Robert Way

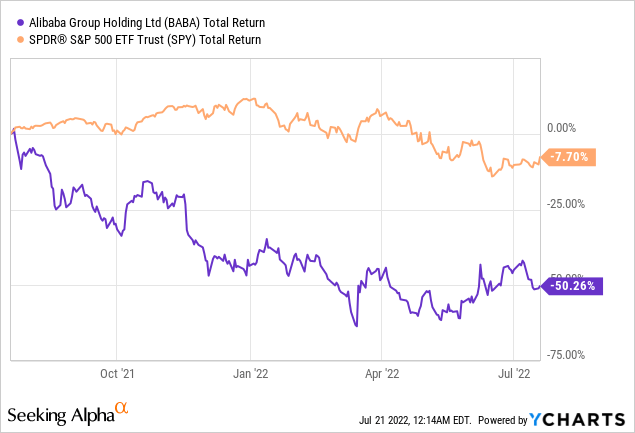

Alibaba (NYSE:BABA) has been the center of the Chinese tech sector for a long time, given all the headlines. As a well-known tech company that is supposed to be Chinese Amazon to lead the future of the digital world such as AI, eCommerce, and fintech, BABA stock has only returned 14% (as of 7/20/2022) since its IPO. While the evaluations and bull cases are very evident, there are still lingering concerns around the industry landscapes, company culture, macro environment, etc. I would like to share some of my thoughts in this article.

BABA is the infrastructure powering the domestic commerce of China and beyond, but it’s not the only one

As we all know, BABA is the largest company in the Chinese eCommerce market. It has 1.3B active consumers, $126.7B in revenue, and generated $16B free cash flow on average in the last five years. Like Amazon (AMZN) in the US, BABA covers a wide range of the business spectrum and is an essential part of everyday Chinese lives.

However, BABA’s dominating position faded in 2011, and it lost shares from 80% to 60%. JD.com (JD), Pinduoduo (PDD), and Meituan (OTCPK:MPNGY) can catch up on their logistics and tech development to compete with BABA neck to neck. BABA is not a monopoly anymore. Recently, even another contender, TikTok has emerged by targeting social Commerce businesses.

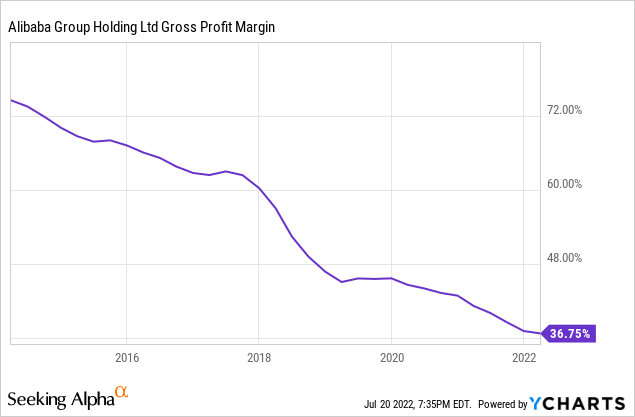

Although the Chinese eCommerce market is large enough to support oligopolies, the best days are over. BABA’s domestic eCommerce has matured and will have to constantly face competition in the future, just like its ever-decreasing margins.

Chinese consumers have not shown up as expected

Several years ago, many experts predict that a new class of Chinese consumers will emerge and power future growth, especially after Xi Jinping’s plan of eradicating poverty. This hasn’t happened yet. As Chinese Premier Keqiang Li admits, 40% of the population still struggles to make ends meet, earning RMB1000 per month. In the latest conference call, BABA’s CEO stated:

Among our 1 billion AACs in China, 124 million consumers spend more than RMB10,000 annually on Taobao and Tmall and 98% of those consumers continue to stay effective in the following years.

On another note, Chinese baby boomers are retiring (20M+ per year). The inevitable fact is that China will quickly enter a serious aging population. The labor advantages and entrepreneurship in the last 30 years just won’t last. I think the China Macro tailwind is fading, and there is limited space for growth in terms of spending power.

The BABA culture is in danger

Following JD’s success, BABA launched Tmall. After observing Pinduoduo’s success in the manufacturer-to-consumer market, BABA quickly launched Taobao Deals. Knowing Amazon’s development of AWS, BABA invested in Ali Cloud. These strategic moves are very successful and keep BABA stay up to the front of the competition. I think BABA is very good at leveraging second-mover advantage by monitoring the market and following innovations in technology and business models.

This requires BABA to move and adapt fast. Under Jack Ma, BABA is a very efficient, nimble, and collaborative organization which is similar to Amazon’s customer-centric culture. Young people with talent used to love working for BABA. While the recent crackdown by CCP has caused financial damage, the real long-term implications are its corporate culture. A CCP party branch was built in the company and enrolled 30% of its employees in CCP. Structure sexual harassment scandal last year shocked a lot of people. I don’t know if BABA has the culture to lead the Chinese innovation anymore without Jack Ma.

Jack Ma talking with employees (BABA website)

The numbers look great, but we have to interpret them in context

From a financial point of view, BABA is clearly an undervalued stock no matter whether you look at the sum of parts, free cash flow, assets, or earnings power. However, I have two concerns:

1, Foreign exchange risk: The Chinese banking system has 350% of the money on its balance sheet while the US only has 100%. An average meal in Beijing costs 3 times than 10 years ago while US and Yuan are always pegged in the range of 6 to 8. I personally think the Chinese currency is overvalued, and I agree with Kyle Bass that China’s currency would collapse by 30% to 40% if CCP stopped supporting it. As BABA has 90% of its business in China, the currency issue will always be a risk.

2, Inflation of accounting numbers: BABA’s financials are not fully audited. It is extremely difficult to know if BABA actually owns the properties and rights claimed. I remember the book by Qiaohua Zhang, an outspoken retired investment bank insider who suggests a rule of thumb of cutting 30% to 50% valuation multiples of any Chinese company.

BABA works for Munger but maybe not for you

Charlie Munger is a China guru. He made lots of money for Berkshire by investing in PetroChina and BYD. He also has a long-term relationship with Li Lu who arguably has one of the best investing records focusing on Chinese and Asian securities. However, Buffett didn’t follow Munger to buy BABA. Li Lu bought BABA but sold out in Q2 2020. All these investors are rarely wrong. They act differently because of different timeframes, return expectations, probability expectations, etc.

In terms of who knows BABA the best, I think definitely Masayoshi Son, other than Jack Ma. He is the one who oversaw BABA’s operations from day one and is still holding around 25% of BABA. SoftBank (OTCPK:SFTBY) only has a $60B market cap while 25% of BABA stock worth $70B. Therefore, you don’t actually have to invest in BABA. Buying SoftBank will offer you a discount and include all other SoftBank holdings for free such as Uber (UBER), DoorDash (DASH), Coupang (CPNG), etc. Plus, there is a 10B buyback that is ongoing. Masa recently just completed the registration of the ADR conversion facility for BABA which means he can quickly sell his holdings. This gives lots of flexibility, and I am pretty sure he could make good investment decisions on BABA given his long relationship with the company.

Bottom line

Overall, BABA is still a great company with lots to offer. I am especially interested in its cloud and international business. I think these two sectors are where BABA really can dominate for a long time. Especially for the international business (around 10% of all sales), Lazada, Trendyol, Daraz, and AliExpress are all growing very fast in East Asia, Russia, and Europe. In the US, we have Shopify (SHOP) which offers dropshipping. This helped thousands of US businesses to source products from AliExpress and sell to US consumers. For example, original hair in the US may cost $500 but you can source it from China for $50.

That being said, I don’t think BABA is a 10x or 5x opportunity given all the concerns. It is a company already 23 years old and matured to a state where stability is more important than growth. Most importantly, it is not the sole force of Chinese Tech anymore. It will still grow but maybe only faster than overall GDP by 3-5 points.

Be the first to comment