and bottom line numbers missed the consensus.

The bottleneck in the global supply chain played havoc with CalAmp’s results for the second straight quarter. The Telematics Products division was the cause of the shortfall. Thanks to component shortages and customer conversions to recurring software subscription arrangements, revenues of $25.2 million were lower sequentially from the $27.2 million and down significantly from the same period a year ago.

| Three Months Ended | ||||||||

| May 31, | ||||||||

| Description | 2022 | 2021 | ||||||

| Revenues: | ||||||||

| Software & Subscription Services (S&SS) | $ | 39,557 | $ | 35,043 | ||||

| Telematics Products | 25,169 | 44,631 | ||||||

| $ | 64,726 | $ | 79,674 | |||||

| Gross margin | 40 | % | 41 | % | ||||

| Net loss | $ | (12,173 | ) | $ | (6,000 | ) | ||

| Net loss per diluted share | $ | (0.34 | ) | $ | (0.17 | ) | ||

| Non-GAAP measures: | ||||||||

| Adjusted basis net income (loss) | $ | (3,405 | ) | $ | 2,946 | |||

| Adjusted basis net income (loss) per diluted share | $ | (0.10 | ) | $ | 0.08 | |||

| Adjusted EBITDA | $ | 1,856 | $ | 8,385 | ||||

| Adjusted EBITDA margin | 3 | % | 11 | % | ||||

However, it should be noted that subscription revenue rose to $39.6 million from $35 million in 1Q2021. For the second straight quarter, subscription revenues were over 60% of overall sales. Total subscribers hit 1.2 million which is up 25% from the same period a year ago and 13% sequentially from the fourth quarter of 2021.

Analyst Commentary & Balance Sheet

Since first quarter earnings posted, both Roth Capital ($13 price target, down from $13.50 previously) and Northland Securities ($11 price target, down from $12 previously) have reissued their Buy ratings on the stock. The company ended the first quarter with nearly $60 million of cash and marketable securities on its balance sheet after posting a GAAP net loss of $12.2 million during the quarter. The company has just over $225 million of long-term debt.

Just over four percent of the outstanding float of the stock is currently held short. Insiders are signaling the company’s long-term prospects are bright. Since late June, the CEO has purchased 53,000 shares while a director added approximately 600,000 shares. A beneficial owner also bought nearly 150,000 shares.

Verdict

The current analyst consensus has the company losing roughly a dime a share in FY2022 as revenues shrink some five percent to $280 million. They do expect a rebound with over 25 cents a share of profit in FY2023 as sales increase some 10%. It should be noted there currently is a wide range of estimates for both earnings and sales next fiscal year among the analyst community. All five analyst firms covering the firm do see CalAmp returning to profitability in FY2023, however.

The company is adding important customers. Recently, BMW selected CalAmp as its provider of new Stolen Vehicle Technology Services and became a new product offering at Volkswagen Leasing. A lot of the company’s supply chain issues last quarter were the result of Covid-19 lockdowns in China, which have since ebbed greatly.

FY2023 is shaping up as a bounce back year when CalAmp returns to profitability. The stock is not expensive at about 50% of forward sales. As a greater proportion of revenues come from subscription services, margins should improve. The company should also benefit from improvements in the global supply chain. Insiders are certainly putting their money where their mouths are with their recent purchases. Given that, I have added to my holdings in CAMP recently via covered call orders in anticipation of brighter horizons ahead.

Difficulties strengthen the mind, as labor does the body.”― Lucius Annaeus Seneca

Be the first to comment