Justin Sullivan/Getty Images News

Alphabet (NASDAQ:GOOGL) has approved a 20-for-1 stock split, its first since 2014. This stock split has the potential to increase liquidity and pave the way for multiple expansion, something that has eluded the stock. The company is arguably taking the right steps to earn a premium multiple including its aggressive share repurchase program. GOOGL represents one of the most compelling risk-reward opportunities still available in the market today.

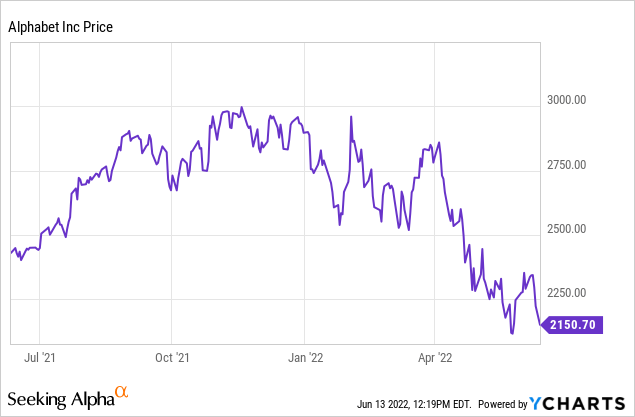

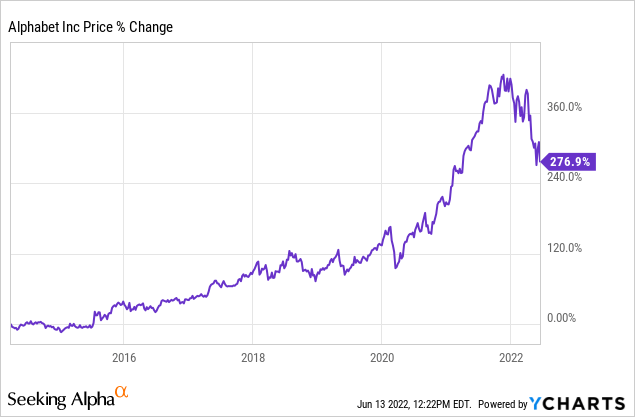

Google Stock Price

GOOGL peaked around $3030 per share and has since dropped 30%.

I last covered the name in October of last year, when I called it a strong buy based on the business model, balance sheet strength, and share repurchases. The company continues to deliver stellar results all while implementing a share repurchase program that will only be more efficient with these lower prices. This is a stock which has proven time and time again why it deserves to be one of the largest holdings in the Best of Breed portfolio.

Google Stock Key Metrics

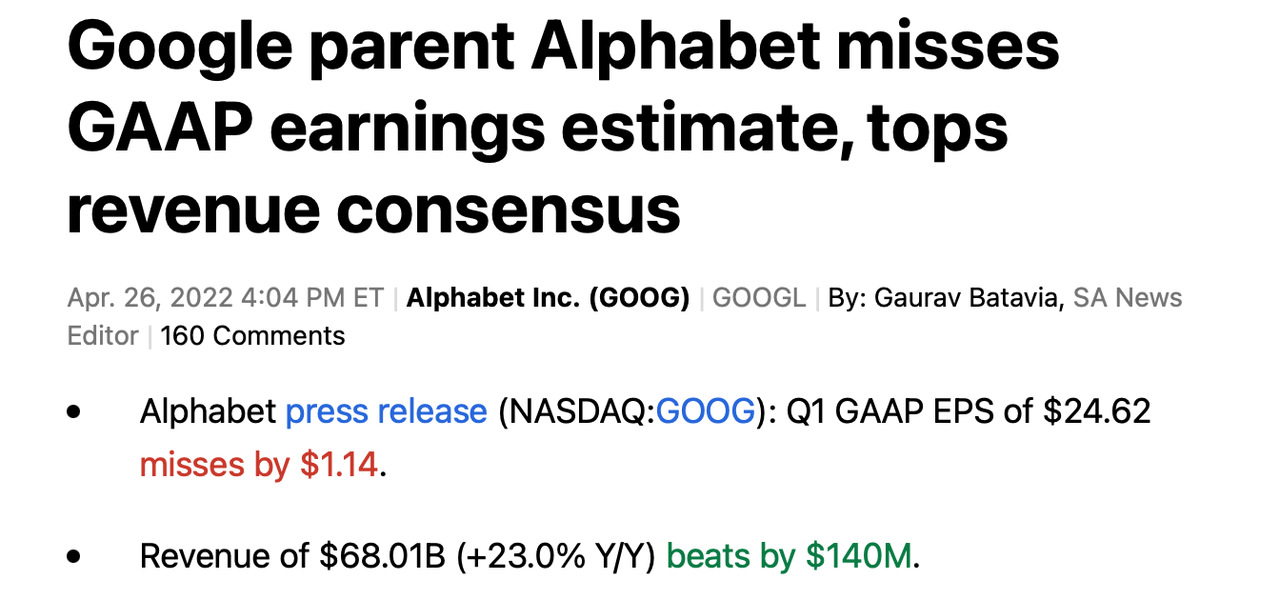

Let’s discuss the recent earnings report. The headlines showed an earnings miss.

Seeking Alpha

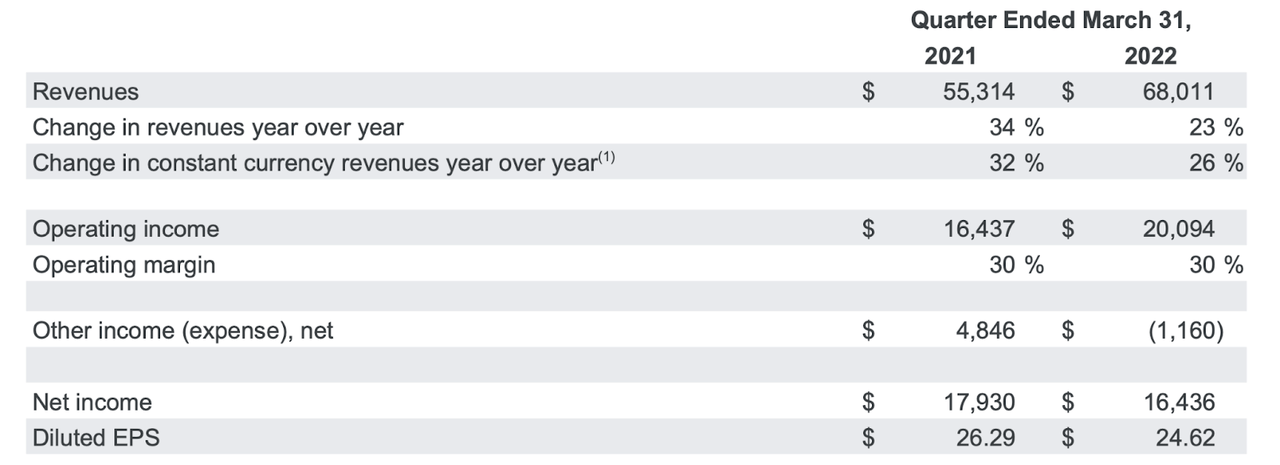

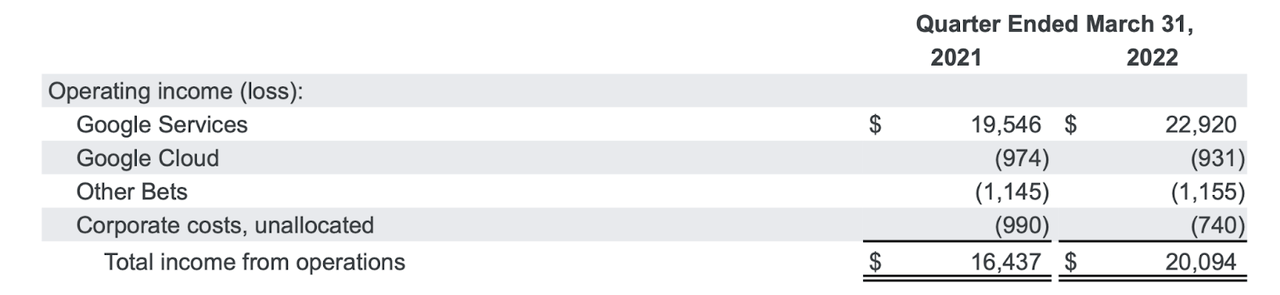

Earnings are often misunderstood at GOOGL due to their large investment portfolio. Unrealized gains are required to be shown on the income statement ever since 2019, even though those gains (or losses) do not reflect operational earnings. We can see below that operating income grew 23% over the prior year, even as net income went down.

2022 Q1 Press Release

On an adjusted basis (my adjustment for unrealized gains), GOOGL earned $26.77 in EPS versus $19.24 in the prior quarter. That reflects growth of 39%.

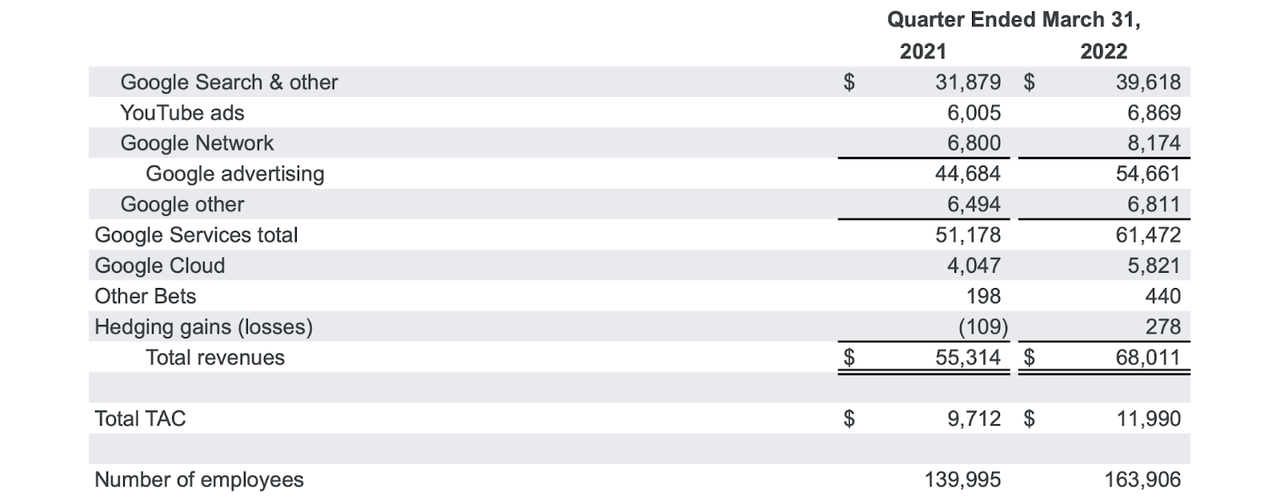

GOOGL posted solid growth in all segments, though YouTube growth was surprisingly weak.

2022 Q1 Press Release

Part of that was due to the Ukraine war, but mostly it was due to an increasing amount of “Shorts,” which is YouTube’s answer to TikTok. This is nothing new: whenever these companies unveil new video formats, the monetization is always lower at first. Analysts are looking for any reason to sell tech stocks nowadays, especially names like GOOGL which has not fallen as much as peers. In the long term, quarter to quarter volatility is meaningless: online advertising remains one of the strongest secular growth stories in the market today – especially for the company that owns search.

GOOGL continued to print money, but operating income did not grow faster than revenues.

2022 Q1 Press Release

I have discussed for subscribers how earnings at tech companies, especially the likes of Meta (META) and GOOGL, are deeply understated due to the aggressive investment in growth. I see analyst after analyst criticizing GOOGL for the lack of operating leverage, including the operating losses at Google Cloud. Some have even stated things like if Google Cloud isn’t making money, then does it matter?

My view is that Google Cloud could be profitable if it wanted to, but the company is hiring new headcount so quickly that any top-line gains are more than offset by increased expenses. You can expect this to be true in all departments at the company. Here’s the irony: while many investors are upset with the understated earnings, investors should actually want GOOGL to report as little profit as possible. Less profit implies more investments in growth, and GOOGL has historically been a phenomenal allocator of R&D dollars.

On the other hand, GOOGL has historically been a poor allocator of shareholder earnings, as evidenced by the historically increasing cash hoard. This is in my opinion the only key metric worth focusing on right now (GOOGL is such a clear-cut story that focusing on quarter to quarter numbers is missing the bigger picture). Things are looking up, though.

In the last quarter, GOOGL generated $15.3 billion of free cash flow and spent $13.3 billion on share repurchases as well as $2.9 billion on payments related to stock-based award activities. In other words, GOOGL has finally taken upon a capital allocation policy that I have been vouching for quite a while. The company is directing all of its free cash flow towards share repurchases. With the net cash position now at over $100 billion, there is no need to continue hoarding cash – and management finally seems to understand this. On April 20th, GOOGL authorized a $70 billion share repurchase program. It looks like this company has finally matured from a cash-hoarding arrogant tech firm to a shareholder-focused mature company.

When Was Google’s Stock Split Approved?

At the 2022 Annual Shareholder’s Meeting on June 1st, GOOGL shareholders approved a 20-for-1 stock split. This means that for every share, shareholders will receive 20 shares at the end of the business day on July 15th.

How Many Times Has Google Stock Split?

This is the first time GOOGL has split since its first split on April 3, 2014, when the company executed a 1998-for-1000 stock split. The point of that stock split was to create the new Class C shares, an event which helped the company’s founder retain voting control of the company.

How Did Google Stock Do After Its Last Stock Split?

Since that 2014 stock split, GOOGL has returned nearly 300%.

I’d make the argument that the strong stock price performance was not due to the stock split but instead due to the strong underlying fundamental performance – the company increased earnings from $21.02 per share in 2014 to $94.06 per share in 2021. Regarding this most recent stock split, though, one could point out that it may be more meaningful due to the greater number of shares being created in the transaction. Stock splits do not change the fundamental value of the stock, but the lower stock price may help to increase liquidity, as some retail investors may favor lower stock prices and may find it easier to trade options on the stock.

Is Google A Good Long-Term Investment?

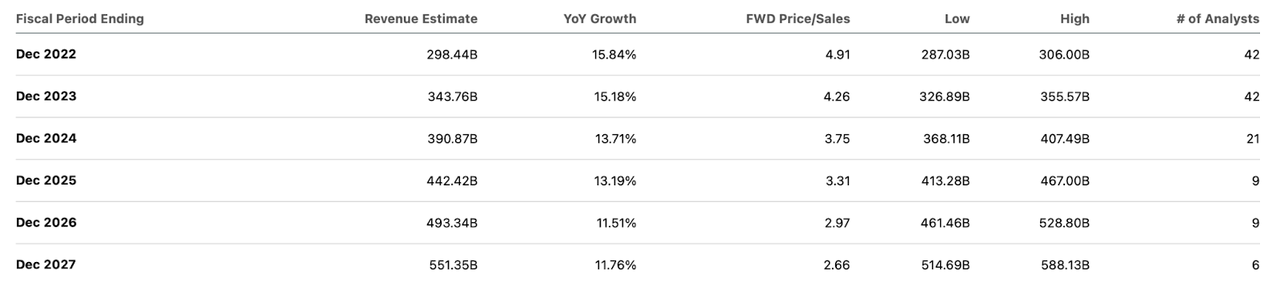

With a commanding position in online advertising, GOOGL remains a compelling long-term investment. We can see below that consensus estimates call for double-digit topline growth for many years to come.

Seeking Alpha

Assuming operating leverage, that top-line growth could lead to even greater earnings per share growth.

Unlike peers like Meta, GOOGL retains full control over much of its platforms, like search and YouTube. That makes it more similar to Apple (AAPL). Yet AAPL is trading at the same 22x earnings multiple as GOOGL. That valuation comparison is curious considering that AAPL is projected to grow at half the rate of GOOGL. GOOGL also has an 8.4% net cash position (versus 3.3% at AAPL). On a growth-adjusted basis, GOOGL is trading with great undervaluation relative to AAPL.

Is Google Stock A Buy, Sell, Or Hold?

That undervaluation may not last forever. I have the view that AAPL earned its premium multiple primarily due to its aggressive share repurchase program. GOOGL has begun a similar endeavor and still has plenty of net cash on its balance sheet to fund aggression in the future. AAPL is trading at around a 2x price to earnings growth ratio (‘PEG ratio’). GOOGL, on the other hand, trades at less than a 1x PEG ratio. On a like-for-like basis, GOOGL could trade up 100% to simply match AAPL on a PEG ratio basis. That would place the stock at around 44x earnings, an arguably reasonable multiple considering the sustainable double-digit growth and ongoing share repurchases. Over the long term, I could see GOOGL settling for a 25x to 30x earnings multiple. That means that shareholders could benefit from both the benefits of compounded annual growth as well as long-term multiple expansion. GOOGL isn’t trading as cheaply as many tech peers, but its strong margins and clear outlook make it a compelling investment opportunity, nonetheless. What are the key risks here? Over the near term, advertising spend could experience volatility, which would negatively impact GOOGL’s growth rate and margins. There may also be regulatory risk as mega-cap tech giants are easy targets for fines, and in all honesty, GOOGL’s business feels very much like a monopoly (after all, that is what makes this stock so compelling). It is arguably unclear if breaking up the business would really be bad for shareholders, but such a possibility may remain as an overhang on multiples until resolved. I view the fact that management has embraced share repurchases as helping to offset the risk of compressed multiples, as the company will be able to take advantage of low stock prices. I rate GOOGL a strong buy based on both the strong growth outlook and multiple expansion potential. GOOGL remains a core anchor of the Best of Breed portfolio.

Be the first to comment