Redfox_Ca/iStock Editorial via Getty Images

The Bank of Nova Scotia (NYSE:BNS, TSX:BNS:CA) kicked off the earnings reporting season for Canadian banks on a somber note today. Adjusted net income for the bank’s fiscal fourth quarter came in at C$2.06 (~$1.51) a share, down from C$2.10 (~$1.54) a year earlier, as its investment banking division reported a slump in advisory and trading revenues. And against the backdrop of a worsening macroeconomic outlook, the lender also set aside higher provisions for loan losses.

Nevertheless, earnings came in ahead of what analysts had expected, with the bank delivering adjusted earnings slightly below the same period in 2021. By comparison, the consensus adjusted EPS forecast was only C$1.97 (~$1.45), which meant BNS delivered an earnings beat of C$0.09 (~$0.07).

Tough Comparables

Analysts had been warning about a tough quarter for Canadian banks in the run up to today, and so Scotiabank’s latest set of figures should not have come as too much of a surprise. For instance, the dearth of dealmaking compared to last year meant a slump in advisory and trading revenues could not have been avoided.

Its wealth management business also suffered from choppy markets, with net income in the segment down 6% year-on-year, and 4% lower on the previous quarter, at C$361 million (~$265 million). This was primarily driven by lower mutual fund fees, which decreased due to market volatility and lower asset valuations. However, this was partly offset by strong private banking loan growth and margin improvement, which delivered net interest income growth of 28%, or 3%, from Q4 2021 and Q3 2022, respectively.

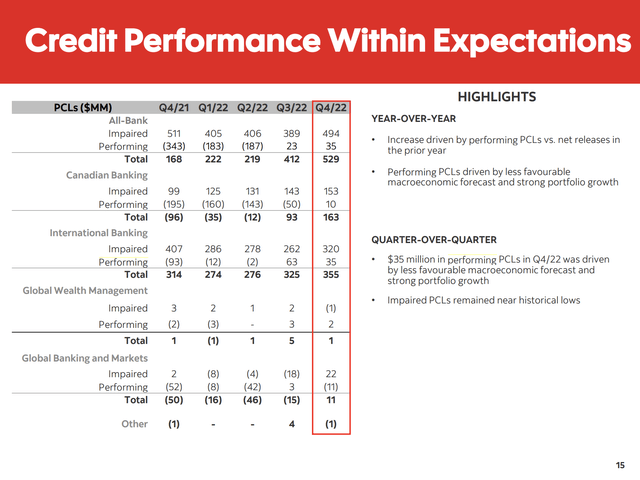

Amid moderating economic growth in Canada and elsewhere, as well as housing and recession risks, the pace of provision normalization has also accelerated. The lender booked loan loss provisions of C$529 million (~$389 million) in the three months to October 31, more than tripling from the year-ago quarter’s provision of C$168 million (~$123 million). That said, much of this increase was attributed to a return to positive performing reserve build, compared to a net release of C$343 million (~$252 million) for performing loans in the prior year quarter. On a sequential quarterly basis, provisions for Q4 2022 rose more modestly, up 28% from C$412 million (~$303 million) in Q3 2022.

Provision For Credit Losses (Bank of Nova Scotia’s Q4 2022 Earnings Presentation)

Resilient Loan Growth

Against the cloudy macro backdrop, BNS saw resilient loan and deposit growth from consumers and businesses in both Canada and internationally. Total loans were 17% higher than a year ago, and 4% higher than three months ago, with growth witnessed across almost all forms of lending.

Despite the slowing housing market, particularly in Canada, its residential mortgages loan book held up better than expected, with growth seen on both a sequentially quarterly basis as well as year-on-year.

As expected, though, other categories of lending, including personal loans and credit cards, grew more quickly. It confirmed that the appetite for consumer borrowing has returned, as the rising interest rate environment and changing economic landscape shifted consumers’ borrowing patterns.

The standout performer was business lending, which saw a 25% increase in loans from a year ago. This reflected a return to growth in borrowing, particularly from larger corporations, as the pandemic-era slump has finally come to an end. Looking ahead, business demand for borrowing will likely continue to outperform, as companies are under pressure to rebuild inventories and fund new investments.

International Banking

Elsewhere, an improving financial performance from its international operations did partly offset the slowdown at home. Unlike its bigger domestic rivals, BNS does not have a large presence in the U.S., but instead has significant operations in the Caribbean, and Pacific Alliance countries, including Mexico, Chile, Peru, and Colombia.

International banking hasn’t been plain sailing for the group. Its operations outside of Canada have historically accounted for a disproportionate share of its loan losses, yet the return on equity abroad has also lagged behind its Canadian bank in recent years.

| Return on Equity | 2022 | 2021 | 2020 | 2019 | 2018 |

| International Banking | 12.9% | 10.4% | 5.0% | 13.2% | 13.1% |

| Group Average | 15.6% | 15.0% | 10.4% | 13.1% |

13.7% |

Source: The Bank of Nova Scotia

Its international business had also been harder-hit during the pandemic, and recovered more slowly than in Canada since then. However, market conditions appear to have switched around, as a belated recovery in international markets begins to offset the slowdown at home. This diversification helps to mitigate some of the volatility that we would otherwise see. International banking was the only segment to deliver growth in net income compared to last year, following a 12% increase to C$679 million.

Net Interest Margin Weakness

On the downside, net interest margins decreased by 4 basis points from Q3 2022, as higher funding costs and deposit spreads squeezed on margins. This came against the trend of improving NIMs since Q2 2022.

According to the bank’s own latest interest rate sensitivity analysis, a 100 basis points increase in interest rates would decrease its annual net interest income by C$340 million (~$250 million). Meanwhile, a 100 basis points downwards parallel shift in interest rates would increase net interest income by C$326 million (~$240 million).

That is to say, Scotiabank’s balance sheet is positioned to benefit from declining rates. This contrasts with almost all of its domestic peers, as well as a majority of banks globally, which for the most part are positioned to benefit from rising interest rates.

It’s also important to note that the bank’s sensitivity to interest rates has increased significantly from three months ago, when a +100 basis points or -100 basis points parallel shift was expected to have an impact on net interest income of -C$267 million (~$196 million) or +C$231 million (~$170 million), respectively.

Given that further rate hikes will likely be needed to tame inflation, this puts BNS in a comparatively worse position than its peers in the short- to medium-term. Scotiabank’s own forecasts point to a further 50 basis points increase in the Bank of Canada policy interest rate by the end of 2022, to 4.25%. Moreover, the policy rate is expected to remain high for a sustained period, in order to bring inflation back to its policy target of 2%.

Final Thoughts

Against the backdrop of rising interest rates and a worsening macro-outlook, earnings at The Bank of Nova Scotia could have further to fall in 2023. Domestic peers such as Royal Bank of Canada (RY, RY:CA), Toronto-Dominion Bank (TD, TD:CA) and Bank of Montreal (BMO, BMO:CA) seem better positioned to weather near-term headwinds, given they have better margins, greater exposures to the outperforming U.S. market, and asset-sensitive balance sheets.

Be the first to comment