Solskin

Introduction

I have frequently written about contract drug manufacturer Avid Bioservices (NASDAQ:CDMO) in the past, and the company is one of my largest holdings. However, I acknowledge the speculative nature of the investment and will highlight the risk points for current or prospective investors. I hope to reflect the potential by the end of the article. For further insights, please refer to my prior articles: January 2022 and August 2021.

The CDMO Market

CDMO’s are a relatively new public sector of the public market due to the rising complexity of manufacturing medicines, particularly biologics and gene therapies. Historically, manufacturing approved drugs has been an internal process undertaken by each pharma or biotech company, usually at significant capex costs and risk. The ability to outsource manufacturing to FDA approved facilities that can handle these modern technologies is a natural advancement for the industry to undertake.

Avid used to be one such early-stage clinical research company that decided on using their in-house facilities to manufacture partner’s therapies rather than their own. To understand the industry potential further, let’s see what the new ChatGPT has to say about the industry:

The contract drug manufacturing organization (CDMO) industry is one of the fastest-growing sectors in the healthcare industry. CDMOs are service providers who specialize in the manufacture of pharmaceutical products, including active pharmaceutical ingredients (APIs) and finished dosage forms (FDFs). They provide a broad range of services, from drug formulation and development to manufacturing and packaging, and have become essential partners for many pharmaceutical companies.

The global CDMO market is expected to grow at a compound annual growth rate of 8.3% between 2020 and 2027, reaching $254.2 billion. This growth is being driven by several factors, such as the rise in demand for generics and biosimilars, increasing prevalence of chronic diseases, and the need for new drug development. Additionally, the growing need for cost-effective drug manufacturing solutions and the increasing trend of outsourcing drug production activities to CDMOs is further driving the growth of this market.

Well, the bot seems to be quite accurate, although I would take those annual growth rate expectations with a grain of salt. The key points, however, are all true, so if you ever need a quick summary about an industry, ChatGPT is a quick way to summarize the data. However, I will provide my biased human deep dive ability to provide my readers with slightly higher quality data. First, I will cover the current players in the industry, and compare their financials to Avid’s.

The industry remains quite small, in terms of investor exposure, but the available market is huge. In fact, dozens of famous companies around the world have CDMO services including Boehringer Ingelheim, AbbVie (ABBV), Pfizer (PFE), GSK (GSK), Samsung Biologics (OTCPK:SSNNF), Fujifilm (OTCPK:FUJIY) (who bought their production facilities from Biogen (BIIB), and Thermo Fisher (TMO). Some major pure-play investments include Lonza (OTCPK:LZAGY), Catalent (CTLT), WuXi Biologics (OTCPK:WXXWY), and Avid. However, Avid is a relatively new player to the industry and understanding the maturation phase is the key to the investment. To understand Avid’s potential, I will average the financial performance (5-year averages) of the three larger peers.

-

Annualized revenue growth: 27.5%

-

Annualized EBITDA growth: 31.6%

-

Annualized diluted EPS growth: 44.5%

-

Average net income margin: 20.4%

-

5-year total return: 141.6% (vs 63.8% for the S&P 500 Index)

There are two patterns that I believe investors should take note of: both profitability and growth are high. The financial data is just reflecting the immense opportunity present in the industry, whether it is the fast growing WuXi (who had a lucrative boost to growth thanks to COVID) or established and profitable Lonza. Despite this, the total return only suggests a 19.3% annualized growth rate across the three strong companies. While some of this is a result of Catalent’s brush with the FDA, the general market malaise is undoubtedly leading to a buying opportunity across the sector. The key will be if Avid also offers this same opportunity, considering it may be a few years before financials are up to par with the industry.

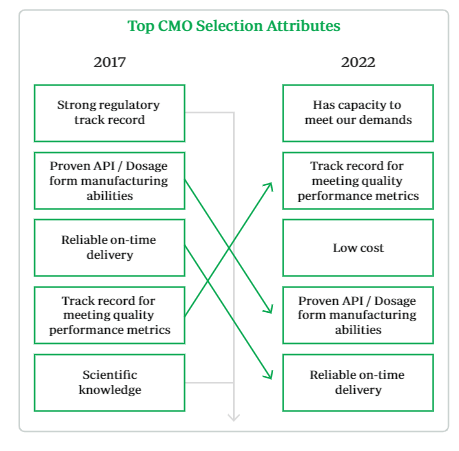

What Avid must do to remain competitive with the larger peers can be summarized by a recent report that was released with the 2022 CMO Leadership Awards. As the image below indicates, no longer are customers focusing on the pedigree or track record of CMO’s, instead, the focus is on the ability to meet demand and perform the required work quickly and effectively. This means that there is plenty of demand in the market, allowing Avid to have the client base necessary to drive growth. However, it will still be incredibly important for them to be reliable, accurate, and efficient. To date, there have been no issues with production or FDA facility approval, and management states that current clients are continuing to establish new contracts.

CMO Leadership Awards 2022

Revenue Growth

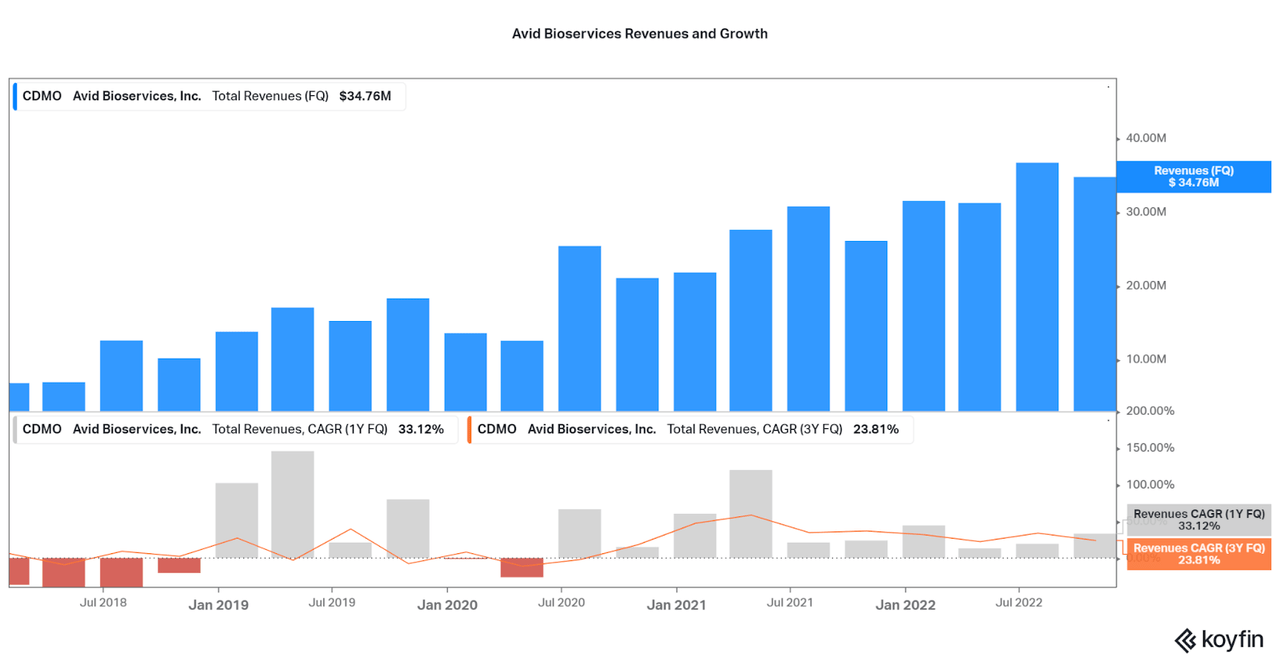

Across the industry, growth is driven by either increasing the pricing on contracts or expanding production. At the moment, Avid is heavily investing in new manufacturing facilities and revenues are growing over 23% per year (3 year average). It is also important to note that Avid has no exposure to COVID-related manufacturing, and so there is no reason for growth to stall moving forward (unlike WuXi and Catalent who may see a swift slowdown). The company also raised guidance for year end, signaling that there may be some ability to increase their pricing on the fly, or that the expansions are progressing faster than expected. As stated by management with the last earnings report:

With respect to our facilities and capabilities expansions, work continues to advance according to plan. During the second quarter, we continued to make progress with our cell and gene therapy expansion. We have already launched the analytical and process development capabilities for this business which has allowed us to escalate our dialog with prospective new customers. We are pleased to report that our first customer is already onboarding in this facility. With respect to the GMP suites for our cell and gene therapy business, construction continues on schedule and we expect them to be completed by mid-calendar 2023.

Likewise, our mammalian cell business capacity expansion is progressing as planned. During the first quarter, much of the downstream equipment was positioned in the Myford facility and validation of this equipment was initiated. During the second quarter, we installed the upstream equipment. As we stand today, the facility is largely mechanically complete and is currently undergoing qualification and validation. We remain on schedule for release to operations during the first quarter of calendar 2023. And finally, expansion of our process development capacity is well underway. The addition of this new capacity is ideally timed as our updated revenue guidance puts our capacity utilization at close to 90% of our current capacity.

Based on the company’s performance during the first six months, we anticipate that fiscal 2023 will be another strong year for Avid. The company’s strategic transformation is well underway, and we look forward to achieving the milestones that will position us for consistent growth in the future.

Koyfin

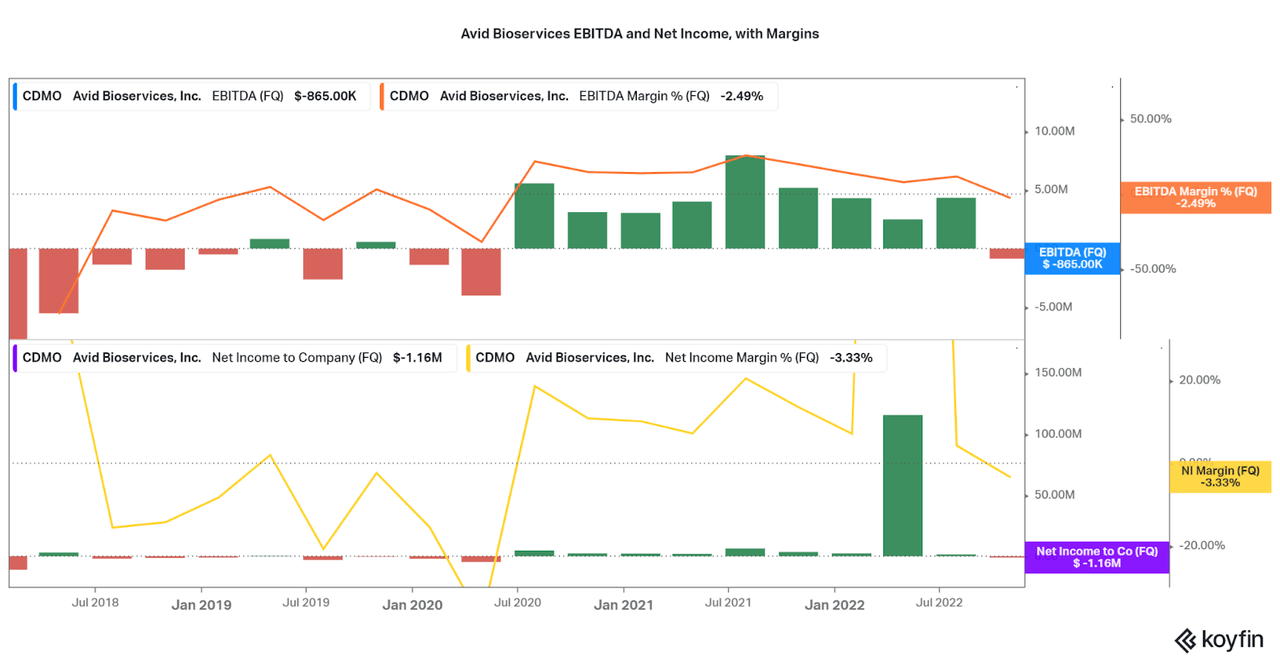

However, growth is irrelevant if there is no profitability to go along with it. This is where the risk of the small company scale arises. As shown with the historical data, earnings have been volatile over the past five years and the last quarter saw an EBITDA and Net Income loss. I will be addressing the reasons why in the next section. For now, it is just important to realize that Avid has shown over the past few years that they are able to be profitable, and the current losses are temporary and will improve with continued scale. With maturation, investors should expect significant earnings growth potential down the road.

Koyfin

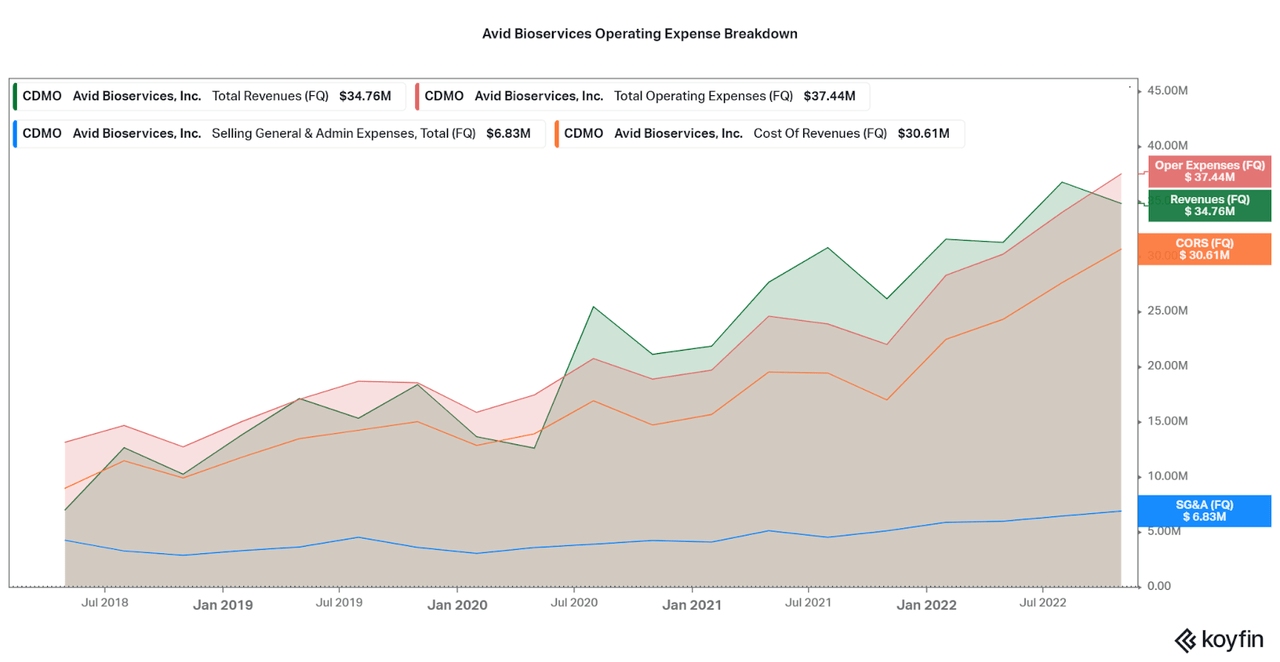

To understand the current impacts to the profit margins, I created a chart highlighting cost of revenues, SG&A expenses, and total operating expenses. As shown, losses can solely be attributed to rising costs, raw materials, energy, etc, rather than excessive marketing or compensation expenses. This is a good sign, particularly due to the fact that we know the current environment is quite difficult in terms of material and energy costs, rather than attributing the expenses to industry weakness.

The issue would be if the costs continued to rise faster than revenues, as this may be an issue with contract pricing instead. Considering the strong margins prior to the last quarter, I would not expect this to be the case. Therefore, I expect profits to return quickly over the next few quarters.

Koyfin

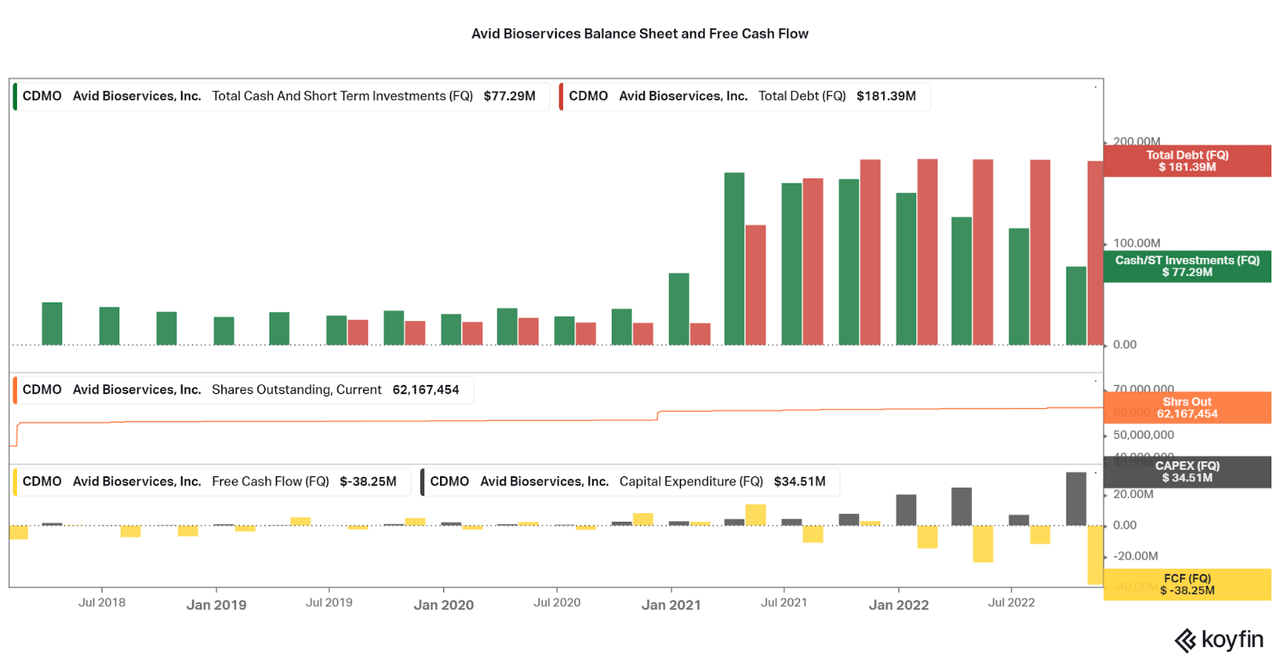

The income statement-based losses are not the only worry point for investors. Free cash flow is also very low at a $38 million loss for the last quarter, and negative for the trailing twelve months. This is due to the fact that the company also has capital expenditures being spent on the expansion. These funds are being taken from the current cash balance and are not reflected in the net income. As a result, leverage is now an issue as current net debt has reached $100 million compared to TTM EBITDA of less than $15 million.

At current cash levels, capital expenditures will have to be scaled back, profits need to fund all new expenditures, or new debt or dilution must occur. While CDMO took advantage of low interest rates in 2020 to increase their pile of debt, I find it unlikely that the company will add more to the pile. Also, Avid was already public in 2020/21 so they were unable to earn significant cash from adding shares to the market. However, I do believe in the company’s ability to drive profitability in the coming quarters, so I do not believe there will be issues. Unfortunately, the valuation will be depressed as the risk profile is temporarily increased.

Koyfin

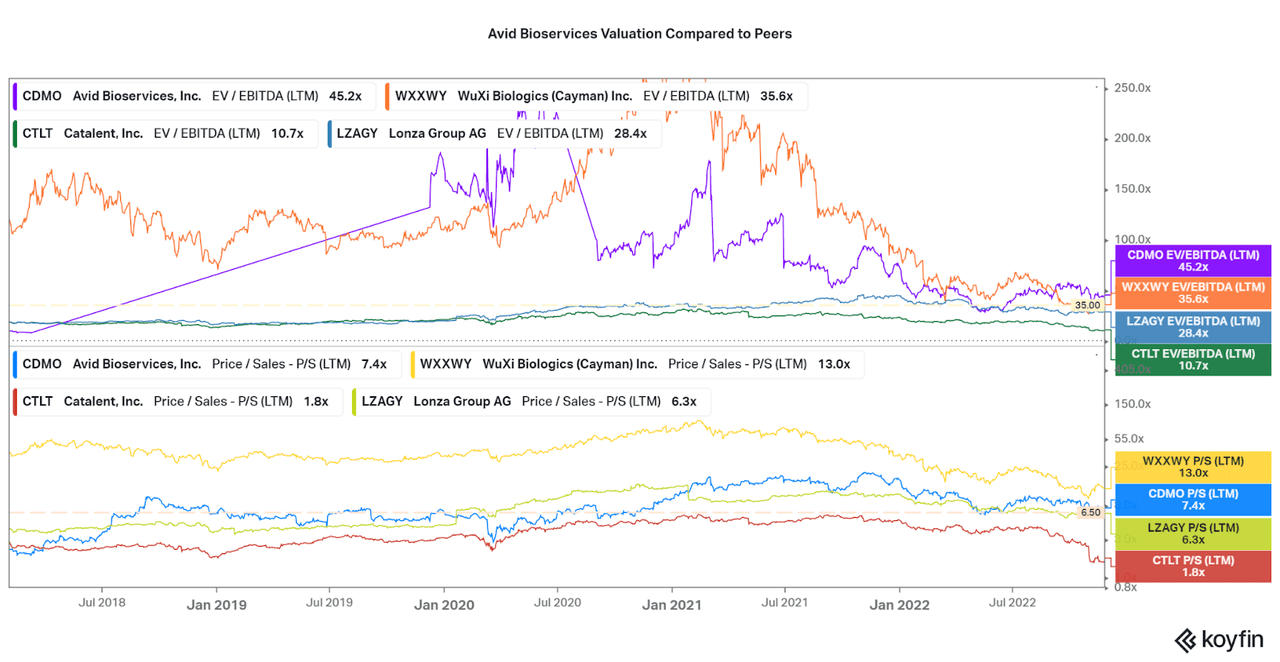

Valuation

As a result of the industry weakness, increased operational expenses, and capital expenditures dragging cash down, the valuation has approached all-time lows (in terms of the company’s CDMO period). The company’s valuation is also not competitive with peers who are performing better, despite the operational weaknesses. As shown in the chart below, Avid is the highest valuation in terms of EV/EBITDA, and second in terms of P/S. I expect that the downside risk remains as long as profitability issues last.

However, the valuation also suggests that investors are of a similar mind with me in terms of the future potential of the company, as the financials would warrant further selling off by this point. Remember, Avid has a market cap of $800 million compared to the $10, $30, and $35 billion market caps of the larger peers I am comparing to.

Koyfin

Conclusion

Avid Bioservices is a very forward-looking investment. I would only be comfortable suggesting the company to those with a high risk tolerance and long-term outlook. However, I also believe that the return potential is significant despite the volatility along the way. I will not be attempting to time any of my purchases or predict the share price in the short-term. Instead, I will be steadily accumulating shares for years to come.

I would also like to state that my analysis is not reflecting an opinion on the other CDMO companies, as each has select benefits and weaknesses that I could address in future articles. For now, I will conclude by stating that the industry has great investment potential despite the general poor market sentiment and readers can feel free to ask questions for now in the comments.

Thanks for reading.

Be the first to comment