wildpixel

ADC Therapeutics (NYSE:ADCT) is a developer of antibody drug conjugates, whose platform is validated by the FDA approval of ZYNLONTA (Loncastuximab tesirine-lpyl) for third line r/r DLBCL.

Both the linker technology and PBD (pyrrolobenzodiazepine) toxic payload that ADCT uses was developed at its parent company Spirogen, which is now owned by AstraZeneca (AZN); the same technology was also used by Seattle Genetics, now Seagen (SGEN) and AbbVie (ABBV).

There are a number of ADC companies, starting with Seagen, however, ADC claims to be different due to its targeted pyrrolobenzodiazepine (PBD’) dimers technology. PBD-based ADCs are not new, however, older molecules produced proteins that caused resistance in cancer cells through DNA-repair mechanisms, which ADC claims its molecules avoid.

Their second candidate, Camidanlumab tesirine, just completed a phase 2 pivotal trial in r/r Hodgkin lymphoma. In a data readout last year, the company announced that the drug showed a response rate of 66.3%. This year, in June, the pivotal trial produced even better data. There was an overall response rate of 70.1% and complete response rate of 33.3% in heavily pretreated patients with 6 or more prior lines of therapy; median duration of response of 13.7 months for all responders in r/r Hodgkin lymphoma patients who were refractory or had relapsed after a median of 6 prior treatments, including brentuximab vedotin (BV’) and a PD-1 blockade.

The company planned to file a BLA for the molecule, however, it was one of the first companies to face the FDA’s new stringent policy on accelerated approvals, where they are looking to accept such BLAs only when a confirmatory study is well underway and ideally fully enrolled. ADC thinks this may take up to 2 years. Thus, that’s the kind of timeline they are looking at right now.

The company noted:

At this time, the Company is pausing any material investments in the HL program and will evaluate options for Cami in HL with a disciplined and strategic approach to resource allocation.

To pile on more trouble, the drug has been less successful in solid tumors. In trials in 44 patients in various solid tumors, there were zero partial or complete responses and just 11 stable diseases.

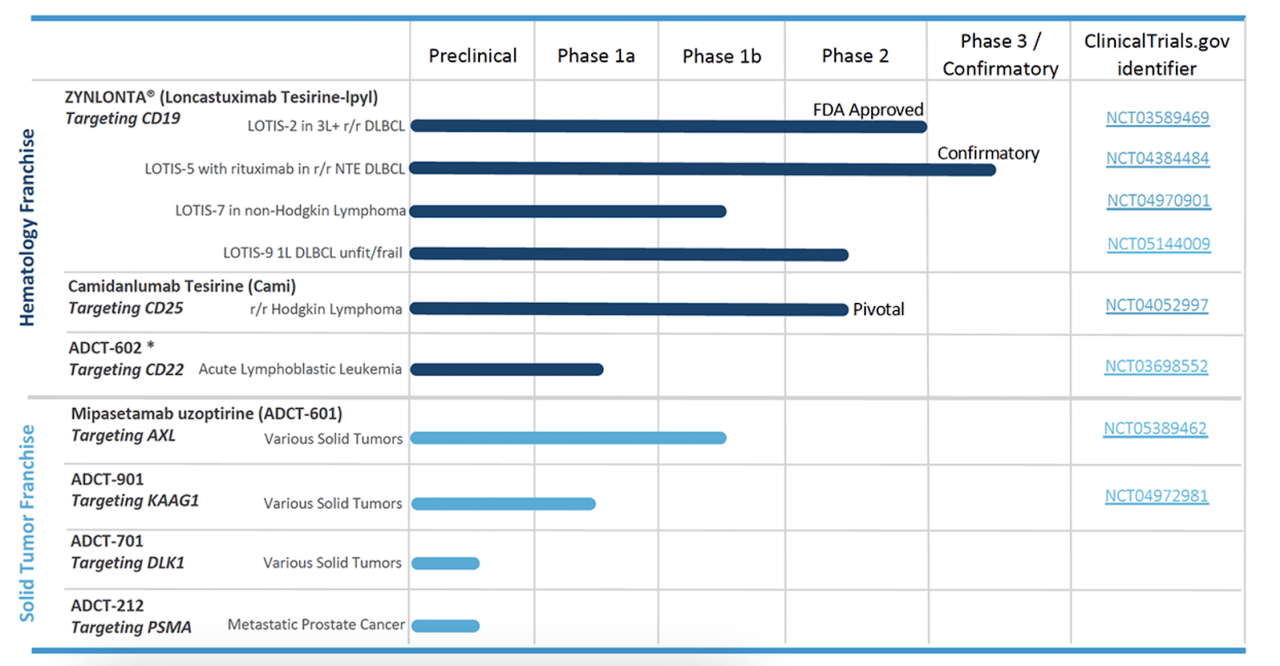

They have two other phase 1b/2 trials, one for Loncastuximab tesirine-lpyl targeting 1L DLBCL which is called LOTIS9 but doesn’t seem to be active, and another for Mipasetamab uzoptirine (ADCT-601) targeting various solid tumors. The pipeline looks like this:

ADC Therapeutics website

Source- ADC Therapeutics website

ADCT is put into some perspective by an interesting factoid. In July 2019, both BioNTech (BNTX) and ADCT were in the news for large series B funding. Both are European companies, and while BNTX raised $325mn, ADCT raised $303mn. Interestingly, BNTX today is valued at $37 billion, while ADCT has a market cap of $286 million. Such are the ironies of fate!

Another tidbit from November 2020:

ADC, meanwhile, has struggled with ADCT-601. This had been put on hold after the US FDA demanded stability data and raised questions over its novel linker technology and trial protocol, according to the group’s IPO document. The study is now marked terminated, though ADCT-601 still appears in ADC’s pipeline.

ADCT-601 is Mipasetamab uzoptirine, which I mentioned just before. Clearly, this isn’t a very active program, either. It is an Axl inhibitor, a mechanism which has had some trouble, see the reference above.

Financials

ADCT has a market cap of $286mn and a cash reserve of $380mn. In the third quarter, Zynlonta had net sales of $21.3mn. The company made another $55mn in upfront fees as license revenue from Sobi for rights to Zynlonta ex-US, China, and Japan. The company has a debt of $337mn. Cost of product sales was $1.3 million for the quarter, R&D costs were $41.7mn, G&A were 19.6mn, and S&M expenses were $16.8mn. At that rate, the company has a cash runway till about 2025.

ADCT took a $175mn loan from two venture capital firms, Owl Rock and Oak Tree, mainly to repay convertible credit notes held by Deerfield. This came after a weak Q2 which saw $17.3mn of Zynlonta sales, well below analyst expectations. Last year, the company sold 7% of Zynlonta and cami’s future royalties for $225 million in cash and an additional $100 million in near-term milestones as part of a royalty sale with HealthCare Royalty.

Bottomline

ADCT has been visited by a lot of bad luck despite an early accelerated approval. Biogen’s aduhelm approval has forced the FDA to adopt this new measure where they are becoming more cautious about granting accelerated approvals. This has been disastrous for ADCT, for no real fault of their own. Unfortunately, their other programs haven’t done too well either, and there’s nothing much to back them up. Even Zynlonta sales have been lackluster. Given all of that, the company remains something of a risky bet even at these 52-week low prices.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment