d25higgins

Stipulation: I am a c-suite alumnus of Caesars from back in the day and have what I believe is a perspective on how the company’s culture has evolved from then to now.

I am a bit bemused by the recent stream of bearish outlooks on the stock of Caesars Entertainment, Inc. (NASDAQ:CZR) that tend to belong to the “Captain Obvious” school of analysis. It’s not that I don’t accept the basic facts presented. They can appear daunting if you are a holder for certain, or off-putting if you are a possible buyer. And they clearly spark happy talk if you are among the 7.22% of CZR holders sitting in the short interest seats of the stock as of this writing. But, above all, what is missing in the bear calls is, with all due respect, a real world, time-tested knowledge of the machine parts that make the casino business hum, sputter, or rev up. It is from that perspective that I present a strong bull case for the stock against the formidable headwinds noted.

We have digested all the bear case assumptions here and across many financial sites. We have refined them if you will down to the base elements, avoiding the complexities and, if I may, some of the metric babble that sometimes accompanies such outlooks. It’s understandable, without question. Investor have come to rely on long-established metrics. It’s a language everyone speaks. I get it. But in a time like this, where the worst possible mixture of macro conditions overlays the entire market, taking no prisoners, it seems kind of foolhardy to me to use long-established metrics, i.e., ones that forecast performance against unknowns.

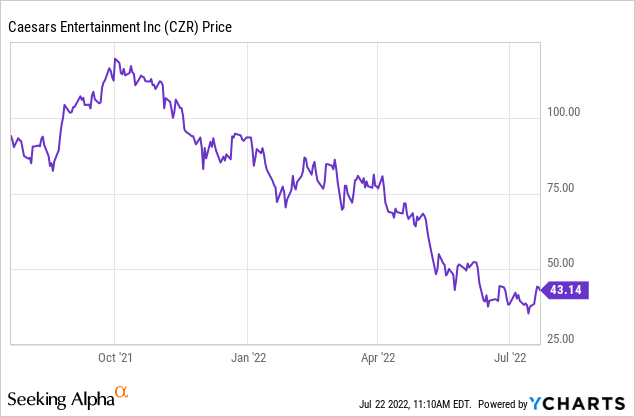

Above: What’s wrong with this picture? Mr. Market is clueless as to the value of CZR’s gold mine database and reality. Icahn was not.

Let’s use a sports analogy for context here.

Look at the metrics a professional team in the four major sports uses to form an offer for a superstar free agent. It begins with a perceived need-that’s clear. In baseball, for example, a team is always going to be lacking in one or more fundamental positions: it needs pitching, position players. It needs power hitters who can be inserted into the middle of the lineup and hit monster home runs.

General managers then look at the back of the trading card. There, a massive jumble of stats will stand as the past record of the player’s brilliance on the court or field. And today, further, they dive into analysis of analysis in their own metric mass of numbers and percentages, fold in the age, the current performance, health, etc., fan appeal, “brand value.”

Then this mass of numbers plus inside-the-sport gossip among former teammates, managers, coaches, etc. come into the mix. And finally, the numbers and opinions are set before the billionaire owner. Then, measuring the level of desperation, out comes the borderline insane offer of centi-millions over many years. After far too many of such deals, we later find, that the team has paid for a Porsche and gotten a serviceably nice Toyota in terms of the performance of the player.

What has happened here is a simple lesson applicable to the stock market as well: You pay for past performance, hoping that future performance will be a good, if not better, because you are probably paying a premium price for old news.

There are clearly free agents, as it were, that do perform to expectations. But then, you look at a sports season, analogous to market trends over time, and the so-called game changer changes very little. He may be a nice addition, a contributor, but in truth what happens in the critical endgame, or the playoffs, if you will, is ultimately a matter of odds in an always random world of outcomes.

So let’s look at what in general, seems to be the bear case we most frequently hear now about the shares of CZR.

The company has over-taxed its balance sheet with debt related to its merger with El Dorado. Its debt load may be bearable in a strong consumer cycle, but facing inflationary pressures and a certain recession, margins will be squeezed, ability to comfortably meet debt obligations begin to look dicey. The company overpaid for its William Hill online betting business. CZR sports book has already lost $1b and will likely continue to lose another $500m before the marketing warfare in sports betting platform abates. A softening of consumer demand, just ahead, will simultaneously hit its Las Vegas flagship properties and its regional casinos. The result: mounting losses.

The announced coming sale of one of its major strip properties with the proceeds going to reduce debt seems to be in limbo. Labor shortages have hit customer service standards badly, and there is no help in sight. Given the above run-through of all kinds of metrics to measure multiples of earnings, risk ratios, relative values to peers, etc., the stock is overvalued even at its current trade. PT’s we have seen look like $33 to $37.50.

Okay. That’s the back of the sports trading card, if you will. Now, let’s do our own, inside-the-business perspective of why we believe the stock is actually undervalued here. We don’t presume to offer a forest of our own data metrics as a response to bear numbers. For those investors who buy or sell speaking only the standard language of metrics, we caution you that we are presenting a case as we would, as we have, from inside the board room to our peers and board members.

The only departure we make from standard metrics is in the calculation of discounted cash flow (“DCF”). We present it not as gospel, but to lend some context with which investors are comfortable. We arrived at our estimate based primarily on what we believe the CZR massive customer data base can produce against recessionary decline percentage experienced on the Vegas strip in the 2007-2009 recession. To that, we added what we believed were the competitive pressures from new properties like Resorts World, which did not exist, and other expansion.

Our result; The DCF value of CZR shares now is $69.50 by our formula-take it for what it’s worth.

1.Heavy debt: CZR total debt (mrq) is $26.3b bearing an interest cost of an estimated $2.26b, yielding a current ratio of 1.0. There is no disputing that this is a pile and a half, and, if management was asleep at the switch, an area of concern. The opposite is true. Firstly, a good portion of the debt is related to acquisitions past with little or none in sight ahead. Another part is huge updating programs at many of the company’s 50-plus properties. Again, most of this capex is in the rear-view mirror.

CZR’s has $814m in cash and an operating cash flow sufficient to meet its obligations. That should be a concern, but not a major one because management has been focused on reducing its debt regardless of the overwhelming challenges during the worst of the pandemic. One of the initiatives is selling one of its strip properties and deploying the proceeds to reduce debt. That process is underway and, according to our sources at the moment, should be completed by the end of this year. For those interested, CZR’s current ratio stands at 1.0.

2. The William Hill acquisition. CZR paid $4b and sold its UK operations to 888 Holdings for ~$3b. By current performance in the total U.S. sports betting sector, all major platforms are losing money. To date, CZR has posted losses of $1b and estimated another $500m to go before the unit turns to at least a break-even if not profitable level. Sunk cost and losses will top $2.5b for CZR. What counts now is the avowed policy already in place, to dramatically cut promotional costs, in distinction from some of its competitors. If you compare the options open to CZR when sports betting broke out of the gate in 2018, you will see that buying Hill was instinctively a smart choice. You have an existing U.S. business base throughout the live sports book locations already operative in the U.S.

You have a legacy brand name U.S. customers already know. Starting from scratch by either building your own tech stack or buying services can be a long hard trek. Take Wynn, for example, who opted to start from scratch with a SPAC that never happened. And after it went ahead on its own, it has thrown up its hands and put its WynnBet platform up for sale.

But the secret sauce here is the CZR rewards program which now includes sports book customers. They can use points accumulated on their sports bets toward comps at CZR properties. The company reports the results of this and other crossover customer migrations to the casino floor have been very strong.

CZR archives

Above: Rewards systems work best when customers enter a trip cycle: Points earned at regional casinos used for special trips to strip flagships and back.

Pareto’s Law holds the key to CZR’s bright, post-pandemic future prospects and more fully valued stock. Here, in brief, is the “law” or theory propounded by Vilfredo Pareto, an Italian mathematician after examining masses of data in several fields.

In plain English, under any given universe of activity, 80% of the output is contributed by 20% of the input. Pareto tested this principal over time and in many universes: real estate, commerce, etc. And the ratio most always held.

During my tenure at CZR, I directed my casino analysis department on three occasions to go through our database. (Back then, it was nothing near what it is today in terms of geographic diversity, sheer numbers, and accumulated spend).

After long and arduous applications of variables including weather, demographics, locations, economics of specific customer origin points, guess what?

Pareto’s Law was the unavailing conclusion. More or less, depending on the property, 80% of our win came from 20% of our customers. There were understandable breaks from the norm. For example, Caesars Palace, which had massive international VIP baccarat play, showed the single largest segment of win, while our AC property, heavy in slot play, indicated that 25c slots provided the immense core play. Yet in diving a bit deeper, there was old Pareto waiting for us: We found that within the slot subset, 80% of our slot win came from high denomination slot players: 50c and $1.

Now to bring this logic forward. Today’s CZR has ~55m customers in its database. Among the points made by CEO Tom Reeg at the last earnings call in May was a broad-based effort to assess the database having examined it and found-yes, that a disproportionate share of casino win came from a far smaller universe of players. The project embarked on then was to literally re-orient the point system employed for comp to stress better rewards for better proven players and at the same time narrow the criteria for mass, less profitable, play in order to put the most comp firepower behind the customer segment with the biggest win potential.

As I learned from my day, and I’m certain the thinking prevails today, you don’t fight Pareto’s Law. And one of the best measures of management skill sets is managing that database to its maximum productivity by applying that principal.

If and when the recession comes, what is most crucial to the performance of any casino operator is how effective is the rewards machine in detecting, reaching, and rewarding the most valuable customers. From what I learned over three recessions during which I ran marketing, I found that there was a resiliency factor among the higher-level play.

Going further, we found that the resilience and continuing number of trips taken, average bets, average win/loss, and comp points earned was definitely related to demos of people with long records of sustained play in good times or bad due to the pressures of recession at worst, trimming marginal levels of expected win per visit. And that included, from what I am told, the most recent, and deepest recession of 2007-09.

So what is the bull case here? We do not suggest CZR is recession-immune. What we do suggest is that we are still at a fairly early stage of total pent-up demand in the pandemic endgame. The initial reopening surge has not withered, according to what former associates are telling me. Add to that a database dominated by higher-value players over a proven length of time – past recessions – and you have the makings of what I believe will be a better 2022 than what has been forecast by many of the bear analyst takes.

You have storied brand names under the CZR banner in a broad national grid of properties. You have the single biggest database that feeds regional customers into the Vegas properties. You have a management past its acquisition phase, in full consolidation of its portfolio, having already passed a peak capex/investment stage since 2020.

I believe that CZR’s August 2d earnings release will provide Mr. Market with a coherent, ground-rooted case for the stock that current appears to escape the conviction of bearish analysis.

The real risk on here is my view of a labor shortage that could show no sign of improvement by 4Q22. Looking from the inside-out as a former executive, I am seeing that as the single factor that could blunt a recovery of CZR revenue is earnings, and by extension, share price too near the DCF number I came to in my own analysis.

Also, CZR has no exposure to Asia at this juncture, with a likelihood that it will keep focused on the U.S. for the foreseeable future. Asia will recover. But it’s a road that’s going to be longer, more potholed with global politics and communist ideology from Beijing. Meanwhile, the staple of CZR is providing a gaming experience on a broad, varied scale to the biggest database in the industry. Incidentally, that is one of the key drivers of what brought Icahn into the picture. He was averaged at about $9. He clearly saw value where we indicate it may well lie now to make a bull case: that magical database.

Over the next two years, I suspect we will see the accretive EBITDA targeted by management when the big acquisition phase was draining the cash and building the debt profile. And when that tide turns, you want to be in the stock ready to maximize possible returns that are not now visible to the bears.

Be the first to comment