alexsl

ContextLogic (NASDAQ:WISH) is an ecommerce company known for its Wish shopping platform. The app took off in popularity during the height of the pandemic. People that were stuck at home embraced Wish’s differentiated “treasure hunt” style of bargain-shopping for unique or unexpected items.

Since early 2021, however, things have gone painfully wrong for both ContextLogic as a company and WISH as a stock. Shares are down more than 90% from the peak, and the company’s financial results are also a mess. What’s gone wrong for the ecommerce site, and is there much hope of a turnaround?

WISH Stock Key Metrics

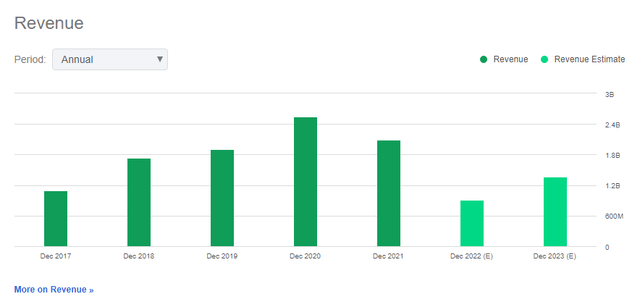

There’s one key metric for ContextLogic that should highlight this company’s problems right from the jump. It’s the company’s top-line sales:

After hitting a peak of $2.5 billion in 2020, the company’s revenues tumbled to $2.1 billion last year. And then, things got really bad. For 2022, analysts now expect the company to generate a mere $907 million of revenues. That’s down by more than half versus 2021 and off by near two-thirds since the 2020 peak.

So, let’s be clear: ContextLogic isn’t just another ecommerce company that is seeing a post-pandemic slowdown. Rather, ContextLogic is a company that currently has a broken business model and needs to wholly reinvent itself if it is going to generate shareholder value going forward.

The company’s bottom line doesn’t look much better. It’s never generated a positive operating income on an annual basis. And, while the company has cut costs recently, it hasn’t been nearly enough to keep up with plunging revenues. Analysts expect the company to lose 57 cents per share in 2022, 47 cents in 2023, and generate another 31-cent loss in 2024.

Given that the company’s stock is trading at less than $2/share now, these are alarmingly large earnings per share losses that are being forecast going forward.

Is ContextLogic Stock Undervalued?

On the basis of the above metrics, I’d argue that ContextLogic stock is overvalued, if anything. The company has generated an operating loss of at least $144 million annually each of the past five years. Sometimes, those losses have been much larger, with operations burning through more than half a billion dollars in 2020 alone.

These large losses seemingly haven’t generated a meaningful recurring revenue base or strong brand that gives the company something to fall back on. Despite investing all this capital primarily in marketing, the moment industry conditions turned in 2021, WISH’s operating results plummeted.

You could argue purely on a market cap basis that shares might be undervalued in one sense. The company is still going to do around a billion in revenues this year and the market cap is just barely above that figure. 1x sales is not a demanding valuation for an online retailer. Or, normally, it wouldn’t be. In the case of ContextLogic, however, those revenues are plunging and there’s little evidence that the company will be able to turn itself around in the intermediate future.

How Does WISH Stock Compare To Other Ecommerce Competitors?

From my understanding, the big difference between Wish and larger ecommerce players is that Wish has focused on a niche rather than broad-based appeal. Unlike, say, Amazon (AMZN), you don’t go on Wish to buy everything under the sun. Rather, Wish has a bargain-shopping driven approach where people can buy products that are new, unique, or different at affordable price points.

This may have proven to be a particularly compelling opportunity during the pandemic when many specialty brick and mortar stores were closed. In a time when Walmart (WMT) or Costco (COST) were the main available in-person shopping experiences, buying some interesting toy or jewelry item or whatnot from Wish gave users something desirable.

Now, however, Wish is competing with a far broader range of alternative shopping options. In addition, Wish’s own reliance on discount pricing has led to serious concerns around product quality. Many reviews cite issues with products that don’t work for very long or seem shoddy in construction. In went further than that. As fellow Seeking Alpha author William Sabga-Aboud pointed out, quality concerns led to France outright blocking the app in that country last fall due to products that were found to be hazardous.

A lot of ecommerce apps have run into tougher operating conditions between the renewed competition from physical stores, supply chain issues, and rising logistics costs. It’s not unreasonable for online marketplaces to be seeing a slowdown in 2022.

But Wish’s decline in operating metrics is on a whole different tier from its rivals. This is a company that desperately needs a new business strategy or marketing angle or something to turn things around.

Is WISH A Good Long-Term Investment?

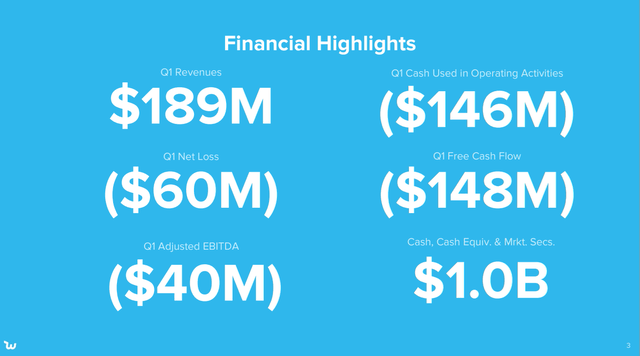

A slide from ContextLogic’s most recent quarterly earnings results puts the company’s predicament into sharp contrast:

WISH financial results (Corporate presentation)

The one good piece of news is that the company still has $1.0 billion of cash and marketable securities left. But, it managed to burn through $148 million of cash just last quarter alone. Note that the company’s free cash flow is substantially worse than its already sizable net loss and negative adjusted EBITDA.

Based just on cash alone, ContextLogic might seem like a decent speculative buy. After all, the market cap is now $1.1 billion, meaning that the actual operating business is only being valued around $100 million or so. And, as mentioned above, there are still annual revenues in the billion dollar range as well. That might seem like enough to give this a shot at working.

But, at a $150 million quarterly burn rate, the company’s cash is likely to be exhausted by early 2024 if things keep going as they are currently. Meanwhile, any significant turnaround would likely force the company to turn marketing spend back up or otherwise invest in growth initiative. ContextLogic’s efforts to lower operating costs in recent quarters, as we’ve seen, have had a devastating impact on the company’s revenue trajectory.

And, as also noted, it’s a difficult operating environment for ecommerce companies and even big brick and mortar operators like Walmart and Target (TGT). ContextLogic is having to try to execute what would already be a challenging business turnaround under unfavorable macroeconomic conditions.

Is WISH Stock A Buy, Sell, Or Hold?

ContextLogic has made some changes. There’s a new CEO. The company has greatly rethought its advertising strategy. And it has made some core improvements in the app, such as having an invite-only approach to onboarding new vendors on the platform to improve quality standards in merchandising.

ContextLogic has been able to show some tangible signs of progress, such as its net promoter score “NPS” doubling since late 2021. It’s a start.

But there’s still so much to be done. The company had 101 million monthly active users “MAUs” in Q1 of 2021. This collapsed to just 27 million in Q1 of 2022. It’s hard to overstate just how quickly or badly this company’s core business has eroded in recent months.

Combine that with the company’s large cash burn and the overall situation here is grim.

ContextLogic has cash and it still has a decent revenue base. However, the odds of the company getting back on track seem rather low. The company’s business model has never consistently produced a profit. And now, with its brand tarnished, the company has to try to bring customers back all while keeping costs in check during a difficult macroeconomic environment.

Be the first to comment