JHVEPhoto/iStock Editorial via Getty Images

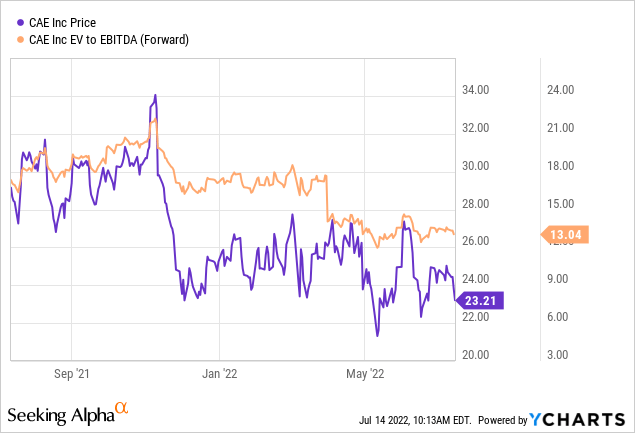

Coming out of the pandemic, there are a lot of reasons to be positive about leading aviation training services provider CAE Inc. (NYSE:CAE). In addition to a cyclical rebound, its differentiated service offering and significant investments made during the pandemic (including the acquisitions of L3Harris’ military tailing business and Sabre) should allow it to capitalize on long-term secular tailwinds ahead. All in all, CAE has an extensive mid to long-term earnings growth runway, likely allowing it to clear an achievable (and potentially even conservative) financial outlook into 2025. With CAE’s free cash generation also intact, the company should have little trouble getting back below ~3x net debt to EBITDA, which coupled with a normalized EBITDA multiple in the mid-teens range (in line with pre-COVID levels), suggests ample upside to the current equity value.

Setting the Stage for a Cyclical Recovery in the Civil Business

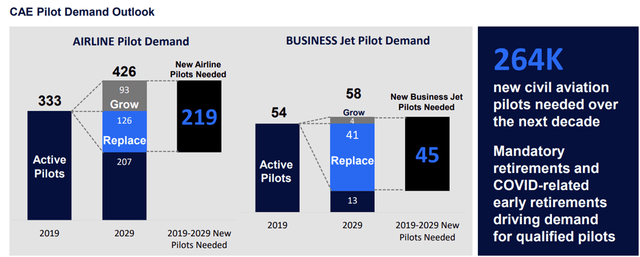

With a passenger travel recovery on the horizon into 2023/2024, CAE’s civil segment looks well-positioned to capitalize. In addition, the company’s long-term secular tailwinds also remain intact – pilot training tends to be a sticky source of demand as individuals continue to require training from cadet to captain (i.e., the full career lifecycle). There is also a clear case for a supply/demand imbalance for pilots – per CAE estimates, passenger demand growth over the next decade, as well as the natural replacement cycle (i.e., the need to replace pilot retirees), will result in the need for >260k new civil aviation pilots (+68% increase versus 2019 levels). A pilot shortage could even materialize sooner than expected – the commercial airline sector is on track for a full recovery to pre-pandemic levels in the next two to three years, while business jet traffic is already tracking above pre-COVID levels.

On a positive note, industry forecasts are starting to turn – both Boeing (BA) and Airbus (OTCPK:EADSF) have published numbers suggesting long-term low-single-digit % aircraft delivery growth, supporting the case for steady civil aviation training demand. In my view, CAE is the best vehicle to capitalize on these trends – the company benefits from long-term, sticky customer relationships across the globe and a differentiated service offering, culminating in its dominant ~30% market share. CAE’s share could further ramp up from here as well – with training programs globally becoming more regulated and standardized, CAE’s extensive experience working with regulators in different jurisdictions stands out.

P&L Update Offers no Major Surprises

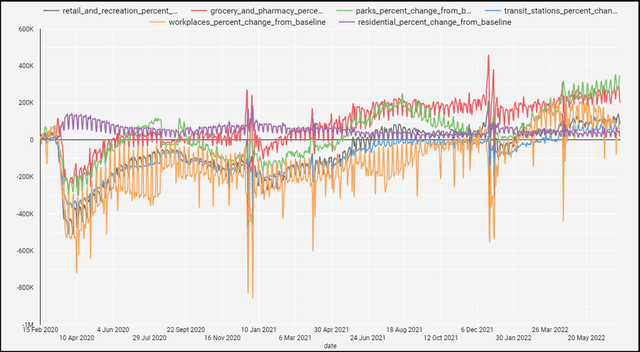

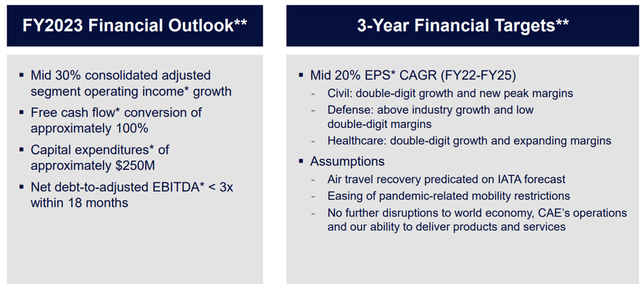

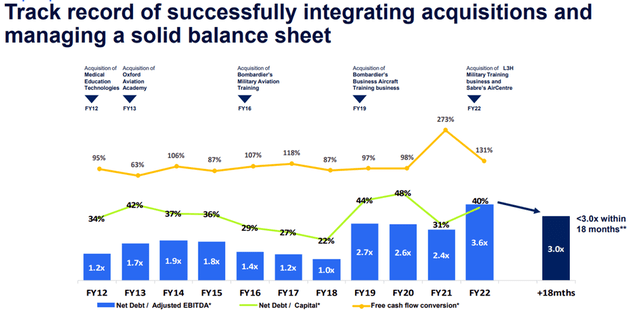

CAE’s near-term financial update was largely status quo, with the company reiterating its prior 2023 revenue and earnings guidance. For context, CAE has guided to adjusted operating income growth in the mid-30% range for the next fiscal year at ~$600m (+35% from the $445m in 2022), with the profile still back-end weighted. FCF conversion will remain strong at ~100% (net of ~$250m of capex), driving a further de-levering of the balance sheet to a <3x net debt-to-adjusted EBITDA through the next year. That said, the relatively conservative assumptions create a potential beat and raise setup – not only are the air travel recovery projections still gradual (tied to the IATA forecast coming out of the pandemic), but the assumed mobility restriction trends seem underwhelming relative to the latest Google activity data.

Building on the resilient 2023 numbers, the three-year financial target will see an EPS CAGR in the mid-20% over the 2022 to 2025 period. The key growth driver remains the civil segment, which is guided to see double-digit growth and higher margins, while the defense segment is set to continue outpacing industry growth and sustain low double-digit margins. Healthcare could spring a surprise, though -the current double-digit growth and margin expansion targets seem conservative given healthcare has been showing inflection signs, with ~25% growth in 2022 (excluding ventilators) despite a challenging backdrop. Plus, the ~50% incremental margins in Q4 2022 indicate massive potential operating leverage benefits should CAE’s healthcare offerings (mainly simulation training) gain traction over the coming years.

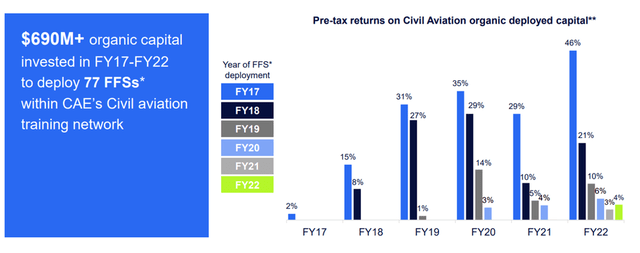

Going on the Offensive with Capital Allocation

In response to prior concerns about whether CAE’s growth investments have generated sufficient returns (thus, justifying more reinvestments vs. capital return), CAE provided an illuminating breakdown of its pre-tax return profile within the civil business at its Investor Day. If we break down the numbers by segment, reinvestments in the civil business have been particularly strong – CAE typically generates returns in the mid-teens before ramping up to an impressive ~30% by year three. Yet, the headline ROCE number has lagged these returns, as CAE has been simultaneously deploying capital into other growth investments in civil and its other businesses (defense and healthcare).

While CAE’s return metrics would be significantly higher if it paused investments (organic and inorganic), the company’s strong returns as these investments mature across its growth opportunities means deploying capital here makes the most sense at this juncture. Net, I view the company’s decision to continue its offensive M&A approach as the right one for equity holders, particularly with asset valuations lower amid the recent rate hikes and with investments made during the pandemic already paying off.

Well-Positioned for a Post-COVID Rebound

With CAE on track to return to pre-COVID levels, there remains ample earnings power to be unlocked. Let’s work through the math – adding the ~$1bn in acquired revenue to CAE’s pre-COVID revenue base of ~$3.6bn puts its normalized revenue at ~$4.6bn. At the targeted 17% operating margin, this implies ~$780m in EBIT generation (or $1.1bn in EBITDA, including normalized D&A). At a pre-pandemic mid-teens EBITDA multiple, which I view as fair given the cyclical and secular tailwinds in pilot training, as well as a de-levered balance sheet, this points toward an equity valuation of >$42/share in a base case scenario. Successfully tapping into incremental revenue levers such as cross-selling opportunities in civil, as well as inorganic growth in defense (e.g., via the addition of L3Harris’ Military Training unit) could help CAE further solidify its market positioning across industries, supporting the case for even more upside ahead.

|

USD bn |

|

|

Revenue (Full Recovery Scenario) |

4.6 |

|

(X) Target Operating Margin |

17% |

|

= EBIT |

782 |

|

(+) D&A (Normalized) |

350 |

|

= EBITDA |

1,132 |

|

(X) EV/EBITDA Multiple |

15.0x |

|

= Enterprise Value |

16,980 |

|

Implied Equity Value @ 3x Net Debt/EBITDA |

13,584 |

|

(/) Shares Outstanding (million) |

318.5 |

|

= Equity Value Per Share |

42.65 |

Source: Author, CAE Financials

Be the first to comment