Ridofranz/iStock via Getty Images

Both L’Oréal (OTCPK:LRLCY) and Estée Lauder (NYSE:EL) are beauty powerhouses with some of the world’s most prestigious brands. Here we do a deep dive into both companies to see which one is the better option for investors. While L’Oréal was born in Europe and Estée Lauder in the US, both have become global companies that are increasingly competing for the same markets, and have to keep innovating to be able to continue to grow.

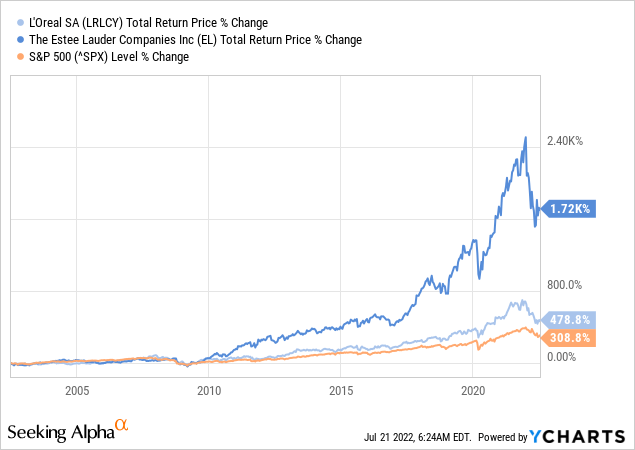

Historically, both companies have delivered impressive returns to investors, both outperforming the S&P 500 in the last 20 years. It is, however, Estée Lauder the one that has delivered the most impressive returns by a wide margin.

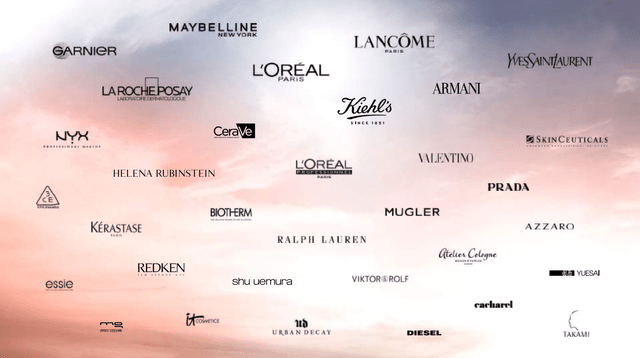

Brands

L’Oréal has an impressive group of brands that covers a lot of different market segments. From luxury with brands such as Prada, Armani, and Valentino, to more everyday brands such as Garnier and Maybelline.

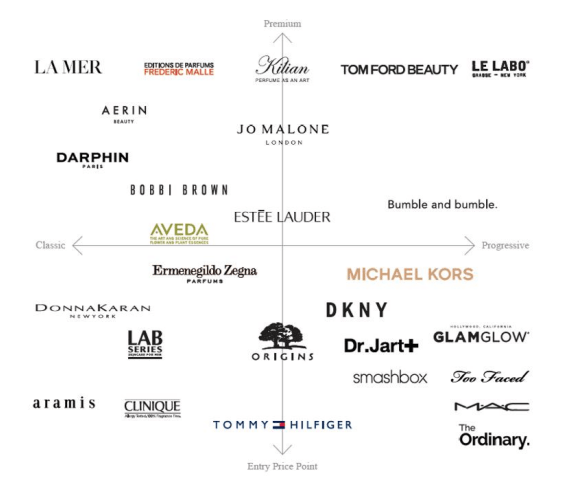

Fortunately for Estée Lauder, it has more than enough to compete, with a brand ensemble that goes from classic to progressive, and from entry price point to premium. Some of the best-known Estée Lauder brands include MAC, Clinique, and the namesake Estée Lauder.

Estée Lauder Investor Presentation

Financials Results

Estée Lauder had a little bit of a hiccup when they reported results last quarter, the reason being that they slashed sales guidance. This made shares fall significantly despite a beat on bottom line figures for the company’s fiscal third quarter and only a narrow miss on revenue estimates. It will be very interesting what level of revenue they report when they announce Q4 earnings on August 18th. The consensus EPS Estimate according to the average compiled by Seeking Alpha of 23 analysts is $0.36 (-53.78% Y/Y) and the consensus Revenue Estimate is $3.48B (-11.57% Y/Y) according to an average of 18 analysts. Some deterioration is therefore expected when compared to the previous year, but what is likely to be much more important is the forward guidance they provide.

Meanwhile, L’Oréal is scheduled to post Fiscal Q2 results on July 28th, Revenue is expected to be 9.28B (+2.95% Y/Y) according to the average compiled by Seeking Alpha of 4 analysts. There are no EPS estimates for the quarter. Given the low expectations for the quarter already, as is the case with Estée Lauder, it is likely that investors will react more to the forward guidance than to the results themselves.

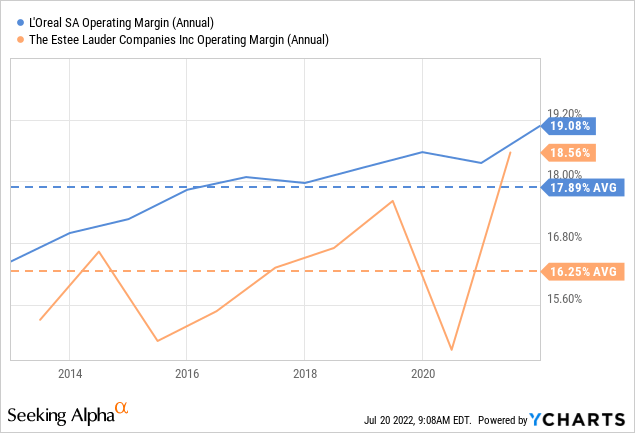

Operating Margins

While both companies have very attractive operating margins, which have been rising significantly over the last decade, it is L’Oréal that wins here, with higher and more stable margins compared to Estée Lauder. We believe the reason is that L’Oréal benefits more from operating leverage, given that it has a much larger revenue base.

Growth

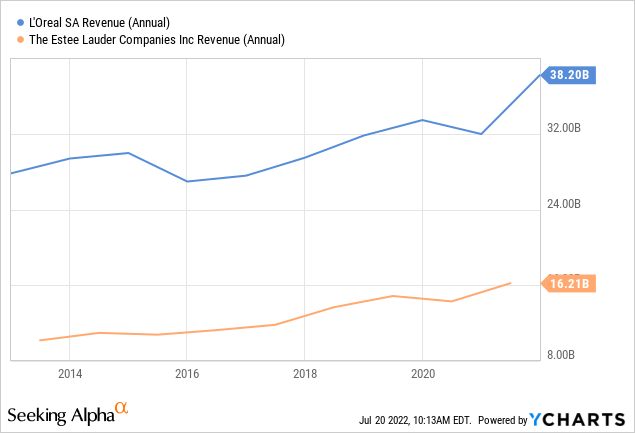

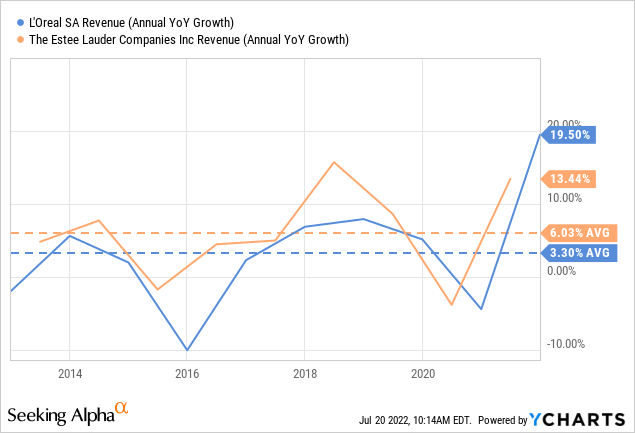

L’Oréal is a much bigger company than Estée Lauder, with more than 2x the revenue. It is, therefore, more difficult for L’Oréal to move the needle in terms of growth with new products.

In any case, Estée Lauder has certainly been growing at a faster pace, with growth over the last decade almost twice that of L’Oréal. This is a big point in favor of Estée Lauder versus L’Oréal.

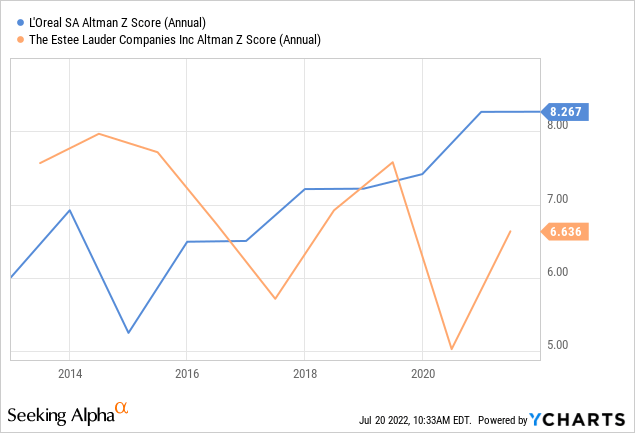

Balance Sheet

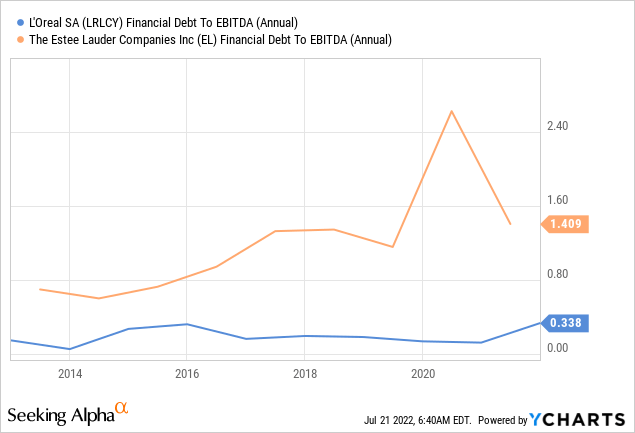

Both Estée Lauder and L’Oréal have strong balance sheets with very moderate leverage. Estée Lauder has debt to EBITDA of ~1.4x, while L’Oréal’s leverage is even lower at just ~0.3x. In any case, we are not worried about either balance sheet. Both companies have about $5 billion in long-term debt, and Estée Lauder has also about $5 billion in cash and short-term investments, while L’Oréal has roughly $3 billion in cash and short-term investments. In terms of the balance sheet, we think it is basically a tie, as both are in pretty good shape.

Valuation

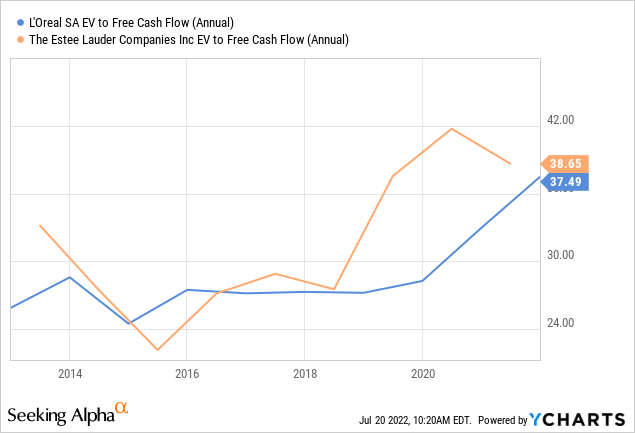

Both companies are trading at similar multiples of annual free cash flow, and while both seem elevated, we believe Estée Lauder offers more value given its historically higher growth rate.

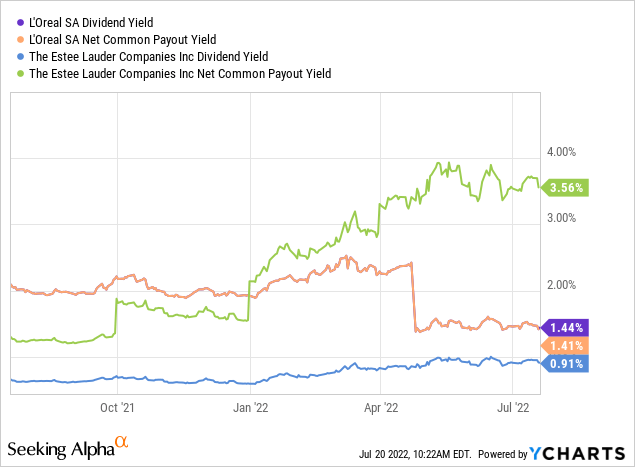

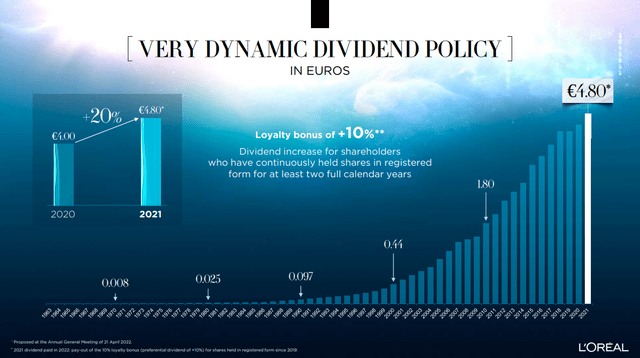

In terms of dividends, L’Oréal yields a little bit more, with a current dividend yield of ~1.4%, while Estée Lauder is yielding ~0.9%. One thing to consider, however, is that Estée Lauder is an aggressive buyer of its own shares. When combining the net share buyback yield with the dividend yield, Estée Lauder has a much more attractive net common payout yield of ~3.5%.

As an interesting aside, and something we consider to be very innovative, L’Oréal has a policy where they add a 10% bonus to the dividend for loyalty. The dividend increases by this amount for shareholders who have continuously held shares in registered form for at least two full calendar years.

Risks

As we’ve already seen, both companies are very profitable and have strong balance sheets. They also operate in the resilient beauty market. Therefore, the two biggest risks we see are a valuation risk, where the valuation of both companies could be significantly re-rated should their growth disappoint, as well as the risk of market share erosion from innovative startups or celebrity product line launches.

Conclusion

Both L’Oréal and Estée Lauder are beauty powerhouses with significant staying power. We believe both companies to be well managed and both have attractive characteristics, including stables of powerful brands. If we had to choose one, we would go with Estée Lauder, as it has grown faster over the last decade. Another reason for going with Estée Lauder is that it has a higher net common payout yield, given the significant share buybacks the company is doing. It will be interesting to watch as this business rivalry evolves over the coming years, and which company comes with the better innovations.

Be the first to comment